Inflation is always and everywhere a monetary phenomenon RELATIVE to real economic activity. This last part is key.

More from Economy

You get the impression from the eco-socialists and degrowthers that humanity wouldn\u2019t face the threat of climate change or biodiversity loss if it weren\u2019t for capitalism (or rather, if it weren\u2019t for capitalist modernity).

— Leigh Phillips (@Leigh_Phillips) February 2, 2021

But I see no evidence to suggest this is the case.

The historical counterfactual also in not totally convincing. So let's assume Germany and Europe went socialist. The world economy would have evolved exactly the same way it did? 🤔 I doubt it, this is too deterministic. Examples: /2

We do not know if the transition from coal to oil would have taken place when it took place, the way it did. From Timothy Mitchell we know that oil was a fix for capitalism to bypass the labour strikes of coal workers. One would think that socialists would treat workers better /3

We also do not know if socialist governments would strong arm the Middle East the way capitalists did, starting wars to secure cheap oil, and setting up puppet governments. One would want to think that Rosa Luxembourg would not go down that path..../4

We also do not know if they would have continued colonial unequal exchange, extracting raw materials as cheap as possible from the rest of the world. Without cheap oil and cheap materials, it is anyone's guess if GDP and CO2 would be where it is now. /5

You May Also Like

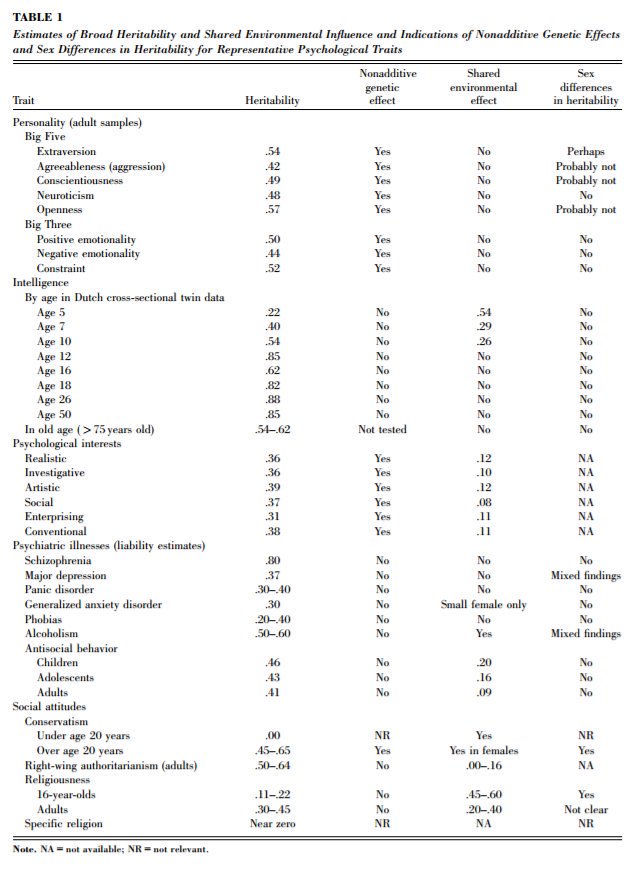

1. IQ is one of the most heritable psychological traits – that is, individual differences in IQ are strongly associated with individual differences in genes (at least in fairly typical modern environments). https://t.co/3XxzW9bxLE

