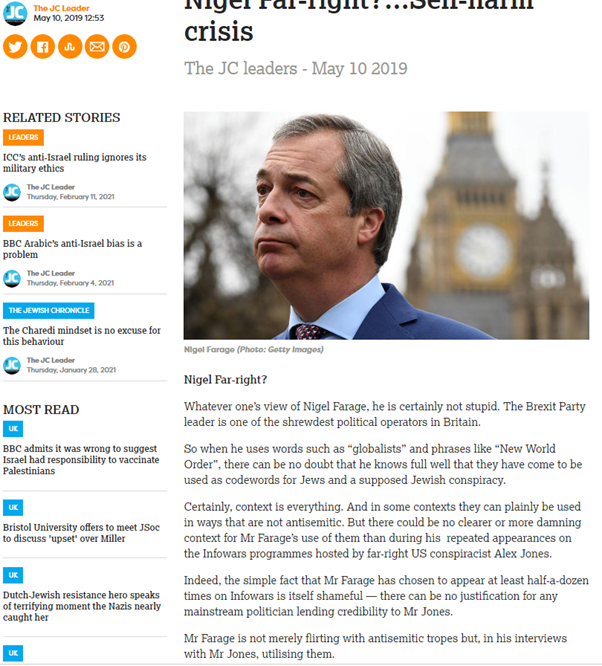

We all know no-one should profit from antisemitic hate speech right? Well, tell that to the @JewishChron.

In their media pack they advertise that they've run (at least) one event with Nigel Farage as a speaker. The JC is using their connection with an antisemite to make money.

What kind of advertisers do they want??

Is Nigel actually an antisemite, Geoffrey hears someone ask in terribly bad faith. Well, lets explore his history of antisemitism through the JC’s own articles!

Now lets work backwards, shall we?

Now, Farage dismisses all the criticism. The one time he has responded to coverage of it, he called the condemnation a "manufactured story" and "pathetic". He has no apparent intention of stopping the use of such themes.

— Peter Walker (@peterwalker99) June 29, 2020

6/

More from Finance

👇

Equity/ownership is a force. Getting it in the hands of the right people generously will drive alignment and execution.

— Joey Santoro (@Joey__Santoro) January 21, 2021

It is a joyful and serious responsibility \U0001f332

1/ The discount you offer to strategic investors is both to account for the risk of an unlaunched product, but also as compensation for continued value add and support.

So make sure you know the investor will support you and not leave you on read once the docs are signed!

2/ Having someone on your cap table/ token allocation is as important as hiring.

You wouldn't hire someone just because they are influencers on Twitter- you do your reference checks and find evidence of value add from other companies the investor has invested in.

3/ Don't trust, verify.

Many investors will promise you the world when they're trying to get on your cap table.

Talk to founders they backed to see how much of it is bullshit. Ask them about how the investor was there for them during hard times.

4/ Don't just go for "name brand" funds because you want the brand.

Sure, it's great validation, but optimize for fit, not vanity.

However, I do think many well-known VCs are good actors, especially those with roots in successful trad VCs. They have a rep for a reason!

For a naked option to make money, it's better if IV rises or at least stays flat.

Rule 3 : DO NOT run or trade everything that moves. Focus on a few stocks and master them. When a move comes, make the max out of that move.

— Subhadip Nandy (@SubhadipNandy16) October 14, 2021

Example : in this crazy mkt, I did not even trade TataMotors this week. Stayed focussed on ITC and it gave good returns https://t.co/41wkugZg1I

This is a thread I wrote on IV, IVR etc

IV - A thread

— Subhadip Nandy (@SubhadipNandy16) September 20, 2018

In financial mathematics, implied volatility of an option contract is

that value of the volatility of the underlying instrument which, when

input in an option pricing model ) will return a theoretical value equal to the current market price of the option (1/n)

You May Also Like

Here's the most useful #Factualist comparison pages #Thread 🧵

What is the difference between “pseudonym” and “stage name?”

