New Youtube Video :

Top 7 Books that Every Trader Must Read to Become a Successful Trader !

I have personally benefited a lot from these books and I am sure you'll also benefit in the same manner :)

https://t.co/A7aS4JgDrW

#trading #youtube #books

More from Sourabh Sisodiya, CFA

Thread 🧵:

A Day in the Life of a Trader (A day in my Life)

1) I absolutely love my work❤️! In fact, I grew up dreaming to be a trader. So trading, to me, doesn’t feel like working (except when I lose😂).

It’s fascinating because it’s different every day.

#trading #life

2)7:30 AM : Alarm Rings

A typical week day for me begins at 7:30 AM.

I spend the next 30 minutes on my daily chores — get ready for office, grab a quick breakfast & have a hot cuppa coffee.

3) 8:00 AM : Leave for office

On my way to office, I check what happened at the Wallstreet overnight & how are Asian markets performing.

I then look for any macro news that may affect overnight positions

P.S: We are moving to a new bigger office & will share pics of that soon

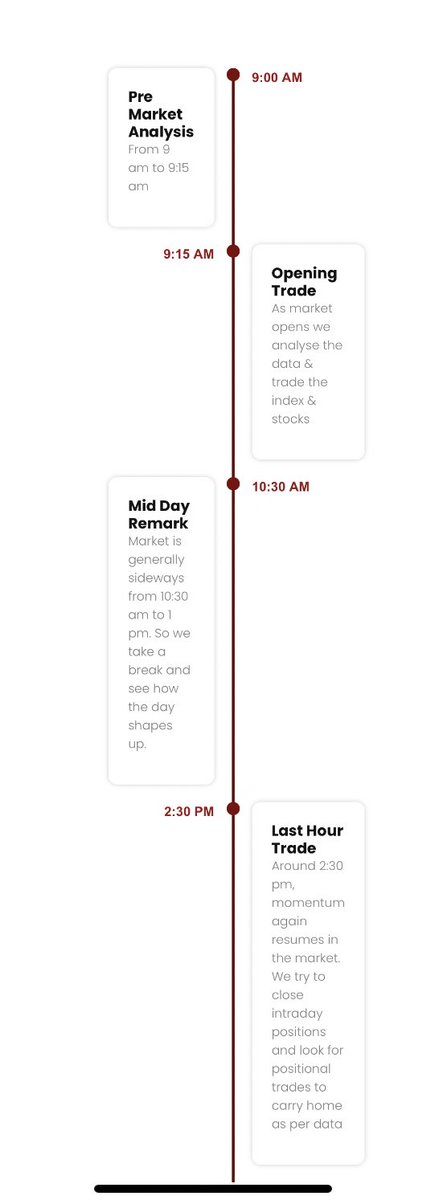

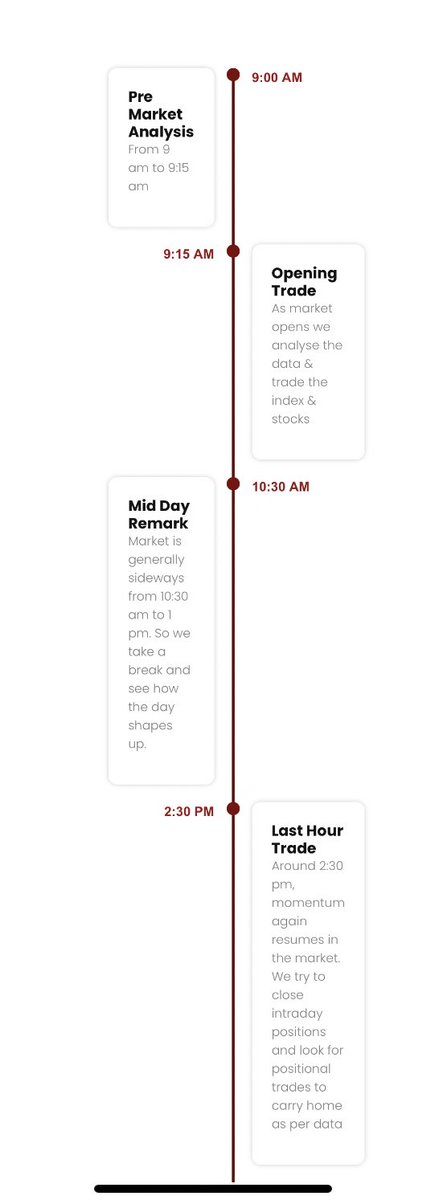

4) 9 AM - Connect with Trade Room members

I connect with trade room members on zoom & share my plan for the day, stocks to keep in radar & how to play the index & which option strategies to execute

