Bitcoin is now at all-time highs capping off an extremely successful year.

But it was by no means stable ride up.

2020 was a historically volatile year.

@YoungCryptoPM and I provided a detailed overview of every month of 2020 in all its glory.

https://t.co/qZZWdNBbTm

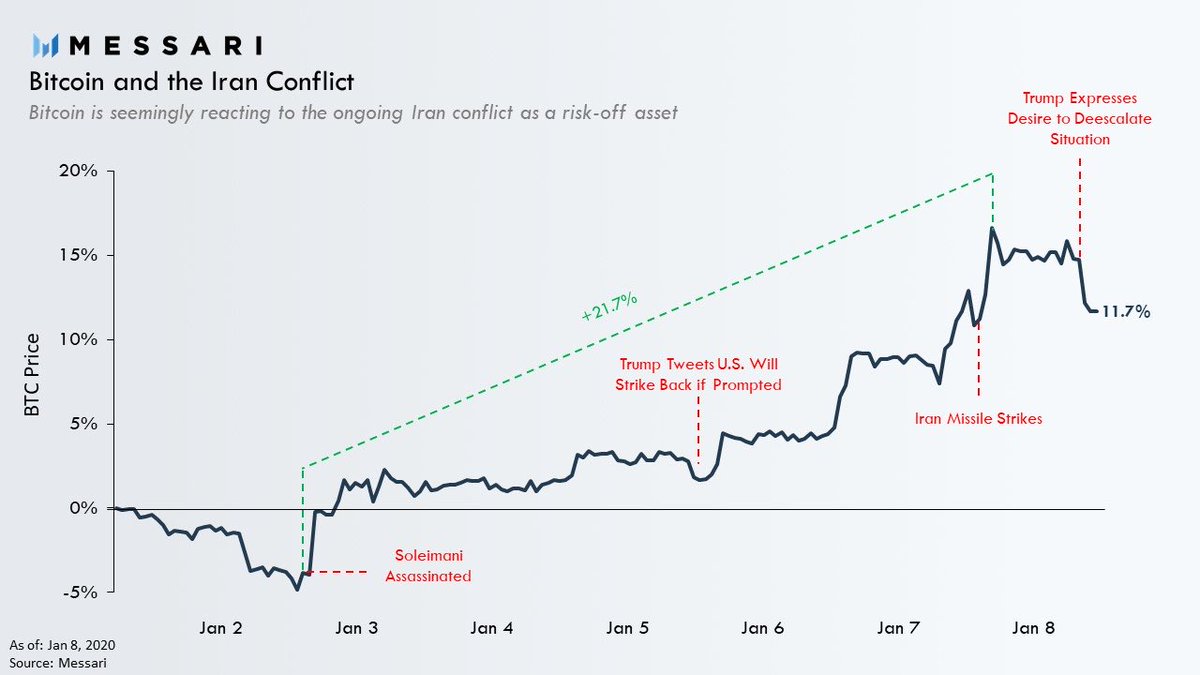

Jan.

3 days into the new year the US assassinated Iran’s top general Soleimani.

BTC surprisingly reacted to the events behaving like a safe haven as the risk of war increased.

The events provided the first hints of BTC potentially having graduated to a legitimate macro asset.

Feb.

