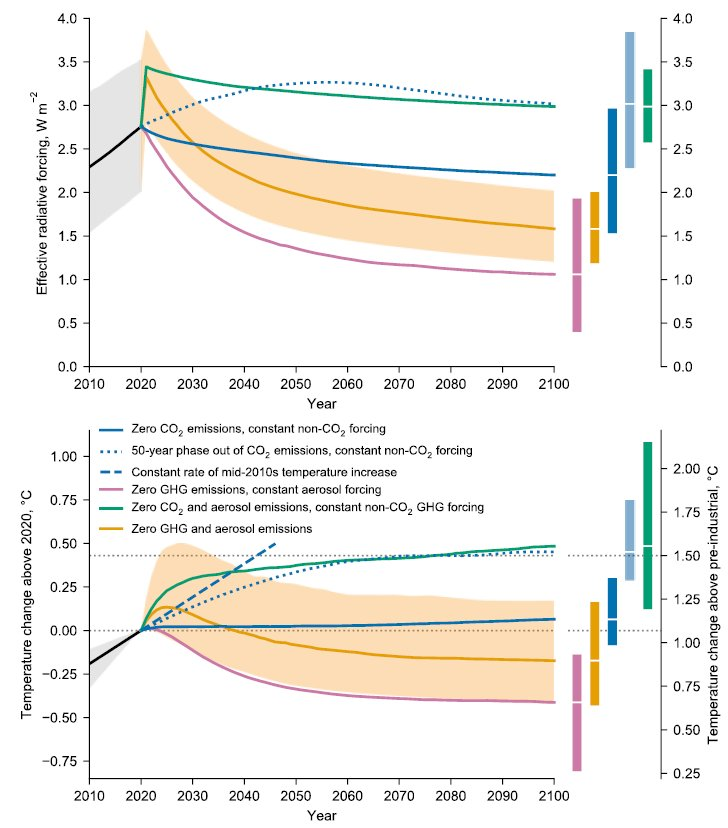

Fascinating new paper by @AndrewDessler and colleagues arguing committed warming might be higher than expected given historical pattern effects. Its combining a lot of different concepts together, so lets spend some time disentangling them https://t.co/ILi5z515Qy

A thread: 1/19

More from Climate change

The UK government's climate advisory body is launching its next carbon budget: basically, outlining what the UK can emit between 2033 and 2037. It's a big deal - launch video starting right now.

Watch along:

Will tweet along snippets. Pretty relevant to...............everything, really. #UKCarbonBudget

"Instead of being just a budget, it's a pathway we have to tread to reach net zero in 2050" @lorddeben

