Stocks that are bullish have the characteristics that they continue to make new highs. One of the best ways to identify such stocks is to look out for the stocks that are in the 25% range of all-time high levels.

IN TRADING, THE TREND IS YOUR FRIEND!

Buying a weak stock and Selling a strong stock is a crime in trading.

Sharing 3 SIMPLE methods that a buyer can use to identify strong stocks in an uptrend and increase the probability of success.

Sharing screeners link to help you out!

Stocks that are bullish have the characteristics that they continue to make new highs. One of the best ways to identify such stocks is to look out for the stocks that are in the 25% range of all-time high levels.

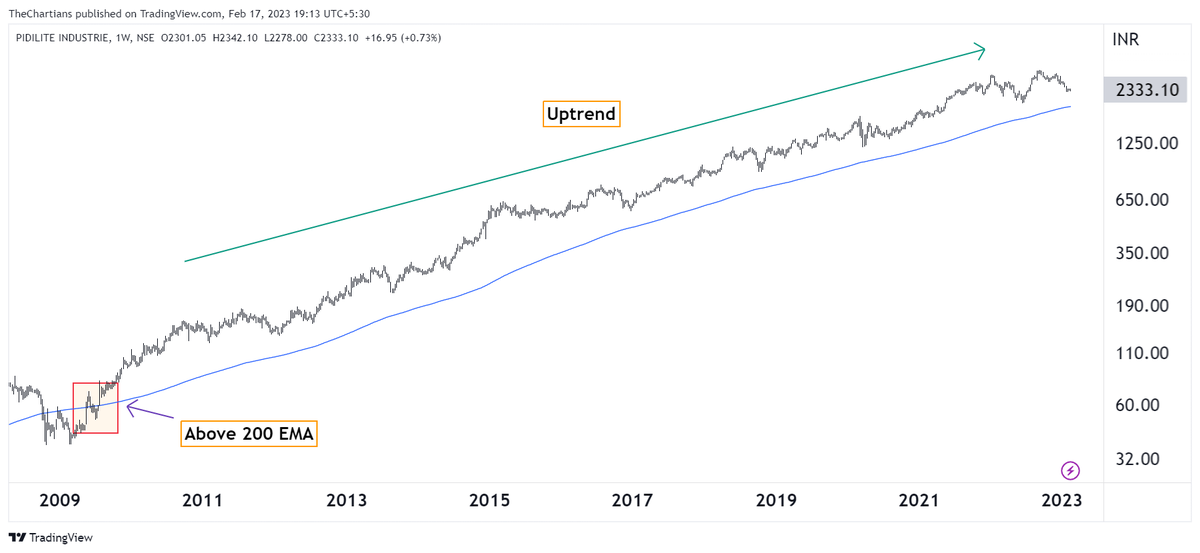

Investors can use 200 EMA on the weekly time frame and any stock that is above it can be considered as a strong stock in investment.

Pidilite is above 200 EMA since 2010 and it has created enormous wealth for investors.

https://t.co/iwXDnSvwzl

Traders can use 200 EMA on the daily time frame and any stock that is above it can be considered as a strong stock in investment.

Screener Link: https://t.co/OdhkEtn8H4

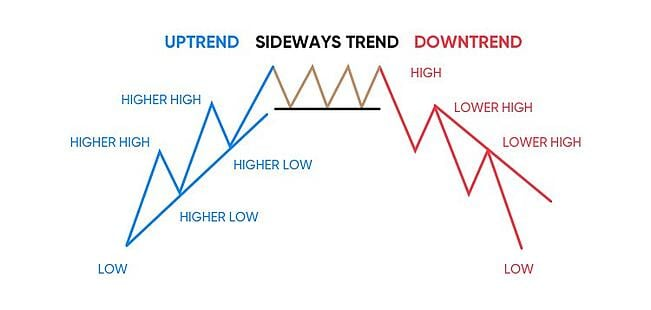

There are two trends that can be identified using Dow theory.

