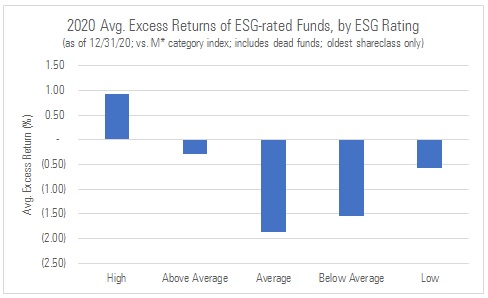

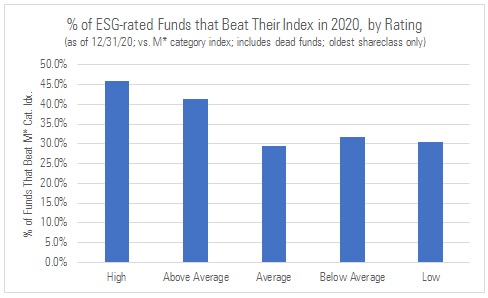

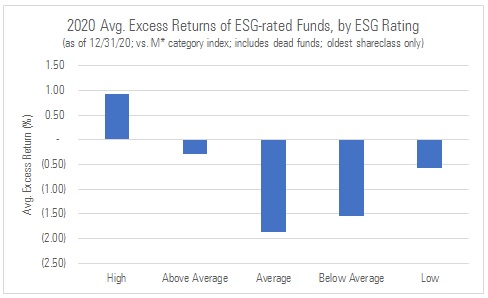

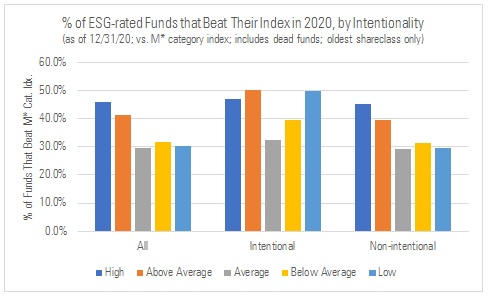

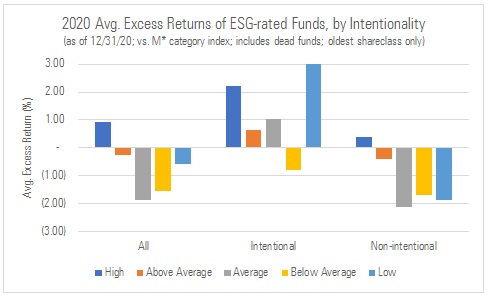

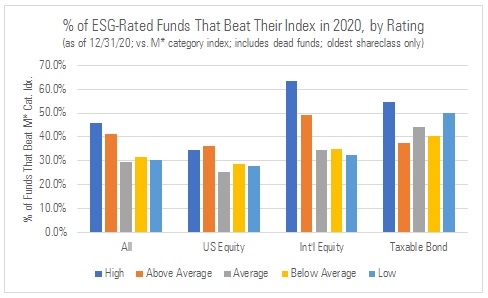

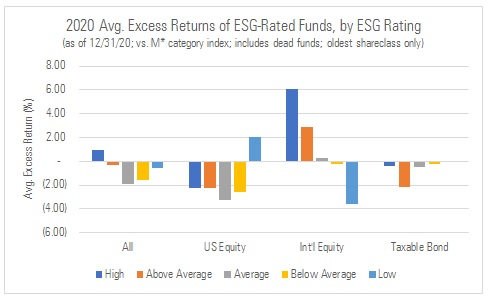

How'd funds fare in 2020 when viewed through an ESG lens? We assign Globe Ratings, w/'High' (ie 5 globes) going to funds whose holdings court less ESG risk and vice versa for 'Low' (1 globe). Tldr: Funds w/higher ESG ratings beat their M* idx more often than those w/lower ratings

More from Finance

Having made over 1000 boxes for vulnerable families in Cambridge via @RedHenCambridge (thanks to our customers 🙏🏽) My thoughts on the £30 box thing. Lots of factors at play here. 1/

If the pics in this @BootstrapCook thread are true and correct then the Govt/taxpayers & families in need are getting absolutely SHAFTED 👇🏽 2/

There are some mitigating circumstances. A £30 box won’t ever contain £30 (retail) worth of food - people aren’t factoring in

-the cost of the box

-paying someone to fill it

-rent & rates

-& most expensive the *transport/distribution*

3/

If you’re doing the above at scale. Delivering *across the UK* it’s not cheap BUT IMHO there should be at LEAST £20 worth of groceries in a £30 box. To get more value they need more fresh produce. Just carrots & apples is terrible. 4/

I’m gonna put my rep on the line here & say something about these big national catering companies whose names I’ve seen mentioned. They are an ASSHOLE to deal with & completely shaft small businesses like mine with their terms which is why I won’t deal with them. 5/

If the pics in this @BootstrapCook thread are true and correct then the Govt/taxpayers & families in need are getting absolutely SHAFTED 👇🏽 2/

Hi all. I\u2019ve been sent LOTS of photos of the food parcels that have replaced the \xa330 vouchers and asked what I would do with them. I\u2019m replying with advice privately because to do so publicly would look like justifying these ill thought through, offensively meagre scraps /1.

— Jack Monroe (@BootstrapCook) January 11, 2021

There are some mitigating circumstances. A £30 box won’t ever contain £30 (retail) worth of food - people aren’t factoring in

-the cost of the box

-paying someone to fill it

-rent & rates

-& most expensive the *transport/distribution*

3/

If you’re doing the above at scale. Delivering *across the UK* it’s not cheap BUT IMHO there should be at LEAST £20 worth of groceries in a £30 box. To get more value they need more fresh produce. Just carrots & apples is terrible. 4/

I’m gonna put my rep on the line here & say something about these big national catering companies whose names I’ve seen mentioned. They are an ASSHOLE to deal with & completely shaft small businesses like mine with their terms which is why I won’t deal with them. 5/