Categories Crypto

7 days

30 days

All time

Recent

Popular

Back with another #FreeLoveFriday. Last time, we covered how Mastercoin/@Omni_Layer pioneered digital asset issuance on blockchains. Today, let’s discuss @Chainlink and the vital role it plays in connecting blockchains to the real world.

I have said repeatedly that digital asset issuance is the killer application for blockchains. The next frontier is bringing real world assets to networks like @AvalancheAVAX, but we often face a significant problem:

Namely, how do you get data from the real world onto blockchains and into applications running on them? More critically, how do you achieve that securely and transparently in real-time? Smart contracts are tamper-proof, but they're only as reliable as their input data.

Enter ChainLink in September 2017, with a whitepaper outlining a vision for a decentralized network of “oracles,” entities that inject facts from the external world into blockchains in a suitable format for smart contracts.

Until ChainLink, oracles were trusted and centralized. This is a huge problem for high-value assets and smart contracts. High value projects, such as @CelsiusNetwork, @synthetix_io, @Aaveaave and others depend critically on oracle data.

Back with another #FreeLoveFriday. My first thread focused on what I love about Bitcoin, and features we borrowed for @AvalancheAVAX. Today, let's focus on @Omni_Layer, or as OGs knew it, Mastercoin https://t.co/fXFgmaeUEz

— Emin G\xfcn Sirer (@el33th4xor) January 15, 2021

I have said repeatedly that digital asset issuance is the killer application for blockchains. The next frontier is bringing real world assets to networks like @AvalancheAVAX, but we often face a significant problem:

Namely, how do you get data from the real world onto blockchains and into applications running on them? More critically, how do you achieve that securely and transparently in real-time? Smart contracts are tamper-proof, but they're only as reliable as their input data.

Enter ChainLink in September 2017, with a whitepaper outlining a vision for a decentralized network of “oracles,” entities that inject facts from the external world into blockchains in a suitable format for smart contracts.

Until ChainLink, oracles were trusted and centralized. This is a huge problem for high-value assets and smart contracts. High value projects, such as @CelsiusNetwork, @synthetix_io, @Aaveaave and others depend critically on oracle data.

Where should I start?

1) Is Blockfi profitable?

2) How much money does BlockFi have on its balance sheet?

3) Is the yield that BlockFi pays to its depositors earned or subsidized by billionaire investors?

4) Has BlockFi ever been profitable?

5) Are you planning to go public?

1) Is Blockfi profitable?

2) How much money does BlockFi have on its balance sheet?

3) Is the yield that BlockFi pays to its depositors earned or subsidized by billionaire investors?

4) Has BlockFi ever been profitable?

5) Are you planning to go public?

When is the interview published? @otisa502

— Jakob.Cel (@HedegaardJakob) February 14, 2021

1. Yes, Trump will claim to intend to target GOP senators up for reelection in '22 (like he did to Thune with Kristi Noem) if they don't join in @HawleyMO's sedition on Jan. 6, but the fact is, it's not clear whether Trump will be successful in ANY of those efforts & voting yes

2. to hedge off these threats will also create fissures & fractures for these incumbents among other elements of their party that could complicate their renominations. Indeed, what worries me the most about the potential for the country to slip into @anneapplebaum territory is

3. that what should be robust and intense push back from the party establishment against actually ending democracy- bc that's what Trump's request would do, if it was granted, is fairly muted. What we SHOULD be seeing from the mainstream of the party is threats to strip committee

4. assignments, chairs, privileges, even reelection funds, if anyone gets involved in this bullshit- in the House & the Senate, and the fact that you don't see it is more than a story of McConnell & McCarthy being afraid of Trump & his base. Its a story of receptivity, of the

5. level of receptivity the congressional and party leadership is dealing with both within the rank and file membership of the party and within its donor class, and THAT, my friends, is why you find me so concerned. That, and my decision to finally pull @anneapplebaum's book

A lot of conversations today among Republican senators over move by @HawleyMO to challenge the certification of Biden\u2019s Electoral College victory. Small groups of Rs were huddling on & off the floor trying to game out the politics of what will happen Jan. 6

— John Bresnahan (@bresreports) January 1, 2021

2. to hedge off these threats will also create fissures & fractures for these incumbents among other elements of their party that could complicate their renominations. Indeed, what worries me the most about the potential for the country to slip into @anneapplebaum territory is

