#CandleTrading : #Bullish

'Lord #NarsimhaPattern'

#Pattern #Psychology :

First long bar depicts the long pillar from which the lord emerges & kills the negativity

More from Sacchitanand Uttekar

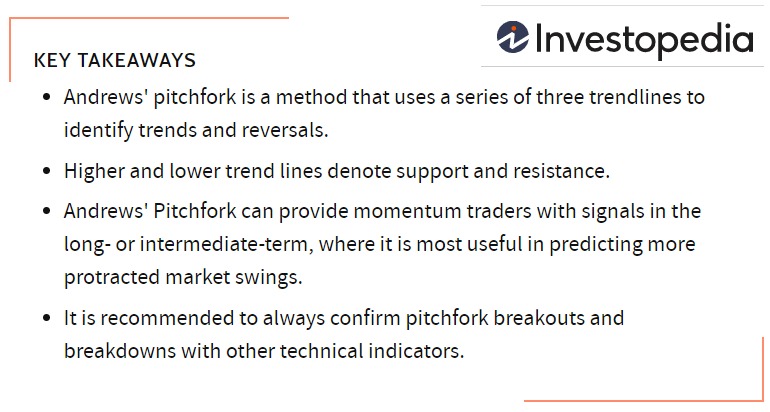

#Nifty50 #AndrewsPitchfork

This is how it works & holds price within 😊, reaction swings at its best possible levels with #Candlesticks providing clarity on breakouts & breakdowns.

Most price action retaining with tools support & median levels. Next week shall be interesting 😜 https://t.co/XIN54TOT41

This is how it works & holds price within 😊, reaction swings at its best possible levels with #Candlesticks providing clarity on breakouts & breakdowns.

Most price action retaining with tools support & median levels. Next week shall be interesting 😜 https://t.co/XIN54TOT41

#Nifty50 trend & demand supply zones via #AndrewsPitchfork.

— Sacchitanand Uttekar (@USacchitanand) June 13, 2021

Its a tool which is ignored by most traders & hence highlighting it here for better reference learning due to its relevance with current price action. pic.twitter.com/5G33NU9q8Z

