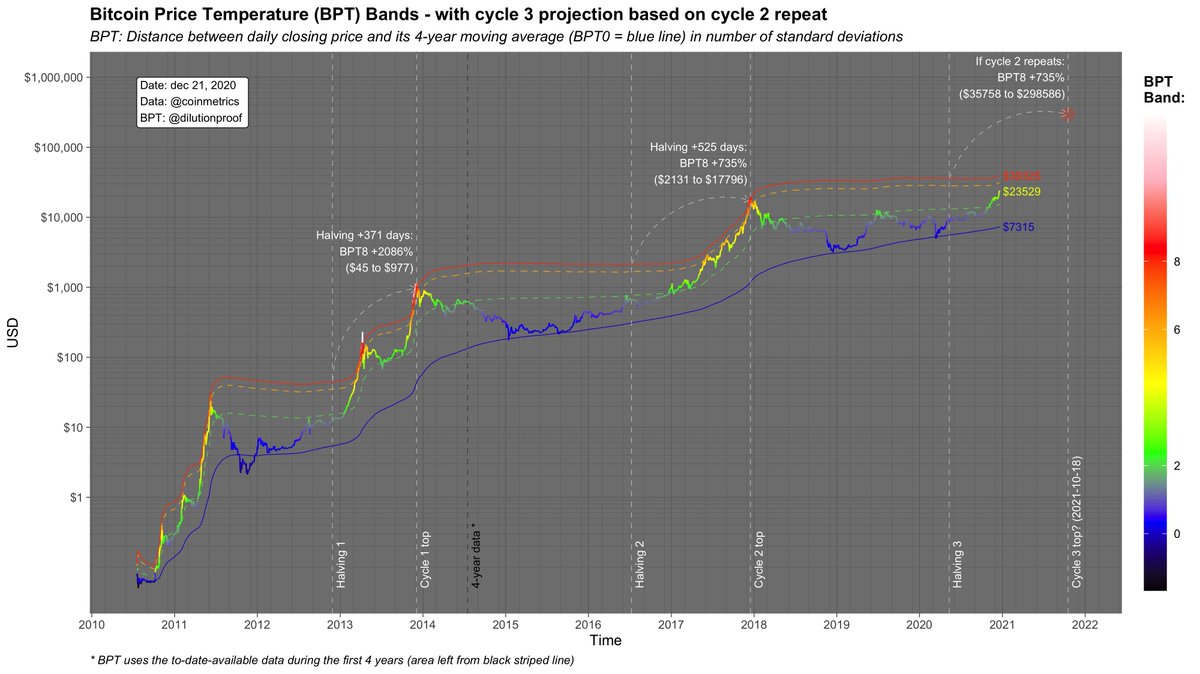

1/10 A rough prediction using the #Bitcoin Price Temperature (BPT) Bands:

If the current #Bitcoin post-halving bull run has a similar growth & volatility as the last one, this cycle could top at around $300k in October 2021 👀

Q&A with interpretation & nuances in this thread 👇

More from Crypto

1/ ERC-20 token standard approve() has caused an unnecessary cost of $53.8M for #Ethereum and #DeFi users

This is bad. Continue reading why and how to avoid this in the future.

👇👇👇

2/ Before you go all rage on the flaws of my analysis, please read the whole Twitter thread for disclaimers and caveats.