Pseudonym means “a fictitious name (more literally, a false name), as those used by writers and movie stars,” while stage name is “the pseudonym of an entertainer.”

https://t.co/hT5XPkTepy #english #wiki #wikidiff

People also found this comparison helpful:

Alias #versus Stage Name: What’s the difference?

Alias means “another name; an assumed name,” while stage name means “the pseudonym of an entertainer.”

https://t.co/Kf7uVKekMd #Etymology #words

Another common #question:

What is the difference between “alias” and “pseudonym?”

As nouns alias means “another name; an assumed name,” while pseudonym means “a fictitious name (more literally, a false name), as those used by writers and movie

Here is a very basic #comparison: "Name versus Stage Name"

As #nouns, the difference is that name means “any nounal word or phrase which indicates a particular person, place, class, or thing,” but stage name means “the pseudonym of an

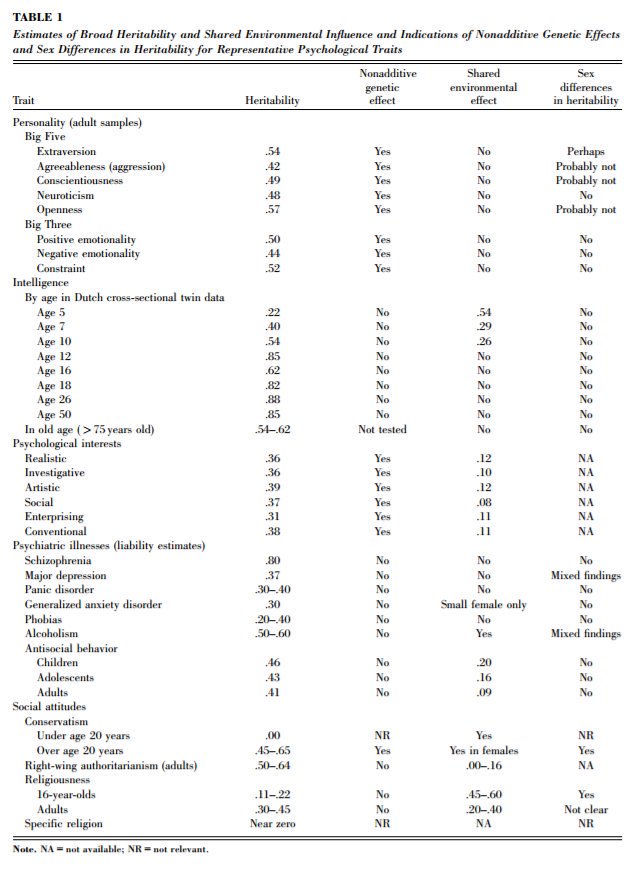

1. IQ is one of the most heritable psychological traits – that is, individual differences in IQ are strongly associated with individual differences in genes (at least in fairly typical modern environments). https://t.co/3XxzW9bxLE

