Simple rules : friday,monday, tuesday do for weekly. Wednesday and thrusday next week

Read this. U may get it for free.

Short straddle :

What is ?? Sell an atm call and put.

Instrument: mostly bnf and nf.

Now there are versions of it.

1. Best version :

Enter around 9.15-20 and exit around 3.20. No adjustment nothing.

1/n.

Simple rules : friday,monday, tuesday do for weekly. Wednesday and thrusday next week

Another better version of mahesh chander kaushik is to do it for monthly expiry.

Bigger premiums and never hav to worry about 200-300 points sudden moves.

2. 2nd version : have combined stoploss of premiums and re-entry criteria. Example :

Let say, in morning,

3rd version : stoplosses at each leg and trail sl to cost type.

Example , 40000 straddle at 400.

This strategy is good when one side trend happens. But, will not work in choppy mkt.

Instead of doing all qty at 9.20, one can do at every hour or every 2 hour. Or may be at every 10 mins.

I hav seen someone selling version 3 algo for every 10 mins.

Let say u sold 40000 call put jodi at 400. And 200 each for call nd put. Now mkt went up and call became 300. Now, u will book call at 300 and will sell 2 lots of call of let say 40400 strike at 150. So, U matched premiums and do adjustments

Requires high margin and if one side move came, u may lose big. On other choppy day, this will make money.

6th version : ekdum copy to 5th version. Here, instead of matching premium, u need to match delta of call nd puts.

Requires understanding of greeks

Requires no sl no tgt.

Whenever mkt moves, u move the straddle.

Example : U sold straddle at 400 at 9.20 am strike 40000.

If mkt move to 40200, shift whole straddle to 40200 and do it for whole day. Eventually theta will come.

Sometimes, monthly far otms too. That too reduce margins.

Another missed point.

Wait n trade straddle :

More from All

You May Also Like

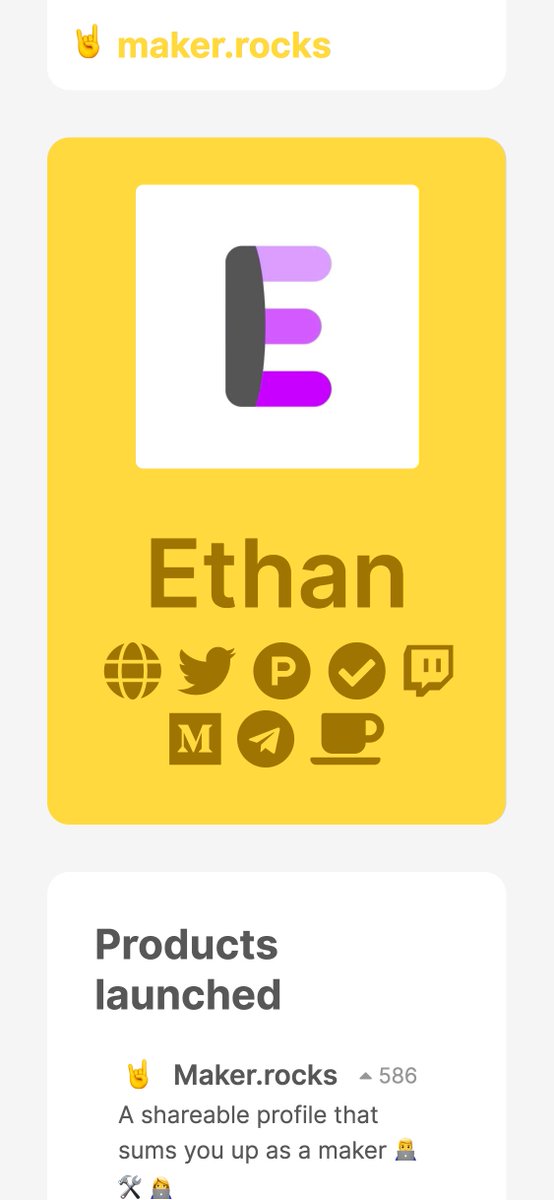

First update to https://t.co/lDdqjtKTZL since the challenge ended – Medium links!! Go add your Medium profile now 👀📝 (thanks @diannamallen for the suggestion 😁)

Just added Telegram links to https://t.co/lDdqjtKTZL too! Now you can provide a nice easy way for people to message you :)

Less than 1 hour since I started adding stuff to https://t.co/lDdqjtKTZL again, and profile pages are now responsive!!! 🥳 Check it out -> https://t.co/fVkEL4fu0L

