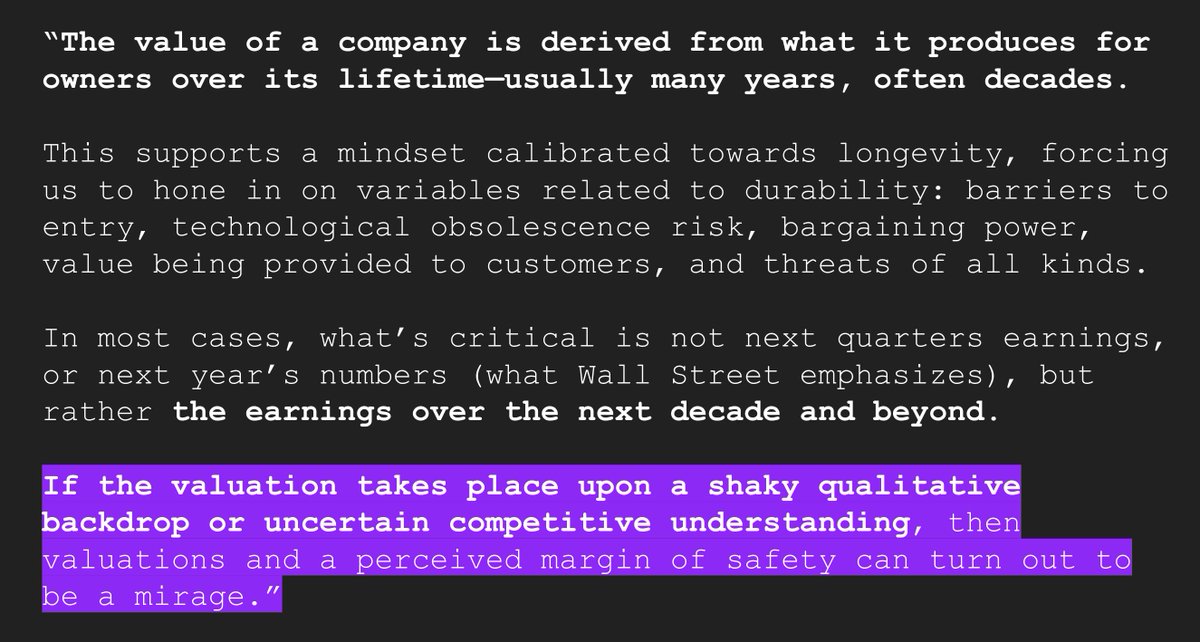

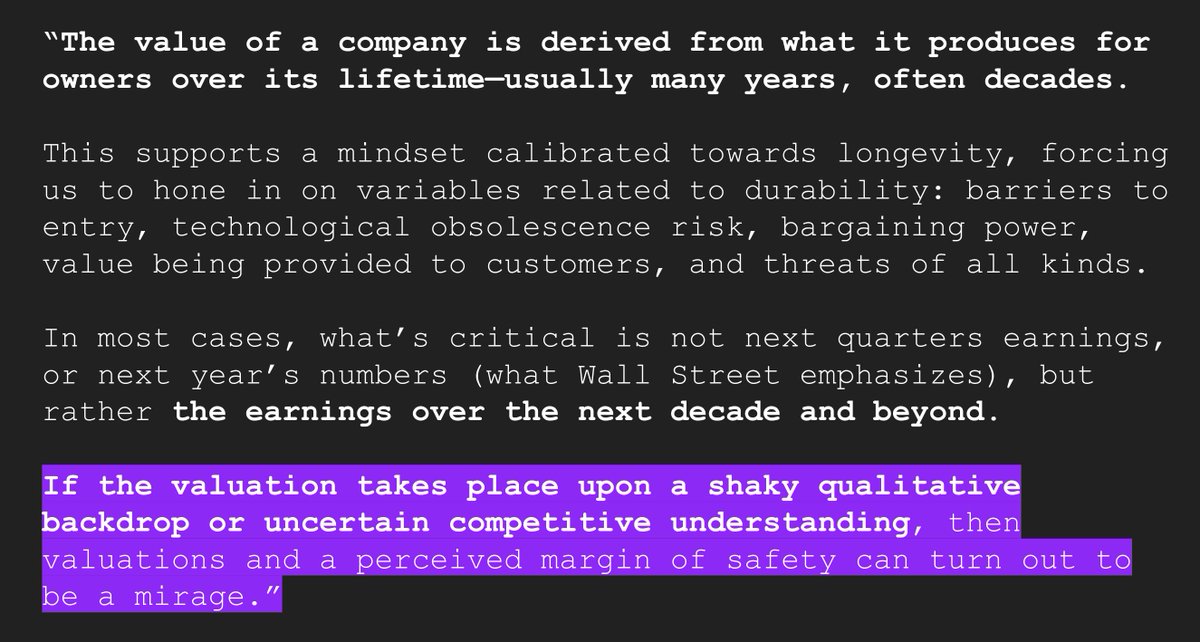

He focuses on variables that affect a business' durability.

Stuff like valuation doesn't matter if the business quality is misjudged.

Since a company's value is determined by its future cash flows...

Hence evaluating its future is key

1/

— 10-K Diver (@10kdiver) July 25, 2020

Get a cup of coffee.

In this thread, I'll help you work out how much money you need to retire.

1/ Thoughts on Research Process

— Mostly Borrowed Ideas (@borrowed_ideas) September 27, 2021

I was invited to present my research process at a college in the US. I am sharing all ten slides here. pic.twitter.com/z0tjZcogfH

\U0001f9d0How to Read 10Ks Like a Hedge Fund\U0001f9d0

— Ming Zhao (@FabiusMercurius) May 7, 2021

\u201cFundamentals don\u2019t matter anymore!\u201d I\u2019ve heard this a lot lately on Fintwit.\U0001f644

But, for those who\u2019ve diversify beyond $GME and $DOGE, here\u2019s a primer on what metrics fundamental buy-side PMs look at and why:

(real examples outlined)

\U0001f447 pic.twitter.com/tLlNRvpnDK

How to read an Annual Report in 1 hour.

— Max Koh (@heymaxkoh) April 4, 2022

A step by step guide for busy people:

1/

— 10-K Diver (@10kdiver) July 25, 2020

Get a cup of coffee.

In this thread, I'll help you work out how much money you need to retire.

1/ Thoughts on Research Process

— Mostly Borrowed Ideas (@borrowed_ideas) September 27, 2021