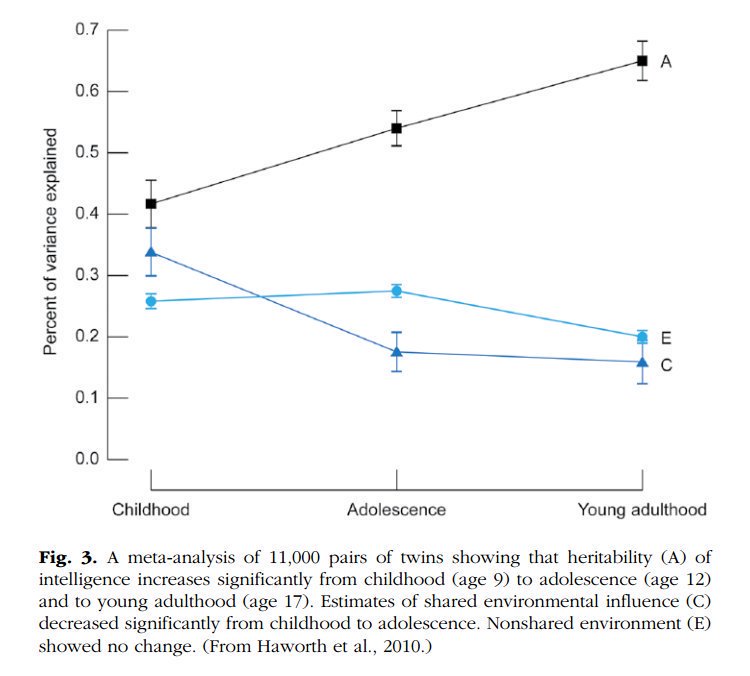

2. The heritability of IQ *increases* from childhood to adulthood. Meanwhile, the effect of the shared environment largely fades away. In other words, when it comes to IQ, nature becomes more important as we get older, nurture less. https://t.co/UqtS1lpw3n

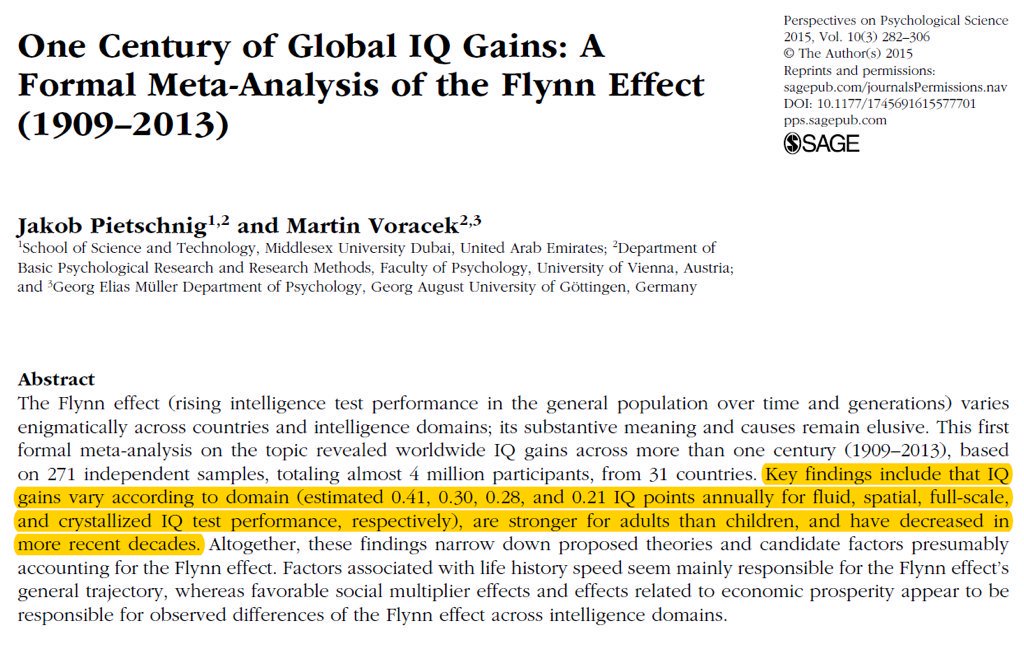

3. IQ scores have been increasing for the last century or so, a phenomenon known as the Flynn effect. https://t.co/sCZvCst3hw (N ≈ 4 million)

(Note that the Flynn effect shows that IQ isn't 100% genetic; it doesn't show that it's 100% environmental.)

