https://t.co/eR3wXegyvN

Candlesticks are Base for Analysis of Charts

— My First Stock (@myfirststock99) August 15, 2022

Here are the 10 Candlestick patterns you must know

A Thread \U0001f9f5\U0001f9f5

Kindly Re-Tweet for Max Reach

Candlesticks are Base for Analysis of Charts

— My First Stock (@myfirststock99) August 15, 2022

Here are the 10 Candlestick patterns you must know

A Thread \U0001f9f5\U0001f9f5

Kindly Re-Tweet for Max Reach

How to create Screeners on Trading View

— My First Stock (@myfirststock99) October 15, 2022

A Thread \U0001f9f5\U0001f9f5

Gold standard info if you can integrate for intraday

Kindly Re-Tweet for Max Reach \U0001f64f

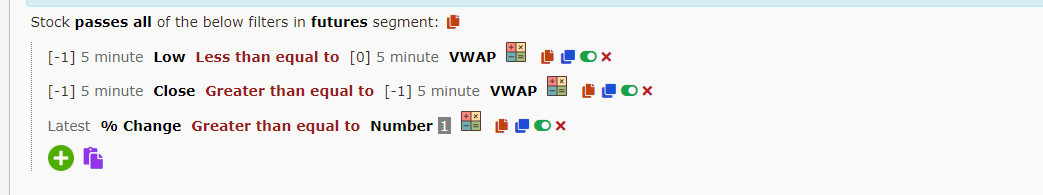

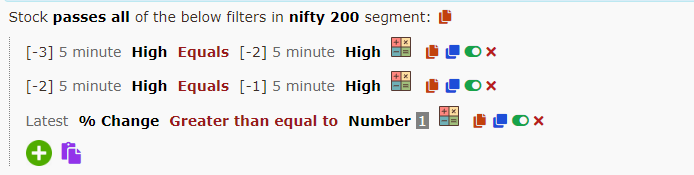

How to Create Screeners on Chart Ink

— My First Stock (@myfirststock99) May 28, 2022

A Thread with 10 Screeners\U0001f9f5\U0001f9f5\U0001f9f5

Kindly Re-Tweet Like for Max Reach

Lets Help \U0001f64f

How to Find Multibagger Stocks

— My First Stock (@myfirststock99) August 27, 2022

How to create screeners and use them

How to read charts \U0001f9f5\U0001f9f5

A thread of all my Threads

Kindly Re-Tweet to help others \U0001f64f

Intraday Technical Analysis

— My First Stock (@myfirststock99) May 14, 2022

Mini Course \U0001f9f5\U0001f9f5 (Free)

How to Enter Long and Short Trade

Explained with 30+ Charts

Kindly Re-Tweet and Like for Max Reach \U0001f64f

Basics of Fundamental Investing \U0001f9f5\U0001f9f5

— My First Stock (@myfirststock99) July 17, 2022

Here are the 10 financial terms/ratios you should know before investing

Please Re-Tweet like for Max Reach.

Straddle buying strategy \U0001f9f5\U0001f9f5

— My First Stock (@myfirststock99) January 8, 2023

Best for volatile market explained in 3 tweets

Kindly retweet like for max reach \U0001f64f

For 7 yrs I struggled to ride trends..

— Trendline Investor (@dmdsplyinvestor) April 30, 2022

& in 2015-17 when I started learning TA smthng crazy happened..

Here is a simple strategy that helped me..

\u2022 Identify turning points in stocks

\u2022 Find quality stocks

\u2022 Not panic & ride trends

\u2022 Finally make \U0001f4b8

CCI & Pivot Strategy\U0001f9f5.. pic.twitter.com/S0QFx00541

There are 1000s of indicators in Technical Analysis...

— Trendline Investor (@dmdsplyinvestor) May 12, 2022

But you need to MASTER ONLY ONE\U0001f3afto win in markets...

I selected 'Commodity channel index' (CCI) as my PRIMARY INDICATOR & all my scanners are a variation of this...

MULTI TIMEFRAME POSITIONAL STRATEGY using CCI...\U0001f9f5 pic.twitter.com/4O2PrBxSw9

My CCI based investment strategy - How does it work? A thread.

— Trendline Investor (@dmdsplyinvestor) May 23, 2020

Objective: Identify stocks that are entering a phase of momentum on the upside and ride the stock until momentum weakens.1/n

A brilliant concept based on the long term and short term EMA by @heartwon. I'm here on twitter for such stuff that helps me build my systems. Really good one. Here is the trading view indicator that I coded. Please RT for everyone's benefit. 1/3 https://t.co/uleWiysyL1

— Trendline Investor (@dmdsplyinvestor) July 5, 2020

Ironies of Luck https://t.co/5BPWGbAxFi

— Morgan Housel (@morganhousel) March 14, 2018

"Luck is the flip side of risk. They are mirrored cousins, driven by the same thing: You are one person in a 7 billion player game, and the accidental impact of other people\u2019s actions can be more consequential than your own."