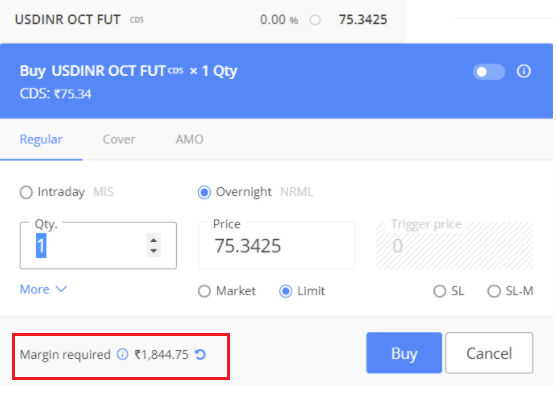

If the pics in this

@BootstrapCook thread are true and correct then the Govt/taxpayers & families in need are getting absolutely SHAFTED 👇🏽 2/

https://t.co/TZSTfMttNa

There are some mitigating circumstances. A £30 box won’t ever contain £30 (retail) worth of food - people aren’t factoring in

-the cost of the box

-paying someone to fill it

-rent & rates

-& most expensive the *transport/distribution*

3/

If you’re doing the above at scale. Delivering *across the UK* it’s not cheap BUT IMHO there should be at LEAST £20 worth of groceries in a £30 box. To get more value they need more fresh produce. Just carrots & apples is terrible. 4/

I’m gonna put my rep on the line here & say something about these big national catering companies whose names I’ve seen mentioned. They are an ASSHOLE to deal with & completely shaft small businesses like mine with their terms which is why I won’t deal with them. 5/

They want you to deliver their fruit&veg everyday for a month then expect 45, 60, 90 or 120 days credit. Even then, they don’t pay on time. 6/

Now here’s the killer. They use their buying power to ask for HUGE kickbacks, ie discounts by way of a returned cheque which enables them to show their customers the original invoices & say ‘look this is how much we paid’

It’s endemic in this industry & a shitty practice. 7/

It’s a difficult task distributing these boxes nationally. You need a good infrastructure so I get why the govt went to the big catering firms.

But I do wonder what’s going on at the highest levels of govt. sending £5 of food to the poorest & charging £30 is outrageous. 8/

Some of these big catering firms are really struggling right now & I have ZERO sympathy. Shitting on their suppliers is standard practice. I had to wait 6 months for payment once. Even then they pay by cheque to long it out further. 9/

So anyway. Any kind of outsourced catering in big institutions even your office canteen, it’s quite likely a handful of national companies are running it. They won’t think twice about shafting poor kids over. I’m not surprised to see this at all. 10/

Assuming there’s a kickback cheque (a) from the Govt, someone, somewhere is making a lot of money out of this whole situation. -fin.

Actually I’m not finished. I’m really pissed off writing these tweets. Like, payment terms. Who the hell in this day & age of fintech & faster payments needs ONE HUNDRED & TWENTY DAYS to pay a supplier. It’s sole purpose is to shit on you.

One business wanted 90 days to pay me. I told them our standard terms are 30. They said ‘if you want us to pay you ‘early’ then we want a bigger discount’

I politely told them to shove it. 🖕🏾

Anyway, my point still stands. If they can shit on their suppliers, they’ll take full advantage & shit on vulnerable families too. The proof is in the boxes all over social media today. I’m glad this is out. If they all go tits-up in this pandemic I’ll have no sympathy.

Im so pissed off right now. I went downstairs and replicated one of our Charity boxes. We developed this in conjunction with

@RedHenCambridge I’m not gonna link to the shop cos it’s a bit bandwagonny. It shows you what can be done for £20 with top quality fresh local produce.

That’s £10 CHEAPER than the pittance that Compass are rinsing taxpayers for. Yes you can prob get more if this was supermarket gear. But this is greengrocer-quality seasonal nutritious produce. Those blueberries will be swapped for 400g local strawberries in Summer btw.

For absolute clarity I’ll make about £2 off that, for which I’ll pay rent, taxes, wages, biz costs, leaving me with about erm, not much. Our customers are brilliant. They’ve been sending these exact boxes to vulnerable families since the pandemic started. Compass can piss off.

I’m truly pissed off at this mornings news.

One last tweet from me.

Well I *did* say I wouldn’t swear any more. 🤷🏽♂️🤷🏽♂️🤷🏽♂️

#foodparcels

Well this is kinda cool. Got a call from

@bbc5live @BBCBusiness - I’ll hopefully 🤞🏽 be chatting to Wake Up To Money (I listen every day! Love this show!) about this at 5.30am tomorrow morning. Tune in folks!