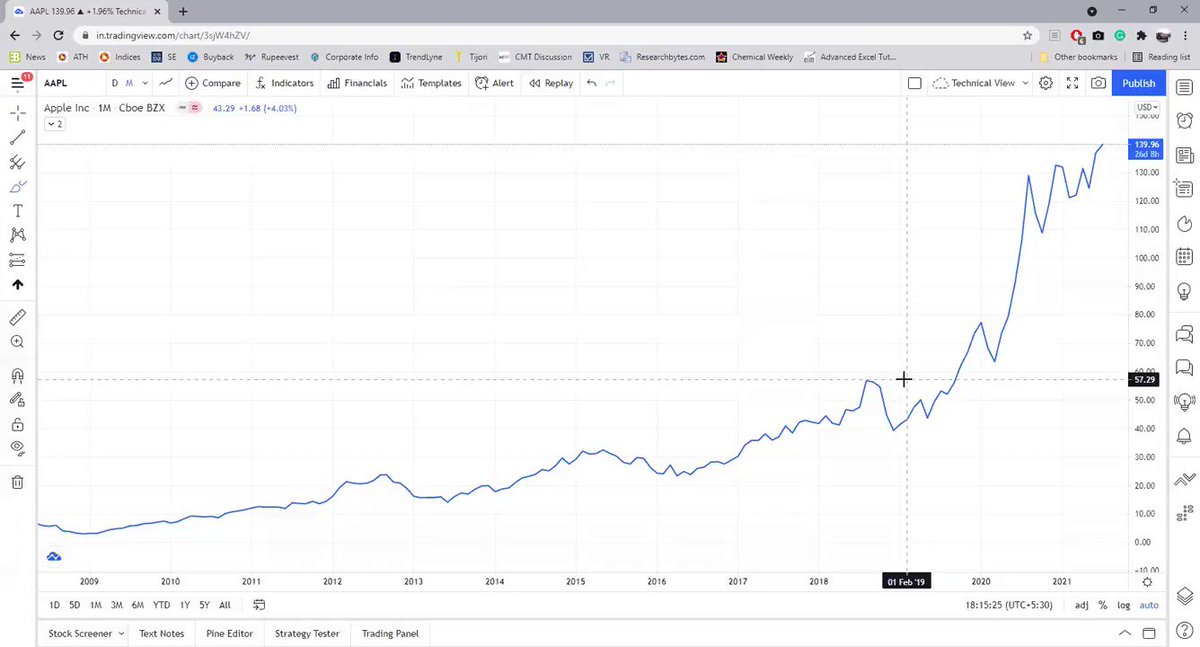

I have been aggressively investing more in Chinese equities than Indian ones.

I have been aggressively investing more in Chinese equities than Indian ones.

More from Tar ⚡

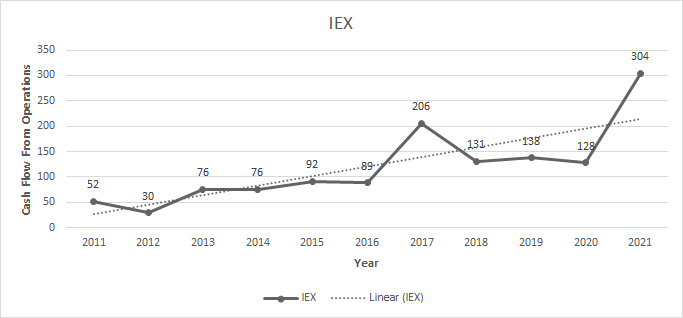

#IEX finally getting close to my average price, will start adding it below 150 (15% further correction from here)

Please do your due diligence and do not copy me blindly here

My investments in IEX are part of an experiment to hold a good stock for 10 yrs + buying sporadically

IEX has also started ground work for trading carbon credits

Still believe this is one stock where dividend every year in 10 years can be equal to my entire investment amount considering it throws up so much cash

Still maintain

NSE + Zerodha =

Please do your due diligence and do not copy me blindly here

My investments in IEX are part of an experiment to hold a good stock for 10 yrs + buying sporadically

IEX has also started ground work for trading carbon credits

Still believe this is one stock where dividend every year in 10 years can be equal to my entire investment amount considering it throws up so much cash

Still maintain

NSE + Zerodha =

#IEX in my PF is a giant growing dividend paying Gorilla

— Tar \u26a1 (@itsTarH) October 18, 2021

Main reason I don't mess around with my holdings is cause I expect it to.

Pay Dividend = to my investment within the next decade

Glad they are considering Bonus Issue (tax favorable) instead of Cash Dividend. pic.twitter.com/2cLt6yK0Xw

More from Genericlearnings

You May Also Like

Joe Rogan's podcast is now is listened to 1.5+ billion times per year at around $50-100M/year revenue.

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu