Zurich axioms are simple rules in order to learn about betting to win.

Zurich axioms - A book on Risk taking, by Max Gunther

@safiranand @jposhaughnessy @Vivek_Investor @BalakrishnanR @Covel @shyamsek @_anshulkhare

#investing

#Bookthread 👇🧵

Zurich axioms are simple rules in order to learn about betting to win.

ON RISK

- Life is an adventure. In order to experience life to its full potential one has to take meaningful risk.. All Investments are speculation. Some people accept it. some don’t.

Always play for meaningful stakes.

ON GREED

- One must take profits soon. Long winning streaks are rare and short ones are vastly common One doesn’t know how long a winning streak will continue. Averages overwhelmingly favor the ones who quit early.

- One must decide in advance how much gain one wants from a venture & when one gets it, square off the position.

- One way to reinforce the ending of a streak is to buy some kind of a reward from the gain.

ON HOPE

- When the ship starts to sink, don't pray. Jump.

- Knowing how to get out of the bad situation takes courage and a sense of honesty. A Professional speculator studies how he will save himself when things fall.

- Accept small losses cheerfully. Taking small losses is a much better way to protect oneself from the big one. Don’t sit on a sinking ship.

ON FORECAST

- Human behavior cannot be predicted. Distrust anyone who claims to know the future, however dimly.

- No one knows what's gonna happen in the future, great speculators don't listen to the forecasts.

On PATTERNS

- Chaos is not dangerous until it begins to look orderly.

World of money is a patternless disorder and utter chaos. Humans have a nature of keeping things in order, eg. unwarranted belief that history repeats itself.

ON MOBILITY

- Avoid putting down Roots. They impede motion. Do not become trapped in a souring venture because of sentiments like loyalty and nostalgia. It is a mistake to let oneself get too attached to businesses in which capital is invested.

- Never hesitate to abandon a venture if something more attractive comes into view.

- Preserve mobility, be ready to jump away from trouble and seize the opportunities quickly.

- All the moves should be made only after careful assessment of the odds for and odds against. When a venture is clearly souring one must sever those roots and go.

ON INTUITION

- A hunch can be trusted if it can be explained. A hunch is a mental event that feels something like knowledge but doesn't feel perfectly trustworthy.

- One is likely to be hit by hunches frequently. Learn to use them.

- When a hunch hits, ask whether a big enough library of data could exist in mind to have generated that hunch. Never lean on hunches too hard.

ON RELIGION AND THE OCCULT

- It is unlikely that God's plan for the universe includes making one rich. Sometimes occult beliefs can get in the way of sound speculative thinking. Leaning on such beliefs may not be hazardous to health, but it is to money.

ON OPTIMISM AND PESSIMISM

- Optimism means expecting the best, but confidence means knowing how to handle the worst. Never make a move solely on optimism. In poker, if a pro arrives at a situation where the odds say he shouldn’t bet then he doesn’t.

- Optimism feels much better than pessimism. It has a hypnotic allure. That’s why bulls outnumbers bears.

- Optimism leads to the ventures with no exits and when there is an exit, it persuades to not to use it.

ON CONSENSUS

- Majority opinions are probably wrong. One should try to come to his own conclusion.

- Never follow speculative fads. Unseen pressure of the majority can not only dislodge a good hunch but can also create doubts on one’s judgments.

- Various entities like brokers and people giving hot tips can constantly bombard an active speculator to buy whatever the majority is buying.

ON STUBBORNNESS

- One must defeat the emotion of perseverance when it is leading one astray.

- Perseverance is not a good idea for speculators. One must persevere to learn, improve and grow rich.

- Never try to save a bad investment by averaging down. Don’t hold your investments in the spirit of stubbornness.

- Value the freedom to choose investments on their merits alone.

More from The Tycoon Mindset

More from Book

Another thread on Whittle as a companion to this thread.

Here Stephen makes an impassioned plea for the rights of trans people not to be sterilised. I agree. Does Stephen know that we are now, effectively, sterilising “transkids”? Is Stephen speaking out about this?

Yes. I agree you have the right to be parents. You know many “transmen” who have given birth. What will happen to the kids put on #PubertyBlockers followed by Cross-sex hormones?

Makes a clear statement activists did not want to campaign on “surgical status”. #LeaveNoOneBehind. Also that they have the right to bodily privacy,

Just trans folks? Do women have the right to bodily privacy?

Is this what passing looks like? Ignoring women?

Congratulations

An impassioned defence of the campaign for Self-Identification. Make no mistake this was a demand that women accept male-bodied women in single sex spaces. That was significant over-reach and a massive blunder. Women only spaces, regardless of surgery, is my stance now.

So I am in the middle of a document co-authored by Stephen Whittle. I took a little detour to have a look at Whittle on YouTube.

— Patrick\U0001f578 (@STILLTish) December 9, 2020

Here are a few clips. This one surprised me. Whittle recalls being heckled by Butch Lesbians and is asked about their role. pic.twitter.com/OWFd0kNDei

Here Stephen makes an impassioned plea for the rights of trans people not to be sterilised. I agree. Does Stephen know that we are now, effectively, sterilising “transkids”? Is Stephen speaking out about this?

Yes. I agree you have the right to be parents. You know many “transmen” who have given birth. What will happen to the kids put on #PubertyBlockers followed by Cross-sex hormones?

