That's step 1

I'm sure someone else has explained this, but it is just so cool and I want to explain how this works.

— Andre Cronje (@AndreCronjeTech) January 15, 2021

That's step 1

Swap $1m sUSD for $1m sBTC? flat 0.3% fee

Swap $10m sUSD for $10m sBTC? flat 0.3% fee

swap $100m sUSD for $100m sBTC? Well, there isn't that many synths in Curve, yet but you get the point. The only limit is the pool depth

1. Curve lets you swap like-assets with extremely low slippage and a low fee

2. Synthetix lets you convert synths to other synths, with no slippage and a low fee

What happens if we just... combine them?

1. I swap my "real asset" (e.g. USDC) for a "synthetic" one (e.g. sUSD)

2. I exchange one synthetic asset for another (e.g. sUSD -> sBTC)

3. I swap my new synthetic asset to a "real" asset again (e.g. wBTC)

It is. It's not cheap either, at over 1m gas to execute. And to make matters worse, due to how a Synthetix swap works, you actually have to wait a few minutes between the swap, so it isn't even full atomic!

The answer is capital efficiency. AMMs with a curve that allows trading assets that are dissimilar are inefficient with larger and larger swaps.

For example, a $10m USDC -> wBTC swap on Uniswap right now has >13% slippage!

Of course you would pick this option now!

But on principle, this will be the best way to perform a high-value swap!

I think as we have seen, gas fees are just going up and up and up. Optimism soft-launched their L2 today, but Ethereum's success means that block space will always be at a premium.

The gas costs will not be coming down as much as you'd think!

This more efficient means of large-value swaps will see a lot of use on base layer Ethereum, as gas prices continue to grow.

Hobbyist/frequent traders will move to Layer 2, where smaller value trades will be economically more efficient.

More from Crypto

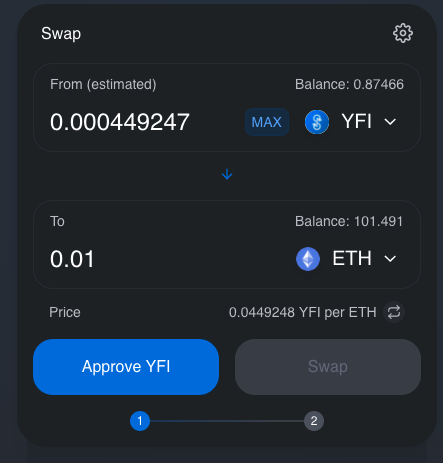

1/ ERC-20 token standard approve() has caused an unnecessary cost of $53.8M for #Ethereum and #DeFi users

This is bad. Continue reading why and how to avoid this in the future.

👇👇👇

2/ Before you go all rage on the flaws of my analysis, please read the whole Twitter thread for disclaimers and caveats.

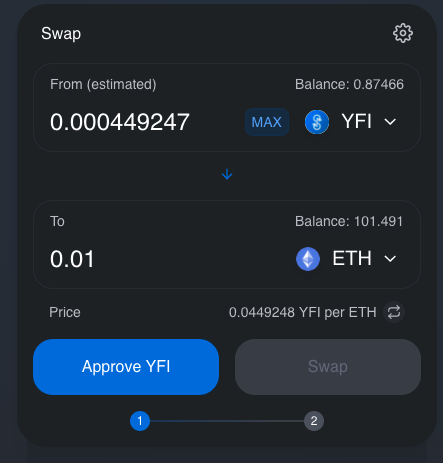

3/ approve() is an unnecessary step of ERC-20 tokens when they interact with smart contracts.

You know this because when you do a Uniswap trade you need press two transaction buttons instead of one.

4/ Why there is approve() - you can read the history in this Twitter

5/ I queried all approve() transactions on Google BigQuery public dataset and calculated their ETH cost and then converted this to the USD with the current ETH price.

This is bad. Continue reading why and how to avoid this in the future.

👇👇👇

2/ Before you go all rage on the flaws of my analysis, please read the whole Twitter thread for disclaimers and caveats.

3/ approve() is an unnecessary step of ERC-20 tokens when they interact with smart contracts.

You know this because when you do a Uniswap trade you need press two transaction buttons instead of one.

4/ Why there is approve() - you can read the history in this Twitter

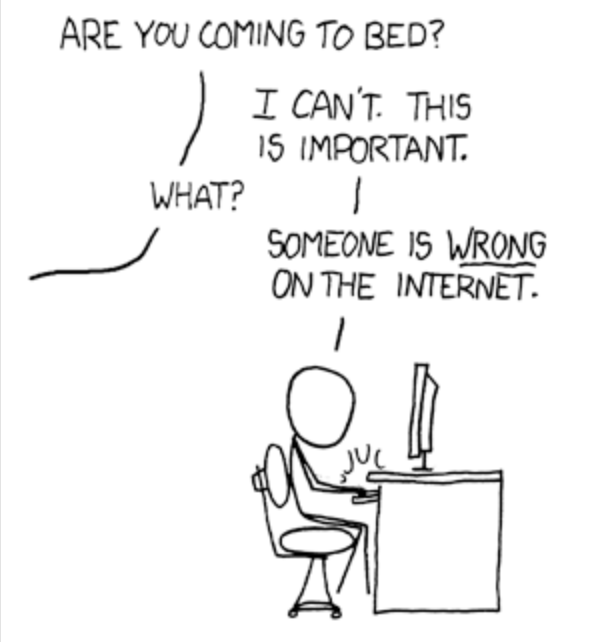

1/ I just spend my Saturday morning on a call with a crypto fund explaining to them how #Ethereum ERC-20 token approve() function works

— \U0001f42e Mikko Ohtamaa (@moo9000) August 29, 2020

I am too old for this shit. pic.twitter.com/7EYfOaRP5L

5/ I queried all approve() transactions on Google BigQuery public dataset and calculated their ETH cost and then converted this to the USD with the current ETH price.

You May Also Like

My top 10 tweets of the year

A thread 👇

https://t.co/xj4js6shhy

https://t.co/b81zoW6u1d

https://t.co/1147it02zs

https://t.co/A7XCU5fC2m

A thread 👇

https://t.co/xj4js6shhy

Entrepreneur\u2019s mind.

— James Clear (@JamesClear) August 22, 2020

Athlete\u2019s body.

Artist\u2019s soul.

https://t.co/b81zoW6u1d

When you choose who to follow on Twitter, you are choosing your future thoughts.

— James Clear (@JamesClear) October 3, 2020

https://t.co/1147it02zs

Working on a problem reduces the fear of it.

— James Clear (@JamesClear) August 30, 2020

It\u2019s hard to fear a problem when you are making progress on it\u2014even if progress is imperfect and slow.

Action relieves anxiety.

https://t.co/A7XCU5fC2m

We often avoid taking action because we think "I need to learn more," but the best way to learn is often by taking action.

— James Clear (@JamesClear) September 23, 2020