2/ Inequality is growing to unsustainable levels comparable to that in the early 1900s prior to WWI & the 1700s prior to the French Revolution & sweeping changes throughout Europe.

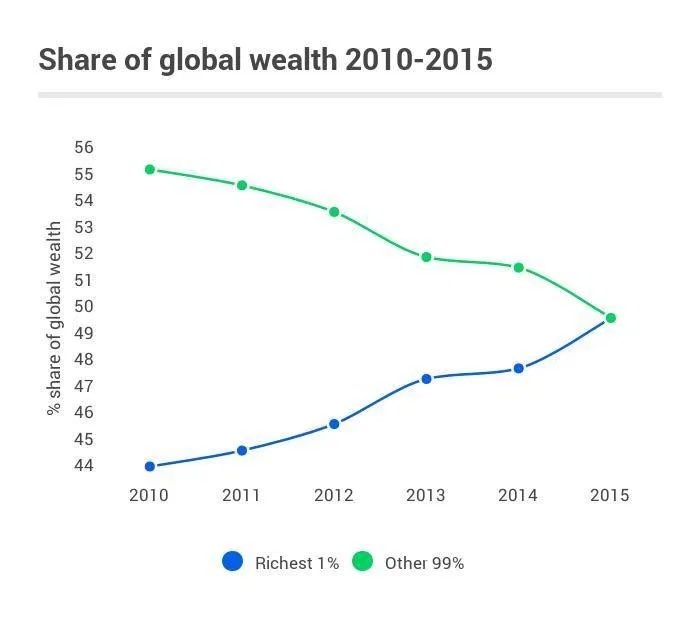

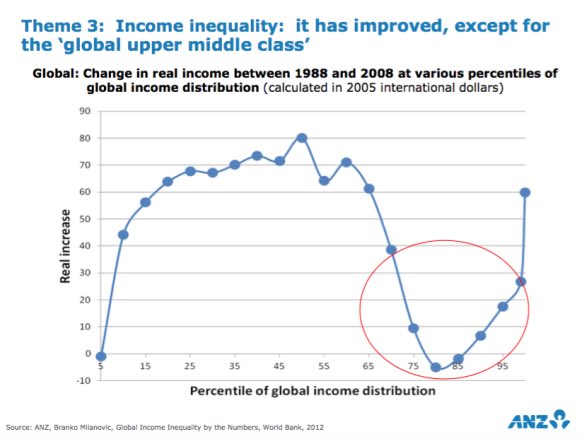

The top 1% (~80M people) now owns the same amount of capital as the remaining 99% (~7.9B people).

3/ Historically, there are only two solutions to extreme levels of inequality:

1. Revolution: Violence or war that leads to wealth redistribution to those who fought & won

2. Intervention: Political change that raises taxes on the rich & increases benefits to the poor

4/ But is there another way? One that doesn’t require war or heavy government oversight?

Is another option even possible when the system, power, rules, governance, capital, tech, etc. are centralized among the 1%, as they have been for millennia?

Historically, the answer is no.

5/ Today’s society also faces something new that no other generation has: global technologies that have further centralized power and wealth, as well as automated work and reduced demand for labor, particularly among the middle class.

Tech is accelerating inequality.

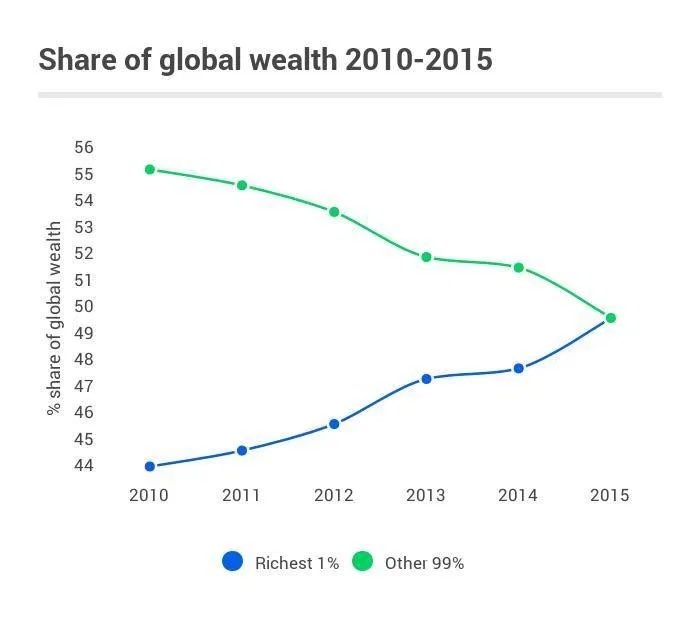

6/ McAfee at MIT & others studied the effects of technology & automation on labor—one of the key findings is that tech has helped the poor and rich but disproportionately hurt the middle class. Some call it the “U Curve.”

