Now this thread isn’t really about whether or not you believe in bitcoin, but more about how to use leverage and other peoples money (OPM) to buy yourself more assets.

Let me explain...

It pays to be a web3 power user.

— Coopahtroopa \U0001f525_\U0001f525 (@Cooopahtroopa) December 9, 2020

Five networks that issued retroactive airdrops to value added actors \U0001f4dd

BAL is live!

— Balancer Labs (@BalancerLabs) June 23, 2020

The 435k BAL for liquidity providers of the first three weeks of liquidity mining (145k per week) have just been sent out to the wallets used to provide liquidity on Balancer.https://t.co/pkXFzwzPVC

Check out @Cooopahtroopa's latest post for all the #DeFi farmers out there \U0001f468\u200d\U0001f33e

— Zerion \U0001f3e6 (@zerion_io) June 26, 2020

Turns out @synthetix_io & @CurveFinance were ploughing the fields long before $COMP & $BAL came along.

Learn how to put your #crypto to work with this #yieldfarming 101 \U0001f4b8

\U0001f449 https://t.co/zYUKtqx3BK

2/ What is a Fair Launch?

— fair launch capital (@fairlaunchcap) August 26, 2020

A FL enables founders to bootstrap new crypto networks that are earned, owned, and governed by their community from the outset.

In this dynamic, everyone participates on equal footing\u2014there is no early access, pre-mine, or allocation of tokens.

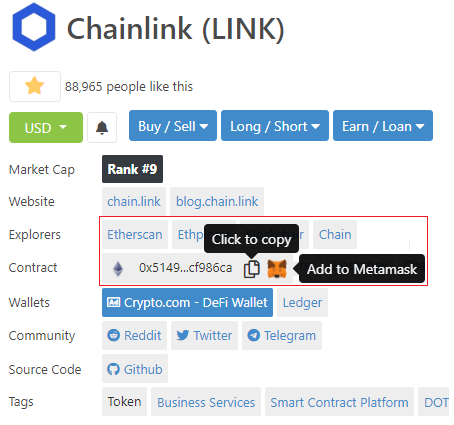

Introducing an effortless way to add tokens to your @metamask_io wallet \U0001f4e5

— CoinGecko (@coingecko) February 8, 2021

Skip the hassle of copying/pasting contract addresses to your wallet. Add an asset and it'll appear in your wallet with just a click - tap the \U0001f98a and try it out for yourself! pic.twitter.com/u26BA29ubs

#PancakeSwap Welcomes @SoteriaFinance to Syrup Pool

— PancakeSwap \U0001f95e #BSC (@PancakeSwap) January 20, 2021

Stake $CAKE, Earn\xa0$wSOTE!https://t.co/liMimqoGDy

Learn how to trade your #BinanceSmartChain assets on the @OpenOceanGlobal DEX aggregator, from within the @TrustWalletApp DApp browser.

— Trust - Crypto Wallet (@TrustWalletApp) January 20, 2021

Combine the best rates for your trades, from 3-4 different exchanges \U0001f680

Step-by-step how-to guide, here \U0001f447