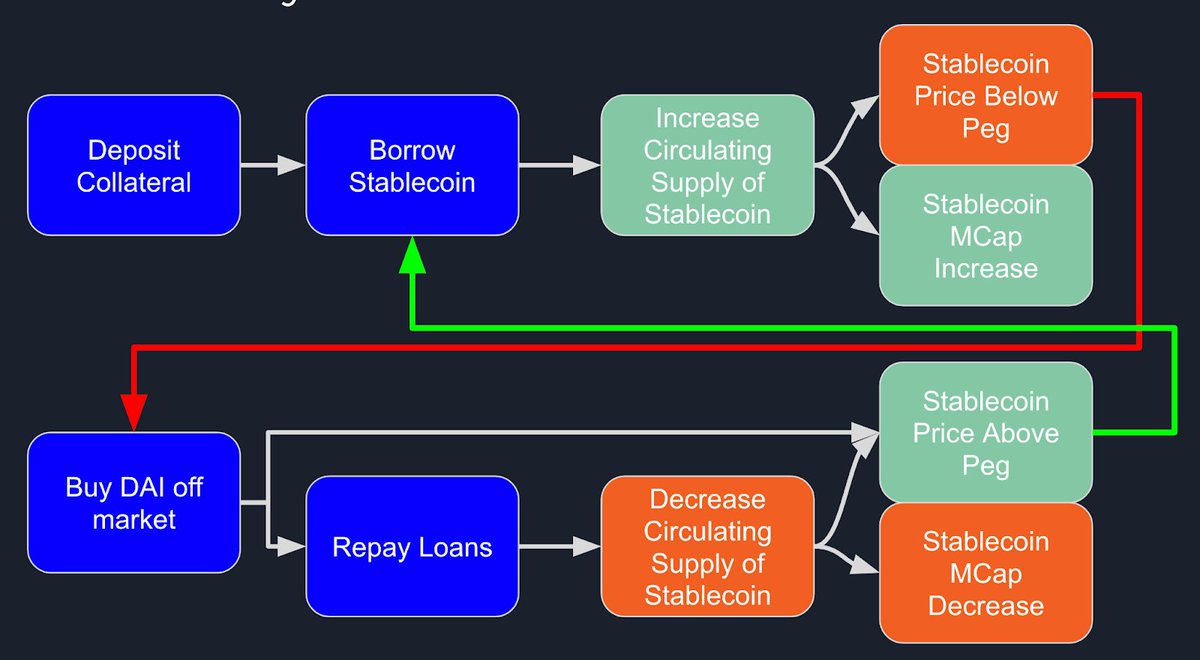

As a stablecoin backed by collateralized debt positions, the outstanding loans within DAI’s economy play an important role with regard to DAI’s ability to maintain its peg.

Why $ust's peg has everything to do with @CurveFinance's #3pool

A thread on $ust's collapse with @dicksonlai_ @GabrielGFoo @themlpx 🧵

@TheSpartanGroup @nansen_ai

#luna

As a stablecoin backed by collateralized debt positions, the outstanding loans within DAI’s economy play an important role with regard to DAI’s ability to maintain its peg.

As a result, this increases DAI’s circulating supply, bringing DAI back to peg.

Vice versa.