3. that what should be robust and intense push back from the party establishment against actually ending democracy- bc that's what Trump's request would do, if it was granted, is fairly muted. What we SHOULD be seeing from the mainstream of the party is threats to strip committee

4. assignments, chairs, privileges, even reelection funds, if anyone gets involved in this bullshit- in the House & the Senate, and the fact that you don't see it is more than a story of McConnell & McCarthy being afraid of Trump & his base. Its a story of receptivity, of the

5. level of receptivity the congressional and party leadership is dealing with both within the rank and file membership of the party and within its donor class, and THAT, my friends, is why you find me so concerned. That, and my decision to finally pull @anneapplebaum's book

1/ Well looks like folks wanted a 121 tweet tl;dr thread of my annual crypto theses. I was rooting for "delete account" to win the poll below instead, but here goes...

121 crypto theses for 2021.

(not investment advice)

2/ Get the full report here!

It's on the industry's banned books list, so you know it's good and deliciously irreverent.

3/ 1.1 Buy BTC. Buy ETH. Buy DeFi.

(political speech, not investment advice)

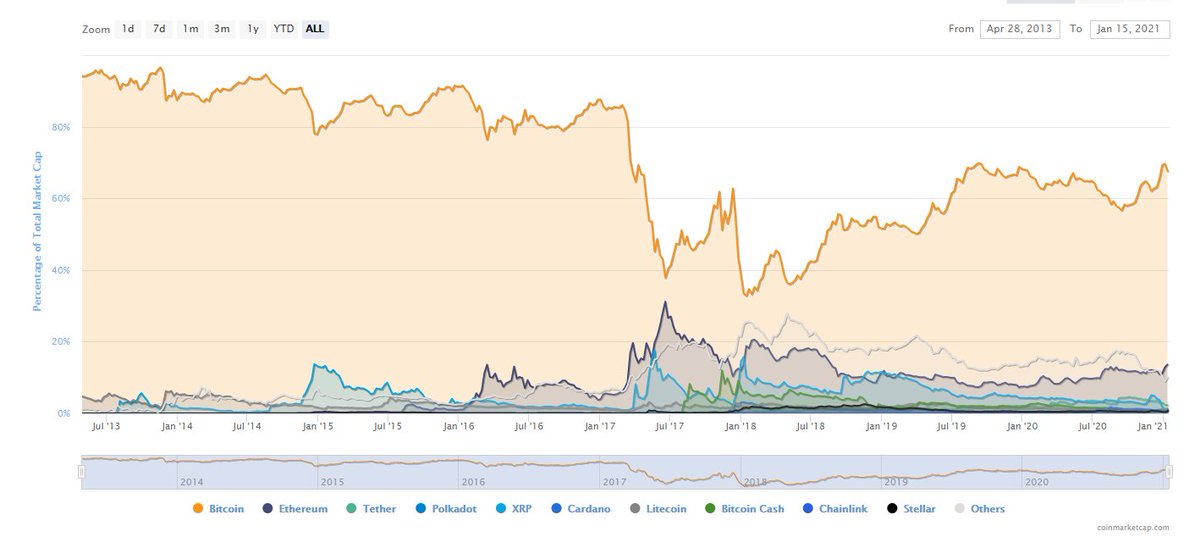

There's real fundamental drivers behind these assets today vs. 2017. I think we'll hit $100k / BTC next year, and $3 trillion of crypto market cap next cycle.

4/ 1.2 Buy BTC.

Not my advice, but it is from Paul Tudor Jones, Stanley Druckenmiller, Cathie Wood, Bill Miller, Raoul Pal, Chamath, and dozens of other institutional investors.

