Aave also allows those will idle assets to earn a relatively safe return on capital from lenders, whose rates are determined by a curve.

We're in the phase of the market where there's a lot of retail inbounds but not enough education about the Ethereum ecosystem and DeFi.

So, let's break down the basics of some of the top protocols.

First on deck: Aave (@AaveAave), an Ethereum-based money market protocol.

A 🧵

Aave also allows those will idle assets to earn a relatively safe return on capital from lenders, whose rates are determined by a curve.

Users would hold BTC, ETH, and other assets (including many ERC-20 tokens) with no expectation of a native yield or dividends.

ETH, for instance, was long just an asset for transaction fees, as was Bitcoin.

Users can deposit a variety of assets as collateral, then use that collateral as ammo to borrow other assets to be used in DeFi or beyond.

Loans are *overcollateralized*.

1. Those looking for steady, relatively safe yield on idle assets.

2. Those that want to leverage their assets by borrowing against their holdings, then trading and spending the loan to achieve utility beyond the rate they pay.

- Find idle assets that can be lent out on Aave

- Deposit said assets

- Earn a per-block, pro-rata interest paid for by those that borrow your assets (assets are pooled, then used) from the protocol

- Find inactive, useless asset

- Deposit it into Aave

- Enable it as collateral

- Borrow desired assets from protocol

- Use borrowed assets for trading, yield farming, spending, etc.

Shorting:

A user can borrow an asset from Aave, sell it, buy it back when the price is lower, then pocket the delta.

This works because the loan is denominated in the asset(s) borrowed.

ETH natively does not produce yield.

It can be used as collateral to borrow assets that *can* earn yield.

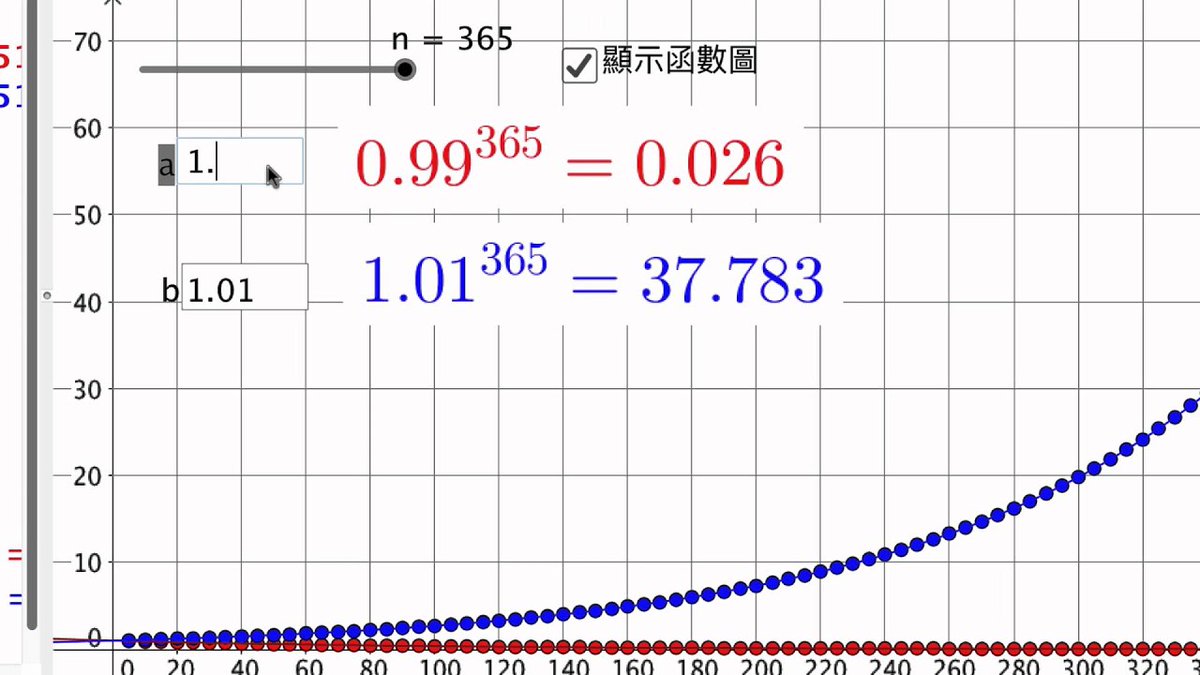

Assuming you can earn 15% on USDC and borrow @ 5%, borrowing USDC at a 200% collat. ratio will allow for an effective yield of 5% on ETH.

