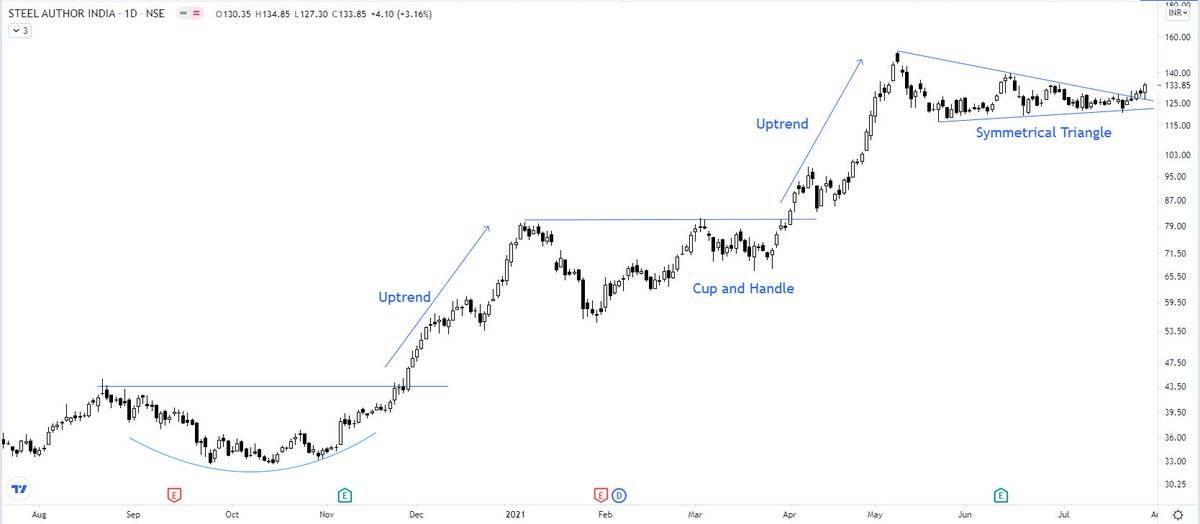

More from The_Chartist 📈

Explained you same concept with Elxsi. The real test of a strong Breakout is that the big hand will not give you another chance to buy the share at the breakout level. They will absorb all the selling of weak hands. I mean "STRONG breakout". https://t.co/7fxFqGQl3p

Tata Elxsi ---

— Steve Nison (@nison_steve) June 30, 2021

In the last 10 minutes, all the selling was absorbed despite intraday positions being squared off (if not converted). will wait for the EOD data. However, the chart structure is extremely strong. https://t.co/pci7GCDBEO pic.twitter.com/1NBD9V3mKc

ITC - how beautifully the price patterns work. All of a sudden an increased momentum right from the support of the channel boundary. Has a minor resistance to nail down in the middle.

— The_Chartist \U0001f4c8 (@charts_zone) March 18, 2022

Anyone observing it would have gone aggressive at lower end for a swing move pic.twitter.com/YqxkdFlJXQ

You May Also Like

Decoded his way of analysis/logics for everyone to easily understand.

Have covered:

1. Analysis of volatility, how to foresee/signs.

2. Workbook

3. When to sell options

4. Diff category of days

5. How movement of option prices tell us what will happen

1. Keeps following volatility super closely.

Makes 7-8 different strategies to give him a sense of what's going on.

Whichever gives highest profit he trades in.

I am quite different from your style. I follow the market's volatility very closely. I have mock positions in 7-8 different strategies which allows me to stay connected. Whichever gives best profit is usually the one i trade in.

— Sarang Sood (@SarangSood) August 13, 2019

2. Theta falls when market moves.

Falls where market is headed towards not on our original position.

Anilji most of the time these days Theta only falls when market moves. So the Theta actually falls where market has moved to, not where our position was in the first place. By shifting we can come close to capturing the Theta fall but not always.

— Sarang Sood (@SarangSood) June 24, 2019

3. If you're an options seller then sell only when volatility is dropping, there is a high probability of you making the right trade and getting profit as a result

He believes in a market operator, if market mover sells volatility Sarang Sir joins him.

This week has been great so far. The main aim is to be in the right side of the volatility, rest the market will reward.

— Sarang Sood (@SarangSood) July 3, 2019

4. Theta decay vs Fall in vega

Sell when Vega is falling rather than for theta decay. You won't be trapped and higher probability of making profit.

There is a difference between theta decay & fall in vega. Decay is certain but there is no guaranteed profit as delta moves can increase cost. Fall in vega on the other hand is backed by a powerful force that sells options and gives handsome returns. Our job is to identify them.

— Sarang Sood (@SarangSood) February 12, 2020