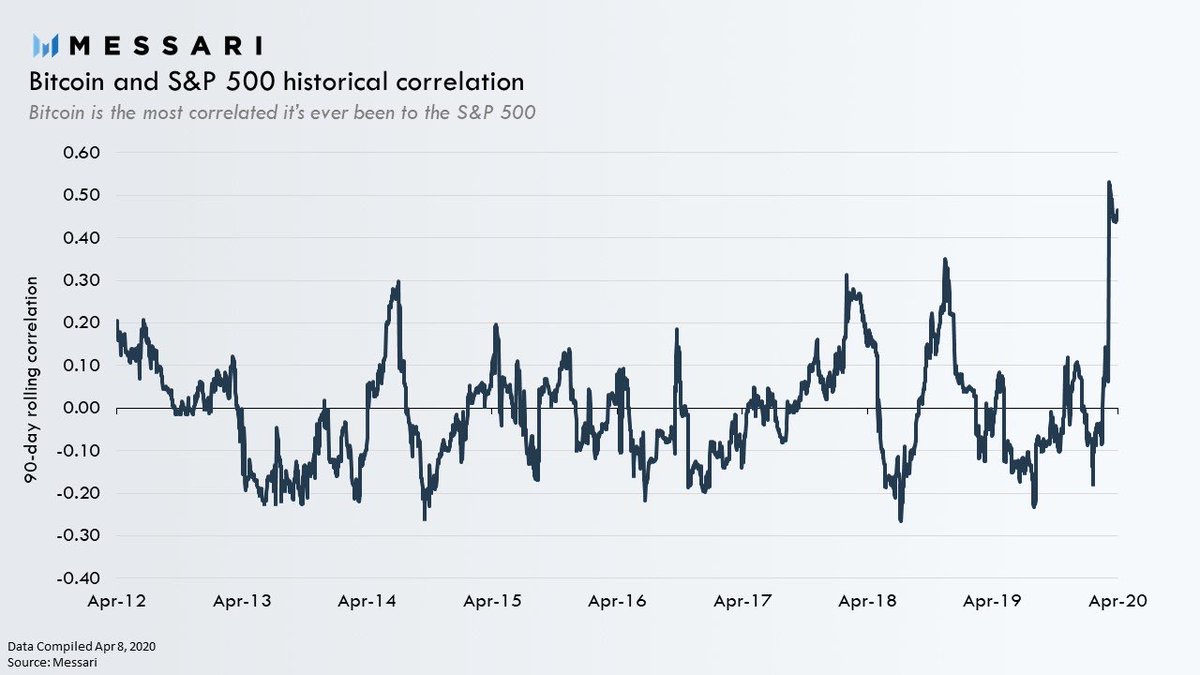

COVID-19 reached a tipping point causing markets to crash.

BTC’s correlation with the S&P 500 reached an ATH in the following weeks.

This is when everyone learned BTC was not a recession hedge, it was a hedge against inflation and loss of confidence in fiat currencies.