Say a user is holding Wrapped Bitcoin and wants something on-chain or IRL, though doesn't want to get rid of their WBTC exposure.

A user can collateralize their WBTC, buy what they want, then pay back the loan with income or other assets to reclaim their WBTC.

Aave pioneered flash loans, a concept where anyone can borrow any amount of capital within a single block for a number of use cases.

Did a thread here in the past.

https://t.co/FRn5Pj2TFk

If you've been following DeFi or Ethereum over the past few months, you've likely heard the term "flash loan" mentioned again and again.

— Nick Chong (@n2ckchong) October 29, 2020

This new DeFi primitive has been at the core of a number of economic exploits and arbitrages.

A thread on the basics of flash loans - \U0001f447 pic.twitter.com/uOQC2tzlYl

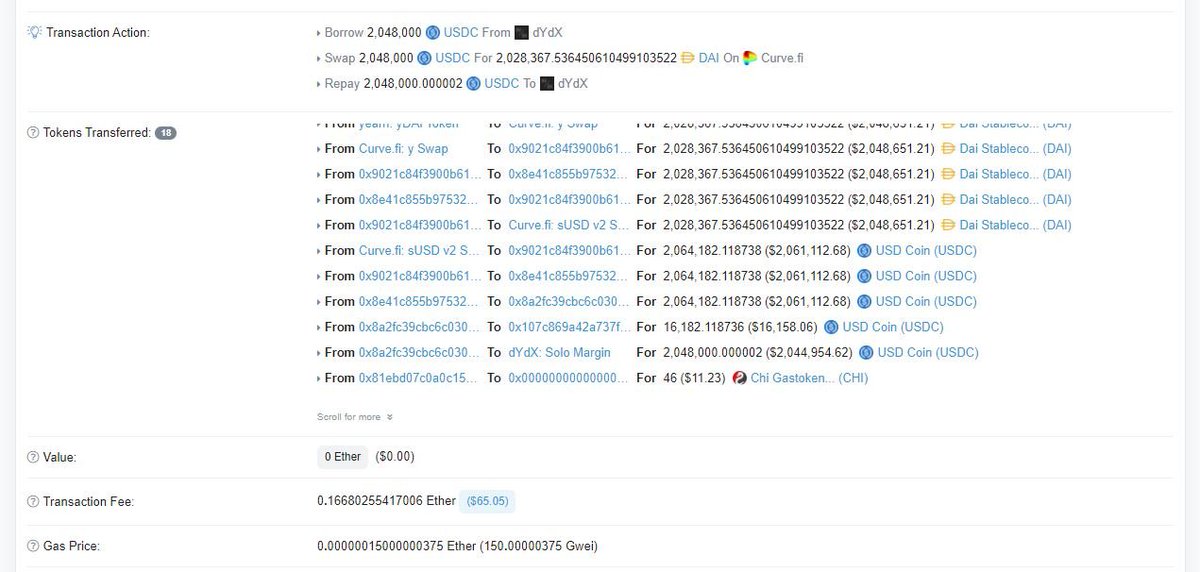

- A user borrowed 2,048,000 USDC from dYdX

- Traded that USDC for 2,028,367 DAI in Curve's Y pool

- Traded that DAI for 2,064,182 USDC in Curve's sUSD pool

- Paid dYdX back + 2 wei

All in one block...

