When costs are reduced, margins and profits increase.

Interpretation of Financial Statements - preliminary filters.

1. Looking for sustainable competitive advantage:

When looking for sustainable moat, you wanna see consistency - in earnings, in having low debt, in having growing earnings, low spending in capital expenditures, etc.

When costs are reduced, margins and profits increase.

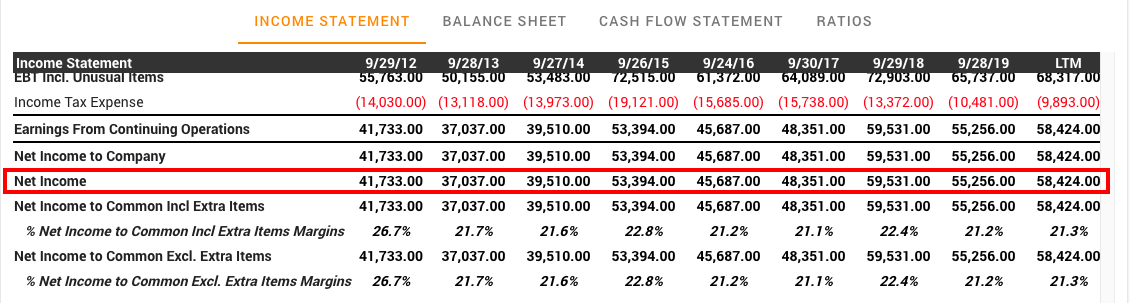

Let's take a look at Apple:

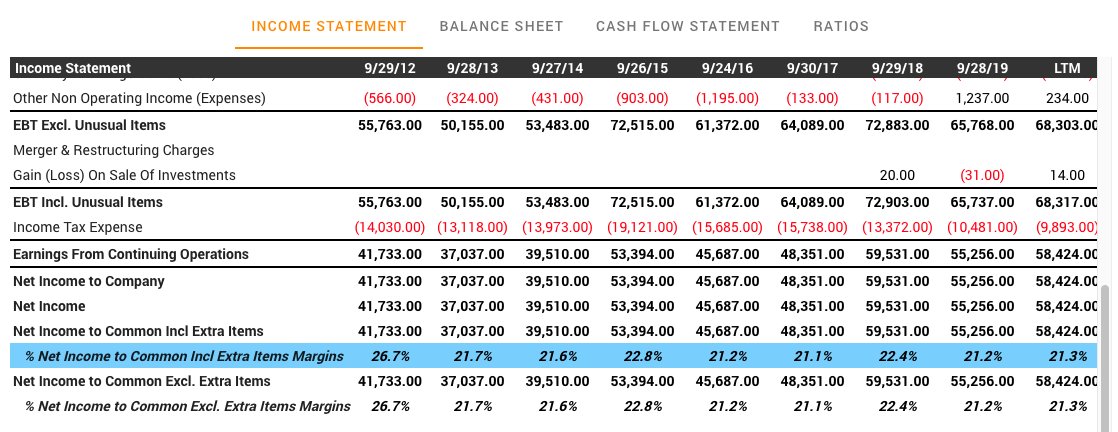

i) You want to see earnings grow at a steady pace. Take a look at the net income below.

