Exclusive: Alleged RCMP mole accused of selling secrets to kingpin money launderer and terror-financier’s network | https://t.co/6oS5jHrnWQ https://t.co/evpm0Eh9S6 @CullenInquiryBC

More from Finance

I'm lucky to attain financial freedom before 30.

I credit Fintwit for my learnings.

Here's 10 key concepts every investor must know:

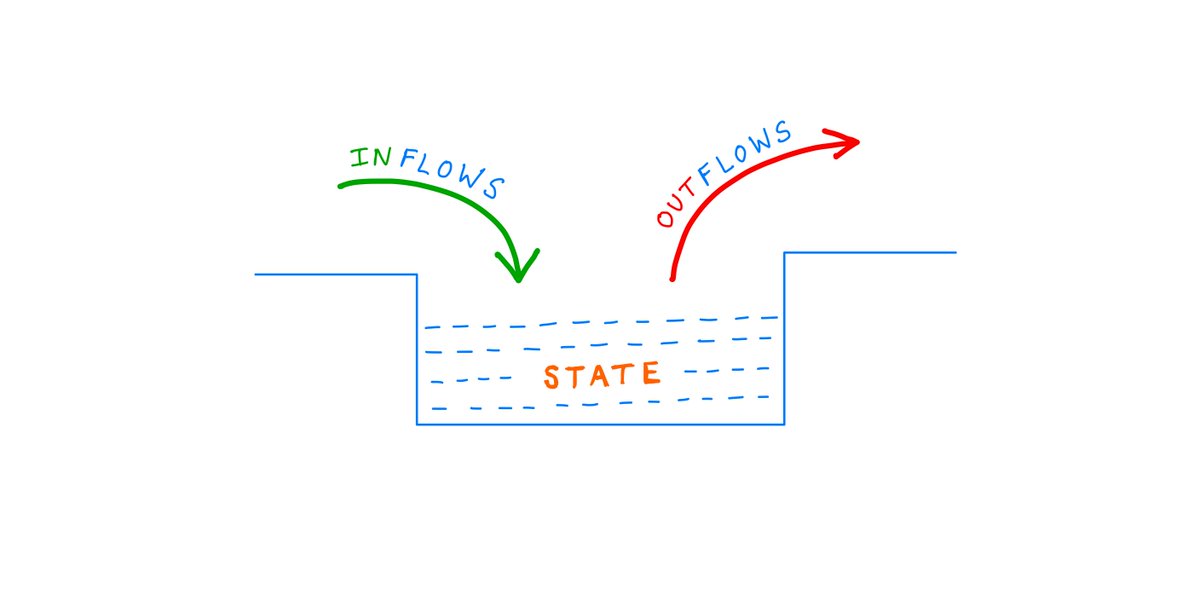

1. $$ needed to retire

2. Researching a business

3. Reading annual reports

4. Reading earnings calls

5. Criteria of a multi bagger

(Read on...)

6. Holding a multi bagger

7. Economic moats

8. When to buy a stock

9. Earnings vs cashflow

10. Traits of quality companies

Here's my 10 favourite threads on these concepts:

1. How much $$ do you need to retire

Before you start, you must know the end game.

To meet your retirement goals...

How much $$ do you need in your portfolio?

10-K Diver does a good job explaining what's a safe withdrawl rate.

Hint: It's NOT

2. Research a business

Your investment returns are a lagging indicator.

Instead, your research skills are the leading predictor of your results.

Conclusion?

To be a good investor, you must be a great business researcher.

Start with

3. Reading annual reports

This is the bread and butter of a good business analyst.

You cannot just listen to opinions from others.

You must learn to deep dive a business and make your own judgments.

Start with the 10k.

Ming Zhao explains it

I credit Fintwit for my learnings.

Here's 10 key concepts every investor must know:

1. $$ needed to retire

2. Researching a business

3. Reading annual reports

4. Reading earnings calls

5. Criteria of a multi bagger

(Read on...)

