There’s also a vast open-plan central London office, easy camaraderie with staff, lots of plants

“Energy needed a digital revolution – and we are it”

Greg Jackson, boss of Octopus Energy, says the sector was ripe for an Amazon or Uber-style disruptor, but that his version will also boost the UK’s green revolution

There’s also a vast open-plan central London office, easy camaraderie with staff, lots of plants

With all these markers of a tech unicorn – a deal last month with Tokyo Gas valued it at $2bn (£1.5bn) – it’s easy to forget that Octopus is an energy company

Jackson, 49, says the distinction is increasingly irrelevant

But Jackson’s vision goes well beyond Britain

And he plans to reach this ambitious milestone within a few years

“We didn’t know about energy, but we could see that the sector had not yet had a digital revolution. From windfarms to household, it ran on systems that were two decades old”

But in a world where cheap and abundant renewable energy is charging millions of batteries in homes and cars, consumers can become active participants in the energy system

It’s one example of a future hi-tech energy system that empowers individuals

“Electricity is becoming a tech sector,” said Jackson.

Already 17 million customers are plugged into Kraken software

Amazon and Uber used technology to trigger a fundamental global shift in sectors which are arguably far more local and personal than energy supply

More from JPR007

More from Business

The Mother of All Squeezes

How Volkswagen went from being on the brink of bankruptcy to the most valuable company in the world in two days

/THREAD/

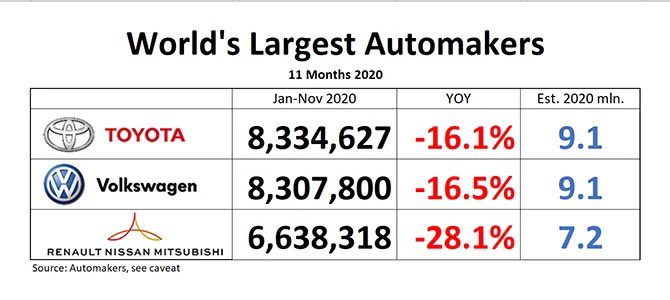

1/ At the peak of the 2008 financial crisis, Volkswagen was considered a very likely candidate for bankruptcy.

Heavily indebted and already financially struggling before 2008, with car sales expected to plummet due to the ongoing global crisis.

2/ With GM and Chrysler filing for bankruptcy in 2009, shorting the VW stock would seem a safe bet.

If you are not familiar with stock shorts and short squeezes check my thread

3/ On October 26, 2008, Porsche announced it had increased its stake at VW from 30% to 74%.

This was a surprise to many who were led to believe that Porsche wasn't planning a takeover of VW, based on the company's announcements.

4/ Before the announcement, the short interest was approximately 13% of the outstanding shares, a number considered relatively low.

Porsche had a 30% stake, the Lower Saxony government fund held 20% of the shares, and another 5% was held by index funds.

How Volkswagen went from being on the brink of bankruptcy to the most valuable company in the world in two days

/THREAD/

1/ At the peak of the 2008 financial crisis, Volkswagen was considered a very likely candidate for bankruptcy.

Heavily indebted and already financially struggling before 2008, with car sales expected to plummet due to the ongoing global crisis.

2/ With GM and Chrysler filing for bankruptcy in 2009, shorting the VW stock would seem a safe bet.

If you are not familiar with stock shorts and short squeezes check my thread

Shorts, Squeezes, and Betting Against Stocks

— Kostas on FIRE \U0001f525 (@itsKostasOnFIRE) January 27, 2021

What is short selling, how is it used and why is it risky?

/THREAD/ pic.twitter.com/PyDd208hFe

3/ On October 26, 2008, Porsche announced it had increased its stake at VW from 30% to 74%.

This was a surprise to many who were led to believe that Porsche wasn't planning a takeover of VW, based on the company's announcements.

4/ Before the announcement, the short interest was approximately 13% of the outstanding shares, a number considered relatively low.

Porsche had a 30% stake, the Lower Saxony government fund held 20% of the shares, and another 5% was held by index funds.

This is a GREAT argument to pull up when talking to people about minimum wage. Some others nested below

A large number of new jobs being created are minimum to low wage, so looking for a new job generally won’t increase pay.

Raising minimum wage helps things not directly related.

Helps Infant mortality? Yup.

Lowers Suicide? Yup.

Reduce smoking rates? You bet.

It also boosts the local economy! Minimum to low wage earners spend more % of their money, so an increase means more is spent, often in community!

Low paying jobs are often in sectors which would gain from this. More people spending money in your shop makes your business more money! Now you have more profits and increased labor costs are covered.

"it doesn't affect me if companies pay low wages"

— Dan Price (@DanPriceSeattle) February 11, 2021

In reality, you're paying for it. Over 50% of people on food stamps are actively working. The leading employers are Walmart, McDonald's and Amazon.

As taxpayers, you're subsidizing corporations to pay literal poverty wages.

A large number of new jobs being created are minimum to low wage, so looking for a new job generally won’t increase pay.

Raising minimum wage helps things not directly related.

Helps Infant mortality? Yup.

Lowers Suicide? Yup.

Reduce smoking rates? You bet.

It also boosts the local economy! Minimum to low wage earners spend more % of their money, so an increase means more is spent, often in community!

Low paying jobs are often in sectors which would gain from this. More people spending money in your shop makes your business more money! Now you have more profits and increased labor costs are covered.

You May Also Like

I think a plausible explanation is that whatever Corbyn says or does, his critics will denounce - no matter how much hypocrisy it necessitates.

Corbyn opposes the exploitation of foreign sweatshop-workers - Labour MPs complain he's like Nigel

He speaks up in defence of migrants - Labour MPs whinge that he's not listening to the public's very real concerns about immigration:

He's wrong to prioritise Labour Party members over the public:

He's wrong to prioritise the public over Labour Party

One of the oddest features of the Labour tax row is how raising allowances, which the media allowed the LDs to describe as progressive (in spite of evidence to contrary) through the coalition years, is now seen by everyone as very right wing

— Tom Clark (@prospect_clark) November 2, 2018

Corbyn opposes the exploitation of foreign sweatshop-workers - Labour MPs complain he's like Nigel

He speaks up in defence of migrants - Labour MPs whinge that he's not listening to the public's very real concerns about immigration:

He's wrong to prioritise Labour Party members over the public:

He's wrong to prioritise the public over Labour Party