https://t.co/JB7dJ3qp6M

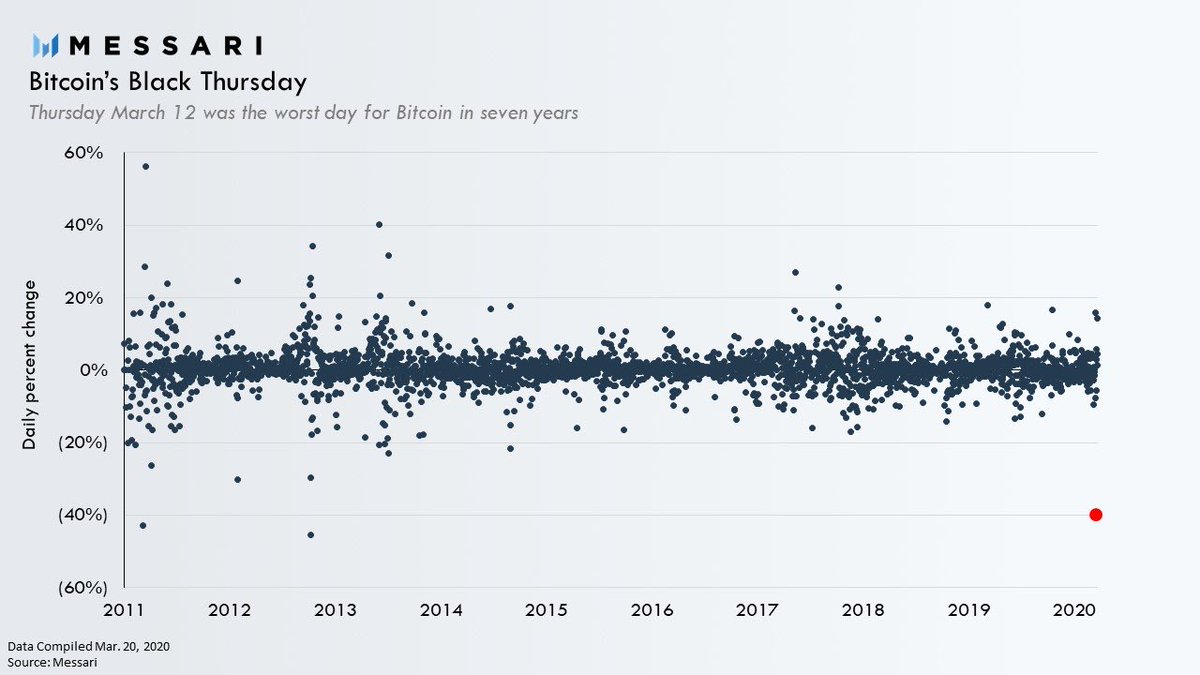

Mar.

Financial markets in free fall.

The liquidity crisis was so severe BTC experienced one of it’s worst days ever.

Now known as Black Thursday, on March 12, BTC plummeted as much as 50% to below $4,000 at its lowest point on the day.

BTC closed the day down 40%

The sell-off was so violent that cryptocurrency market structure broke due to a cascade of large liquidations on derivatives exchanges.

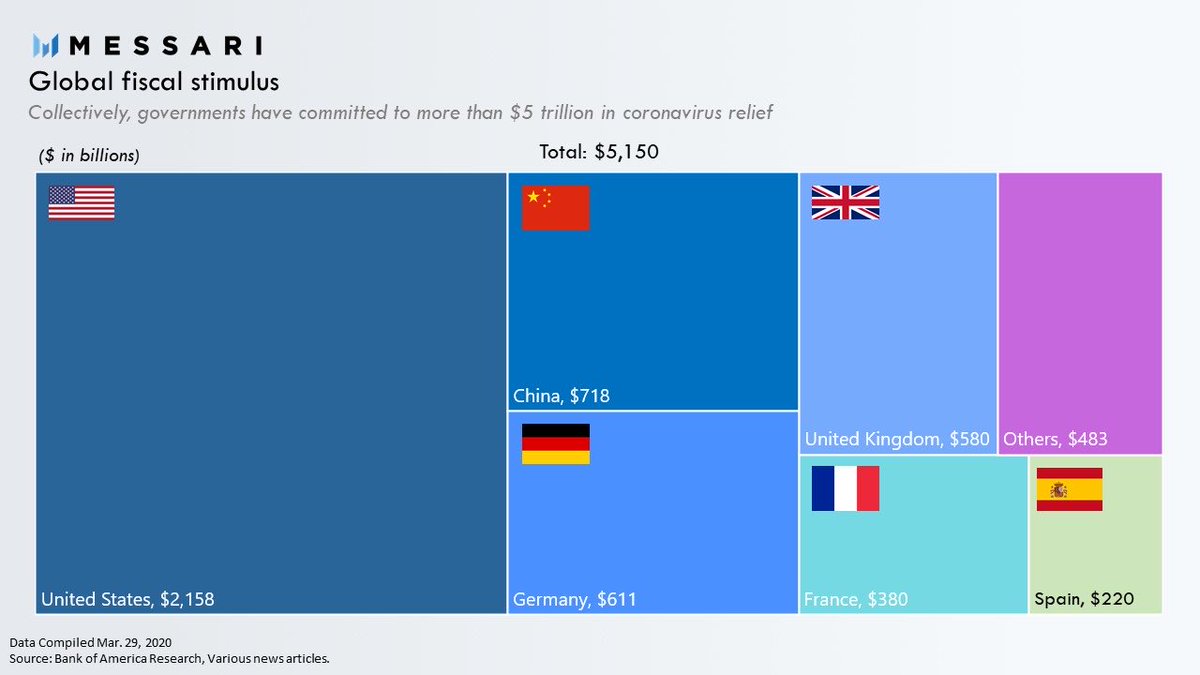

With turmoil in broader financial markets as the backdrop central banks start printing and governments launch bazooka stimulus packages.