6. Holding a multi bagger

7. Economic moats

8. When to buy a stock

9. Earnings vs cashflow

10. Traits of quality companies

Here's my 10 favourite threads on these concepts:

1. How much $$ do you need to retire

Before you start, you must know the end game.

To meet your retirement goals...

How much $$ do you need in your portfolio?

10-K Diver does a good job explaining what's a safe withdrawl rate.

Hint: It's NOT

1/

— 10-K Diver (@10kdiver) July 25, 2020

Get a cup of coffee.

In this thread, I'll help you work out how much money you need to retire.

2. Research a business

Your investment returns are a lagging indicator.

Instead, your research skills are the leading predictor of your results.

Conclusion?

To be a good investor, you must be a great business researcher.

Start with

1/ Thoughts on Research Process

— Mostly Borrowed Ideas (@borrowed_ideas) September 27, 2021

I was invited to present my research process at a college in the US. I am sharing all ten slides here. pic.twitter.com/z0tjZcogfH

3. Reading annual reports

This is the bread and butter of a good business analyst.

You cannot just listen to opinions from others.

You must learn to deep dive a business and make your own judgments.

Start with the 10k.

Ming Zhao explains it

\U0001f9d0How to Read 10Ks Like a Hedge Fund\U0001f9d0

— Ming Zhao (@FabiusMercurius) May 7, 2021

\u201cFundamentals don\u2019t matter anymore!\u201d I\u2019ve heard this a lot lately on Fintwit.\U0001f644

But, for those who\u2019ve diversify beyond $GME and $DOGE, here\u2019s a primer on what metrics fundamental buy-side PMs look at and why:

(real examples outlined)

\U0001f447 pic.twitter.com/tLlNRvpnDK

** MEGA THREAD ON Cryptocurrencies/Blockchain**

I wanted to know the best resources to learn about cryptocurrencies and blockchain for someone with zero knowledge. I asked Twitter, and Twitter answered.

This thread is a compilation of the best resources I was recommended. 👇👇

Let's start with ** BOOKS **

The first thing you should do before you pick up any book:

Learn about Bitcoin & Ethereum by reading the respective whitepapers.

- [Bitcoin white paper](https://t.co/cErOaFn6QL) by Satoshi Nakamoto

- [Ethereum White paper] (https://t.co/0g5kYCGJGq) by Vitalik Buterin

Even if you are not tech savvy, you can get a good grasp about how blockchain functions from these papers.

1) *The Basics of Bitcoins and Blockchains: An Introduction to Cryptocurrencies and the Technology that Powers Them* by Antony Lewis

This book covers topics such as the history of Bitcoin, the Bitcoin blockchain, and Bitcoin buying, selling, and mining.

It also answers how payments are made and how transactions are kept secure.

Other cryptocurrencies and cryptocurrency pricing are examined, answering how one puts a value on cryptocurrencies and digital tokens.

I wanted to know the best resources to learn about cryptocurrencies and blockchain for someone with zero knowledge. I asked Twitter, and Twitter answered.

This thread is a compilation of the best resources I was recommended. 👇👇

Let's start with ** BOOKS **

The first thing you should do before you pick up any book:

Learn about Bitcoin & Ethereum by reading the respective whitepapers.

- [Bitcoin white paper](https://t.co/cErOaFn6QL) by Satoshi Nakamoto

- [Ethereum White paper] (https://t.co/0g5kYCGJGq) by Vitalik Buterin

Even if you are not tech savvy, you can get a good grasp about how blockchain functions from these papers.

1) *The Basics of Bitcoins and Blockchains: An Introduction to Cryptocurrencies and the Technology that Powers Them* by Antony Lewis

This book covers topics such as the history of Bitcoin, the Bitcoin blockchain, and Bitcoin buying, selling, and mining.

It also answers how payments are made and how transactions are kept secure.

Other cryptocurrencies and cryptocurrency pricing are examined, answering how one puts a value on cryptocurrencies and digital tokens.