Profit: 16,182 USDC

Cost: $60 in gas

I'll cover:

- Interest rates

- Terms

- Liquidations

- aTokens

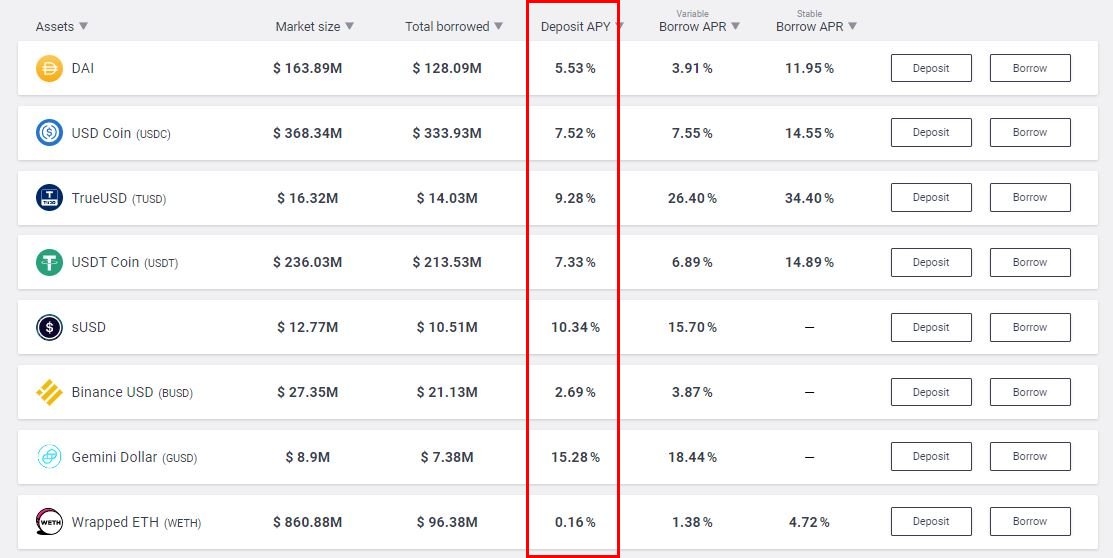

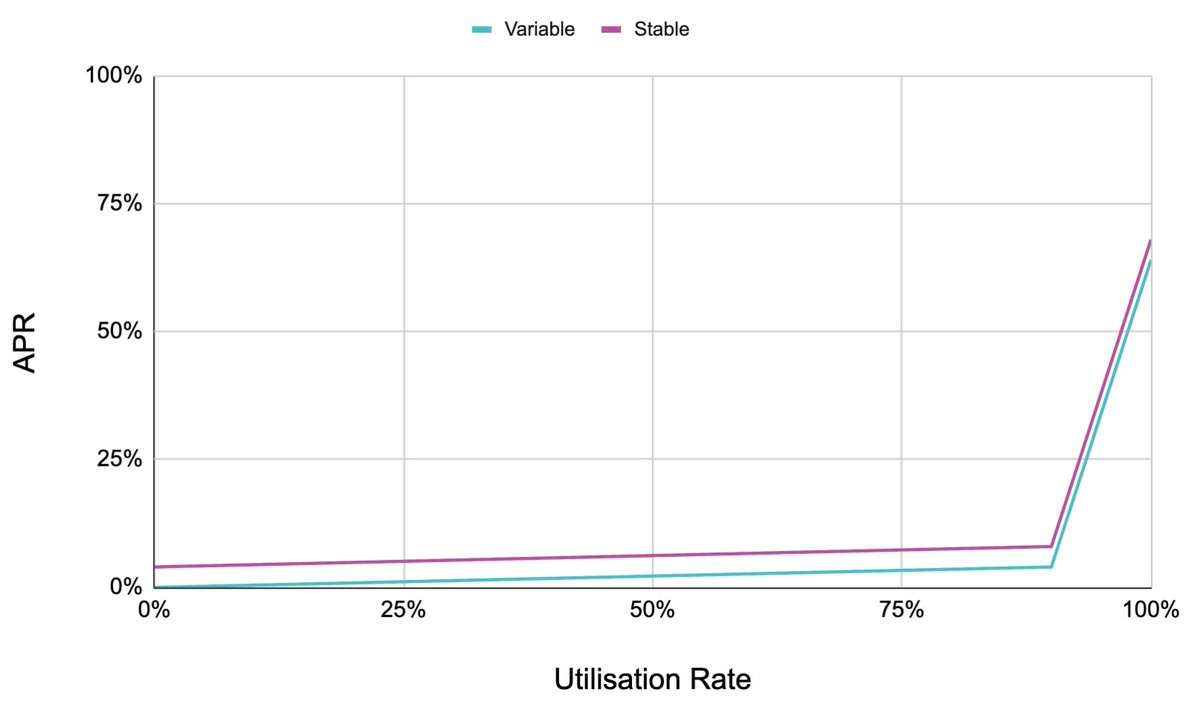

The more an asset is utilized, the higher the rate lenders earn and borrowers pay.

