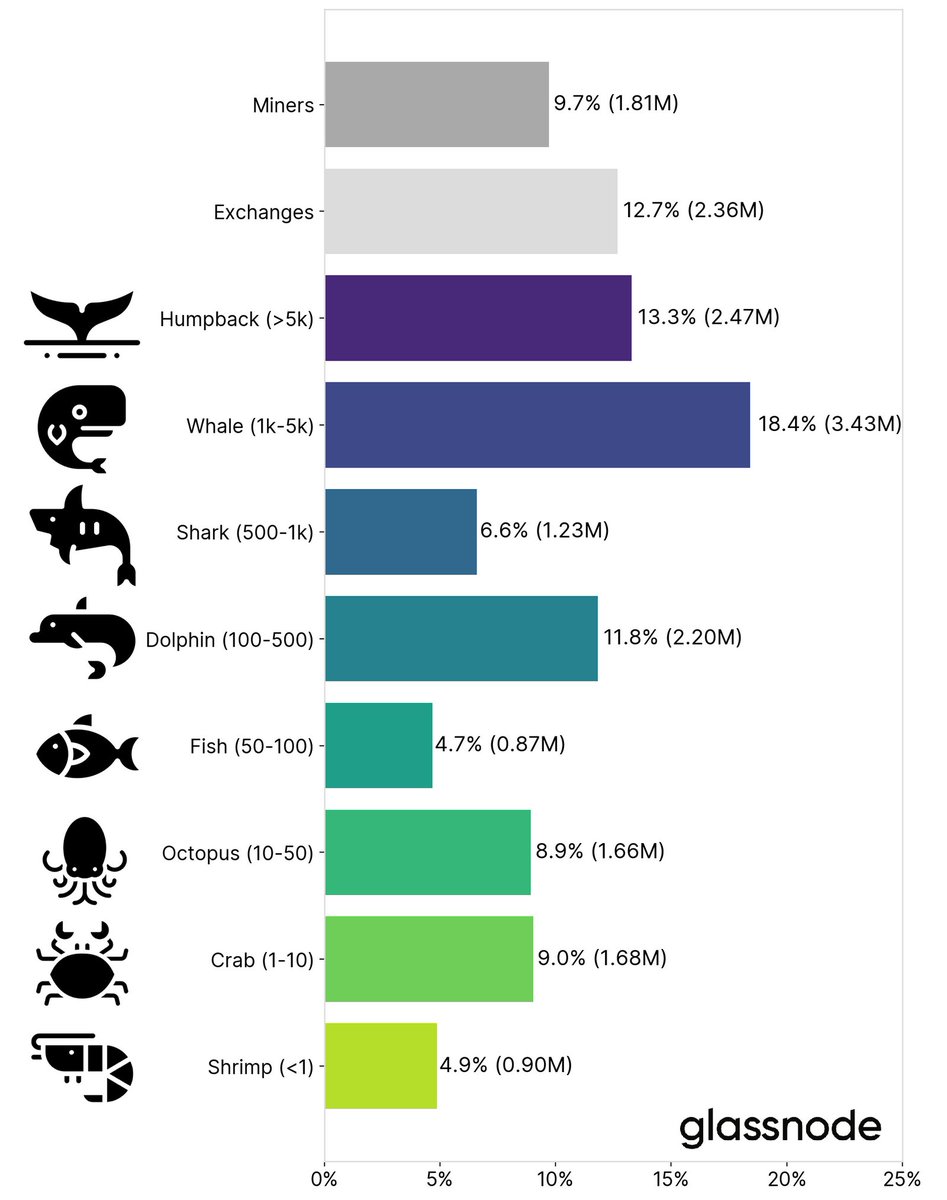

address =/ account.

one person can control multiple addresses.

one address can hold bitcoin belonging to multiple ppl.

exchanges and trading firms will have addresses with large balances that represent client funds.

My $BTC short-term view after long deliberation and some flip flopping is rangebound in 30K-40K until the curve and vols come off a further. Then, 50K. I wouldn't be surprised if 30K is briefly breached but the risk is to the upside. Those calling for 20K missing the big picture.

— Alex (@classicmacro) January 12, 2021

ECB President Christine Lagarde called for global regulation of #Bitcoin, saying the digital currency had been used for money laundering activities in some instances and that any loopholes needed to be closed. Follow #ReutersNext updates here: https://t.co/4MgFy4jnw5 pic.twitter.com/qlBtoDuZLW

— Reuters (@Reuters) January 13, 2021