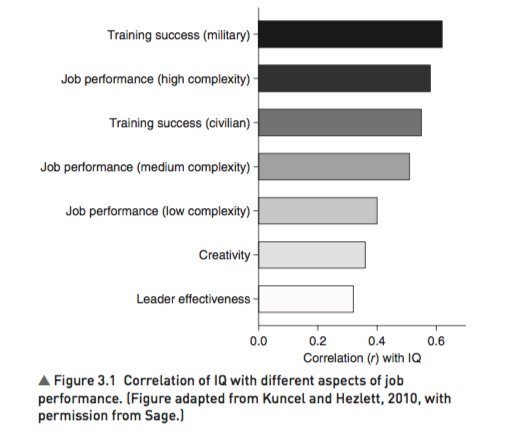

4. IQ predicts many important real world outcomes.

For example, though far from perfect, IQ is the single-best predictor of job performance we have – much better than Emotional Intelligence, the Big Five, Grit, etc. https://t.co/rKUgKDAAVx https://t.co/DWbVI8QSU3

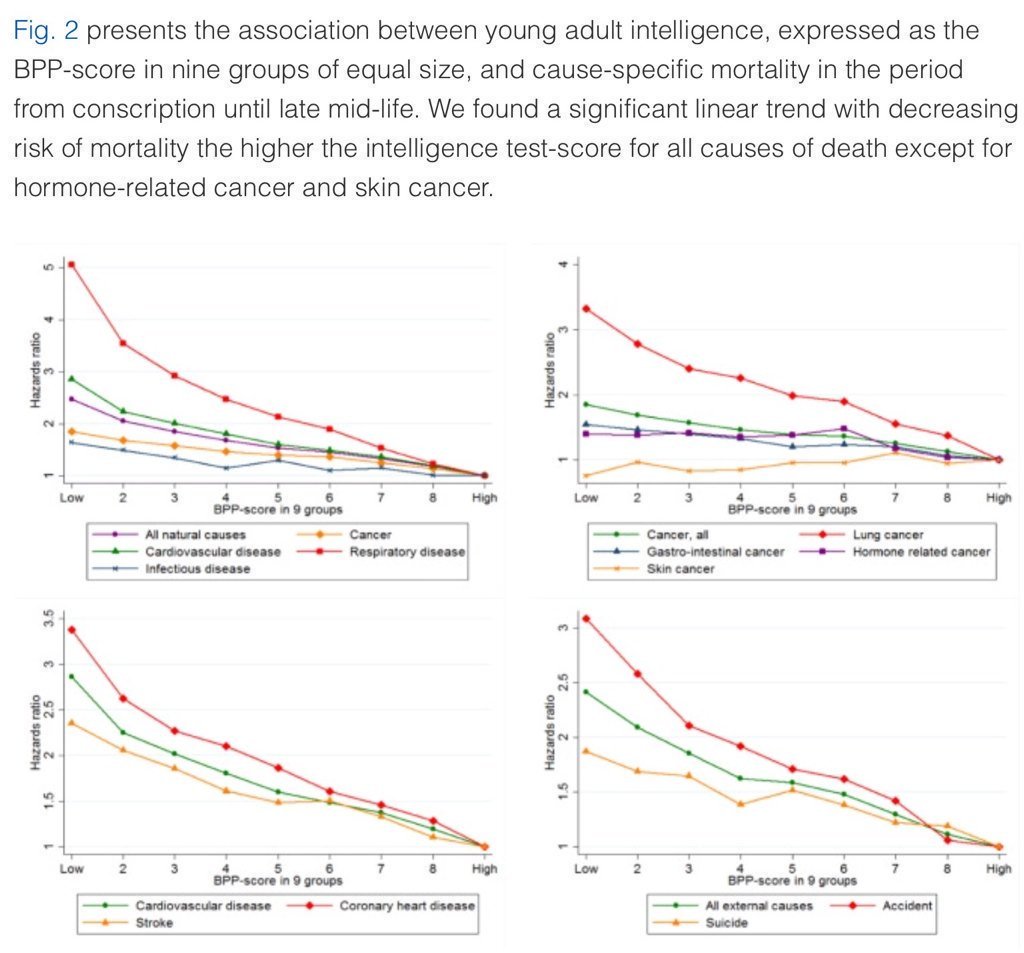

5. Higher IQ is associated with a lower risk of death from most causes, including cardiovascular disease, respiratory disease, most forms of cancer, homicide, suicide, and accident. https://t.co/PJjGNyeQRA (N = 728,160)

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0