Uptrend: Price forming Higher Lows and Higher Highs

Downtrend: Price forming Lower Highs and Lower Lows

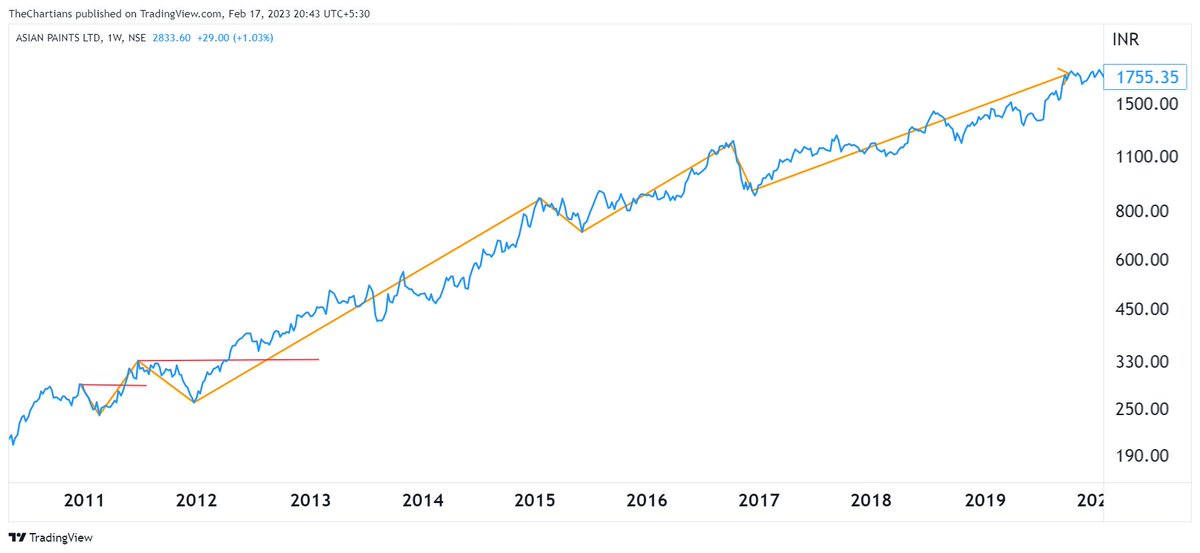

In Asian Paints charts, we can see how previous high is breaking and lows are getting shifted upward which means a stock is strong.

If you found this useful, please RT the first tweet.

For live trading and stock market related updates, you can join our Telegram Channel⤵️

https://t.co/FSyDMbgo3n

More from The Chartians

#chartkyaboltahai

- 730 dop can be bought for tgt of 1000.

- Stock has made first HH-HL.

- Breaking previous swing low.

- Ascending traingle pattern on daily.

@ydstartupreneur

@caniravkaria bhaiji looks good on charts https://t.co/iwy4wXUiJf

#chart kya bolta hai?#kiska weekly chart hai?

— Yash Dugar (@ydstartupreneur) July 10, 2021

It is said that when weekly trend reversals are with huge volumes & strong RSI the stock becomes a good positional trade/investment.

Those who will answer it fully correctly will get access to our full report on it by @FinterestC pic.twitter.com/I4DX29TpRg

Dip*

More from Catagory trading

Very important thread for all option buyers 🧵

Just 5 to 10 minutes to read but it can change your trading a lot.

Support us by RETWEET this tweet to help more option buyers to gain knowledge & to avoid getting trapped from big players https://t.co/yBZ6Y7BaGx

Option Buying Simplified

— Learn to Trade (@learntotrade365) August 31, 2022

Very important thread for all option buyers \U0001f9f5

Just 5 minutes to read but it can change your trading a lot.

Support us by RETWEET this tweet to help most option buyers to gain knowledge & to avoid getting trapped from big players pic.twitter.com/BaaTjJix7F

I do Intraday Live Market session via Youtube Live on all trading days - Follow us on twitter @learntotrade365

Join the Telegram channel for Live Market updates and more free content.