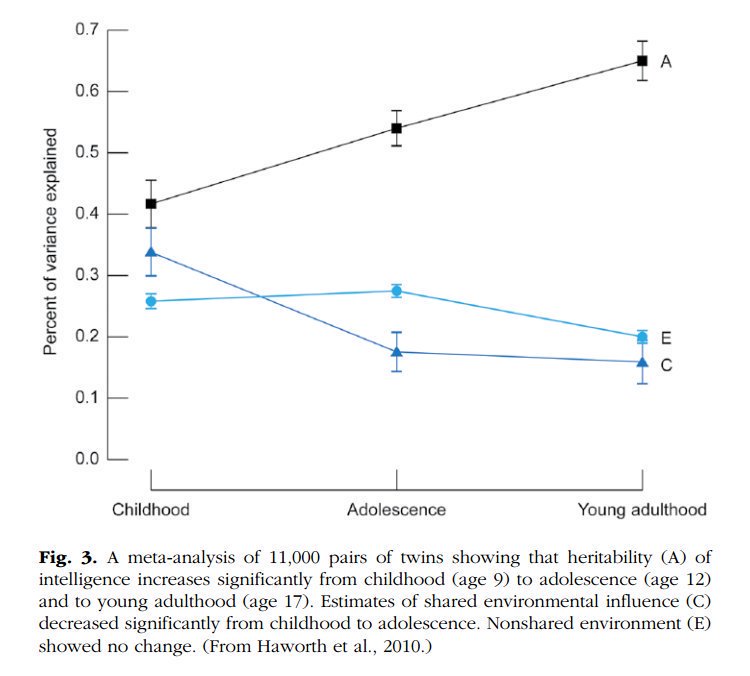

2. The heritability of IQ *increases* from childhood to adulthood. Meanwhile, the effect of the shared environment largely fades away. In other words, when it comes to IQ, nature becomes more important as we get older, nurture less. https://t.co/UqtS1lpw3n

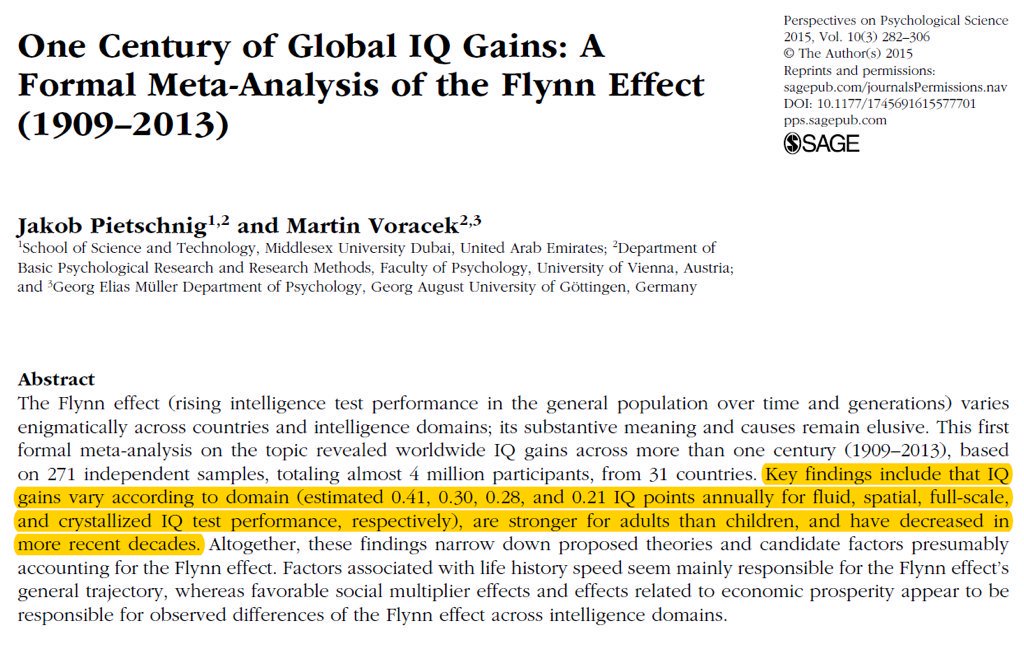

3. IQ scores have been increasing for the last century or so, a phenomenon known as the Flynn effect. https://t.co/sCZvCst3hw (N ≈ 4 million)

(Note that the Flynn effect shows that IQ isn't 100% genetic; it doesn't show that it's 100% environmental.)

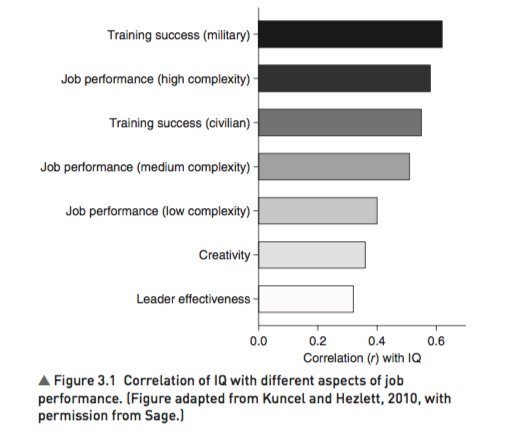

4. IQ predicts many important real world outcomes.

For example, though far from perfect, IQ is the single-best predictor of job performance we have – much better than Emotional Intelligence, the Big Five, Grit, etc. https://t.co/rKUgKDAAVx https://t.co/DWbVI8QSU3

