Keep it Simple Stupid!

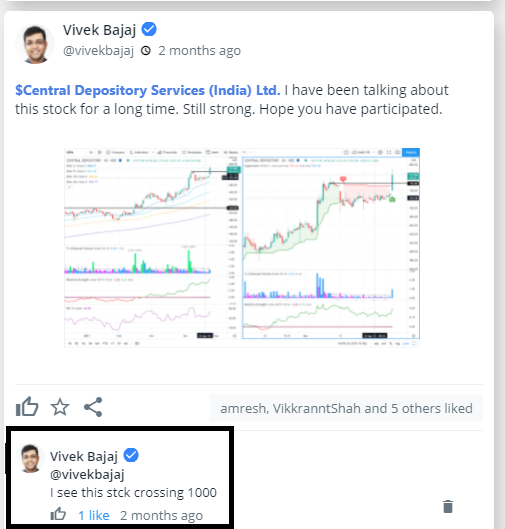

#cdsl has been a great compounder with a simple RS strategy.

1000 was clearly evident as discussed 2 months ago in #StockEdgeClub

More from Learner Vivek Bajaj

More from Cdsl

CDSL

CMP: 1258.55

One of my long term PORTFOLIO STOCK is getting ready for the next phase.

Will be a good point to add more quantity. https://t.co/KaidnjSWpY

A lot of friends ask for stocks that they can invest for next 5 years. I personally believe and personally invested into

— TECHVESTOR (@AshrafZaman3) May 23, 2021

1. IEX

2 CDSL

3. IRCTC

4. NAZARA TECHNOLOGIES

Please do not take this as an investment recommendation. Also my entry price is lower.#investing pic.twitter.com/vKBLV9u4mL

Objective is to move higher towards

3.618%(1287)

4.236%(1476)

4.618%(1593)

#Probability^^^

#CDSL -1050

— MaRkET WaVES (DINESH PATEL ) Stock Market FARMER (@idineshptl) July 9, 2021

Now above 2.618% and objective is to move higher towards 3.618%

4.236% and 4.618%....

What will Drag lower this stock price \U0001f602 ?

Only if you can sell your holding

Means Verticle rise ?

Than why it decline from (486-180.)#Observation #Perspective pic.twitter.com/evxYOjH8Qv

Either entry only above 1600 or let it

correct towards 987...

#Update

#CDSL -1050

— MaRkET WaVES (DINESH PATEL ) Stock Market FARMER (@idineshptl) July 9, 2021

Now above 2.618% and objective is to move higher towards 3.618%

4.236% and 4.618%....

What will Drag lower this stock price \U0001f602 ?

Only if you can sell your holding

Means Verticle rise ?

Than why it decline from (486-180.)#Observation #Perspective pic.twitter.com/evxYOjH8Qv