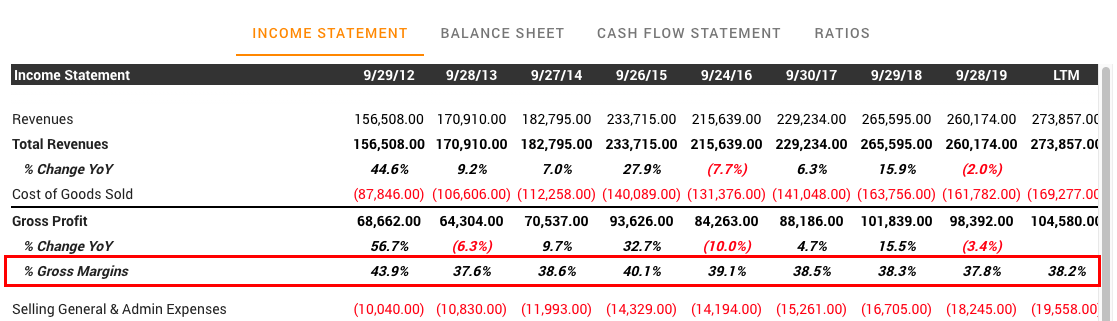

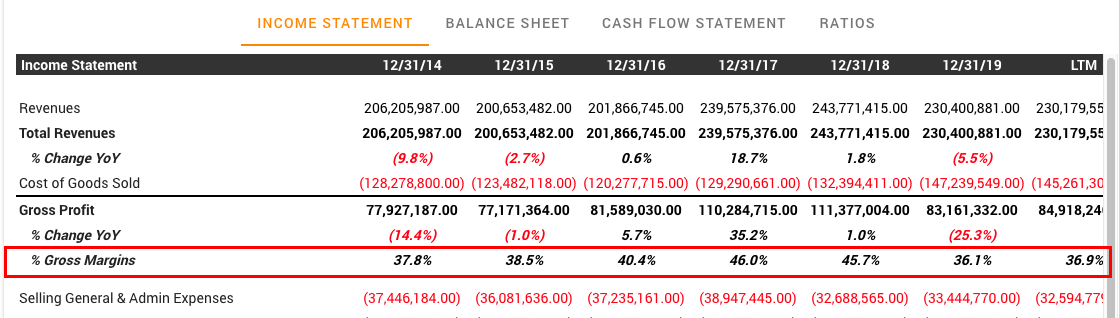

As a thumb rule, Warren Buffett wants to see a gross margin of around 40% or above.

Although not quite 40%, it's around that range with respect to Apple.

Samsung's gross margins are around similar range, highest being 45.7% in 2018, and Huawei had a gross margin of 38.6%.

Gross margin = (revenue - cost of goods sold) / revenue

Net margin = net income / revenue.

You want to see the company having higher net margin compared to their competitors.

Typically, net margin above 20% is a very strong one, indicating that we are dealing with a smoothly run business.

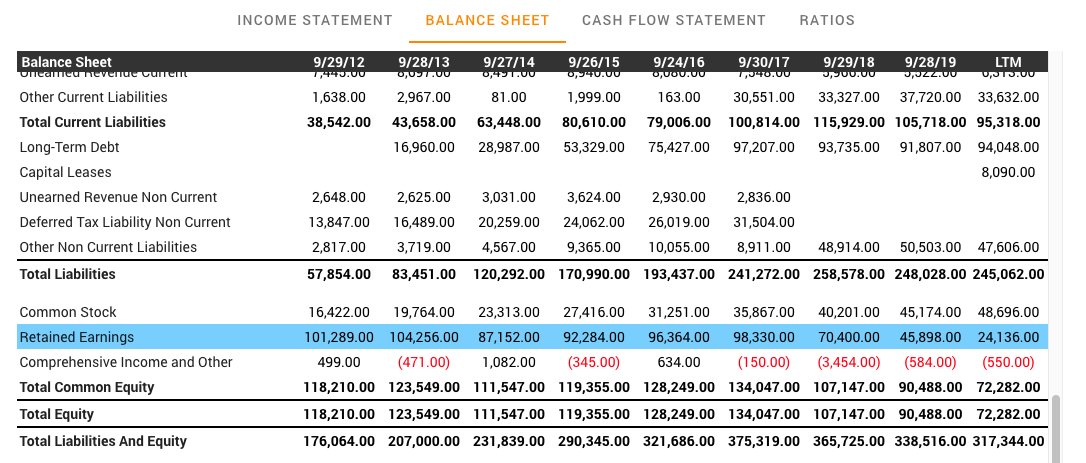

Look at the figure - "Retained Earnings".

Using retained earnings, you can find out if a company is reinvesting its income or not. A steady growth in this number means the business is profitable, and that it's identifying good investing opportunities.

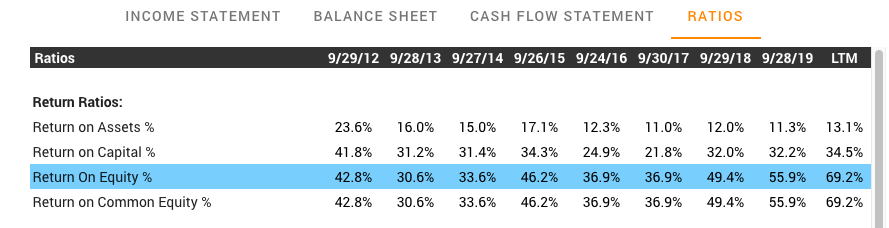

To measure how efficiently a company is using these retained earnings, Return on Equity (ROE) is used.

Apple looks quite strong in this aspect. It's partly an effect of distributing a lot of their earnings to shareholders. It also signifies the sustainable competitive moat.

