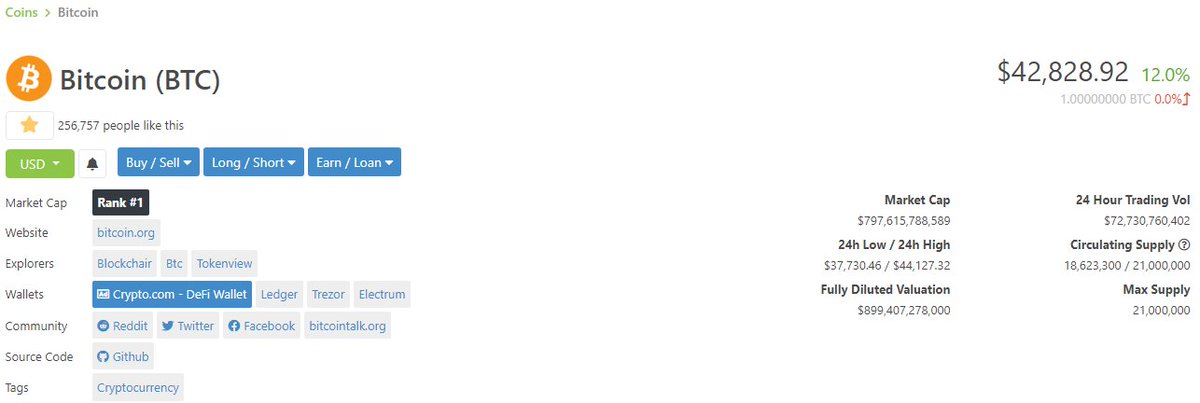

"Bitcoin’s ultra-orthodox monetary policy of targeting a fixed money supply, is the ideal hedge for fiat money printing."

- @pierre_rochard

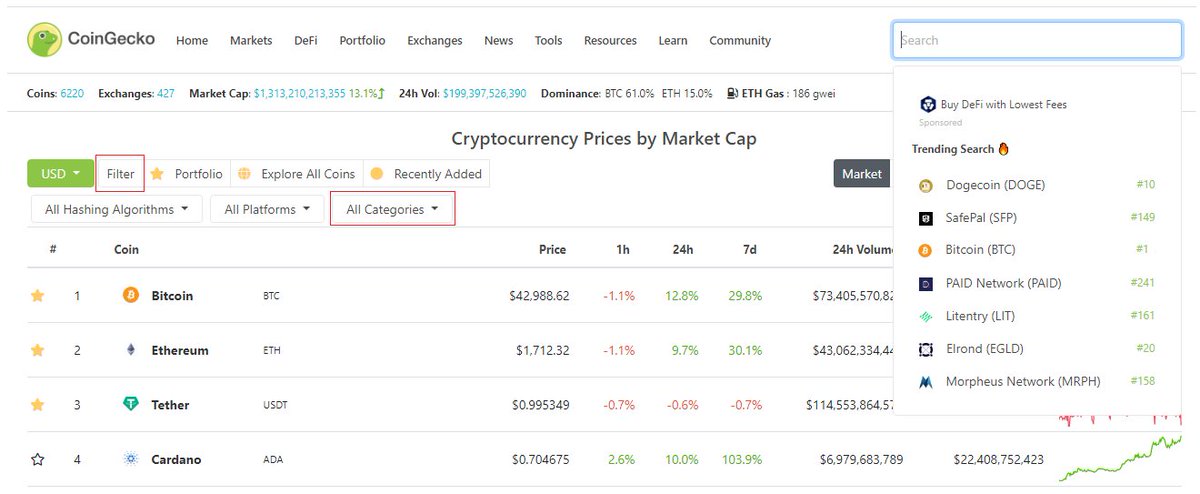

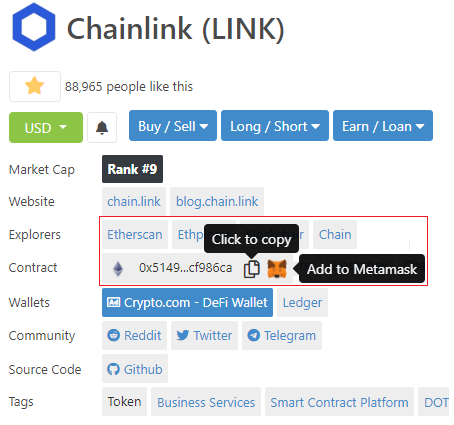

Introducing an effortless way to add tokens to your @metamask_io wallet \U0001f4e5

— CoinGecko (@coingecko) February 8, 2021

Skip the hassle of copying/pasting contract addresses to your wallet. Add an asset and it'll appear in your wallet with just a click - tap the \U0001f98a and try it out for yourself! pic.twitter.com/u26BA29ubs

1. From Day 1, SARS-COV-2 was very well adapted to humans .....and transgenic hACE2 Mice

— Billy Bostickson \U0001f3f4\U0001f441&\U0001f441 \U0001f193 (@BillyBostickson) January 30, 2021

"we generated a mouse model expressing hACE2 by using CRISPR/Cas9 knockin technology. In comparison with wild-type C57BL/6 mice, both young & aged hACE2 mice sustained high viral loads... pic.twitter.com/j94XtSkscj

1. High Probability of serial passaging in Transgenic Mice expressing hACE2 in genesis of SARS-COV-2!

— Billy Bostickson \U0001f3f4\U0001f441&\U0001f441 \U0001f193 (@BillyBostickson) January 2, 2021

2 papers:

Human\u2013viral molecular mimicryhttps://t.co/irfH0Zgrve

Molecular Mimicryhttps://t.co/yLQoUtfS6s https://t.co/lsCv2iMEQz