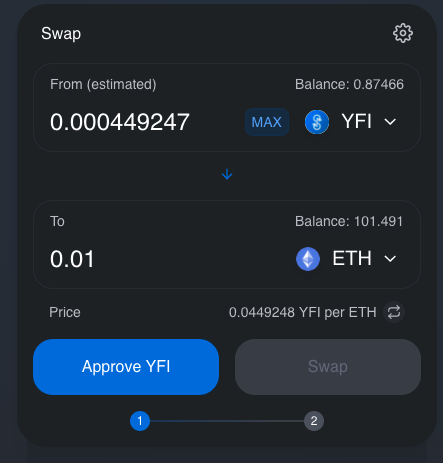

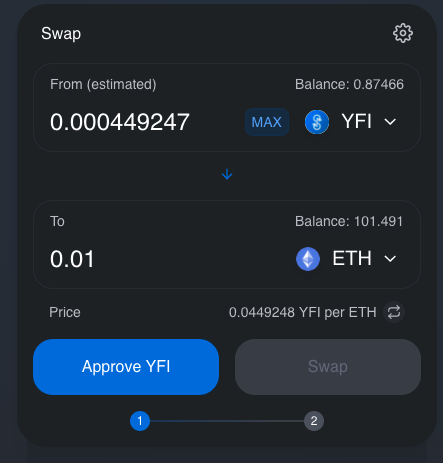

3/ approve() is an unnecessary step of ERC-20 tokens when they interact with smart contracts.

You know this because when you do a Uniswap trade you need press two transaction buttons instead of one.

4/ Why there is approve() - you can read the history in this Twitter

5/ I queried all approve() transactions on Google BigQuery public dataset and calculated their ETH cost and then converted this to the USD with the current ETH price.

This is bad. Continue reading why and how to avoid this in the future.

👇👇👇

2/ Before you go all rage on the flaws of my analysis, please read the whole Twitter thread for disclaimers and caveats.

3/ approve() is an unnecessary step of ERC-20 tokens when they interact with smart contracts.

You know this because when you do a Uniswap trade you need press two transaction buttons instead of one.

4/ Why there is approve() - you can read the history in this Twitter

1/ I just spend my Saturday morning on a call with a crypto fund explaining to them how #Ethereum ERC-20 token approve() function works

— \U0001f42e Mikko Ohtamaa (@moo9000) August 29, 2020

I am too old for this shit. pic.twitter.com/7EYfOaRP5L

5/ I queried all approve() transactions on Google BigQuery public dataset and calculated their ETH cost and then converted this to the USD with the current ETH price.

I'm sure someone else has explained this, but it is just so cool and I want to explain how this works.

So Curve is awesome for swaps between similar assets, right? The fact that they trade very close to each other is a key part about how Curve works, using it's custom swap invariant function.

That's step 1

Step 2 is that Synthetix is awesome for creating "synthetic assets" (aka synths) which are assets that trade like other assets, that are backed by another, entirely different asset. Basically, a plastic banana that I can buy and sell like a real banana.

Synthetix has a feature that lets you swap between any two synths with zero slippage and a flat fee. That's because it is simply converting the sythentic asset into another synthetic asset, the backing for the synth doesn't change it just uses a different price oracle now.

This is important. Absolutely no slippage, at any size

Swap $1m sUSD for $1m sBTC? flat 0.3% fee

Swap $10m sUSD for $10m sBTC? flat 0.3% fee

swap $100m sUSD for $100m sBTC? Well, there isn't that many synths in Curve, yet but you get the point. The only limit is the pool depth

— Andre Cronje (@AndreCronjeTech) January 15, 2021

So Curve is awesome for swaps between similar assets, right? The fact that they trade very close to each other is a key part about how Curve works, using it's custom swap invariant function.

That's step 1

Step 2 is that Synthetix is awesome for creating "synthetic assets" (aka synths) which are assets that trade like other assets, that are backed by another, entirely different asset. Basically, a plastic banana that I can buy and sell like a real banana.

Synthetix has a feature that lets you swap between any two synths with zero slippage and a flat fee. That's because it is simply converting the sythentic asset into another synthetic asset, the backing for the synth doesn't change it just uses a different price oracle now.

This is important. Absolutely no slippage, at any size

Swap $1m sUSD for $1m sBTC? flat 0.3% fee

Swap $10m sUSD for $10m sBTC? flat 0.3% fee

swap $100m sUSD for $100m sBTC? Well, there isn't that many synths in Curve, yet but you get the point. The only limit is the pool depth