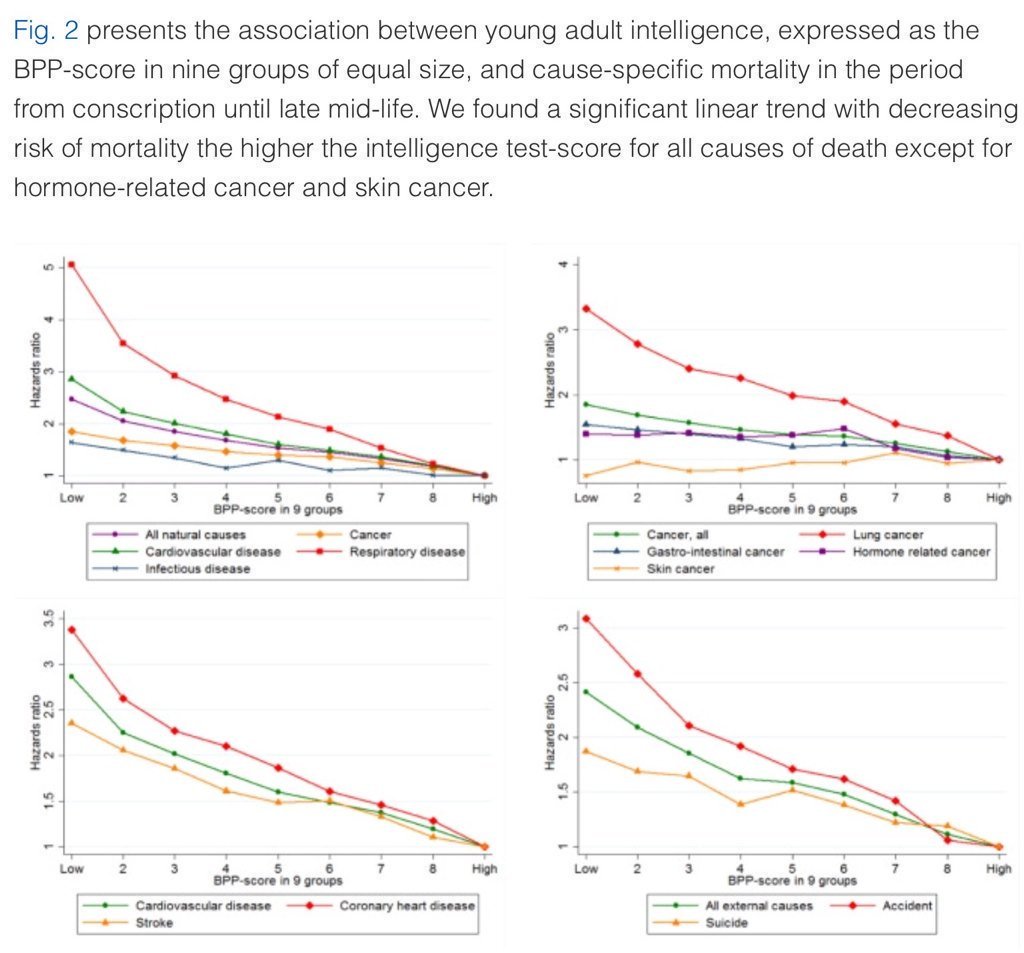

5. Higher IQ is associated with a lower risk of death from most causes, including cardiovascular disease, respiratory disease, most forms of cancer, homicide, suicide, and accident. https://t.co/PJjGNyeQRA (N = 728,160)

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0

THE WINNERS OF THE 24 HOUR STARTUP CHALLENGE

Remember, this money is just fun. If you launched a product (or even attempted a launch) - you did something worth MUCH more than $1,000.

#24hrstartup

The winners 👇

#10

Lattes For Change - Skip a latte and save a life.

https://t.co/M75RAirZzs

@frantzfries built a platform where you can see how skipping your morning latte could do for the world.

A great product for a great cause.

Congrats Chris on winning $250!

#9

Instaland - Create amazing landing pages for your followers.

https://t.co/5KkveJTAsy

A team project! @bpmct and @BaileyPumfleet built a tool for social media influencers to create simple "swipe up" landing pages for followers.

Really impressive for 24 hours. Congrats!

#8

SayHenlo - Chat without distractions

https://t.co/og0B7gmkW6

Built by @DaltonEdwards, it's a platform for combatting conversation overload. This product was also coded exclusively from an iPad 😲

Dalton is a beast. I'm so excited he placed in the top 10.

#7

CoderStory - Learn to code from developers across the globe!

https://t.co/86Ay6nF4AY

Built by @jesswallaceuk, the project is focused on highlighting the experience of developers and people learning to code.

I wish this existed when I learned to code! Congrats on $250!!