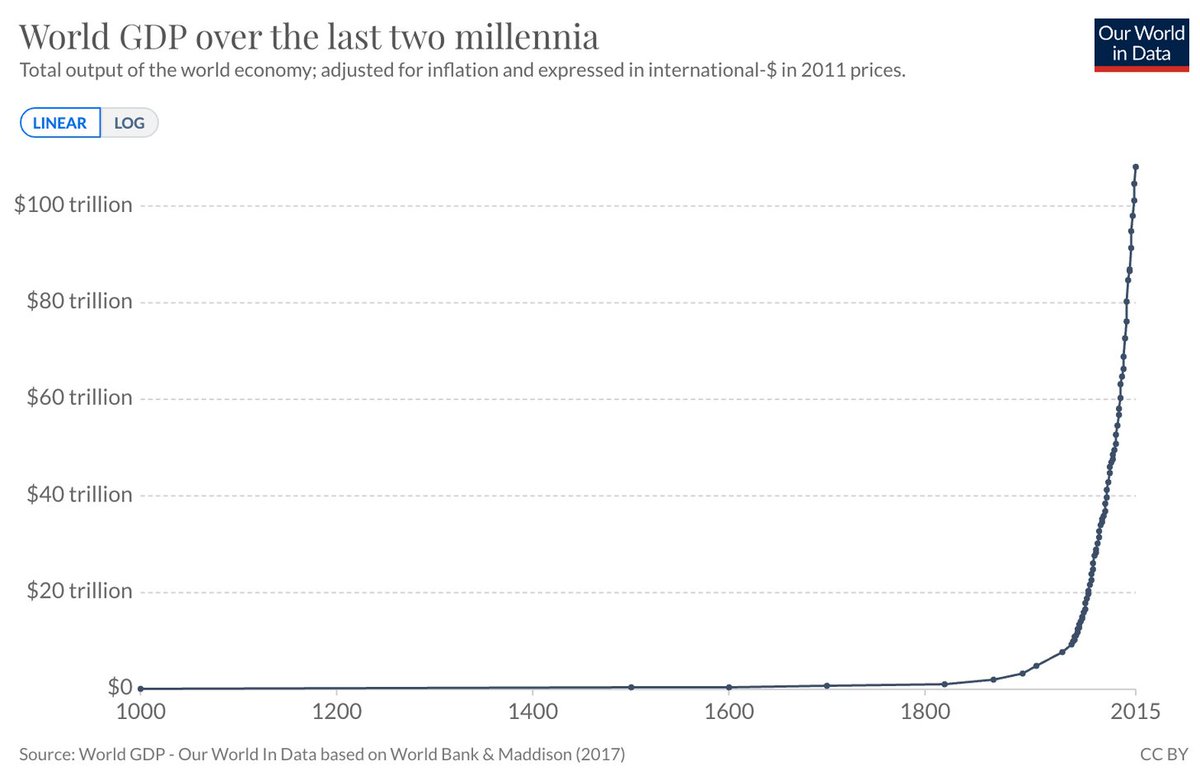

Capitalism totally changed that.

SEC: proposed pilot program to allow tech companies to pay gig workers up to 15% of their annual compensation in equity rather than cash https://t.co/EJjLWQatcr

— Jesse Walden (@jessewldn) November 24, 2020

12/ I call these \u201cCrypto Cooperatives.\u201d They are not only going to change the world, but help fix it.

— Ian Lee \U0001f4ad (@ianjohnlee) December 30, 2020

What we need to do as quickly and reasonably as possible however is design them for everyone and the people who need them the most\u2014to build a better world for all.

Social networks of today are Delaware-based digital dictatorships

— Ric Burton \U0001f1ec\U0001f1e7 \u2023 \U0001f1fa\U0001f1f8 (@ricburton) December 17, 2020

We will look back on the billions of minds controlled by them as serfs toiling the digital soil for their masters

We cannot let so much value be controlled by a few dudes running companies in California

True State of the Nation

— Secret SoSHHiety (@SouledOutWorld) December 19, 2020

You think you know what's coming... but you don't...https://t.co/MVoIuxgaWX pic.twitter.com/DtF2Q53HrT

Truth About Antarctica

— Secret SoSHHiety (@SouledOutWorld) December 19, 2020

Why? Scalar EM Antennas are kept at Antarctica; Scalar EM weaponry is the anonymous weapon to be used by the White Horse of Rev 6.https://t.co/7CDzmQfLSX pic.twitter.com/0400oCN8io

The Finger (fuck you/fuck the world)

— Secret SoSHHiety (@SouledOutWorld) December 18, 2020

The middle finger is the Saturn finger.https://t.co/BsrsBE3f5h pic.twitter.com/ZJqZll8lU1

Bread and Circuses

— Secret SoSHHiety (@SouledOutWorld) December 18, 2020

Bring in the clowns & the fast food...https://t.co/SZAlfkqTI3 pic.twitter.com/gLys0mNMIq

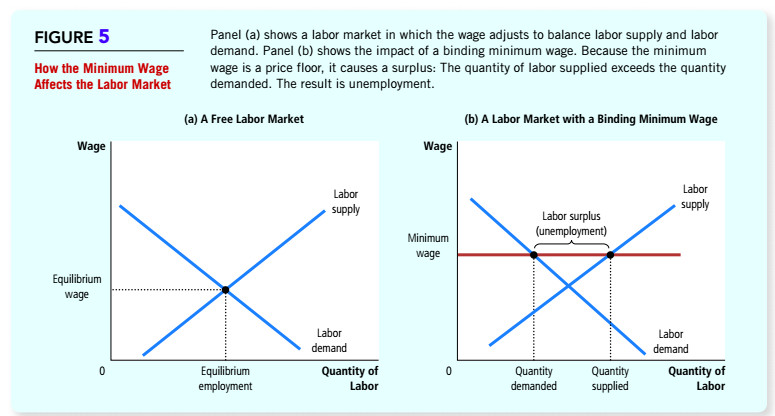

1/4 Most people, especially academic economists, think that the controversy over the minimum wage is a contest over facts. It's not. It's a contest over power, status, and wealth. It is just like the contest over racial and gender justice.

— Nick Hanauer (@NickHanauer) January 17, 2021

A THREAD:

— Aditya Todmal (@AdityaTodmal) November 28, 2020

7 FREE OPTION TRADING COURSES FOR BEGINNERS.

Been getting lot of dm's from people telling me they want to learn option trading and need some recommendations.

Here I'm listing the resources every beginner should go through to shorten their learning curve.

(1/10)

The absolute best 15 scanners which experts are using.

— Aditya Todmal (@AdityaTodmal) January 29, 2021

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

Share for the benefit of everyone.

12 TRADING SETUPS which experts are using.

— Aditya Todmal (@AdityaTodmal) February 7, 2021

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Curated tweets on How to Sell Straddles

— Aditya Todmal (@AdityaTodmal) February 21, 2021

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on Straddles

Share if you find this knowledgeable for the benefit of others.