For more details about Online Trade Room you can check

https://t.co/WrQPxhABsE

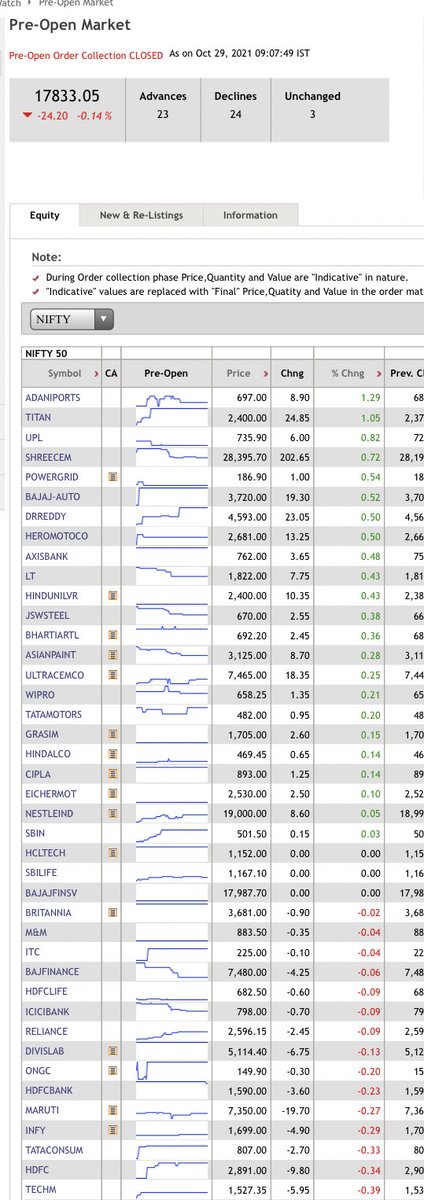

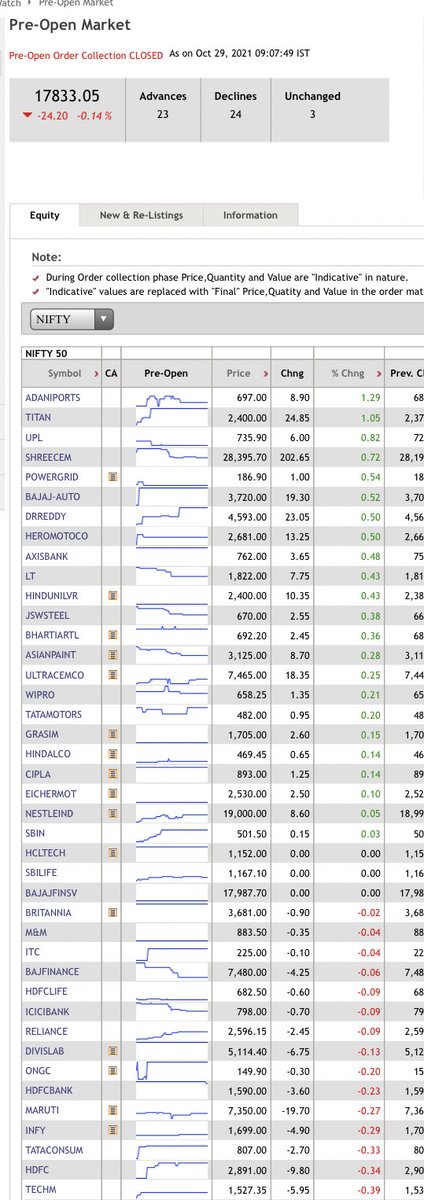

5) 9:07 - Pre Opening session

I keenly observe the pre-opening to get a general sense of where the market is it likely to open. At 9:07 AM, the pre-opening prices are out. I make a note of stocks opening with a big gap up or gap down and keep them on my watchlist.

A Day in the Life of a Trader (A day in my Life)

1) I absolutely love my work❤️! In fact, I grew up dreaming to be a trader. So trading, to me, doesn’t feel like working (except when I lose😂).

It’s fascinating because it’s different every day.

#trading #life

2)7:30 AM : Alarm Rings

A typical week day for me begins at 7:30 AM.

I spend the next 30 minutes on my daily chores — get ready for office, grab a quick breakfast & have a hot cuppa coffee.

3) 8:00 AM : Leave for office

On my way to office, I check what happened at the Wallstreet overnight & how are Asian markets performing.

I then look for any macro news that may affect overnight positions

P.S: We are moving to a new bigger office & will share pics of that soon

4) 9 AM - Connect with Trade Room members

I connect with trade room members on zoom & share my plan for the day, stocks to keep in radar & how to play the index & which option strategies to execute

For more details about Online Trade Room you can check

https://t.co/WrQPxhABsE

5) 9:07 - Pre Opening session

I keenly observe the pre-opening to get a general sense of where the market is it likely to open. At 9:07 AM, the pre-opening prices are out. I make a note of stocks opening with a big gap up or gap down and keep them on my watchlist.