Assembly line workers. Retailer workers. Tellers. Etc.

7/ It’s because of this and a confluence of other factors that we see:

A. Even more capital being invested in technology, in turn creating even more asymmetric outcomes and inequality.

B. Governments seeking to breakup big tech (yet knowing they are central to their economies).

8/ So predictably, we will likely see:

- More big tech (and breakups)

- More automation

- More inequality

- More division

- More unrest

- Revolutions

- Government interventions

- Higher taxes

- UBI

- etc.

But there must be a better way, right? Hopefully?

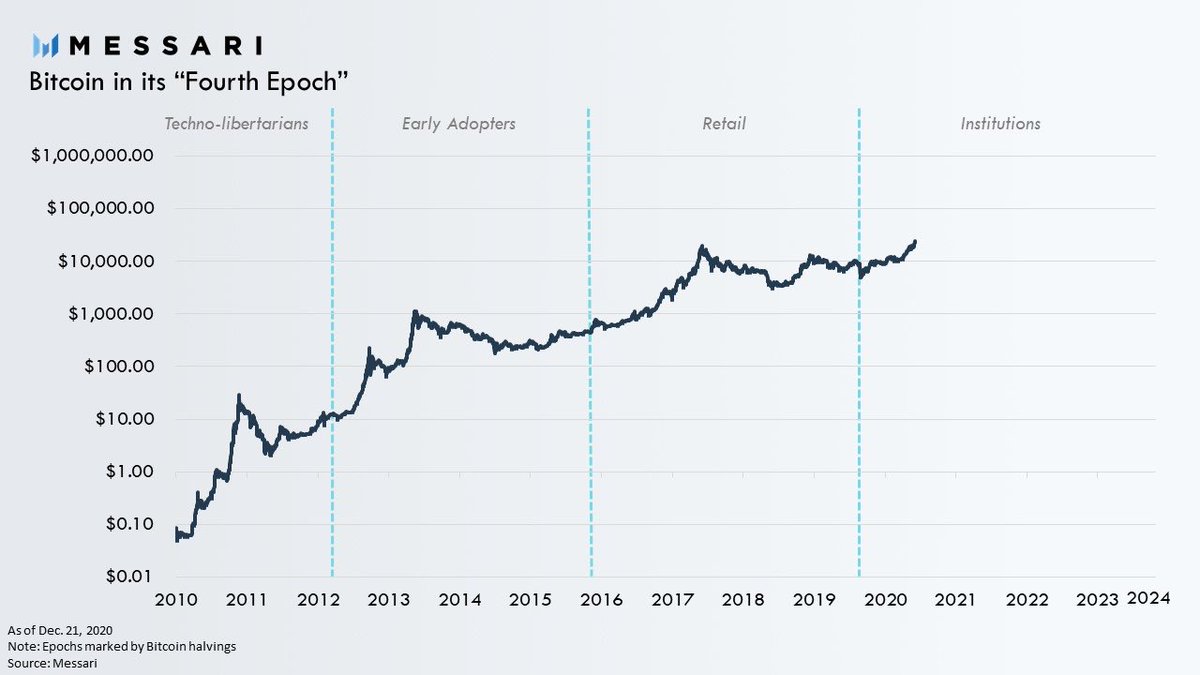

9/ This I believe is where crypto comes in.

Yes it can free the world from fiat.

Yes it can decentralize compute and finance.

10/ But IMO the most important thing crypto can and will do for our society is decentralize and more equitably distribute the ownership of the world’s most consequential global financial and technology platforms. They are also the most valuable capital assets in the world.

11/ Global money platforms like Bitcoin. Global compute platforms like Ethereum. And so much more.

Crypto can turn today’s financial and technology companies into platforms that are community-owned. Digital collectives of creators, contributors, and users that share their value.

12/ I call these “Crypto Cooperatives.” They are not only going to change the world, but help fix it.

What we need to do as quickly and reasonably as possible however is design them for everyone and the people who need them the most—to build a better world for all.

13/ If you are on this quest, like I am, DM me. I’d love to talk.