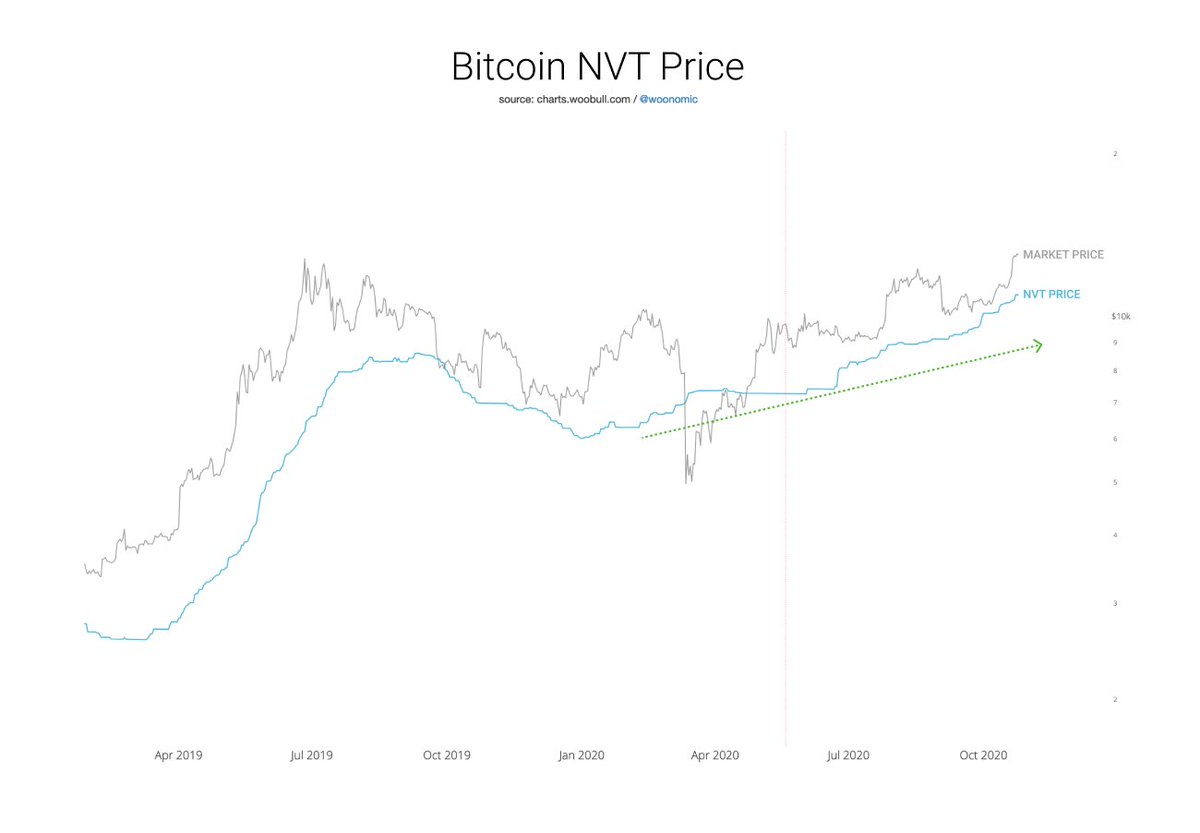

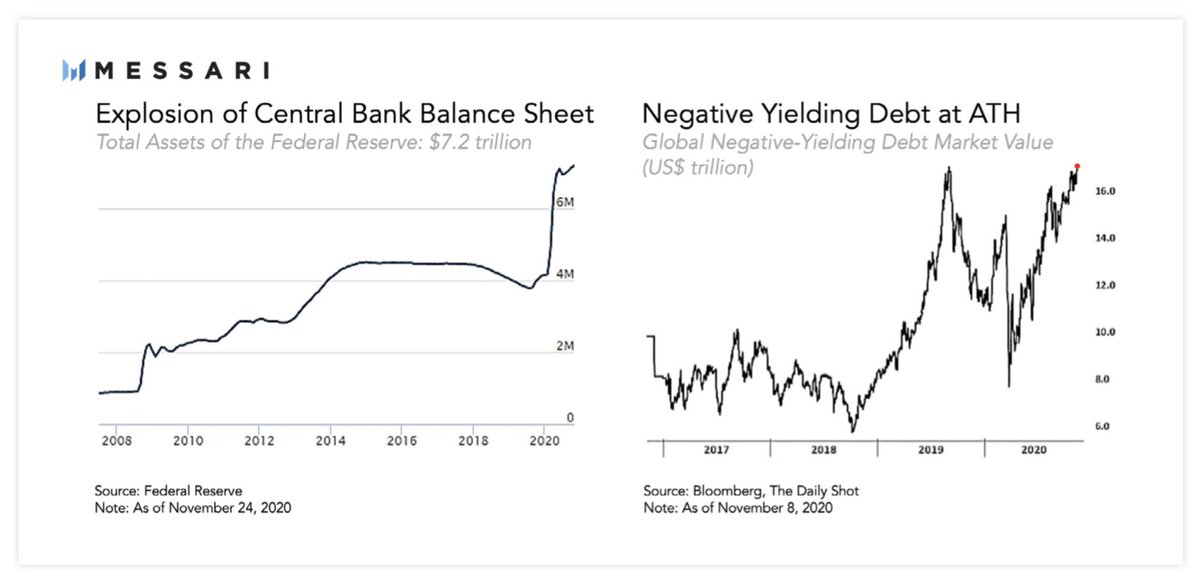

The digital gold narrative has stuck because of this:

