Even though I will miss the adrenaline rush of finding my byline in the paper every morning, I am really excited about starting a new journey with a digital platform.

A personal update: Monday was my last day at Business Standard and I can truly count the past 3 years as the golden phase of my career, where I got the opportunity to not only report but also break some of the biggest news stories during this period.

Even though I will miss the adrenaline rush of finding my byline in the paper every morning, I am really excited about starting a new journey with a digital platform.

https://t.co/NJAcIwAgmC

https://t.co/JmN7VjQxkC

This letter written by the finance ministry to the RBI became the first point of friction between the govt and the regulator. (Ultimately, Urjit Patel had to step down as the RBI Guv)

https://t.co/Z4oFEDZUr8

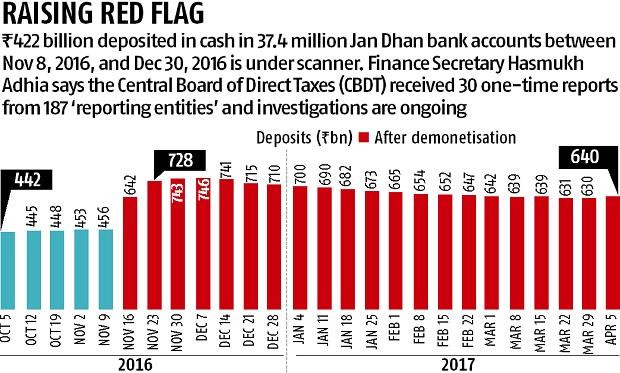

This was followed by extensive coverage on the issue (the govt did acknowledge publicly that there was a cash crunch).

https://t.co/KU67ulaTMO

I reported how PNB (of all banks) didn't receive a crucial directive sent by the RBI in 2016 asking all lenders to strengthen their risk mechanism to avert fraud.

The story about a missing e-mail

https://t.co/My6Ll42Bp0

https://t.co/IREwm8LeOU

https://t.co/3801yfOJRg

https://t.co/BYCVe5kcpq

https://t.co/O3jIuI0dpM

https://t.co/YXDTiarSFh

https://t.co/JCcyzd75gD

https://t.co/gwsYVOQnle

https://t.co/FyagN0UMrY

https://t.co/4A2uw3gppj

https://t.co/FBcV5VTggg

https://t.co/NZGwD4EUpI

https://t.co/9YsxMzBlqr

https://t.co/qMluVa4rLP

https://t.co/GLfNOlEhv0

https://t.co/zejgxPn4MI

More in this thread:

https://t.co/5Kur6wiMyf

Breaking: India's chief economic advisor wants the junked consumer spending report to be made public. Krishnamurthy Subramanian wrote to the National Statistical Commission seeking the survey report of 2017-18 for analysis in the upcoming Economic Survey.https://t.co/IizS3SqQ7i

— Somesh Jha (@someshjha7) December 7, 2020

https://t.co/ibihPxveAS

https://t.co/6FUJaLAwHv

https://t.co/fNh0ltutDe

https://t.co/tX2sCof3Ki

https://t.co/TFMEXfArWD

https://t.co/0xbfbf4qmI

I went to the ground to cover the plight of migrants:

https://t.co/6XSOHu5TDa

https://t.co/wIym1nCfbH

https://t.co/cEA9TmcWaB

https://t.co/Dshk24AcZG

https://t.co/YYY6N284aV

https://t.co/rNMyZpedLj

https://t.co/1NyDcish0A

https://t.co/EGH3qvWJVZ

https://t.co/IPapM0bzog

https://t.co/kv252xNHwE

https://t.co/m6QCiNEEYK

https://t.co/j3AkQ7ihHY

https://t.co/Bn7Kn0W02V

https://t.co/LaGJPOQ3pC

https://t.co/Zx2ZI1uzHJ

https://t.co/3q39YKHJqQ

https://t.co/ox3TMwbSR5

...while also highlighting the issues in the labour laws:

https://t.co/IqiVrt0ri4

https://t.co/lzzeLVL3h0

More from Crypto

You May Also Like

BREAKING: @CommonsCMS @DamianCollins just released previously sealed #Six4Three @Facebook documents:

