Thread on how easy it is to get tricked into haemorrhaging money from your bank account after an online purchase – and why financial regulators seem to be behind the curve on this.🧵💸💻

Forgive the personal story, but I think it's relevant...1/

Yet it’s not always enough.

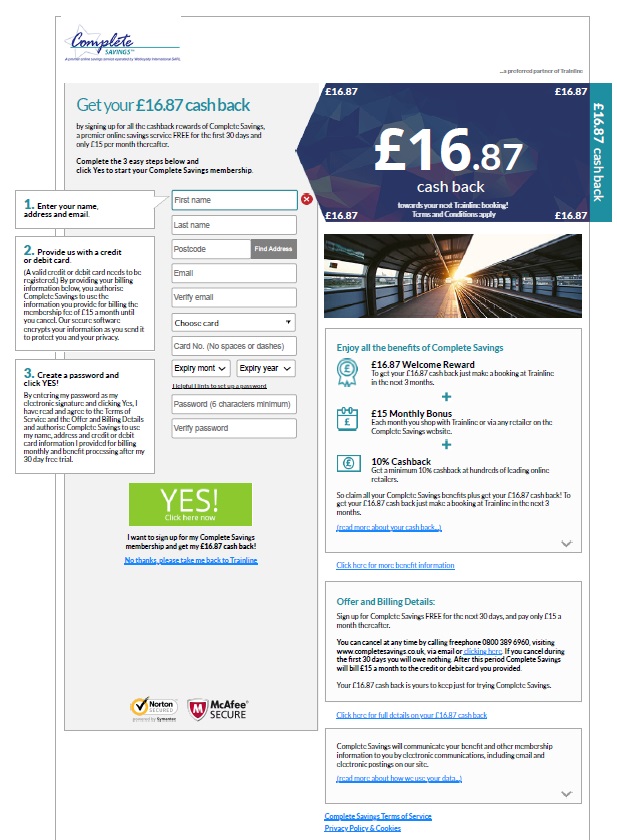

While looking through a list of transactions on my online account before Xmas I noticed a £15 payment to something called "WLY*https://t.co/tSHitonwoT" ...3/

I downloaded my entire statement for the year and discovered I’d made a payment to this entity for the

same amount every month for 14 months, so £210 in total...4/

This is not, to put it mildly, the kind of scheme I would ever knowingly sign up to....5/

I’d zero recollection of doing so....6/

See here:

https://t.co/LisluqZuZt

And here https://t.co/7YNCySY0fS: 7/

But is it ethical?

And should well-known retailers like Trainline be partnering with an organisation like this?...10/

https://t.co/Xd0ZnsLNFi

https://t.co/JRq6JmpJ5H

Readers can draw their own conclusions about whether Trainline is a safe space online....14/

https://t.co/8tmC5K5nHz

https://t.co/BHvg1uzgHy

I believe there are.

Why, despite my keeping a regular eye on my online account, didn’t I spot the payments on my bank statement sooner?...16/

Identifying a relatively small outgoing nowadays is much harder in the morass of payments data...17/

https://t.co/QmGEhrV1sg

But who regulates Complete Savings/Webloyalty/Affinion? 21/

"Subscription/cashback services for retailers would fall outside our remit and this means that our rules don’t apply to these firms and their business falls outside our jurisdiction"...22/

Perhaps you think if I did not immediately notice £15 leaving my account each month I’m well-off enough not to have anything useful to say to people who are financially struggling...23/

But I honestly don’t think it’s unreasonable to conclude that if it can happen to me it can happen to anyone....24/

More here for @IndyVoices:

https://t.co/O3PepQhfM5

ENDS/

More from Finance

I'm lucky to attain financial freedom before 30.

I credit Fintwit for my learnings.

Here's 10 key concepts every investor must know:

1. $$ needed to retire

2. Researching a business

3. Reading annual reports

4. Reading earnings calls

5. Criteria of a multi bagger

(Read on...)

6. Holding a multi bagger

7. Economic moats

8. When to buy a stock

9. Earnings vs cashflow

10. Traits of quality companies

Here's my 10 favourite threads on these concepts:

1. How much $$ do you need to retire

Before you start, you must know the end game.

To meet your retirement goals...

How much $$ do you need in your portfolio?

10-K Diver does a good job explaining what's a safe withdrawl rate.

Hint: It's NOT

2. Research a business

Your investment returns are a lagging indicator.

Instead, your research skills are the leading predictor of your results.

Conclusion?

To be a good investor, you must be a great business researcher.

Start with

3. Reading annual reports

This is the bread and butter of a good business analyst.

You cannot just listen to opinions from others.

You must learn to deep dive a business and make your own judgments.

Start with the 10k.

Ming Zhao explains it

I credit Fintwit for my learnings.

Here's 10 key concepts every investor must know:

1. $$ needed to retire

2. Researching a business

3. Reading annual reports

4. Reading earnings calls

5. Criteria of a multi bagger

(Read on...)

6. Holding a multi bagger

7. Economic moats

8. When to buy a stock

9. Earnings vs cashflow

10. Traits of quality companies

Here's my 10 favourite threads on these concepts:

1. How much $$ do you need to retire

Before you start, you must know the end game.

To meet your retirement goals...

How much $$ do you need in your portfolio?

10-K Diver does a good job explaining what's a safe withdrawl rate.

Hint: It's NOT

1/

— 10-K Diver (@10kdiver) July 25, 2020

Get a cup of coffee.

In this thread, I'll help you work out how much money you need to retire.

2. Research a business

Your investment returns are a lagging indicator.

Instead, your research skills are the leading predictor of your results.

Conclusion?

To be a good investor, you must be a great business researcher.

Start with

1/ Thoughts on Research Process

— Mostly Borrowed Ideas (@borrowed_ideas) September 27, 2021

I was invited to present my research process at a college in the US. I am sharing all ten slides here. pic.twitter.com/z0tjZcogfH

3. Reading annual reports

This is the bread and butter of a good business analyst.

You cannot just listen to opinions from others.

You must learn to deep dive a business and make your own judgments.

Start with the 10k.

Ming Zhao explains it

\U0001f9d0How to Read 10Ks Like a Hedge Fund\U0001f9d0

— Ming Zhao (@FabiusMercurius) May 7, 2021

\u201cFundamentals don\u2019t matter anymore!\u201d I\u2019ve heard this a lot lately on Fintwit.\U0001f644

But, for those who\u2019ve diversify beyond $GME and $DOGE, here\u2019s a primer on what metrics fundamental buy-side PMs look at and why:

(real examples outlined)

\U0001f447 pic.twitter.com/tLlNRvpnDK