Apr.

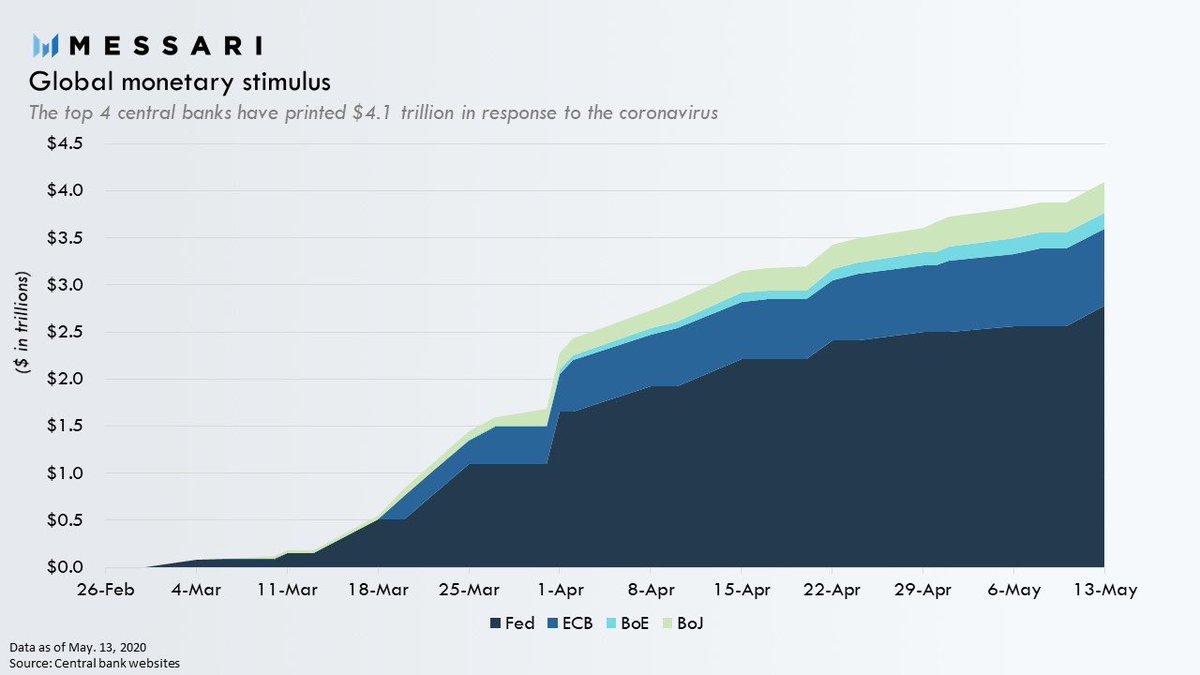

Money printer goes brrr meme goes mainstream.

By the end of the month the top four central banks had printed more than $3.5 trillion in just seven weeks.

QE infinity, 0% interest rates, and MMT enter the conversation.

The inflation narrative for #BTC is planted.

May.

Legendary macro investor Paul Tudor Jones revealed that his Tudor BVI fund would be investing a “low single-digit percentage” of its assets under management in Bitcoin.

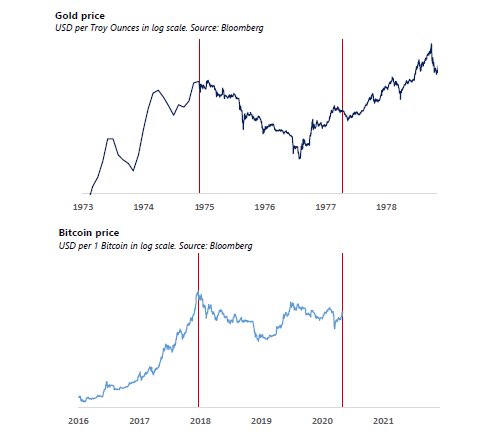

Says BTC is the fastest horse in the inflation hedge race and says BTC Reminds him of gold in 1976.