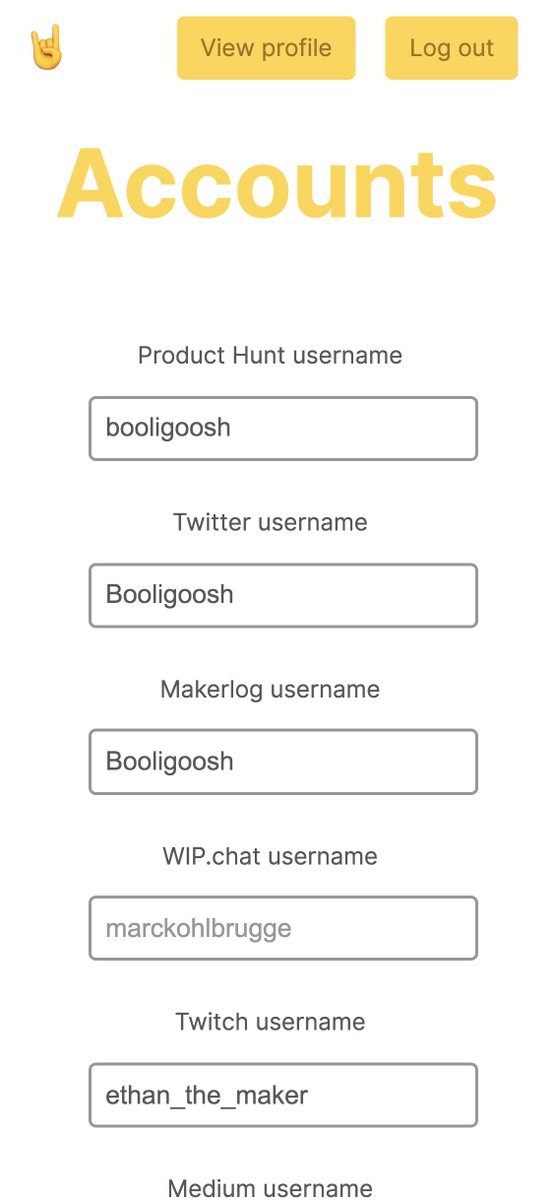

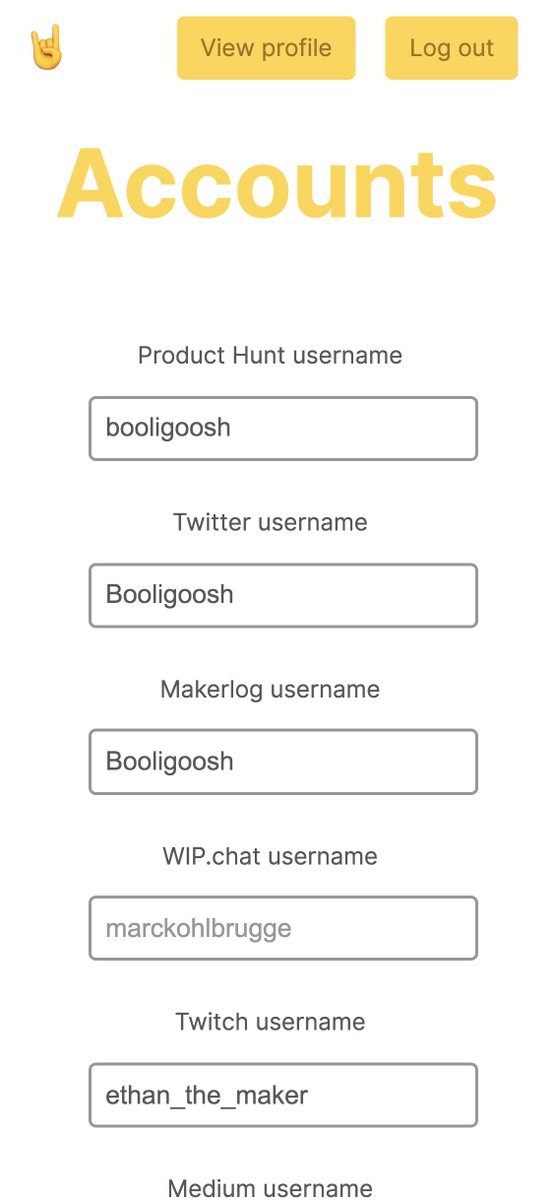

Accounts page is now also responsive!! 📱✨

💪 I managed to make the whole site responsive in about an hour. On my roadmap I had it down as 4-5 hours!!! 🤘🤠🤘

Just added Telegram links to https://t.co/lDdqjtKTZL too! Now you can provide a nice easy way for people to message you :)

Less than 1 hour since I started adding stuff to https://t.co/lDdqjtKTZL again, and profile pages are now responsive!!! 🥳 Check it out -> https://t.co/fVkEL4fu0L

Accounts page is now also responsive!! 📱✨

💪 I managed to make the whole site responsive in about an hour. On my roadmap I had it down as 4-5 hours!!! 🤘🤠🤘