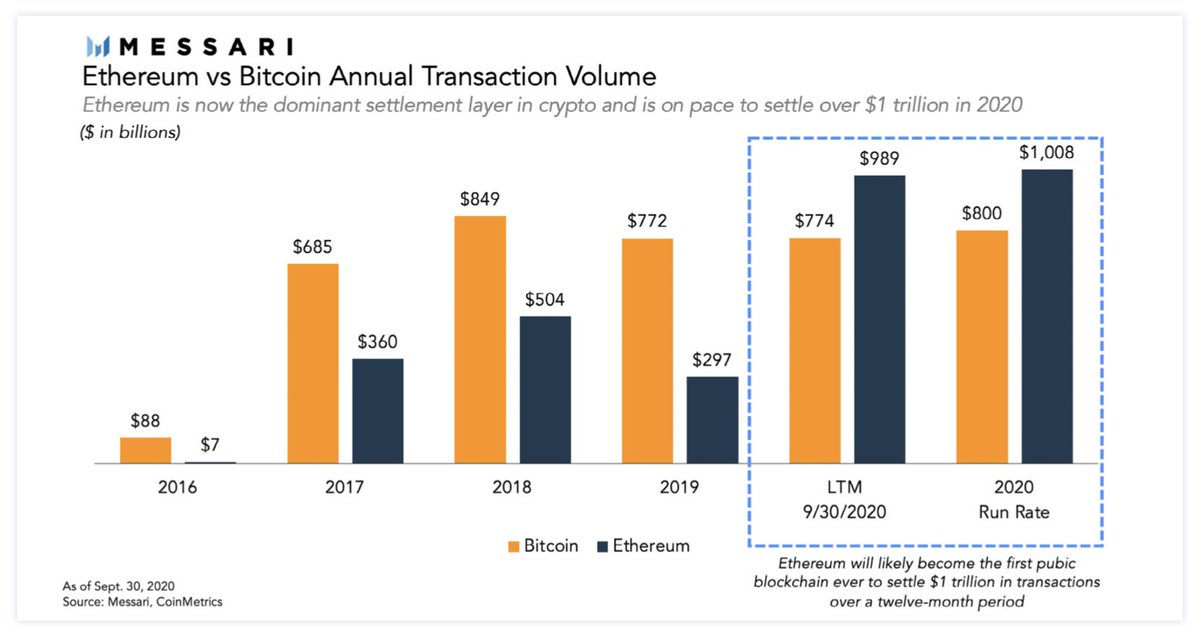

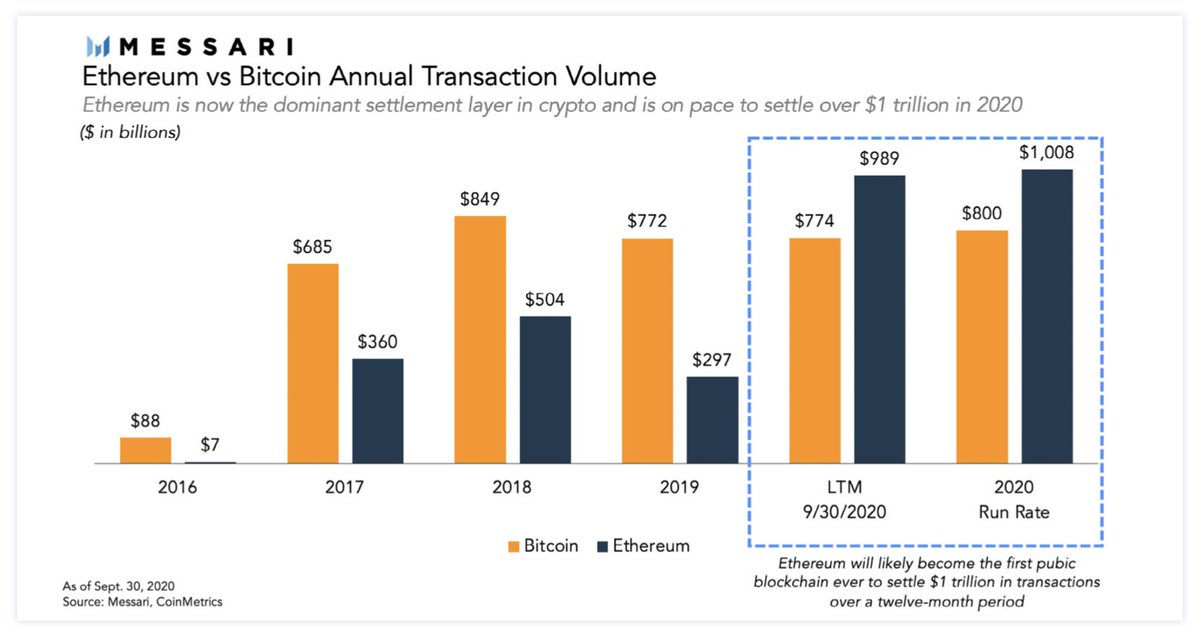

5/ 1.3 Buy ETH.

Ethereum is the everything marketplace + settlement layer for a new decentralized financial system.

It will clear $1 trillion of on-chain transactions this year; the beacon chain upgrade has gone smoothly so far; ETHE will pull in big $$$ (more on that later).

121 crypto theses for 2021.

(not investment advice)

Should I do a 121 tweet thread on the theses for you ingrates, or would you like me to delete my account?

— Ryan Selkis (@twobitidiot) December 10, 2020

Only two options:

2/ Get the full report here!

It's on the industry's banned books list, so you know it's good and deliciously irreverent.

3/ 1.1 Buy BTC. Buy ETH. Buy DeFi.

(political speech, not investment advice)

There's real fundamental drivers behind these assets today vs. 2017. I think we'll hit $100k / BTC next year, and $3 trillion of crypto market cap next cycle.