The borrow rate is always above the deposit rate.

Here's the borrow rate model for USDC / USDT.

To mitigate unexpected spikes in utilization affecting the rate one pays on their loan, users can lock in a fixed rate, so they can manage risk properly.

This rate can readjust based on market conditions.

Aave has a number of loan terms that dictate how much one can borrow, at what point they are liquidated, and how much they pay when they are liquidated.

These terms are determined by a risk team, who assess market conditions to minimize risk to protocol collateral.

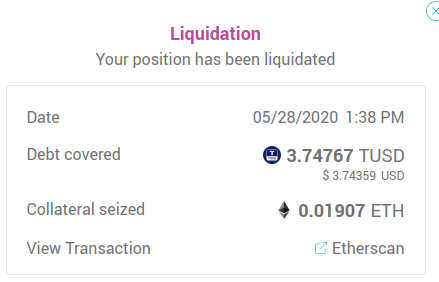

Unlike traditional loans, Aave loans are liquidated autonomously when a user's loan-to-value ratio falls below certain values.

A large enough drop in the value of one's collateral will allow users to bid the collateral, sell it, then pocket a bonus.

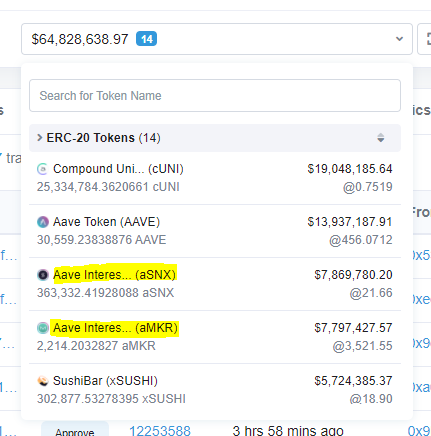

aTokens are yield-bearing assets that accrue interest in real time, allowing one to watch their deposited assets grow by block.

It can be used by other developers to build interesting applications and use cases.

For instance...

@APWineFinance: APWine allows users to trade unrealized yield

etc.

aTokens, flash loans, etc. can all be used in tandem with other contracts to create use cases.

More from Crypto

🚨Altcoin Trading Indicator🚨

How to use it. A THREAD.

Please Share.

To use it to buy Altcoins and make a high probability entry, the following conditions needs to be fulfilled.

For a long.