Scroll down

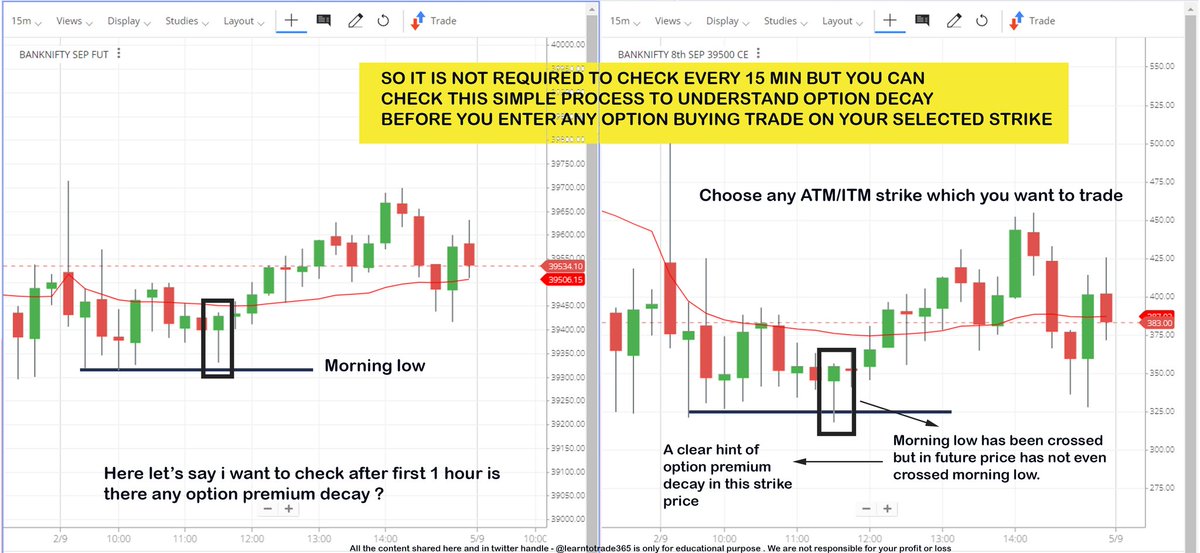

Main problem which most option buyers face is Option Premium erosion ( Theta Decay ). So I have shared a simple & effective process to understand the option decay during Live Market before entering option buying trades

Scroll down 👇

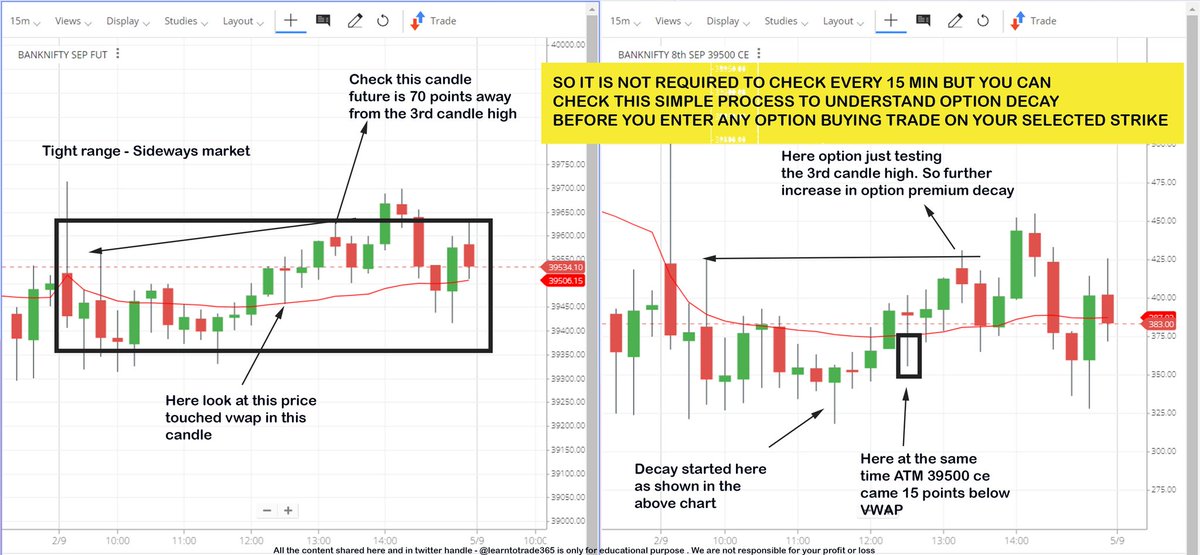

Follow up example from the above chart about Option premium decay during sideways market. In general most option premium erosion (theta decay) happens during sideways market.

