The debate about stablecoin regulation is at bottom part of a broader debate about regulatory classification of fintech payment service providers (PSPs). But it is, IMHO, wrong to reduce this debate to the question, "Is it a 'bank' or not?"

This thread is as predictable as you\u2019d expect: lots of replies handwaving about \u201cinnovation\u201d and \u201cblockchain\u201d, while ignoring that \u2018stablecoin\u2019 is just another word for payments infra.

— Angus Champion de Crespigny (@anguschampion) December 4, 2020

People get so caught up in the tech they don\u2019t realise the ultimate result is the same. https://t.co/OC2auSh0uX

More from Crypto

So what is exactly #ODAP and why this makes $QNT one of the most significant and, regarding #crypto mcap, undervalued projects?

Time for a THREAD⬇️

1/ODAP is the protocol for communication between gateways, primarily with an enterprise focus.

So banks, central banks etc. would run a gateway in Overledger Network and ODAP would be the protocol for gateways to communicate with each other in a secure and trustless manner. $QNT

Attending @ietf 109 to discuss our ODAP proposal with @MIT today. We\u2019re in the secdispatch session. They even have a virtual conference centre. #IETF109 https://t.co/2i9d5JxtR0 pic.twitter.com/osv2LCEUGx

— Gilbert Verdian (@gverdian) November 16, 2020

2/ #ODAP Interfaces are the open source connectors that will connect a gateway to #blockchains and any existing network / API. That is based on the standards from work done at ISO TC 307 which 57 countries are working towards.

$QNT CEO Gilbert Verdian is the founder of TC307.

3/We know from the submitted drafts via #IETF (the Internet Engineering Task Force) $QNT is working on #ODAP with:

✅@MIT

✅@intel

but, there’s more to the story as we found out from Gilbert that US Government, Juniper, payment and telecom companies are also there.

4/So how it all started with #ODAP?

Let’s go back to $QNT CEO Gilbert Verdian’s interview with Santiago Velez on #RealVision (October 14th) and try to put all the pieces of the puzzle together.

I’ll forward his words ⬇️

The #Blockchain Revolution and Economic Changes

— Real Vision (@RealVision) October 28, 2020

What kind of world does @gverdian envision? How will @quant_network change the existing structure to benefit us all?

Real Vision journalists examine @gverdian & @Santiag78758327 latest interview.https://t.co/dfDAjDFbF3

