$600/wk Unemployment Insurance cannot deliver the benefits of a $600/wk Job Guarantee. From the outset, I should say JG is not a replacement for UI, no matter what you may have heard. I’ll get to this later, but read this long 🧶 w/ that in mind.

Surprised so many smart people bought into the idea that $600/wk UI is the same as $600/wk job guarantee (or better) or that JG jobs must be inherently inessential. I\u2019ve addressed this many times & will post a thread later. Trying not to spend precious family time on Twitter.

— Pavlina R Tcherneva (@ptcherneva) December 29, 2020

UI is temporary, which makes matters worse. Even if it were permanent, it still won't resolve the problem of job scarcity.

Or we could choose differently. Thanks for reading. For more: https://t.co/jbpiJDgQ7J

More from Economy

On Jan 6, 2021, the always stellar Mr @deepakshenoy tweeted, this:

https://t.co/fa3GX9VnW0

Innocuous 1 sentence, but its a full economic theory at play.

Let me break it down for you. (1/n)

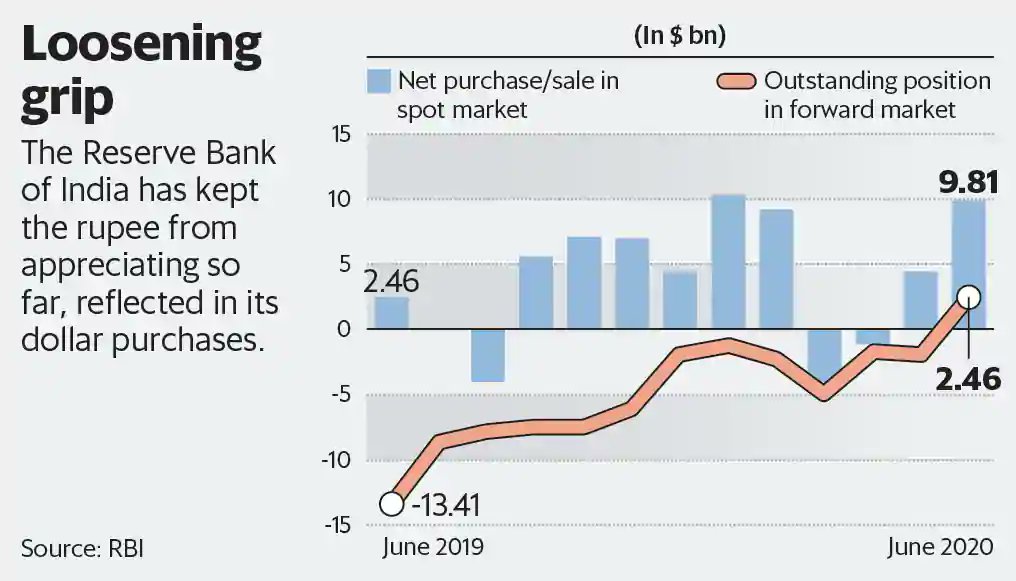

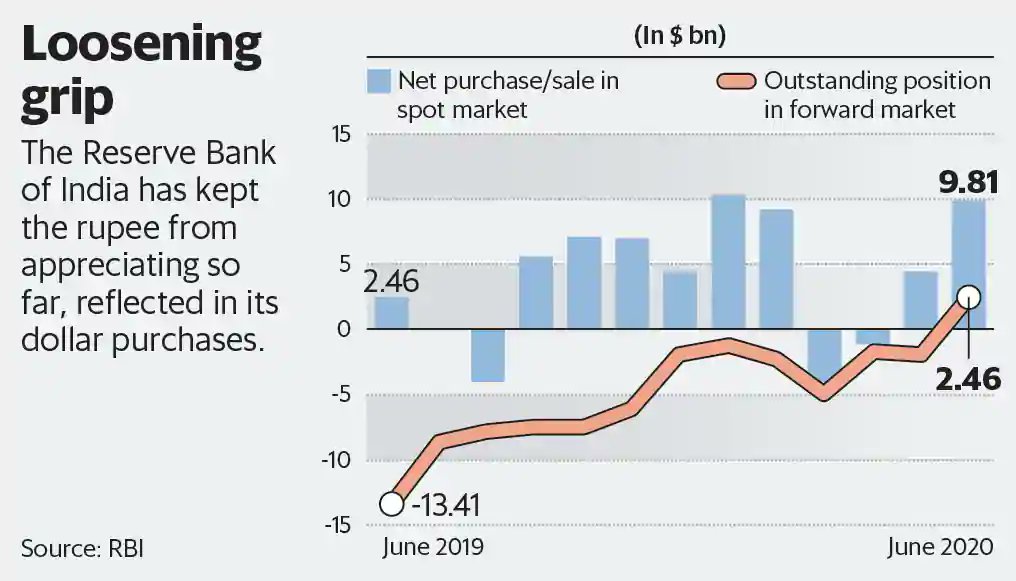

On September 30, 2020, I wrote an article for @CFASocietyIndia where I explained that RBI is all set to lose its ability to set interest rates if it continues to fiddle with the exchange rate (2/n)

What do I mean, "fiddle with the exchange rate"?

In essence, if RBI opts and continues to manage exchange rate, then that is "fiddling with the exchange rate"

RBI has done that in the past and has restarted it in 2020 - very explicitly. (3/n)

First in March 2020, it opened a Dollar/INR swap of $2B with far leg to be unwound in September 2020.

Implying INR will be bought from the open markets in order to prevent INR from falling vis a vis USD (4/n)

The Second aspect is now, that dollar inflow is happening, and the forex reserves swelled -> implying the rupee is appreciating, RBI again intervened from September, by selling INR in spot markets. (5/n)

https://t.co/9kpWP7ovyM

https://t.co/fa3GX9VnW0

Innocuous 1 sentence, but its a full economic theory at play.

Let me break it down for you. (1/n)

91 day TBills at 3.03%. Interest rates are even lower than RBI has them.

— Deepak Shenoy (@deepakshenoy) January 6, 2021

On September 30, 2020, I wrote an article for @CFASocietyIndia where I explained that RBI is all set to lose its ability to set interest rates if it continues to fiddle with the exchange rate (2/n)

What do I mean, "fiddle with the exchange rate"?

In essence, if RBI opts and continues to manage exchange rate, then that is "fiddling with the exchange rate"

RBI has done that in the past and has restarted it in 2020 - very explicitly. (3/n)

First in March 2020, it opened a Dollar/INR swap of $2B with far leg to be unwound in September 2020.

Implying INR will be bought from the open markets in order to prevent INR from falling vis a vis USD (4/n)

The Second aspect is now, that dollar inflow is happening, and the forex reserves swelled -> implying the rupee is appreciating, RBI again intervened from September, by selling INR in spot markets. (5/n)

https://t.co/9kpWP7ovyM