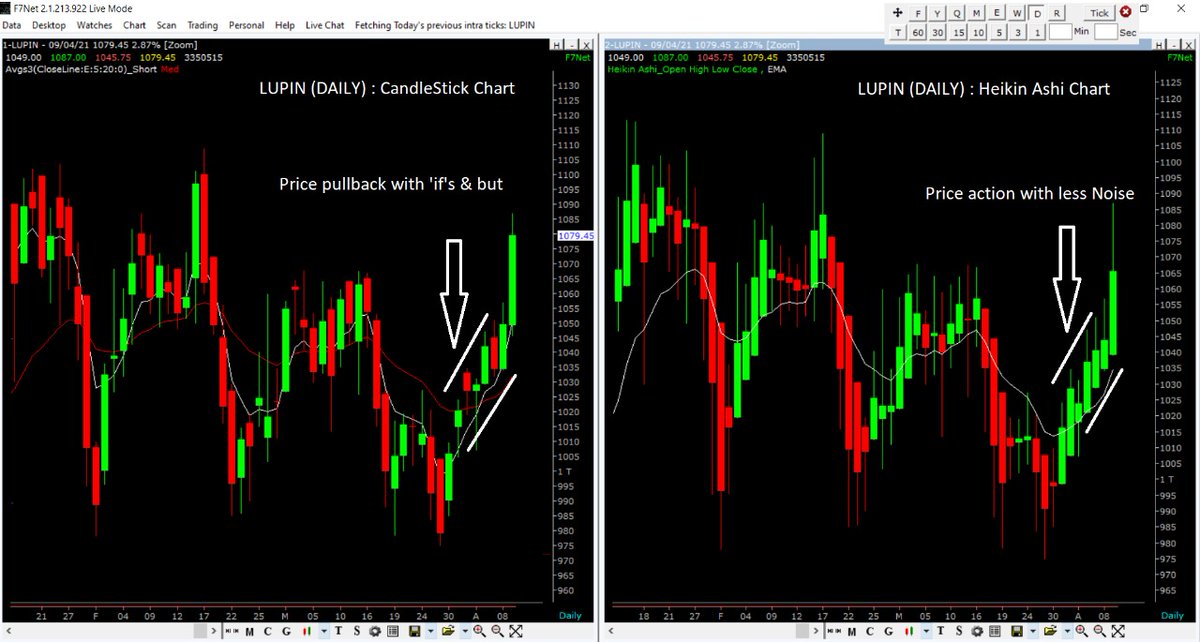

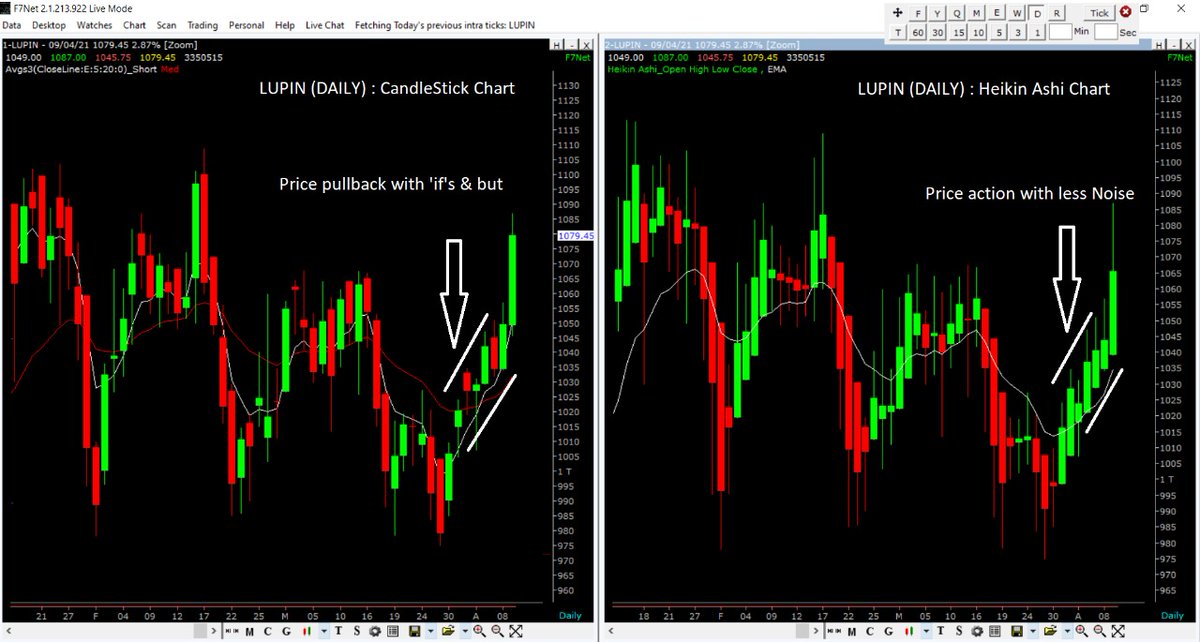

#CandleTrading Mega move

✅ #Candlesticks to spot reversal

+

☑️ #HeikinAshi to capture/ride the trend

Why ? Coz, Heikin dependence on previous candle data delays its signal.

Ideal combination for #Traders; By keeping both the time scales constant.

Do try it 🤗 https://t.co/VSv8lhkAAq

✅ #Candlesticks to spot reversal

+

☑️ #HeikinAshi to capture/ride the trend

Why ? Coz, Heikin dependence on previous candle data delays its signal.

Ideal combination for #Traders; By keeping both the time scales constant.

Do try it 🤗 https://t.co/VSv8lhkAAq

#CandleTrading Mega move

— Sacchitanand Uttekar (@USacchitanand) April 10, 2021

\u2705 #Candlesticks to spot reversal

+

\u2611\ufe0f #HeikinAshi to capture/ride the trend

Why ? Coz, Heikin dependence on previous candle data delays its signal.

Ideal combination for #Traders; By keeping both the time scales constant.

Do try it \U0001f917

More from Genericlearnings

Perhaps you have the idea that calling me " 1 lot Nandy" is somehow derogatory and a easy poke at me. Allow me to explain why I look at this moniker as a badge of honour

I have traded 1 lot continuously twice in my life. The first in 2003 after I blew up on my INFY trade. I traded 1 lot ACC fut consistently and made 50k in a month

The 2nd time in 2013. When I suffered continuous losses for 5-6 months due to a variety of psychological issues. Then I traded 1 lot Nifty options consistently for 3 months. After that 2 lots for next 1 month and slowly increased

I have shared these two incidents on my various interveiws and regularly share this in detail with my handholding students when I talk about trading psychology.

This logic of trading 1 lot to iron out trading issues I learnt from the interview of Anthony Saliba, who traded 1 lot in options for 6 months. BTW, Saliba was the only options trader to have been profiled on the original Market Wizards ( I read his interview and used his logic)

Sir itseems people call you as "one lot Nandy".. Is it true?

— Bittu (@nanoobittu) July 16, 2021

I have traded 1 lot continuously twice in my life. The first in 2003 after I blew up on my INFY trade. I traded 1 lot ACC fut consistently and made 50k in a month

The 2nd time in 2013. When I suffered continuous losses for 5-6 months due to a variety of psychological issues. Then I traded 1 lot Nifty options consistently for 3 months. After that 2 lots for next 1 month and slowly increased

I have shared these two incidents on my various interveiws and regularly share this in detail with my handholding students when I talk about trading psychology.

This logic of trading 1 lot to iron out trading issues I learnt from the interview of Anthony Saliba, who traded 1 lot in options for 6 months. BTW, Saliba was the only options trader to have been profiled on the original Market Wizards ( I read his interview and used his logic)