Some random interesting tidbits:

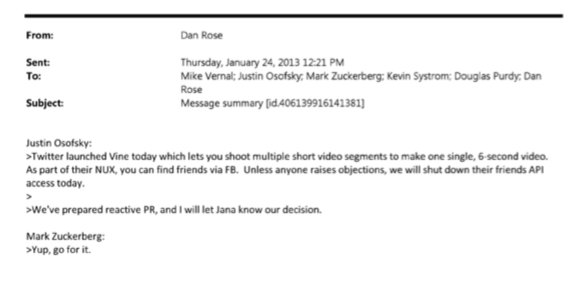

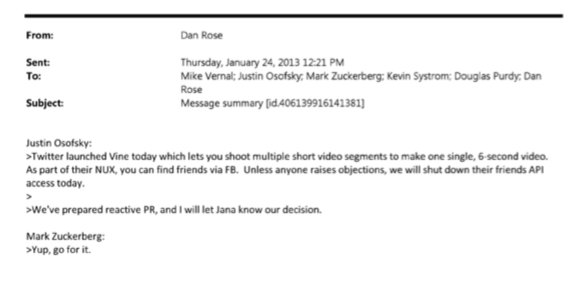

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

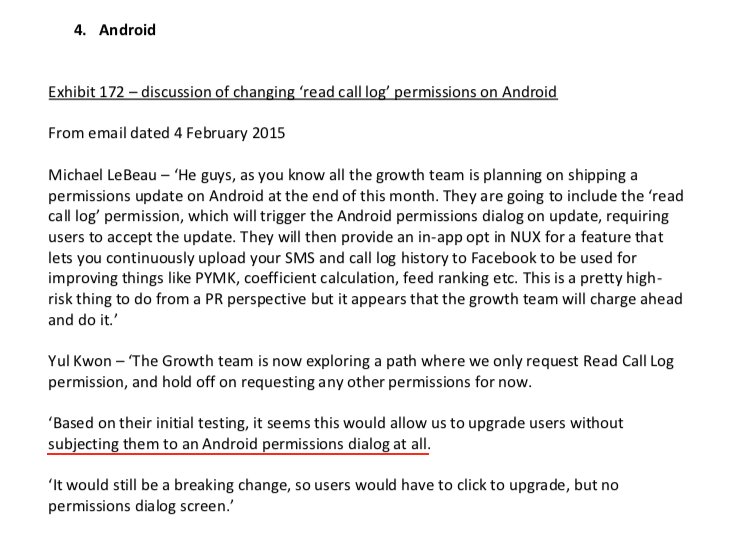

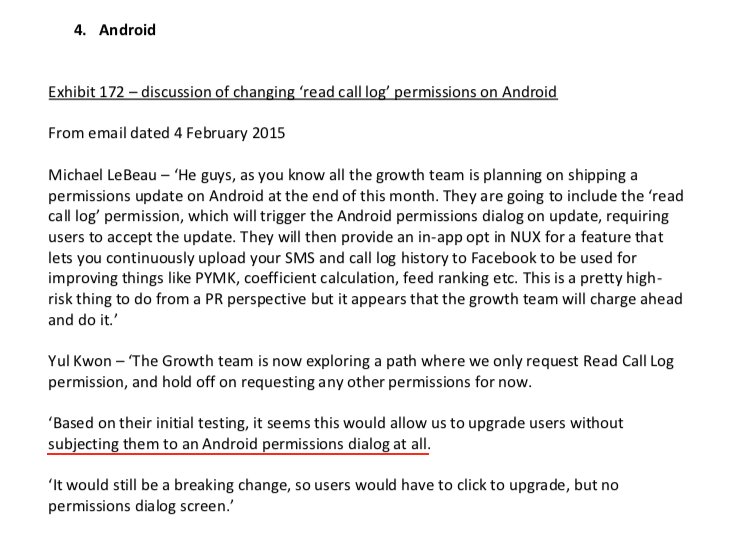

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

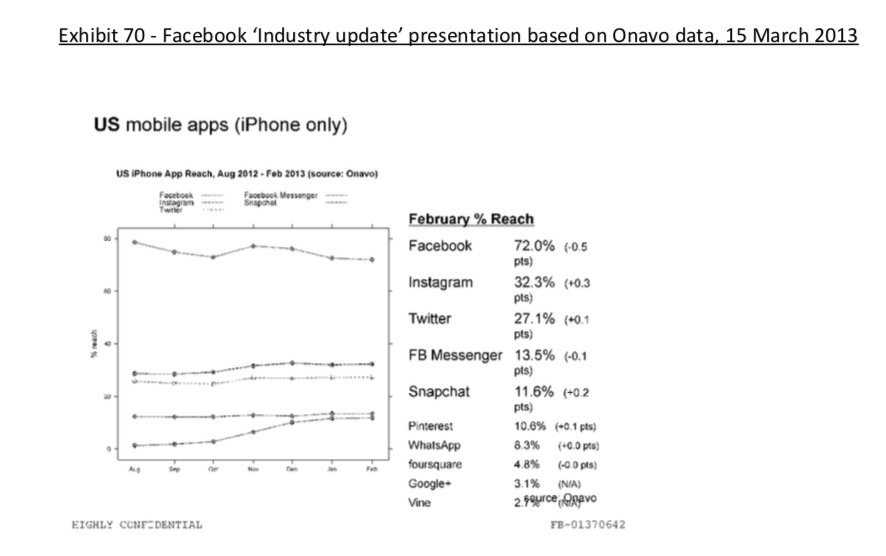

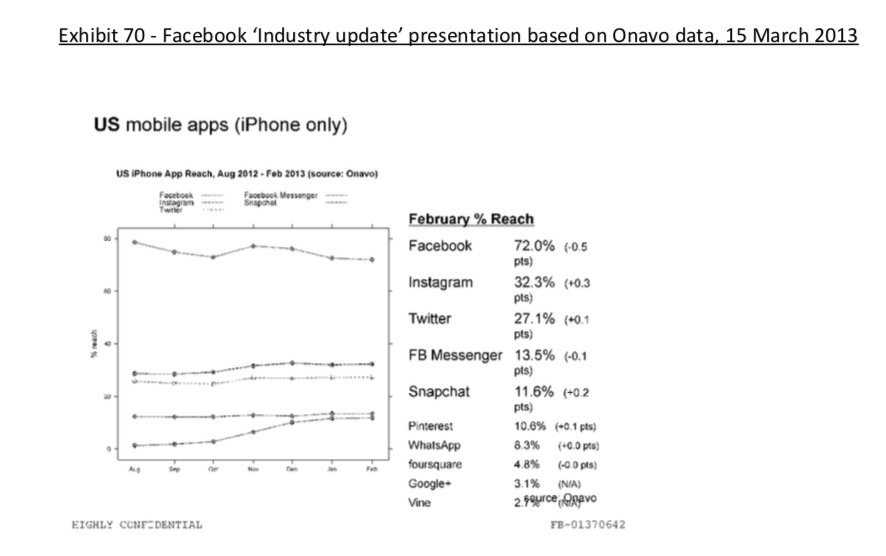

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x

Some random interesting tidbits:

1) Zuck approves shutting down platform API access for Twitter's when Vine is released #competition

2) Facebook engineered ways to access user's call history w/o alerting users:

Team considered access to call history considered 'high PR risk' but 'growth team will charge ahead'. @Facebook created upgrade path to access data w/o subjecting users to Android permissions dialogue.

3) The above also confirms @kashhill and other's suspicion that call history was used to improve PYMK (People You May Know) suggestions and newsfeed rankings.

4) Docs also shed more light into @dseetharaman's story on @Facebook monitoring users' @Onavo VPN activity to determine what competitors to mimic or acquire in 2013.

https://t.co/PwiRIL3v9x