CreditAccess update https://t.co/QqfzUFATcb

CreditAccess update https://t.co/rCTPK5RQtl pic.twitter.com/Qc35AUCSrO

— Professor (@DillikiBiili) March 25, 2022

More from Professor

Starting the Beginner’s Pathway thread for Fundamental Investing.

One Chadarmod on timeline posted that I’m giving gyan without having experience or expertise.

So I’ll begin with paying my portfolio performance tribute to these charlies.

https://t.co/GNM5SsNFNo

Fundamentals based investing can generate serious wealth as the most famous (rather infamous) Warren Buffett has shown.

In India also we have many success stories like @VijayKedia1 @Raamdeo R K Damani Rakesh Jhunjhunwala Late Chandrakant Sampat and many many more....

Though I can't stop mentioning that both Rakesh Jhunjhunwala and R K Damani were traders in their initial days.

Rakesh Jhunjhunwala still trades, he once said Traing is fun, its le fatafat, de fatafat

A lot of people (specially the beginners) buy stocks based on some friend's recommendation : XYZ le le, pukka chalega, maine bhi le rakha hai.

Few might have made money this way, but most do not. Why ?

There has to be a process.

Fundamentals based investing need thorough analysis of the Business & Company.

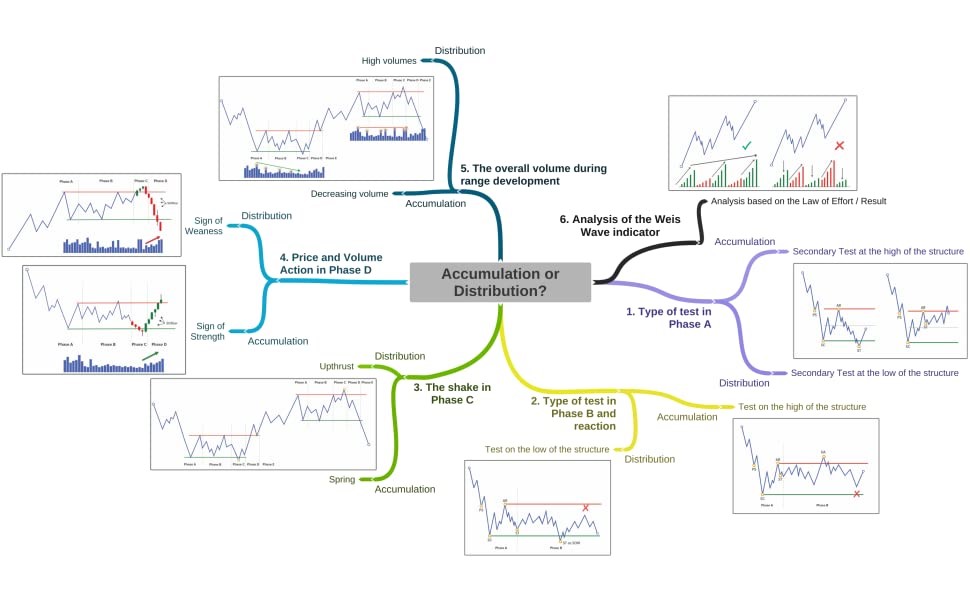

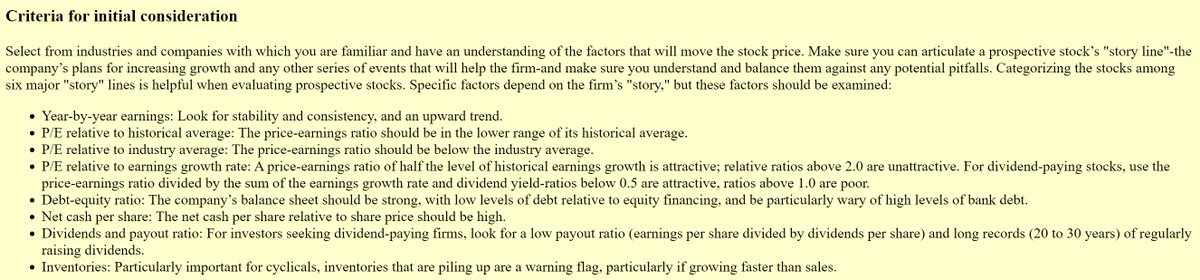

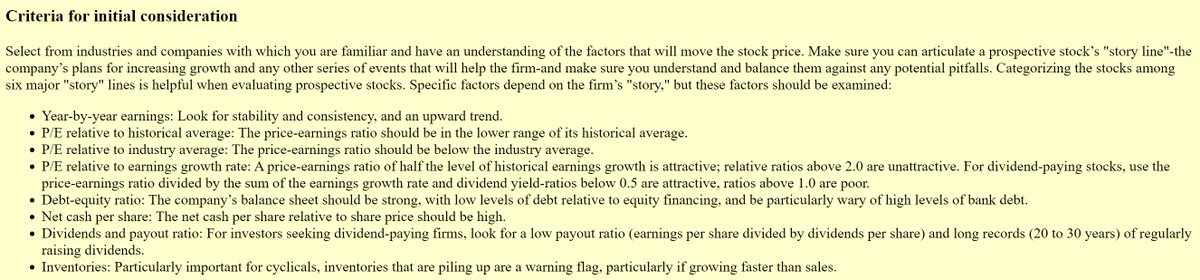

Here is a preliminary checklist by the legendary investor Peter lynch

One Chadarmod on timeline posted that I’m giving gyan without having experience or expertise.

So I’ll begin with paying my portfolio performance tribute to these charlies.

https://t.co/GNM5SsNFNo

Sadda Haqq ! Aithe Rakhh......... pic.twitter.com/IH5q3v2gw9

— Professor (@DillikiBiili) October 5, 2021

Fundamentals based investing can generate serious wealth as the most famous (rather infamous) Warren Buffett has shown.

In India also we have many success stories like @VijayKedia1 @Raamdeo R K Damani Rakesh Jhunjhunwala Late Chandrakant Sampat and many many more....