1. A green candle Closes above the cross.

2. Heikin Ashi candle turns green.

3. Price should be above 0.236 Fib from the swing high.

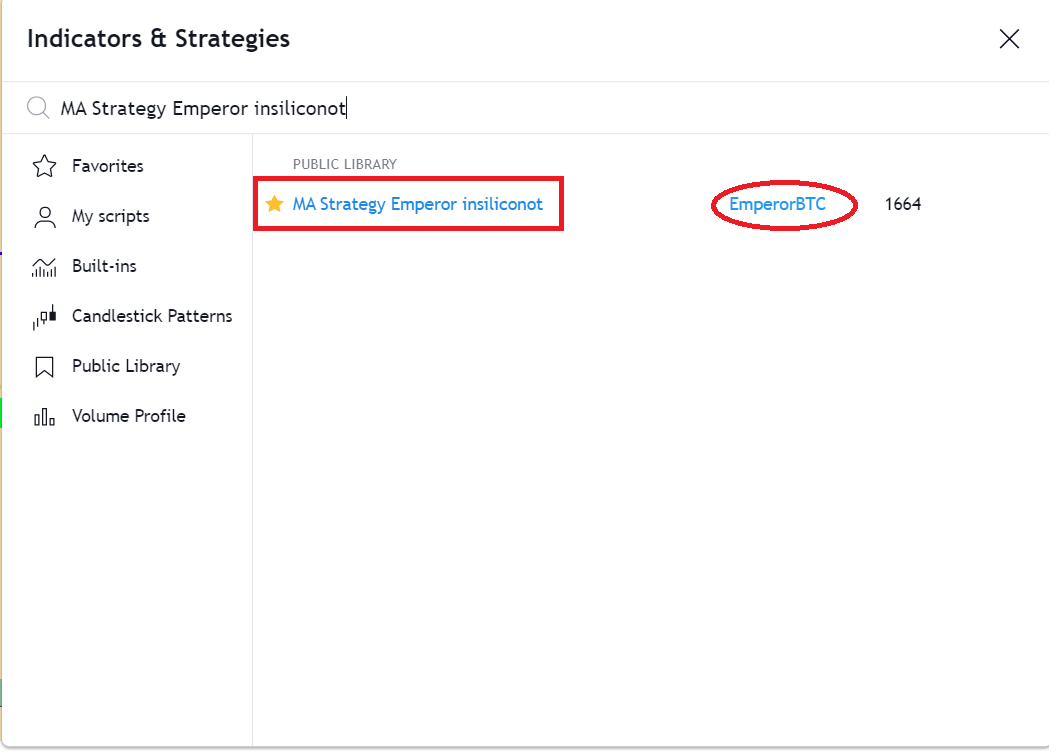

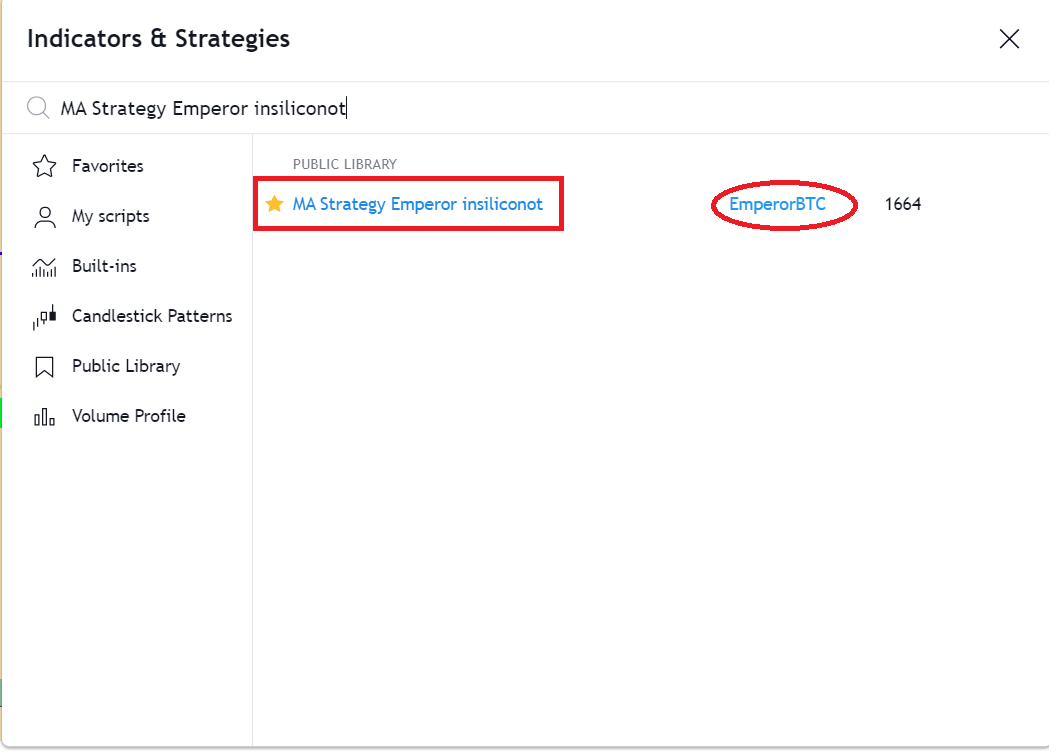

How to add the Indicator.