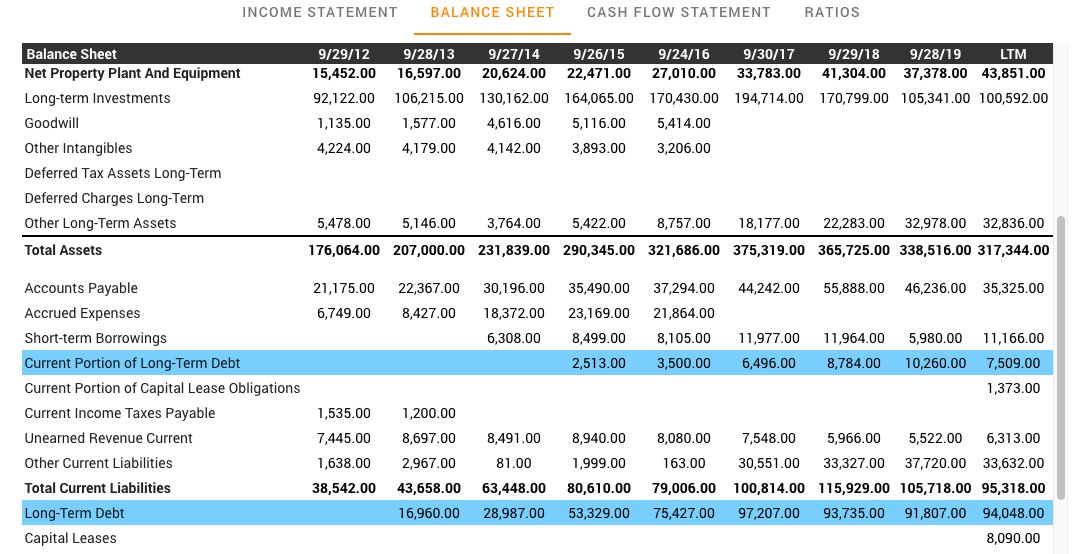

4) Exceptional businesses seldom require a lot of debt to expand (except maybe banks/NBFCs). Instead, they can just use the strong cashflow from the business.

This is where you see the actual in's and out's of money.

Look at "Capital Expenditures" on the cashflow statement.

This is the money being spent on properties, plant, and equipment.

Exceptions: One time payment to grow the business in some capex activity.

3 instances when you could consider selling the stock.

i) You need money for a better investments. This is more so applicable in a bear market, for you to switch from something great to something exceptional.

This may not always apply to all markets, all stocks. But with anything above 40PE, tread carefully and cautiously.

- Competitive advantage and scale

- Consistently high net income, return on equity

- Requires very little debt

- Retained earnings has steady growth

- Capital expenditures should be < 25%

- Sell a company if prices are crazy, or a better opportunity comes up.

https://t.co/nbKA5Bzpi6

https://t.co/MbmUKsE968

More from Shravan Venkataraman 🎡

More from Economy

1. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY" https://t.co/BXdtcNxrVf

2. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

3. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

4. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

5. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

The great replacement isn't a conspiracy theory, it is the inevitable outcome of non-stop immigration of populations whom do not wish to assimilate and have way higher birth rates than the native population... It's purely a mathematical reality.

— Angelo John Gage (@AngeloJohnGage) December 30, 2020

2. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

3. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

4. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

5. "ThE gReAt rEplAcEMeNt iS A cOnSpiRaCy tHEorY"

You May Also Like

There are many strategies in market 📉and it's possible to get monthly 4% return consistently if you master 💪in one strategy .

One of those strategies which I like is Iron Fly✈️

Few important points on Iron fly stategy

This is fixed loss🔴 defined stategy ,so you are aware of your losses . You know your risk ⚠️and breakeven points to exit the positions.

Risk is defined , so at psychological🧠 level you are at peace🙋♀️

How to implement

1. Should be done on Tuesday or Wednesday for next week expiry after 1-2 pm

2. Take view of the market ,looking at daily chart

3. Then do weekly iron fly.

4. No need to hold this till expiry day .

5.Exit it one day before expiry or when you see more than 2% within the week.

5. High vix is preferred for iron fly

6. Can be executed with less capital of 3-5 lakhs .

https://t.co/MYDgWkjYo8 have R:2R so over all it should be good.

8. If you are able to get 6% return monthly ,it means close to 100% return on your capital per annum.

One of those strategies which I like is Iron Fly✈️

Few important points on Iron fly stategy

This is fixed loss🔴 defined stategy ,so you are aware of your losses . You know your risk ⚠️and breakeven points to exit the positions.

Risk is defined , so at psychological🧠 level you are at peace🙋♀️

How to implement

1. Should be done on Tuesday or Wednesday for next week expiry after 1-2 pm

2. Take view of the market ,looking at daily chart

3. Then do weekly iron fly.

4. No need to hold this till expiry day .

5.Exit it one day before expiry or when you see more than 2% within the week.

5. High vix is preferred for iron fly

6. Can be executed with less capital of 3-5 lakhs .

https://t.co/MYDgWkjYo8 have R:2R so over all it should be good.

8. If you are able to get 6% return monthly ,it means close to 100% return on your capital per annum.