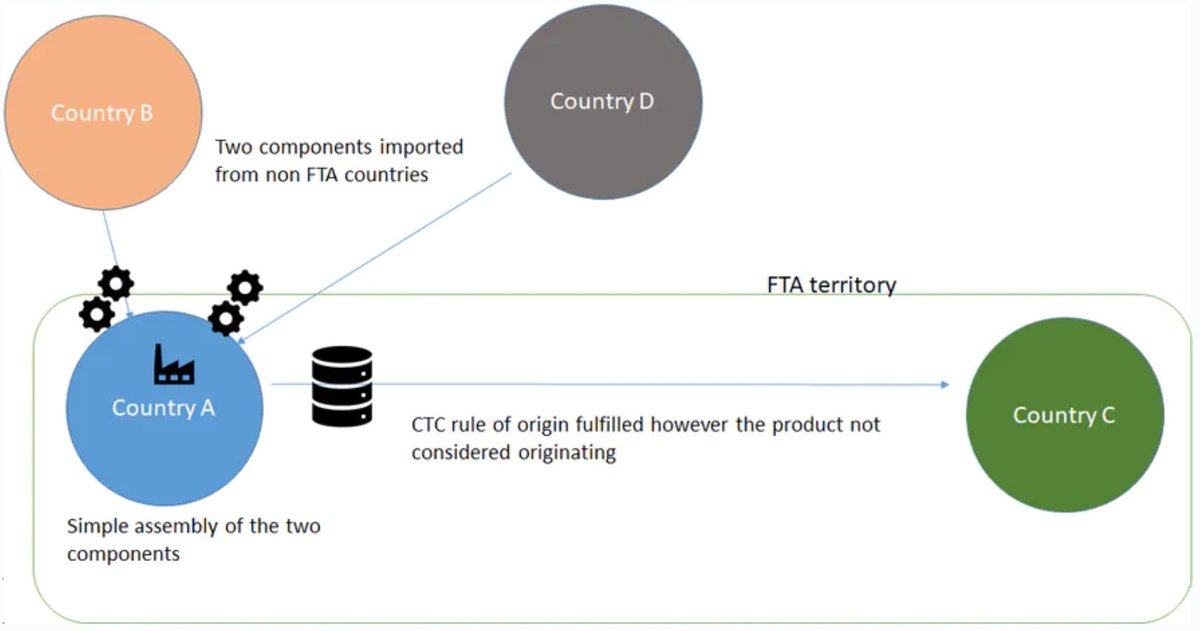

So some of the standard RoO provisions will seem incredibly restrictive under the UK-EU deal.

/2

\U0001f6a8\U0001f6a8\U0001f6a8\U0001f1ea\U0001f1fa\U0001f1ec\U0001f1e7\U0001f69b\U0001f692\U0001f1ea\U0001f1fa\U0001f1ec\U0001f1e7\U0001f6a8\U0001f6a8\U0001f6a8 serious #brexit story alert - companies now starting to see penny drop on what rules of origin does to supply chains (food for example) but Brussels seems deaf to both EU & U.K. pleading. A bellwether? \U0001f62c Stay with me. 1/

— Peter Foster (@pmdfoster) January 6, 2021

https://t.co/HoDSDxhKaL

NEW: Extraordinary examples just published by Govt re what will NOT qualify for tariff free trade under UK-EU FTA from Friday as result of \u201crules of origin\u201d... specialist considerations as to the

— Faisal Islam (@faisalislam) December 29, 2020

1. Grating of cheese

2. Shelling of nuts

3. Assembly of a table

4. Eyes of a doll pic.twitter.com/zOi8COttDJ

Disgraceful and shabby if true: not only ideologically blinkered, but ashamed to admit its ideological blinkers and their consequences. https://t.co/7PgOEogTlA

— George Peretz QC (@GeorgePeretzQC) January 9, 2021

See here a summary of what is permitted from U.K. POV. https://t.co/HkdRlubySr

— Luke Piper (@Pipermigration) January 10, 2021