Theta is option buyers ENEMY

Scroll down 👇

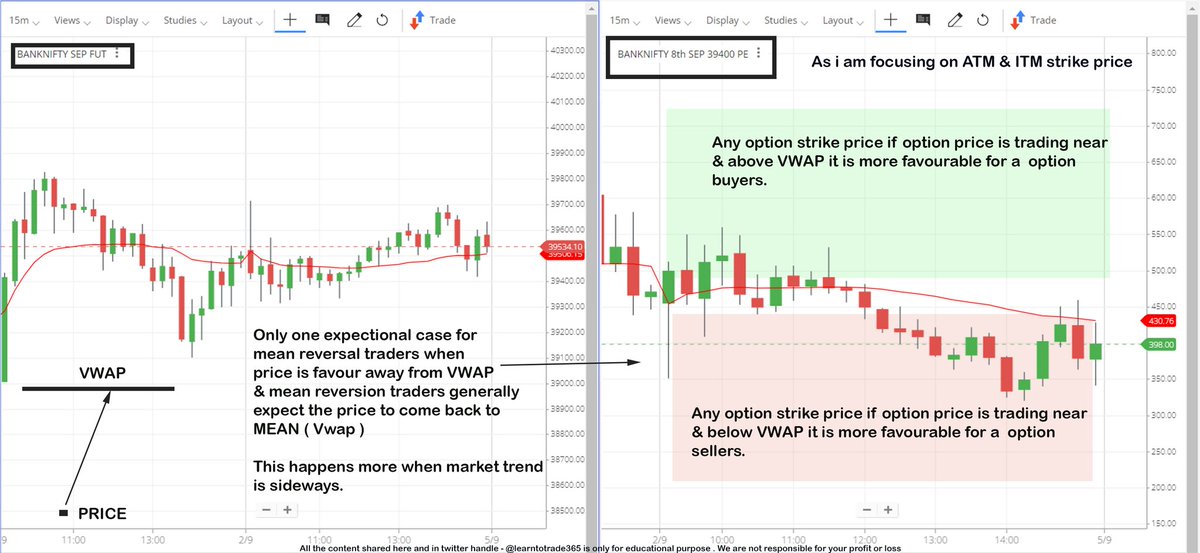

Option Buyers high probability zones while trading ATM & ITM strike prices.

VWAP helps a lot in providing data during Live Market

Scroll down 👇

A Thread 🧵🧵

Tested - Executed in Real - Works

Kindly Re-Tweet for Max Reach 🙏🙏

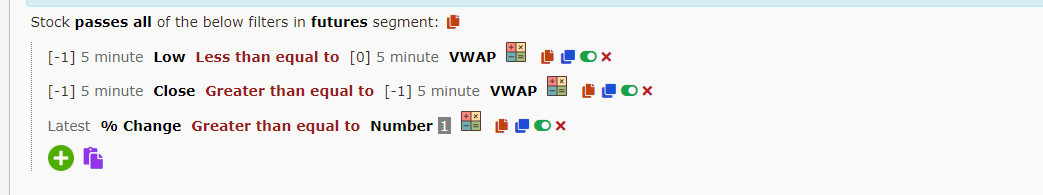

1) Buy a Gainer when bounce from VWAP

Condition apply to chart ink -

- Stock days' gain > 1%

- Candle Low < VWAP and Close > VWAP

- Now check chart manually

You will get list of stocks that are gainers and consolidated to bounce from VWAP

https://t.co/W7HVmFvYpy

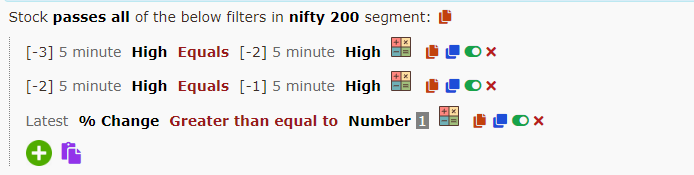

2) Near Day High

- Top gainers make 3-4 times new High in a day

- Best to enter when it break High of one wave

- Check charts manually after you get list

This screener gives you stocks that are near day High

Apply this with Time frame 3 or 15 min -

https://t.co/ocM7Whvtdi

3) Stocks at Resistance -

Conditions to apply -

- Stock day's gain > 1%

- High of Last 3-4 candles is equal

Apply like this -

4) Bullish Engulfing -

Very Good Signal for Intraday buying any time frame

Here is the screener -

Change Time frame according to

You May Also Like

As a dean of a major academic institution, I could not have said this. But I will now. Requiring such statements in applications for appointments and promotions is an affront to academic freedom, and diminishes the true value of diversity, equity of inclusion by trivializing it. https://t.co/NfcI5VLODi

— Jeffrey Flier (@jflier) November 10, 2018

We know that elite institutions like the one Flier was in (partial) charge of rely on irrelevant status markers like private school education, whiteness, legacy, and ability to charm an old white guy at an interview.

Harvard's discriminatory policies are becoming increasingly well known, across the political spectrum (see, e.g., the recent lawsuit on discrimination against East Asian applications.)

It's refreshing to hear a senior administrator admits to personally opposing policies that attempt to remedy these basic flaws. These are flaws that harm his institution's ability to do cutting-edge research and to serve the public.

Harvard is being eclipsed by institutions that have different ideas about how to run a 21st Century institution. Stanford, for one; the UC system; the "public Ivys".