The Bitcoin halving came on May 11, reducing issuance per block from 12.5 BTC to 6.25 BTC.

Despite all the hype around the halving it was ultimately uneventful...

Surprise surprise.

https://t.co/pFHTovsayE

Jun.

The most boring month of the year for Bitcoin.

Despite all the action in Ethereum’s DeFi ecosystem and broader financial markets, Bitcoin traded range bound between $9,000 and $10,000 for 60 days starting at the end of May.

It was kind of eerie.

Jul.

The OCC granted national banks and federal savings associations authority to provide cryptocurrency custody services to customers.

This provided regulatory clarity for banks and paved the way for them to launch cryptocurrency products.

https://t.co/XjG2vtAGBl

Aug.

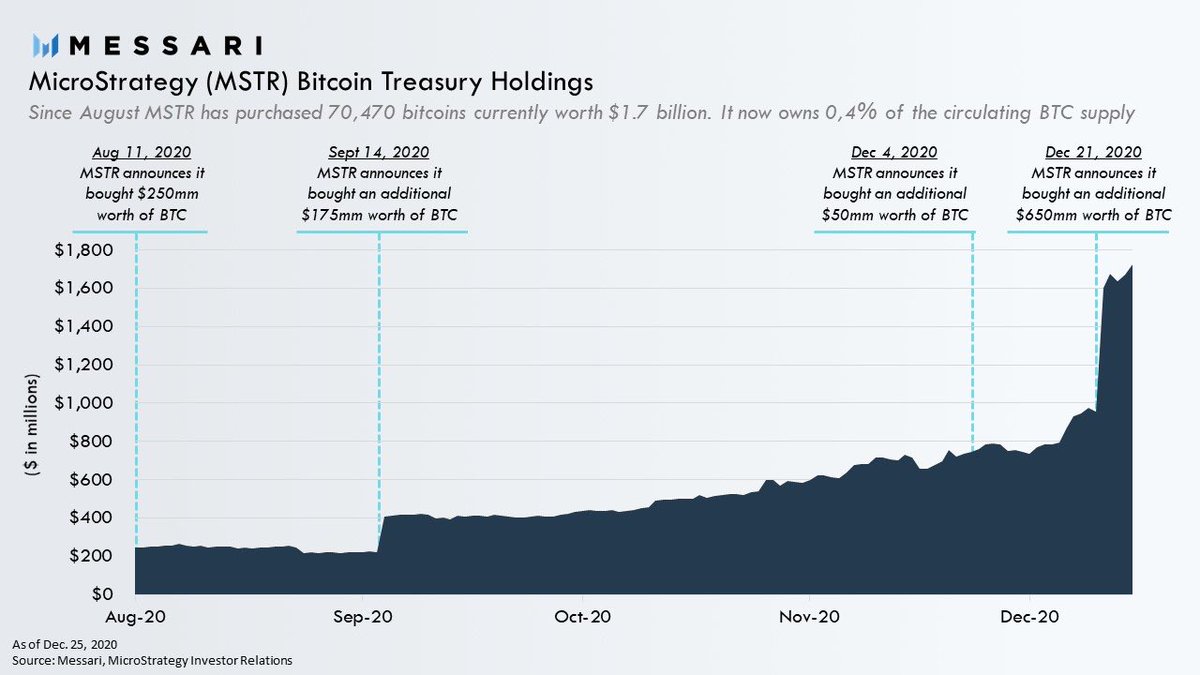

MicroStrategy (MSTR) announced it purchased $250mm worth of Bitcoin (21,454 BTC) as part of a new capital allocation policy aimed at hedging inflation.

MSTR would go on to purchase 70,470 BTC over the next few months.

Its current holdings are worth over $1.7 billion.

Sep.