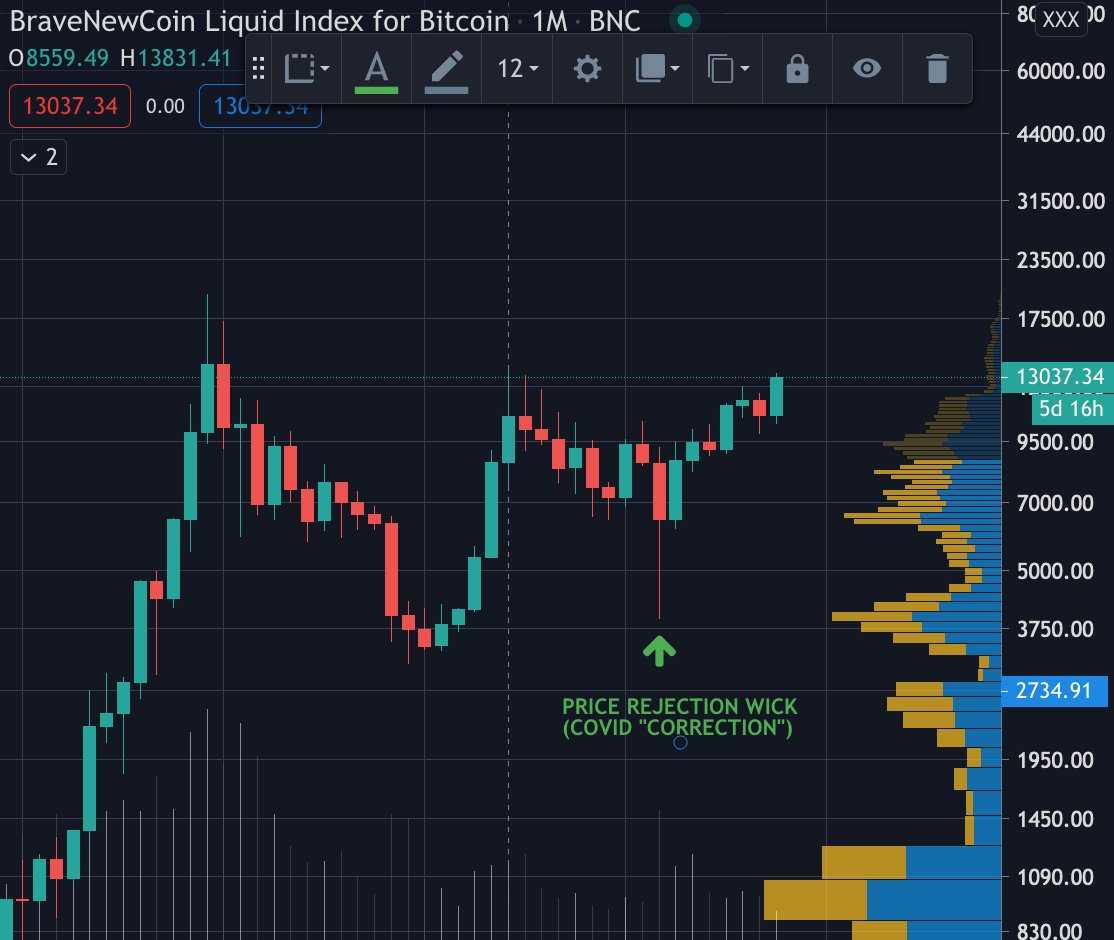

4/ 1.2 Buy BTC.

Not my advice, but it is from Paul Tudor Jones, Stanley Druckenmiller, Cathie Wood, Bill Miller, Raoul Pal, Chamath, and dozens of other institutional investors.

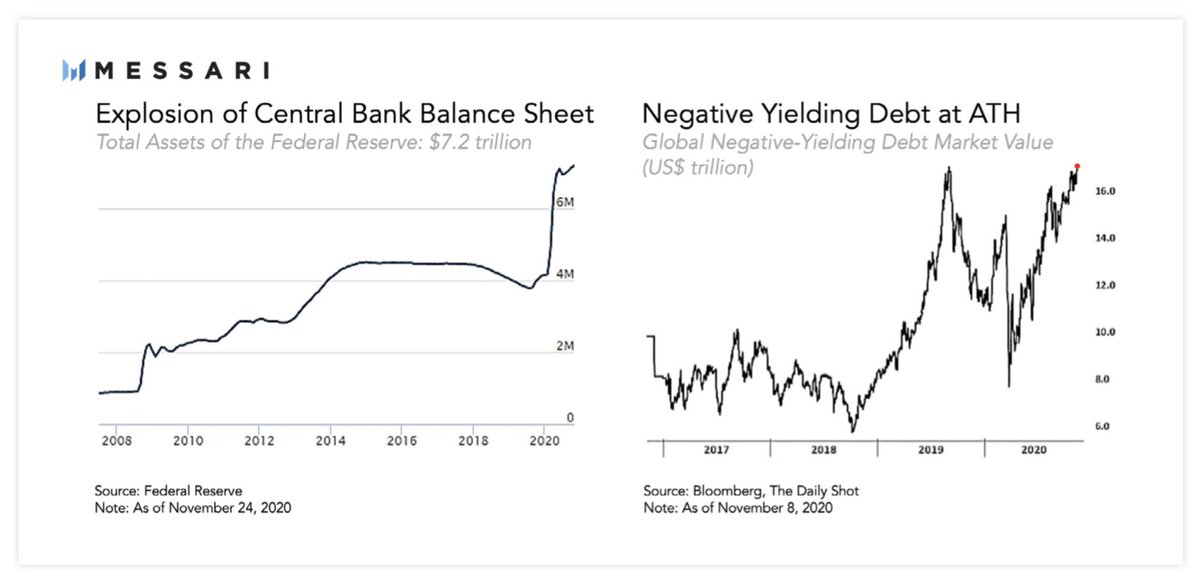

The digital gold narrative has stuck because of this:

5/ 1.3 Buy ETH.

Ethereum is the everything marketplace + settlement layer for a new decentralized financial system.

It will clear $1 trillion of on-chain transactions this year; the beacon chain upgrade has gone smoothly so far; ETHE will pull in big $$$ (more on that later).