here's a thread of valuable non-tech skills you can learn and master lol

https://t.co/imKoAyJCNi

Learn how to help homeowners out of their tough situations they may be going through and flip real estate with little money https://t.co/uw1mBIGsYP

8. HVAC

9. Electrician

All three of these are skills that will always be needed and you name your own prices

More from Finance

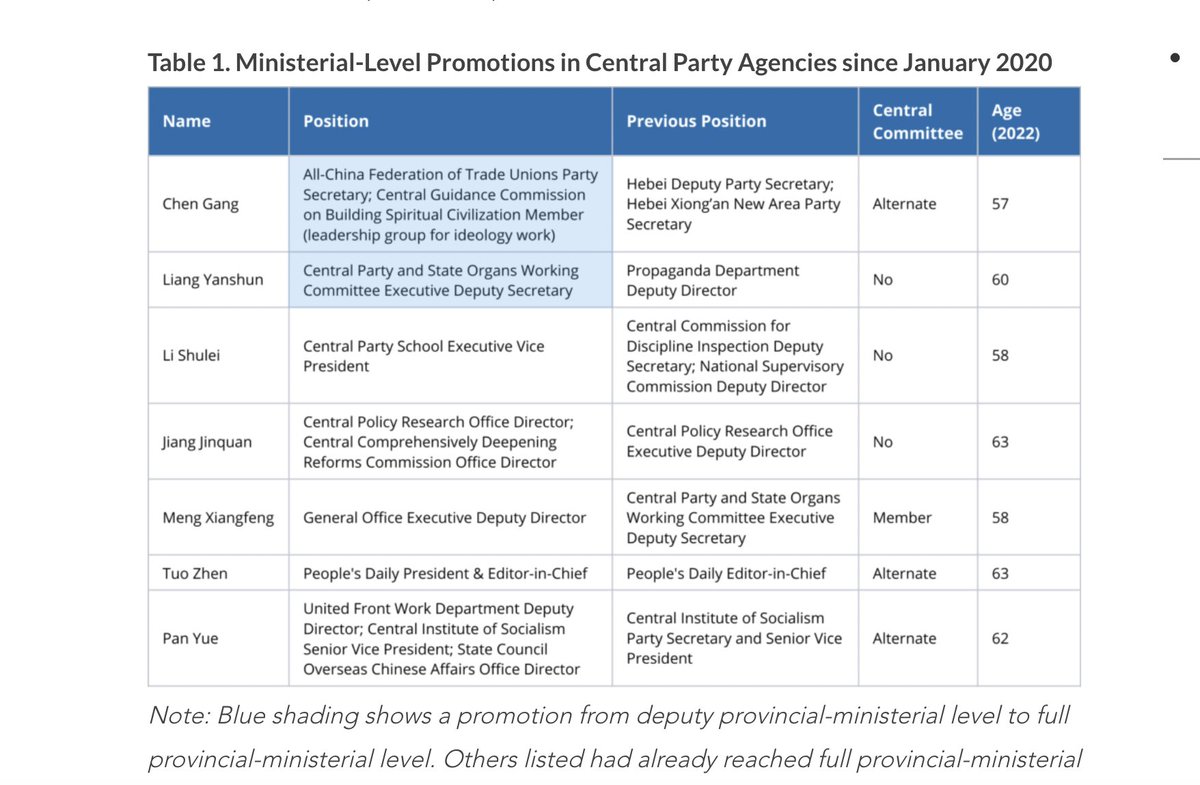

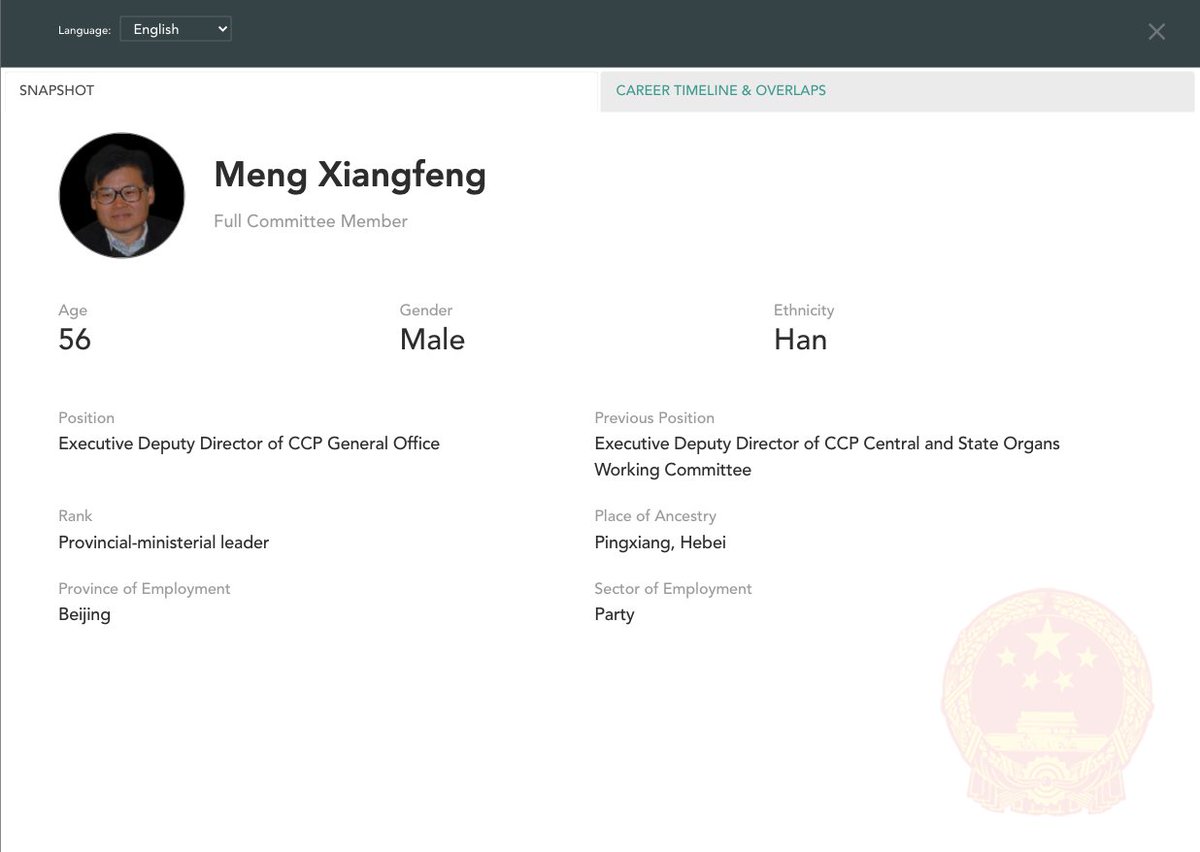

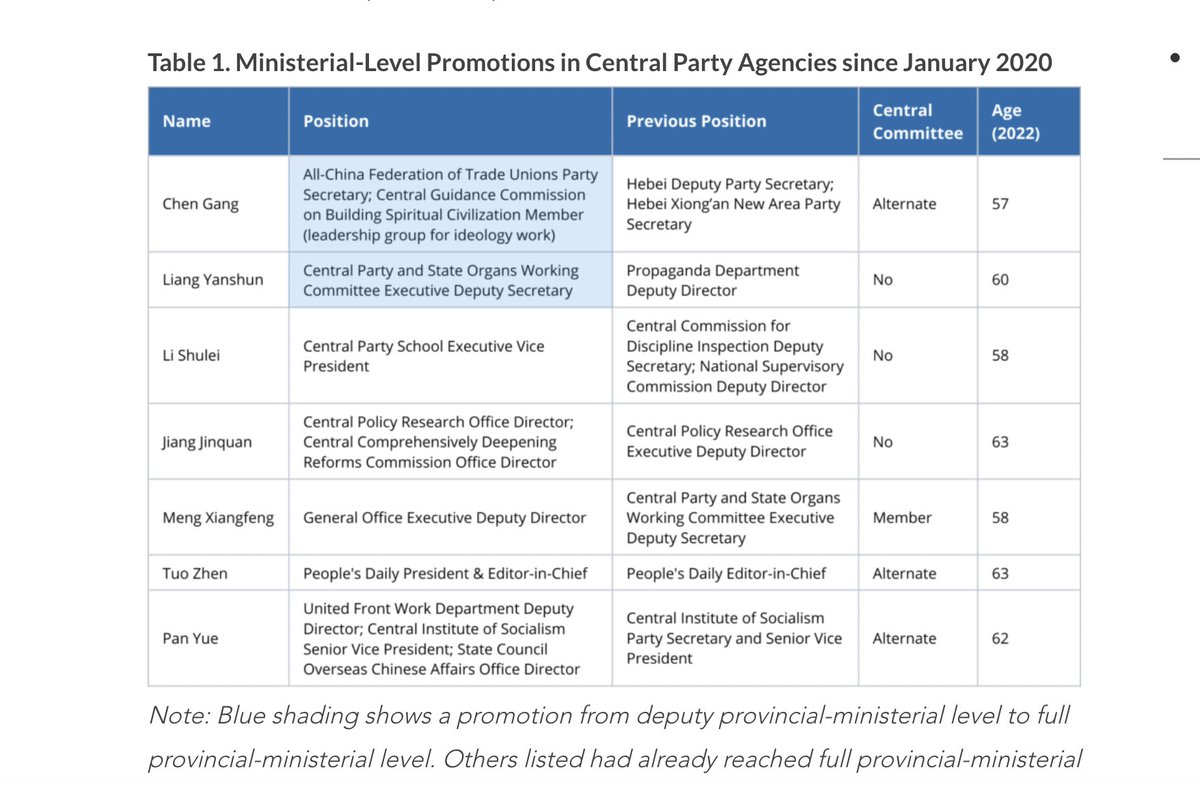

THREAD: Who are the rising stars of Chinese elite politics in the central Party-State bureaucracy?

For @MacroPoloChina I analyzed last year's ministerial-level promotions to posts in Beijing

TLDR: Ties to Xi Jinping—or a Xi ally—are very helpful! (1/14)

https://t.co/kO2A0Efyq2

Seven politicians were promoted to ministerial-level positions in central Party agencies last year

All are likely to feature on the next Central Committee selected at the 2022 Party Congress

Some could make the CCP's elite 25-person Politburo (2/14)