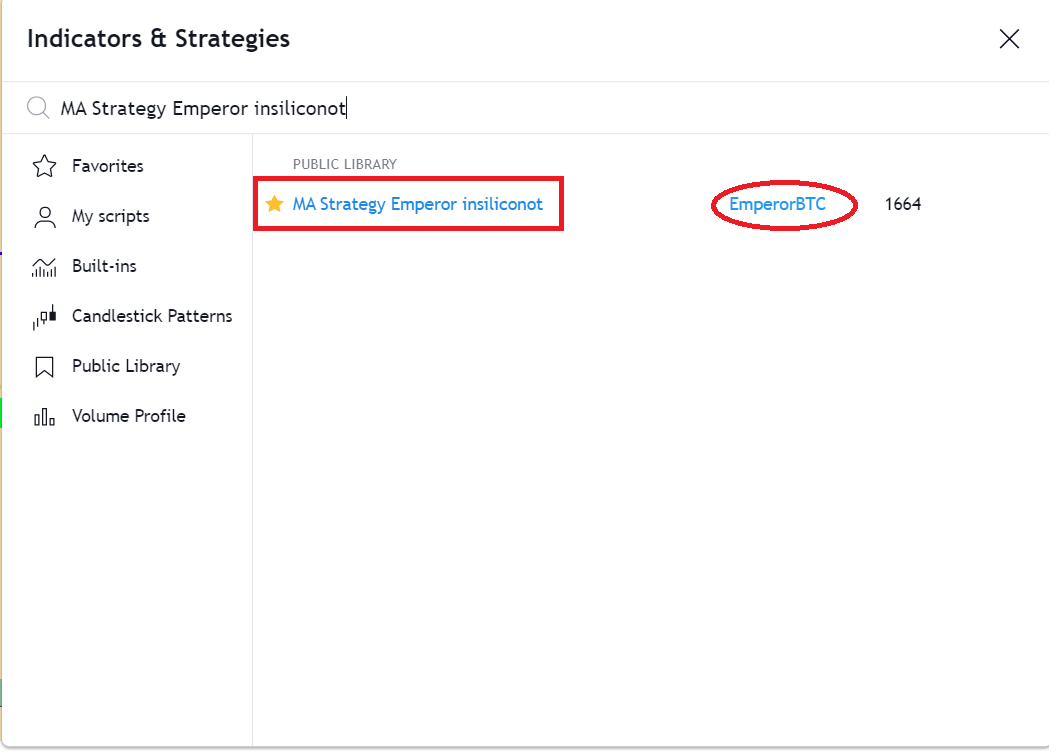

How to use it. A THREAD.

Please Share.

To use it to buy Altcoins and make a high probability entry, the following conditions needs to be fulfilled.

For a long.

1. A green candle Closes above the cross.

2. Heikin Ashi candle turns green.

3. Price should be above 0.236 Fib from the swing high.

How to add the Indicator.

1. Click on the link and Add it to favorites and apply.

https://t.co/Kn90qgDjMi

2. Or Search it in the tab and then apply it.

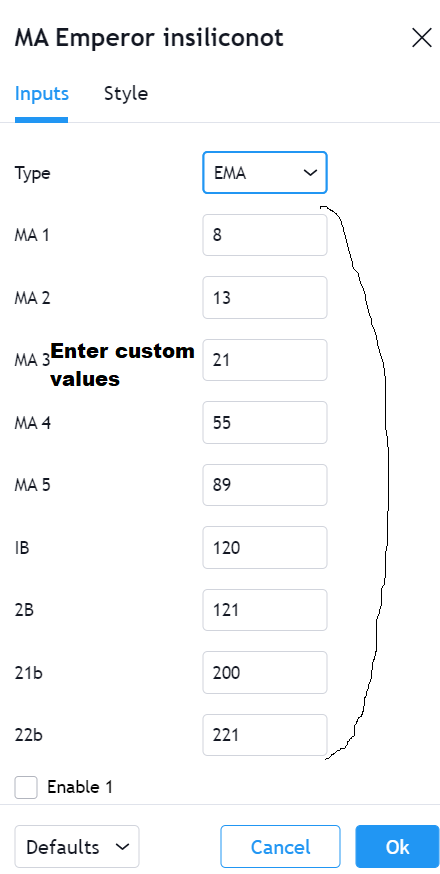

The indicator itself the most comprehensive Moving Average Indicator which provides 9 MAs and 13 Different times of MAs.

The base of the indicator was by @insiliconot.

To further enhance it, I have added a cross indicator on the cross which works the best historically on Alts.

Condition 1- The cross.

Entry is made when a Cross occurs on the EMA 13/21.

The indicator automatically indicators the Cross with P for a positive cross or N for a negative cross.

This is the first condition for an Entry.

Can anyone tell me an estimated time frame that Nexgen could be permitted, start building their mine and be producing #uranium ??? @quakes99 @JekyllCapital @travmcph @NexGenEnergy $nxe

— Michael Pierce (@Big_U_Dawg) January 22, 2021

2/ Given the scale and cost structure of Arrow, it makes sense that investors are intensely focused on its delivery timeline. This thread will discuss possible timelines, current market expectations (i.e., what’s “priced in”) & how different Arrow scenarios will impact the mkt.

3/ As you can see from the litany of responses to Michael’s tweet, there is great skepticism in the market regarding Arrow’s timeline. This is largely due to a bearish narrative conveyed by competing CEO’s whose assets only hold value if Arrow is substantially delayed.

4/ Those who played “King of the Hill” as a child would remember that it is the person at the top who is constantly attacked, not the kid sitting at the bottom of the hill in the mud. No one cares enough about that kid to attack them. This is a good parable for $NXE & Uranium.

5/ First a quick note on “this cycle” – Segra generally defines this cycle as the deficits forecasted from the mid-2020s to late-2030s. When people imply an asset producing in the mid-to-late 2020s will “miss the cycle”, they clearly have not done any real S/D modelling.