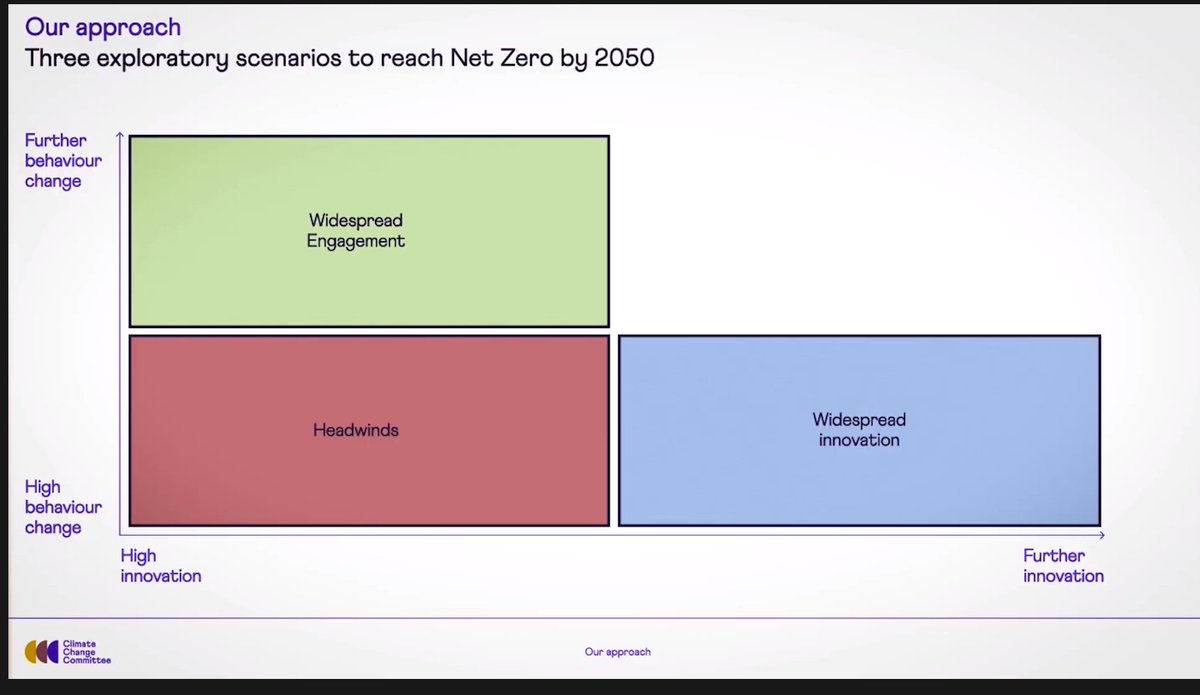

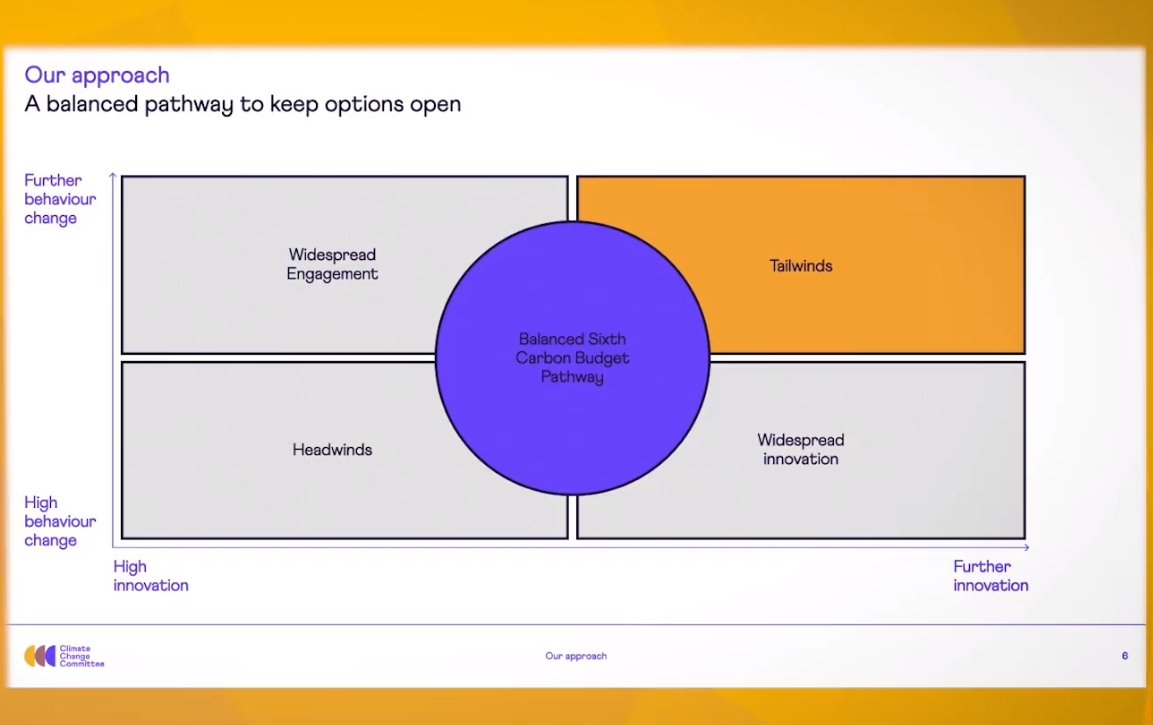

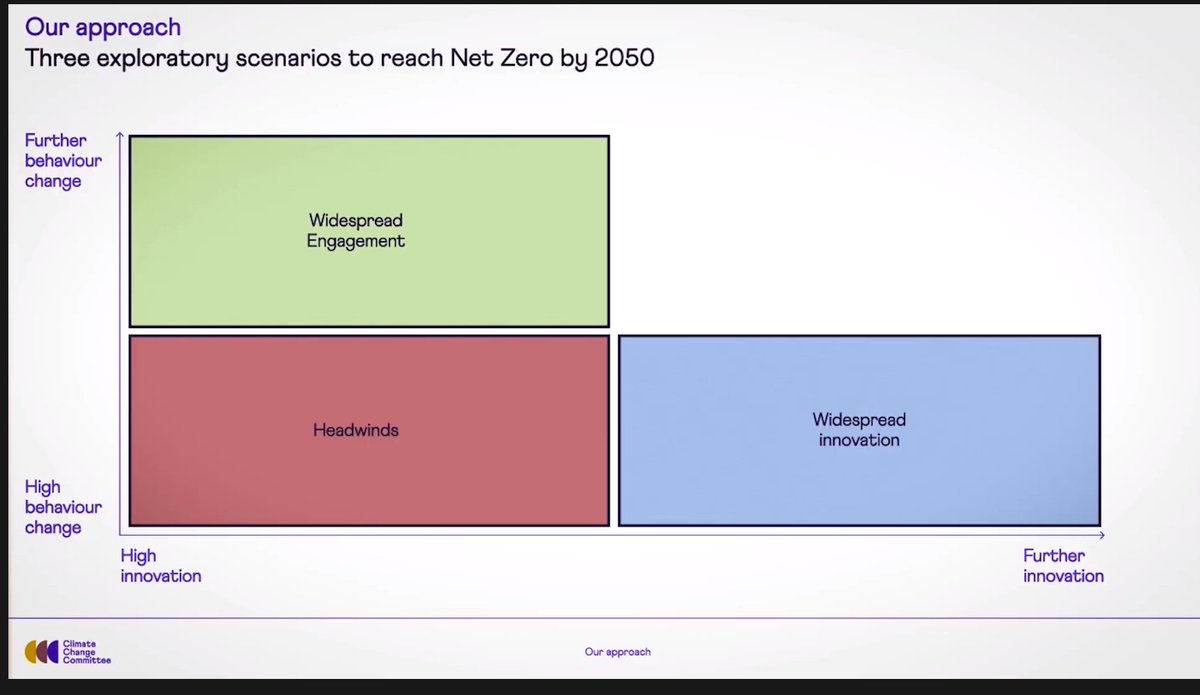

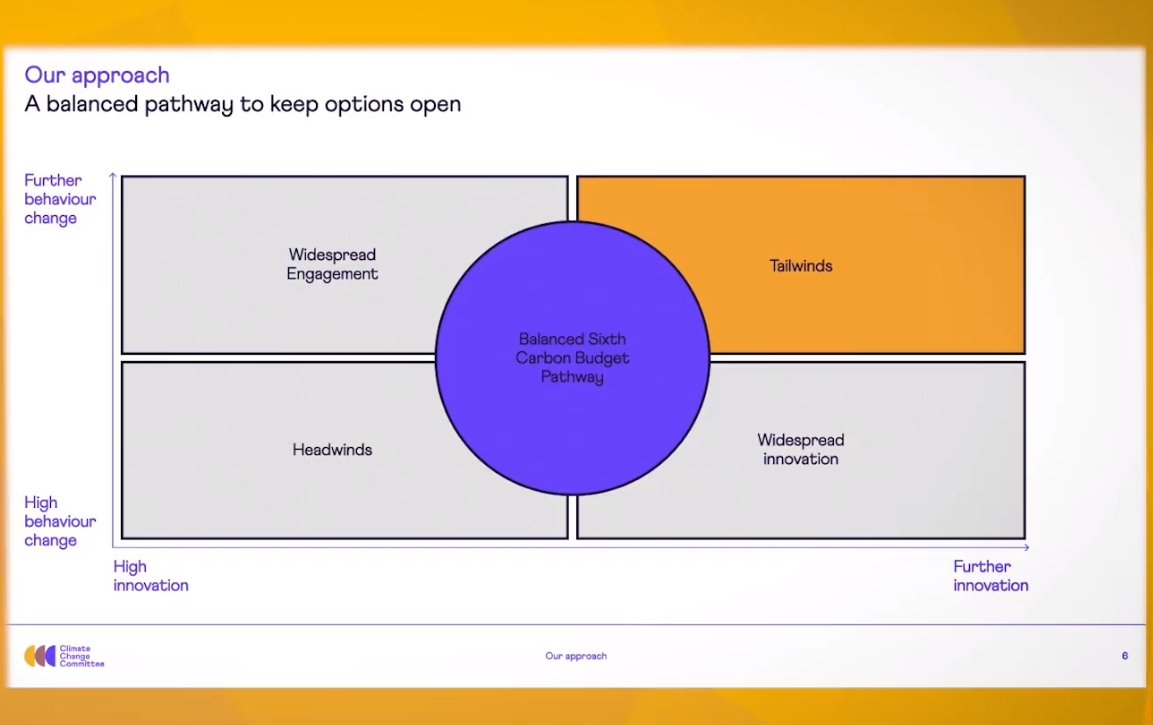

Just like quite a few other modelling exercises, CCC use a spectrum between behaviour change and between technological change. #UKCarbonBudget.

Both = best (just like @AEMO_Media's Step Change scenario in their ISP)

'Balanced' is what they use for their recs. "We're doing 60% of the emissions reductions in the first 15 years, and then 40% in the next".