1. Click on the link and Add it to favorites and apply.

https://t.co/Kn90qgDjMi

2. Or Search it in the tab and then apply it.

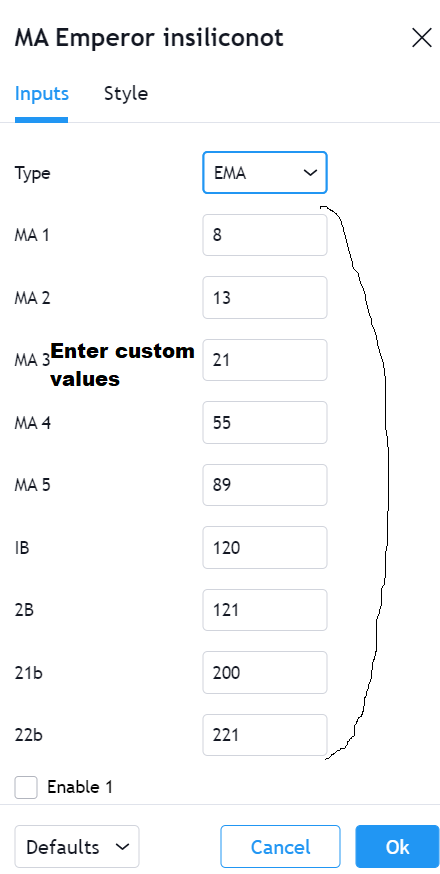

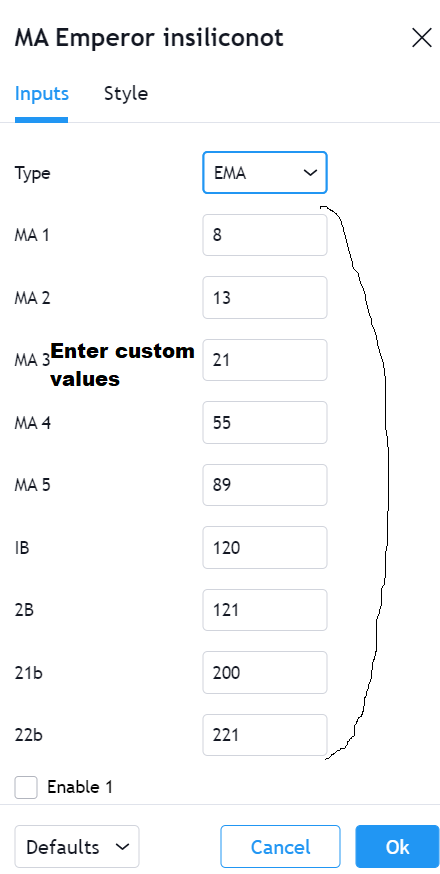

The indicator itself the most comprehensive Moving Average Indicator which provides 9 MAs and 13 Different times of MAs.

The base of the indicator was by @insiliconot.

To further enhance it, I have added a cross indicator on the cross which works the best historically on Alts.

Condition 1- The cross.

Entry is made when a Cross occurs on the EMA 13/21.

The indicator automatically indicators the Cross with P for a positive cross or N for a negative cross.

This is the first condition for an Entry.

How to use it. A THREAD.

Please Share.

To use it to buy Altcoins and make a high probability entry, the following conditions needs to be fulfilled.

For a long.

1. A green candle Closes above the cross.

2. Heikin Ashi candle turns green.

3. Price should be above 0.236 Fib from the swing high.

How to add the Indicator.

1. Click on the link and Add it to favorites and apply.

https://t.co/Kn90qgDjMi

2. Or Search it in the tab and then apply it.

The indicator itself the most comprehensive Moving Average Indicator which provides 9 MAs and 13 Different times of MAs.

The base of the indicator was by @insiliconot.

To further enhance it, I have added a cross indicator on the cross which works the best historically on Alts.

Condition 1- The cross.

Entry is made when a Cross occurs on the EMA 13/21.

The indicator automatically indicators the Cross with P for a positive cross or N for a negative cross.

This is the first condition for an Entry.