Makes a clear statement activists did not want to campaign on “surgical status”. #LeaveNoOneBehind. Also that they have the right to bodily privacy,

Just trans folks? Do women have the right to bodily privacy?

Is this what passing looks like? Ignoring women?

Congratulations

An impassioned defence of the campaign for Self-Identification. Make no mistake this was a demand that women accept male-bodied women in single sex spaces. That was significant over-reach and a massive blunder. Women only spaces, regardless of surgery, is my stance now.

You May Also Like

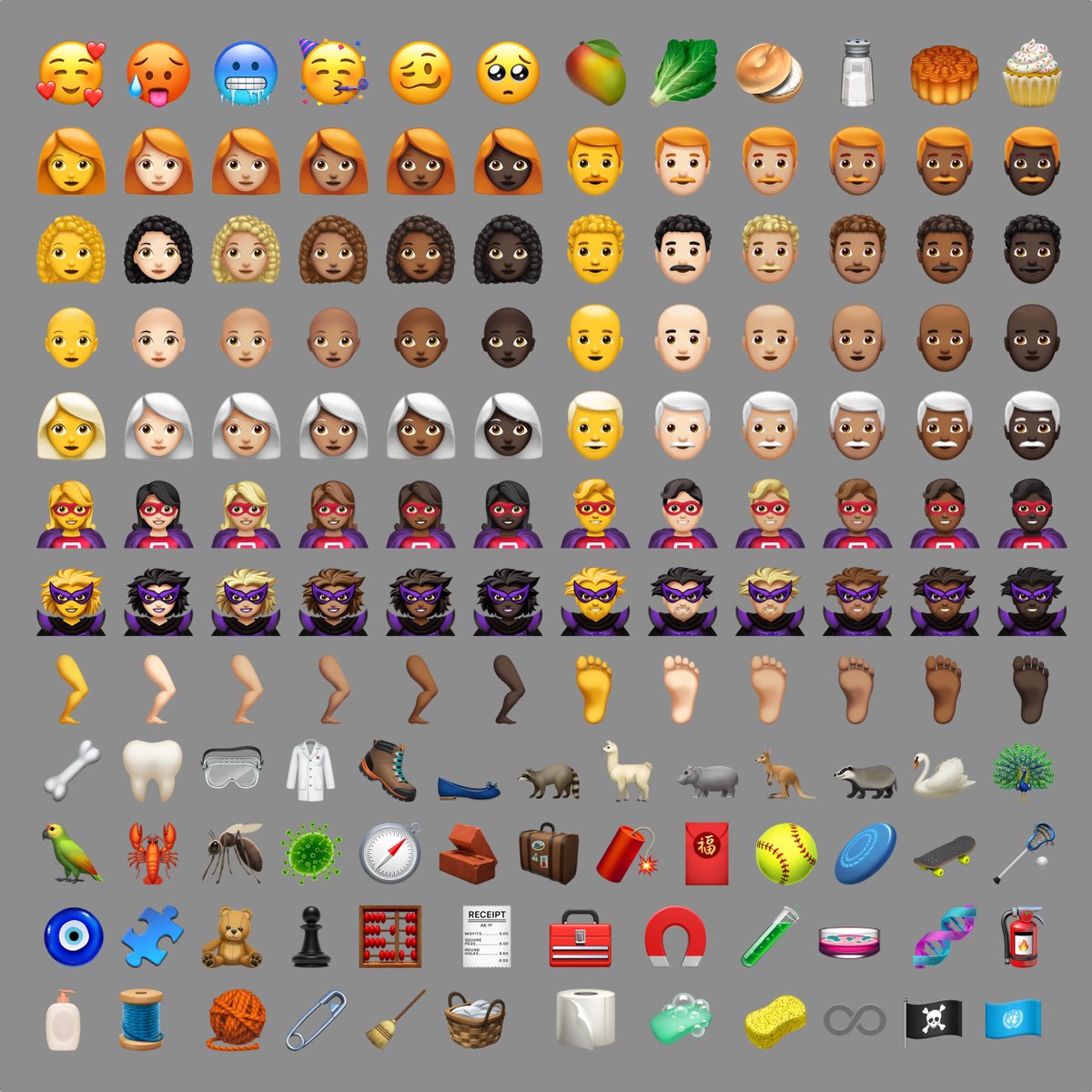

✨📱 iOS 12.1 📱✨

🗓 Release date: October 30, 2018

📝 New Emojis: 158

https://t.co/bx8XjhiCiB

New in iOS 12.1: 🥰 Smiling Face With 3 Hearts https://t.co/6eajdvueip

New in iOS 12.1: 🥵 Hot Face https://t.co/jhTv1elltB

New in iOS 12.1: 🥶 Cold Face https://t.co/EIjyl6yZrF

New in iOS 12.1: 🥳 Partying Face https://t.co/p8FDNEQ3LJ

🗓 Release date: October 30, 2018

📝 New Emojis: 158

https://t.co/bx8XjhiCiB

New in iOS 12.1: 🥰 Smiling Face With 3 Hearts https://t.co/6eajdvueip

New in iOS 12.1: 🥵 Hot Face https://t.co/jhTv1elltB

New in iOS 12.1: 🥶 Cold Face https://t.co/EIjyl6yZrF

New in iOS 12.1: 🥳 Partying Face https://t.co/p8FDNEQ3LJ