CDSL - Learning.... ✅✅

I believe 5-10 stocks are enough for a retail investor to achieve super performance. And with small capital, there is no point in buying 20/30 names which doesn't even get appropriate initial capital.

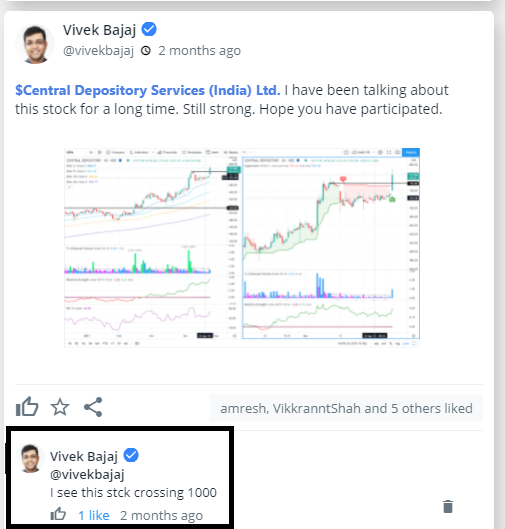

Stock: CDSL

— Steve Nison (@nison_steve) December 16, 2020

CMP - 516.95. Low risk setup. Weak below 500. Target open. Stock retesting the ascending triangle BO line. Kindly check please. @nishkumar1977 @Rishikesh_ADX @VijayThk @kuttrapali @Thekalal @PAVLeader pic.twitter.com/PlcpOMsdnz

More from Steve Nison

ITC - how beautifully the price patterns work. All of a sudden an increased momentum right from the support of the channel boundary. Has a minor resistance to nail down in the middle.

— The_Chartist \U0001f4c8 (@charts_zone) March 18, 2022

Anyone observing it would have gone aggressive at lower end for a swing move pic.twitter.com/YqxkdFlJXQ

More from Cdsl

More fireworks yet to come above 827 BO

This is power of AOV analysis feature.

#Areaofvalue analysis#CDSL

— SSStockAlerts (@ssstockalerts) May 6, 2021

Buy near 21 SMA support. This stock respects 21 SMA for 84% time. Backtested for last 1 year.

Candle size is getting smaller and volume also less then avg volume.

Any time it can reverse from here.

Help/Supporthttps://t.co/rRCfjf3KIi pic.twitter.com/KGyyAAQ1tV

CMP:971.90

Lowest volume and a very tight day today.

Previously such consolidation was followed by a strong move of minimum 10% and continued to rally further.

Can be a sweet spot to enter today.

Investment wise solid stock for longterm

@Atulsingh_asan @nishkumar1977 https://t.co/auSRNis5yv

IEX

— TECHVESTOR (@AshrafZaman3) June 25, 2021

CMP: 377

Vert tight consolidation with lowest volumes since last 4 months. Explosive move expected next week.

Can be bought above 380.60 pic.twitter.com/lrnfLvBged

Objective is to move higher towards

3.618%(1287)

4.236%(1476)

4.618%(1593)

#Probability^^^

#CDSL -1050

— MaRkET WaVES (DINESH PATEL ) Stock Market FARMER (@idineshptl) July 9, 2021

Now above 2.618% and objective is to move higher towards 3.618%

4.236% and 4.618%....

What will Drag lower this stock price \U0001f602 ?

Only if you can sell your holding

Means Verticle rise ?

Than why it decline from (486-180.)#Observation #Perspective pic.twitter.com/evxYOjH8Qv

You May Also Like

Why is this the most powerful question you can ask when attempting to reach an agreement with another human being or organization?

A thread, co-written by @deanmbrody:

Next level tactic when closing a sale, candidate, or investment:

— Erik Torenberg (@eriktorenberg) February 27, 2018

Ask: \u201cWhat needs to be true for you to be all in?\u201d

You'll usually get an explicit answer that you might not get otherwise. It also holds them accountable once the thing they need becomes true.

2/ First, “X” could be lots of things. Examples: What would need to be true for you to

- “Feel it's in our best interest for me to be CMO"

- “Feel that we’re in a good place as a company”

- “Feel that we’re on the same page”

- “Feel that we both got what we wanted from this deal

3/ Normally, we aren’t that direct. Example from startup/VC land:

Founders leave VC meetings thinking that every VC will invest, but they rarely do.

Worse over, the founders don’t know what they need to do in order to be fundable.

4/ So why should you ask the magic Q?

To get clarity.

You want to know where you stand, and what it takes to get what you want in a way that also gets them what they want.

It also holds them (mentally) accountable once the thing they need becomes true.

5/ Staying in the context of soliciting investors, the question is “what would need to be true for you to want to invest (or partner with us on this journey, etc)?”

Multiple responses to this question are likely to deliver a positive result.