The slinky kitty curve....good to see. No evidence of delaying action to Dec 29 2049, here. #UKCarbonBudget

"By front loading, we're minimising the UK's contribution to cumulative emissions" - really important point. A slow path to net zero - more climate harm than a fast one. #UKCarbonBudget

Watch along:

Just 15 mins until the launch event for our new advice to Government on the Sixth Carbon Budget. If you haven\u2019t registered, you can watch live on YouTube from 10am. Link: https://t.co/PjlcIDSYEC #UKCarbonBudget pic.twitter.com/1zOTfmxDVp

— Climate Change Committee (@theCCCuk) December 9, 2020

Will tweet along snippets. Pretty relevant to...............everything, really. #UKCarbonBudget

"Instead of being just a budget, it's a pathway we have to tread to reach net zero in 2050" @lorddeben

Just like quite a few other modelling exercises, CCC use a spectrum between behaviour change and between technological change. #UKCarbonBudget.

Both = best (just like @AEMO_Media's Step Change scenario in their ISP)

'Balanced' is what they use for their recs. "We're doing 60% of the emissions reductions in the first 15 years, and then 40% in the next".

The slinky kitty curve....good to see. No evidence of delaying action to Dec 29 2049, here. #UKCarbonBudget

"By front loading, we're minimising the UK's contribution to cumulative emissions" - really important point. A slow path to net zero - more climate harm than a fast one. #UKCarbonBudget

You May Also Like

I hate when I learn something new (to me) & stunning about the Jeff Epstein network (h/t MoodyKnowsNada.)

Where to begin?

So our new Secretary of State Anthony Blinken's stepfather, Samuel Pisar, was "longtime lawyer and confidant of...Robert Maxwell," Ghislaine Maxwell's Dad.

"Pisar was one of the last people to speak to Maxwell, by phone, probably an hour before the chairman of Mirror Group Newspapers fell off his luxury yacht the Lady Ghislaine on 5 November, 1991." https://t.co/DAEgchNyTP

OK, so that's just a coincidence. Moving on, Anthony Blinken "attended the prestigious Dalton School in New York City"...wait, what? https://t.co/DnE6AvHmJg

Dalton School...Dalton School...rings a

Oh that's right.

The dad of the U.S. Attorney General under both George W. Bush & Donald Trump, William Barr, was headmaster of the Dalton School.

Donald Barr was also quite a

I'm not going to even mention that Blinken's stepdad Sam Pisar's name was in Epstein's "black book."

Lots of names in that book. I mean, for example, Cuomo, Trump, Clinton, Prince Andrew, Bill Cosby, Woody Allen - all in that book, and their reputations are spotless.

Where to begin?

So our new Secretary of State Anthony Blinken's stepfather, Samuel Pisar, was "longtime lawyer and confidant of...Robert Maxwell," Ghislaine Maxwell's Dad.

"Pisar was one of the last people to speak to Maxwell, by phone, probably an hour before the chairman of Mirror Group Newspapers fell off his luxury yacht the Lady Ghislaine on 5 November, 1991." https://t.co/DAEgchNyTP

OK, so that's just a coincidence. Moving on, Anthony Blinken "attended the prestigious Dalton School in New York City"...wait, what? https://t.co/DnE6AvHmJg

Dalton School...Dalton School...rings a

Oh that's right.

The dad of the U.S. Attorney General under both George W. Bush & Donald Trump, William Barr, was headmaster of the Dalton School.

Donald Barr was also quite a

Donald Barr had a way with words. pic.twitter.com/JdRBwXPhJn

— Rudy Havenstein, listening to Nas all day. (@RudyHavenstein) September 17, 2020

I'm not going to even mention that Blinken's stepdad Sam Pisar's name was in Epstein's "black book."

Lots of names in that book. I mean, for example, Cuomo, Trump, Clinton, Prince Andrew, Bill Cosby, Woody Allen - all in that book, and their reputations are spotless.

So the cryptocurrency industry has basically two products, one which is relatively benign and doesn't have product market fit, and one which is malignant and does. The industry has a weird superposition of understanding this fact and (strategically?) not understanding it.

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.

If everyone was holding bitcoin on the old x86 in their parents basement, we would be finding a price bottom. The problem is the risk is all pooled at a few brokerages and a network of rotten exchanges with counter party risk that makes AIG circa 2008 look like a good credit.

— Greg Wester (@gwestr) November 25, 2018

The benign product is sovereign programmable money, which is historically a niche interest of folks with a relatively clustered set of beliefs about the state, the literary merit of Snow Crash, and the utility of gold to the modern economy.

This product has narrow appeal and, accordingly, is worth about as much as everything else on a 486 sitting in someone's basement is worth.

The other product is investment scams, which have approximately the best product market fit of anything produced by humans. In no age, in no country, in no city, at no level of sophistication do people consistently say "Actually I would prefer not to get money for nothing."

This product needs the exchanges like they need oxygen, because the value of it is directly tied to having payment rails to move real currency into the ecosystem and some jurisdictional and regulatory legerdemain to stay one step ahead of the banhammer.