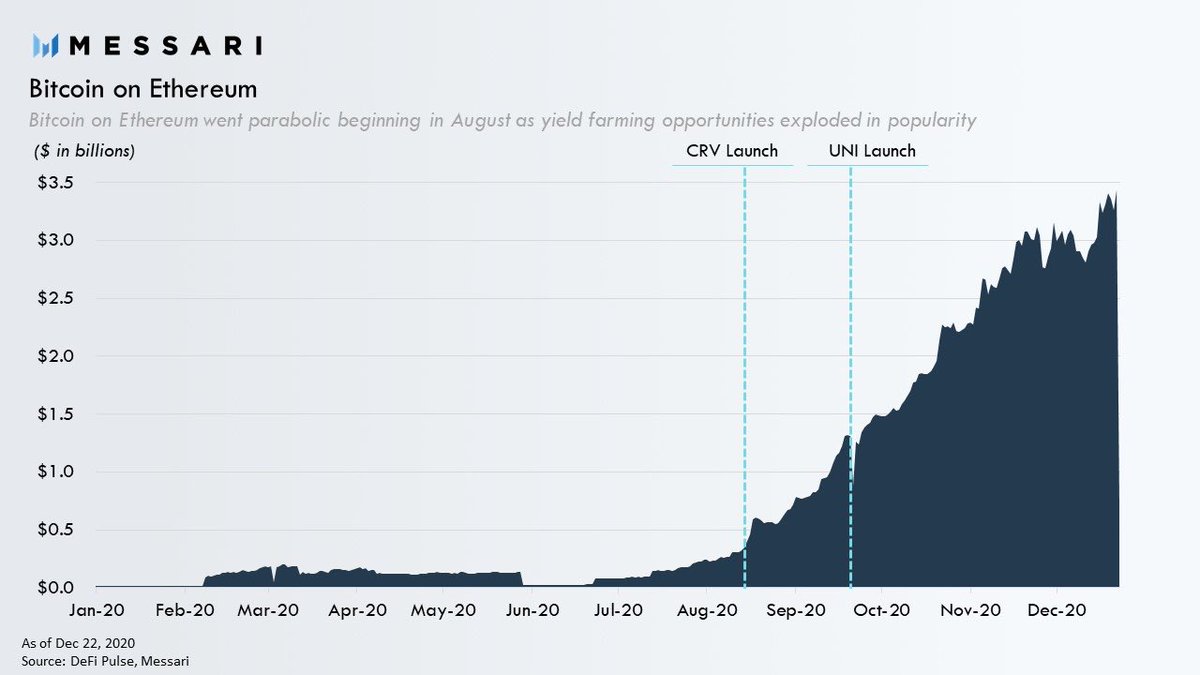

Bitcoin tokenized on Ethereum reached over $1 billion (~92,600 or 0.5% of the total Bitcoin supply).

This growth was primarily fueled by yield opportunities in Ethereum’s DeFi ecosystem.

There is now nearly $3.5 billion of BTC on Ethereum.

Oct.

First day of the month, the DOJ and the CFTC filed charges against BitMEX.

The group was accused of operating an unregistered trading platform and violating CFTC rules, including AML and KYC regulations.

BTC surprisingly barely flinches on the news.

On Oct 8, Square announced it had purchased $50 million worth of Bitcoin (4,709 BTC) for its treasury.

On Oct 21, PayPal launched a new service enabling its 325 million users to buy, hold, and sell cryptocurrency.

Fwiw we noticed an interesting trend.

https://t.co/T52DDHci5o

Nov.

Bitcoin received yet another major institutional validation, this time from legendary macro investor Stanley Druckenmiller who said he owned BTC.

Weeks later Citigroup published a report stating that BTC could reach $318,000 by the end of 2021.

https://t.co/7OPrjSpyuO

At the end of November Bitcoin begins flirting with all-time highs off the strength of increased institutional interest.

Dec.

MassMutual becomes 1st insurance firm to buy Bitcoin.

UK based investment manager Ruffer Investment buys Bitcoin.