Though I can't stop mentioning that both Rakesh Jhunjhunwala and R K Damani were traders in their initial days.

Rakesh Jhunjhunwala still trades, he once said Traing is fun, its le fatafat, de fatafat

A lot of people (specially the beginners) buy stocks based on some friend's recommendation : XYZ le le, pukka chalega, maine bhi le rakha hai.

Few might have made money this way, but most do not. Why ?

There has to be a process.

Fundamentals based investing need thorough analysis of the Business & Company.

Here is a preliminary checklist by the legendary investor Peter lynch

Asian Paints took a bounce exactly from the level given on 21st October.

It has string resistance at 3200, so fresh up-move will be confirmed only when it opens above 3220-3230 levels

#ASIANPAINT

#DKBPositional https://t.co/Q6fTbK5VHM

It has string resistance at 3200, so fresh up-move will be confirmed only when it opens above 3220-3230 levels

#ASIANPAINT

#DKBPositional https://t.co/Q6fTbK5VHM

Asian Paints also at crucial support line, bulls desperately need a reversal here, else it'll go in hibernation..... pic.twitter.com/VTfaMfpHXs

— Professor (@DillikiBiili) October 21, 2021

OI Data reading seekh lo:

See Large OIl buildup kin strikes par hai and in between strikes data kaise move ho raha hai.

Thumb Rule:

Calls Reduction + Puts addition = Upthrust

Calls Addition + Put Reduction = Down move

Higher the Delta OI velocity, faster is the move.

See Large OIl buildup kin strikes par hai and in between strikes data kaise move ho raha hai.

Thumb Rule:

Calls Reduction + Puts addition = Upthrust

Calls Addition + Put Reduction = Down move

Higher the Delta OI velocity, faster is the move.

For Nifty Intraday Traders: As of now, this seems to be a buy on dip market and looks like there won't be any juicy trades on short side. Will update if data changes. https://t.co/PCIyyPld4A pic.twitter.com/ES3o4z60rY

— Professor (@DillikiBiili) March 11, 2022