https://t.co/kO2A0Efyq2

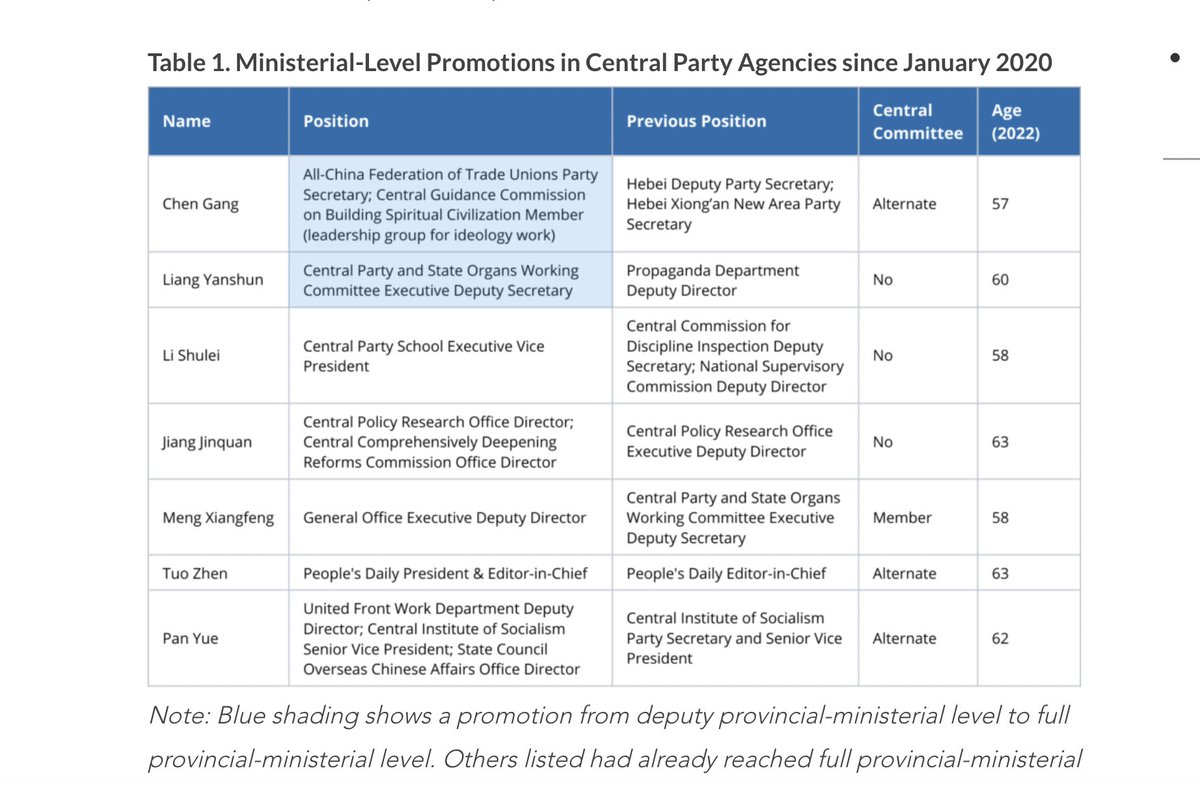

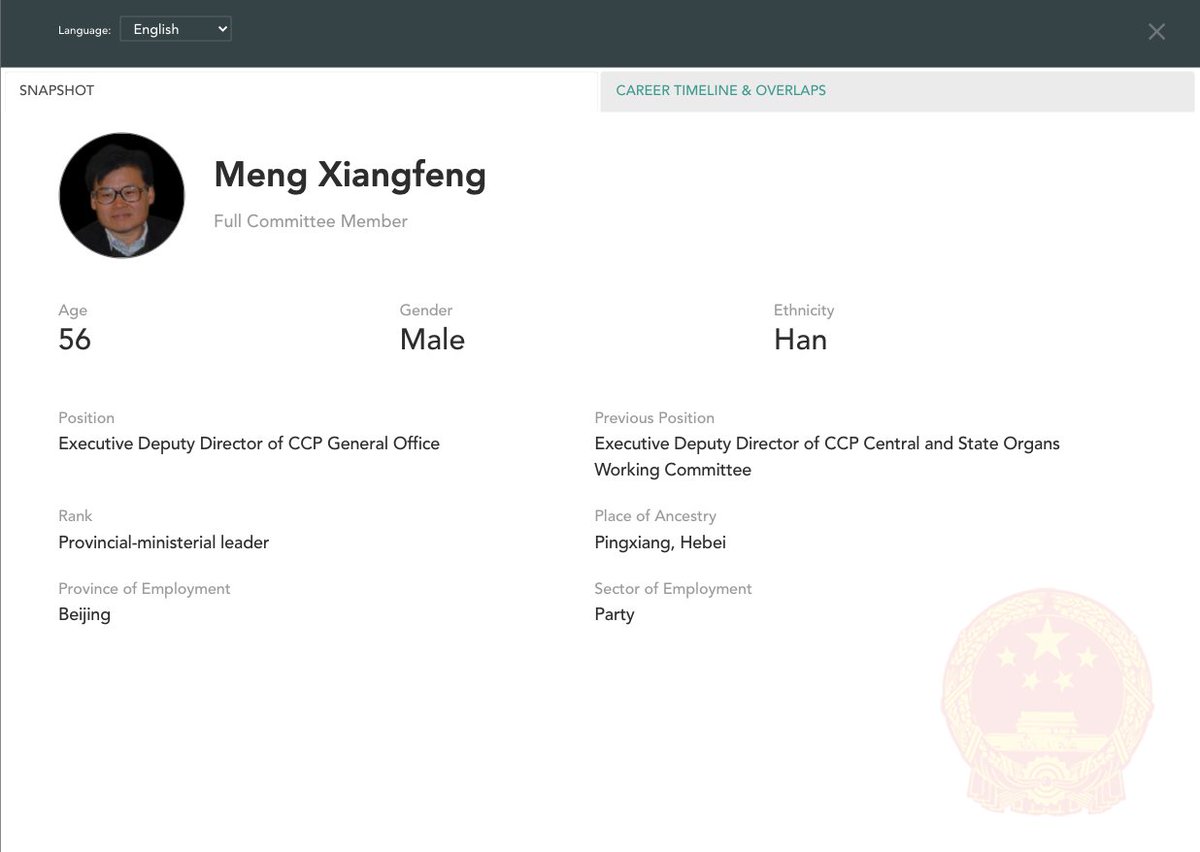

Likeliest for the Politburo is Meng Xiangfeng, new Executive Deputy Director of the CCP General Office

