1) Governance Tokens 🪙

Projects gave complete ownership of billion dollar protocols to their users, often using retroactive airdrops.

Early adopters earned tokens for past usage, and token-based voting now dictates all technical upgrades.

https://t.co/uzR8NW5AyD

2) Liquidity Mining ⛏️

Power users were the first to earn on-going distribution by providing liquidity.

$COMP sparked the wave, with $BAL coining the term a few weeks later.

https://t.co/BGqUNjc0kC

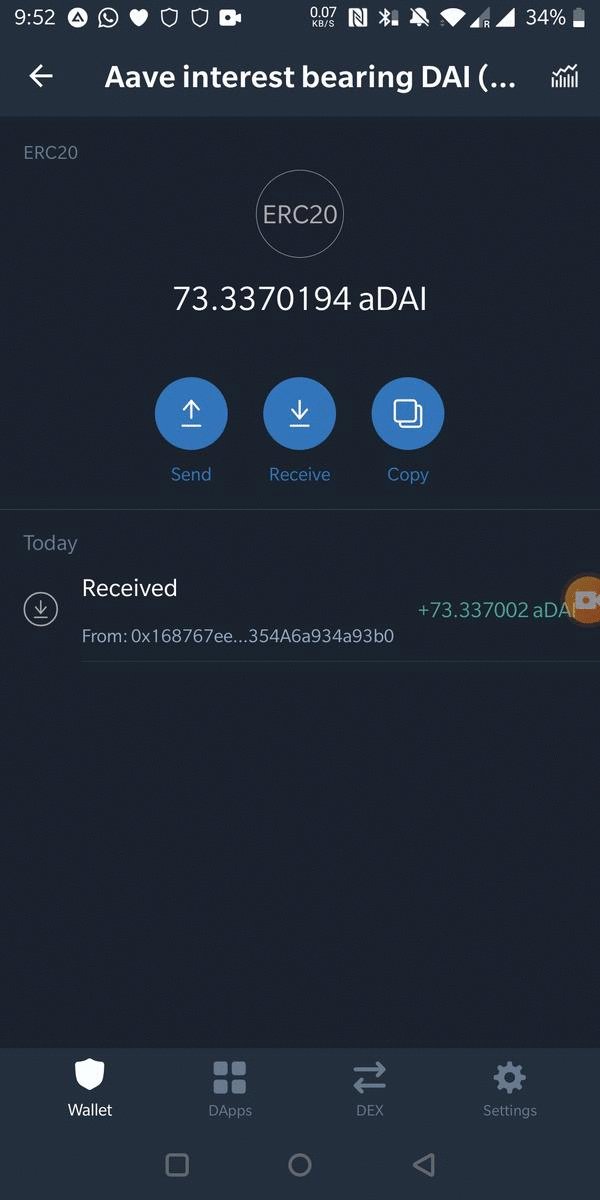

3) Yield Faming 🌾

Projects coupled liquidity mining and governance tokens to boost 'yields' by combining lending rates with an incentive layer.

APYs peaked as high as 1M% during 'DeFi summer', leading to a 'food coin' craze like $YAM and $SUSHI

https://t.co/59pCAav7pk

4) Fair Launches ✅

Who needs investment when you can launch using yield farming?

@iearnfinance debuted $YFI with no formal funding, seeding a community treasury for self-sustainability.

The notion of a core team and community became one and the same.

https://t.co/OuTWjSrcjd

5) Meta-governance 🗳️

Delegation and indexes allowed projects to vote on other protocols using assets under management.

$DPI is the best example, using its $COMP and $UNI to vote based on $INDEX sentiment.

https://t.co/XLjrtRau3w

Key Takeaways:

- Early adopters got paid

- Putting capital to work netted the highest returns

- Liquidity allowed teams to seed a community treasury.

- Treasuries accrued tokens, used to govern other protocols.

Most importantly, team and community merged together.

What's Next?

Composability will flourish, and projects will win liquidity based on cash flows, rather than short-lived APYs.

Governance incentives will boost participation, leading to a vibrant number of protocol politicians.

Curation will thrive.

https://t.co/dxw2P0roQL

This was without a doubt my most exciting year in crypto.

If you're new to #DeFi, take time to learn more with great outlets like

@DefiantNews @DeFiRate @BanklessHQ and

@Yield_TV. S/o Daily Gwei by

@sassal0x and Daily Ape by

@Darrenlautf 💪

Until then, keep up the honest work!