https://t.co/JIO9Ou2NtQ

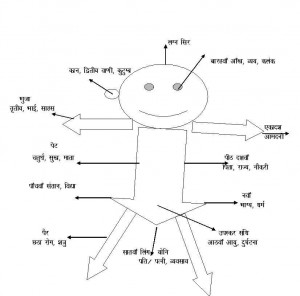

A small thread on intraday support resistance logics over time

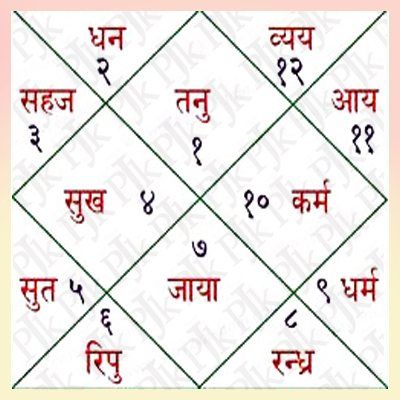

The most common is Pivot , support and resistances calculated from the previous day's data

https://t.co/ILMjMay1zc

They can be calculated for daily, weekly, monthly etc.

https://t.co/JIO9Ou2NtQ

What struck me was that in each of the cases , we were using the OHLC and doing some maths with a multiplier/divider which WE/the trader thought fits the price action of the markets

Now the problem is, what has worked on the past set is on the past set. There is no guarantee that it will work in the future. As markets change, what do we do ?

A few lines of code on python can do this ( choosing some X period of backdata, identifying the best fit and applying them the next day).

Hence I started posting on twitter

More from Subhadip Nandy

My presentation on Money Management was based on a lot of sources as I mentioned. For traders interested on those sources , here they are

#OptimalF

Portfolio Management Formulas: Mathematical Trading Methods for the Futures, Options, and Stock Markets by Ralph Vince

The Mathematics of Money Management: Risk Analysis Techniques for Traders by Ralph Vince

#SecureF

#FixedRatio

The Trading Game: Playing by the Numbers to Make Millions by Ryan Jones

https://t.co/U0c65EbEog.

#OptimalF

Portfolio Management Formulas: Mathematical Trading Methods for the Futures, Options, and Stock Markets by Ralph Vince

The Mathematics of Money Management: Risk Analysis Techniques for Traders by Ralph Vince

#SecureF

#FixedRatio

The Trading Game: Playing by the Numbers to Make Millions by Ryan Jones

https://t.co/U0c65EbEog.