He would replace Xi ally Ding Xuexiang as CCP chief-of-staff if Ding is promoted further in 2022

Meng worked under Xi allies Cai Qi in Hangzhou and Chen Xi in Liaoning (3/14)

Less likely for the Politburo but still important is Jiang Jinquan, new Director of the CCP Policy Research Office

He replaces 5th-ranked leader Wang Huning who led the Party's brains trust for 18 years

Wang remains prominent and will be <68 in 2022, so he'll stay around (4/14)

Other notable central Party promotions include Li Shulei and Liang Yanshun, who both assisted Xi when he led the Central Party School from 2007-2012

Li is a political conservative who is said to be quite close with Xi, even drafting his 2014 speech on culture and art (5/14)

For @MacroPoloChina I analyzed last year's ministerial-level promotions to posts in Beijing

TLDR: Ties to Xi Jinping—or a Xi ally—are very helpful! (1/14)

https://t.co/kO2A0Efyq2

Seven politicians were promoted to ministerial-level positions in central Party agencies last year

All are likely to feature on the next Central Committee selected at the 2022 Party Congress

Some could make the CCP's elite 25-person Politburo (2/14)

https://t.co/kO2A0Efyq2

Likeliest for the Politburo is Meng Xiangfeng, new Executive Deputy Director of the CCP General Office

He would replace Xi ally Ding Xuexiang as CCP chief-of-staff if Ding is promoted further in 2022

Meng worked under Xi allies Cai Qi in Hangzhou and Chen Xi in Liaoning (3/14)

Less likely for the Politburo but still important is Jiang Jinquan, new Director of the CCP Policy Research Office

He replaces 5th-ranked leader Wang Huning who led the Party's brains trust for 18 years

Wang remains prominent and will be <68 in 2022, so he'll stay around (4/14)

Other notable central Party promotions include Li Shulei and Liang Yanshun, who both assisted Xi when he led the Central Party School from 2007-2012

Li is a political conservative who is said to be quite close with Xi, even drafting his 2014 speech on culture and art (5/14)

Ok here is the explanation. Grab a cup of coffee and read on. If you have not read/noticed this, you will see intraday options movement in a new light.

Say we have two options, one 50 delta ATM options and another 30 delta OTM option. Normally for a 100 point move, the ATM option will move 50 points and the OTM option will move 30 points. But in a high volatile environment, the OTM option will also move nearly 50 points

To understand why this happens, first understand why an ATM option is 50 delta. An ATM option has the probability of 50% of expiring as ITM. The price just has to close a rupee above the strike for the CE to be ITM and vice versa for PEs

Now think of a highly volatile day like today. If someone is asked where the BNF will close for the day or expiry, no one can answer. BNF can close freakin anywhere, That makes every option of an equal probability of being ITM. So all options have a 50% probability of being ITM

Hence, when a huge volatile move starts, all OTM options behave like ATM options. This phenomenon was first observed in the Black Monday crash of 1987 at Wall Street, which also gave rise to the volatility skew/smirk

In a high IV environment or when the market is very volatile

— Subhadip Nandy (@SubhadipNandy16) January 21, 2022

" OTM options will behave like ATM options", one will get almost the same delta movement

Say we have two options, one 50 delta ATM options and another 30 delta OTM option. Normally for a 100 point move, the ATM option will move 50 points and the OTM option will move 30 points. But in a high volatile environment, the OTM option will also move nearly 50 points

To understand why this happens, first understand why an ATM option is 50 delta. An ATM option has the probability of 50% of expiring as ITM. The price just has to close a rupee above the strike for the CE to be ITM and vice versa for PEs

Now think of a highly volatile day like today. If someone is asked where the BNF will close for the day or expiry, no one can answer. BNF can close freakin anywhere, That makes every option of an equal probability of being ITM. So all options have a 50% probability of being ITM

Hence, when a huge volatile move starts, all OTM options behave like ATM options. This phenomenon was first observed in the Black Monday crash of 1987 at Wall Street, which also gave rise to the volatility skew/smirk

![Peter McCormack [Jan/3\u279e\u20bf \U0001f511\u220e]](https://pbs.twimg.com/profile_images/1524287442307723265/_59ITDbJ_normal.jpg)