Guggenheim CIO Scott Minerd stated that the BTC could reach over $400,000 based on the assets scarcity and the relative value to gold.

https://t.co/YpgA3zi133

On December 16, Bitcoin finally breaks all-time highs and blows past the $20k psychological barrier.

It was the biggest sign that a new era for Bitcoin had arrived - market validation.

Not surprising, a day later, Coinbase announced it was going public.

https://t.co/NRmmBICTdj

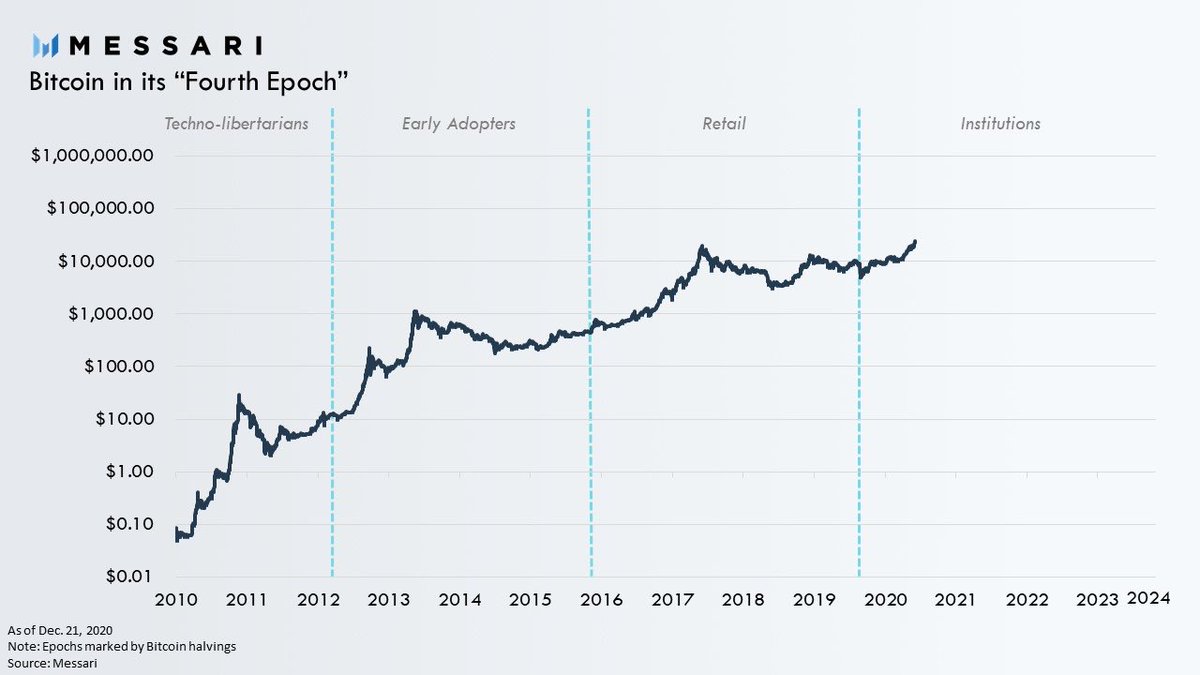

In the years leading up to 2020 it was clear to many that Bitcoin 𝘤𝘰𝘶𝘭𝘥 become valuable as a fixed supply digital store of value, but it was unclear when it 𝘸𝘰𝘶𝘭𝘥 become so.

As Covid-19 came into the picture this year the “when” question became more discernible.

In response to the economic effects of Covid-19 governments around the world have inflated money supplies at historic rates, causing many to begin to question the value of fiat currencies.

https://t.co/kh1ojnJMQc

This has accelerated the timeline for when Bitcoin matters as investors search for inflation resistant assets to hedge against potential fiat currency devaluations.

Bitcoin has the added kicker that it’s an inflation hedge fit for the Digital Age.

#BTC is playing an increasingly important role in the global monetary system, and with institutional grade infrastructure and regulatory clarity, the pathway for increased institutional adoption of Bitcoin in 2021 is clear.

Hope yall enjoy our 2020 review

https://t.co/qZZWdNBbTm