I was invited to present my research process at a college in the US. I am sharing all ten slides here. pic.twitter.com/z0tjZcogfH

\U0001f9d0How to Read 10Ks Like a Hedge Fund\U0001f9d0

— Ming Zhao (@FabiusMercurius) May 7, 2021

\u201cFundamentals don\u2019t matter anymore!\u201d I\u2019ve heard this a lot lately on Fintwit.\U0001f644

But, for those who\u2019ve diversify beyond $GME and $DOGE, here\u2019s a primer on what metrics fundamental buy-side PMs look at and why:

(real examples outlined)

\U0001f447 pic.twitter.com/tLlNRvpnDK

1/ YouTube is an AMAZING resource when used properly (Thread)

— Brian Feroldi (@BrianFeroldi) November 7, 2020

Here are my favorite YouTube channels:

Top 5:

Mark Rober - @MarkRober

Real Engineering

Smarter Every Day - @smartereveryday

Stuff Made Here - @stuffmadehere

Wintegartan - @wintergatan

More \U0001f447\U0001f447\U0001f447\U0001f447\U0001f447

1/ Book recommendations (thread)

— Brian Feroldi (@BrianFeroldi) November 20, 2020

Start Here:

Choose FI

Richest Man in Babylon

Millionaire Next Door

Rich Dad, Poor Dad

The Wealthy Barber

\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f

Boosting your salary is a great way to turbo-charge wealth building

— Brian Feroldi (@BrianFeroldi) November 1, 2020

Here's the good news: Your salary is negotiable!@themotleyfool and @ChooseFi have some AMAZING free resources for scoring a big raise:

Use them!

\U0001f447\U0001f447\U0001f447