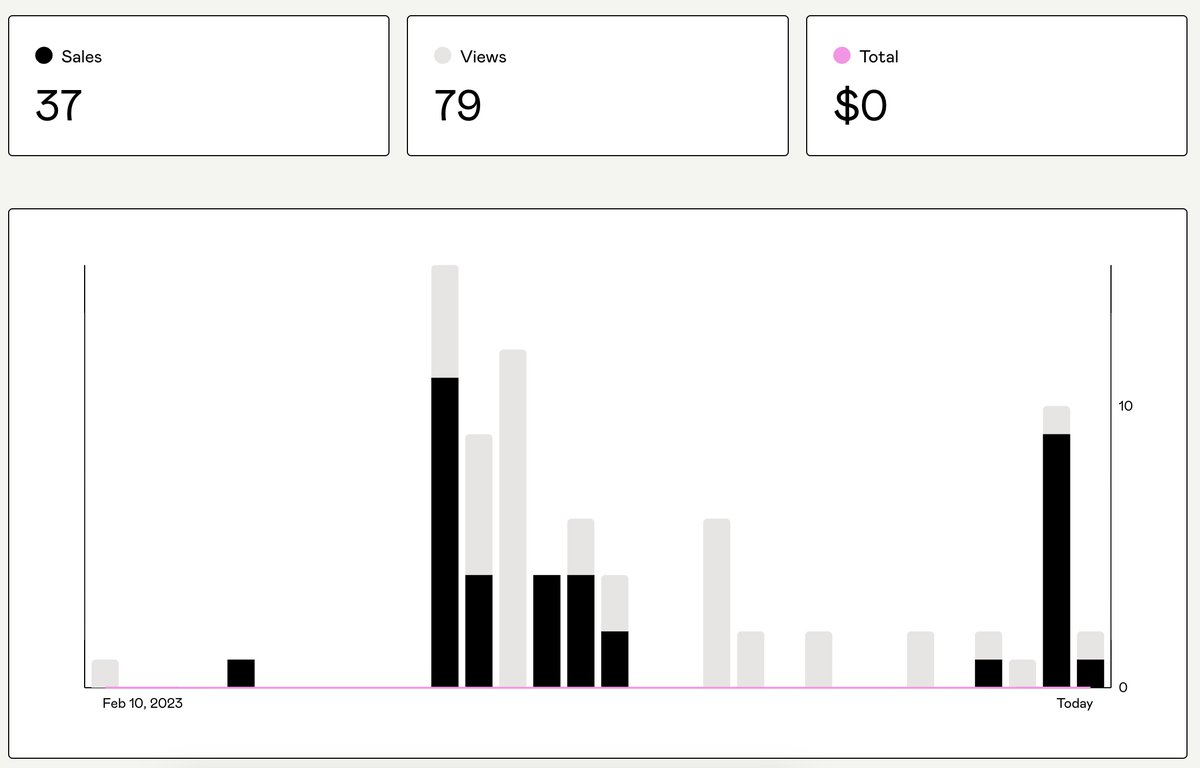

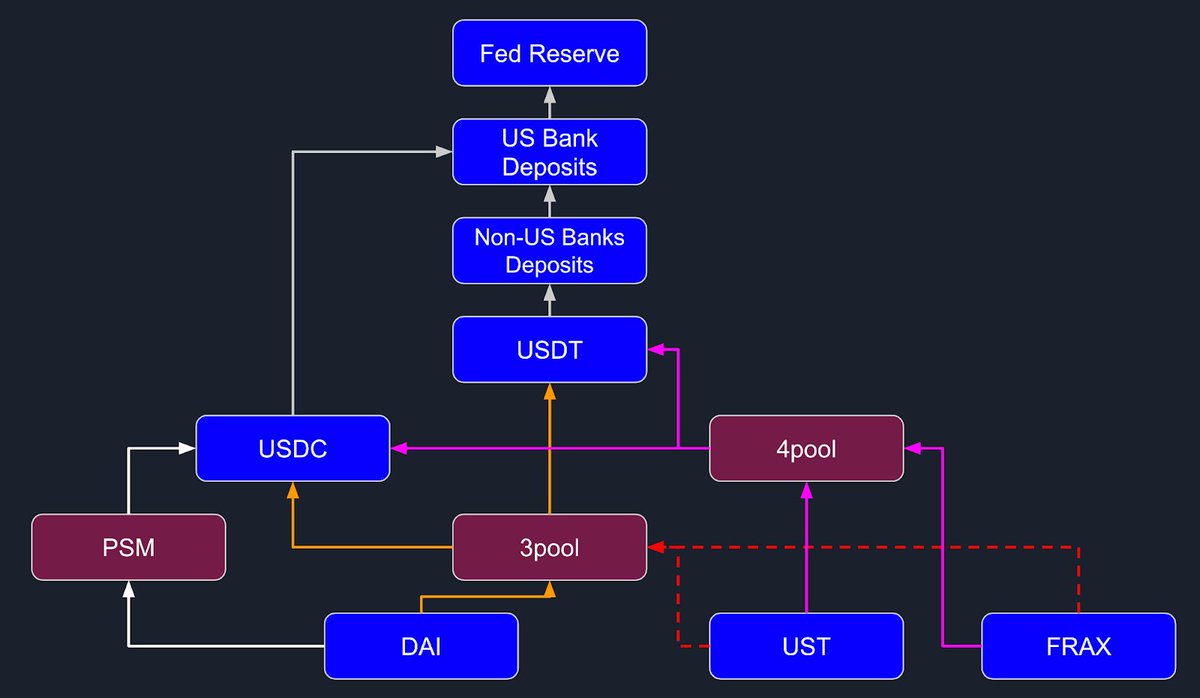

Diagram by @dicksonlai_:

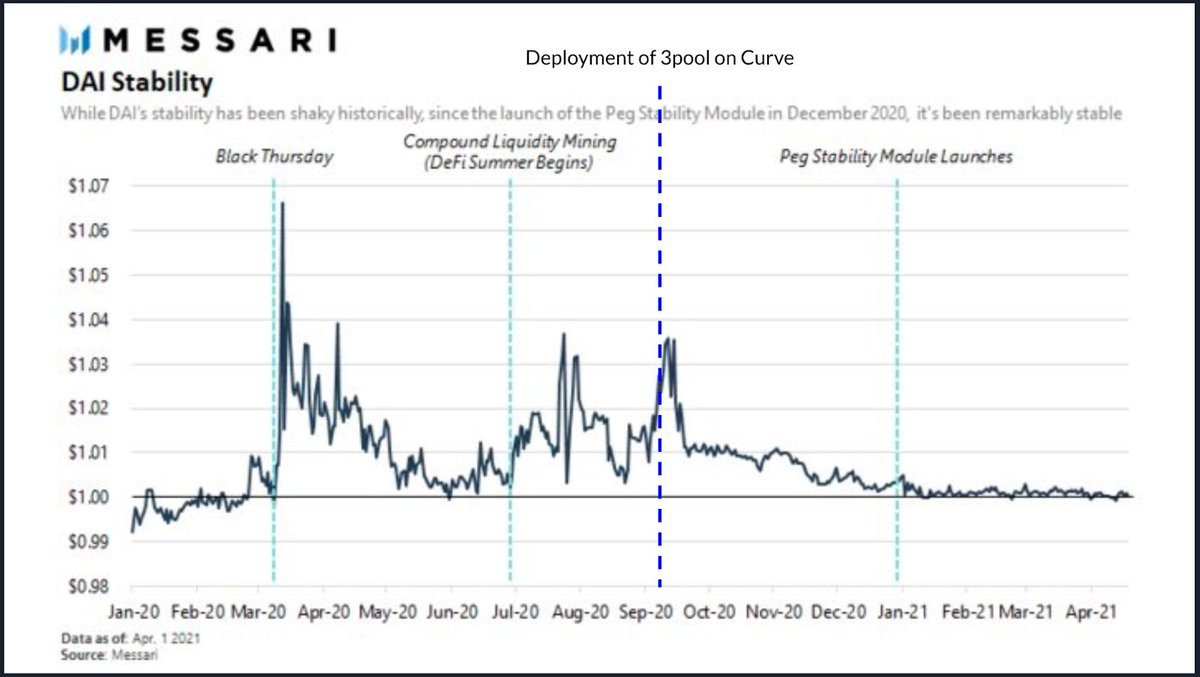

It was only after the deployment of the 3pool that we could start to see the volatility of DAI being managed more effectively.

The improvement was significant; DAI was able to consistently maintain its peg within a much tighter margin of deviation.

This is logical, for the deep liquidity that DAI enjoys with USDT and USDC via the 3pool definitely helps

In essence, DAI is directly pegging themselves to USDC and USDT via the 3pool

$frax and $ust are amongst 2 of the largest contributors of TVL to the 3pool, and both have pushed out significant bribes to incentivize deep liquidity in it.

The 3pool must count for something wrt their abilities to keep peg

me and @dicksonlai_ were never able to prove it, until today.

here's a non-exhaustive list by @Defi_Maestro:

- 3pool liquidity dip

- Anchor rates drop

- Usdd 30% yield

- Ust futures from ftx

- Lack of automation for LFG peg protection

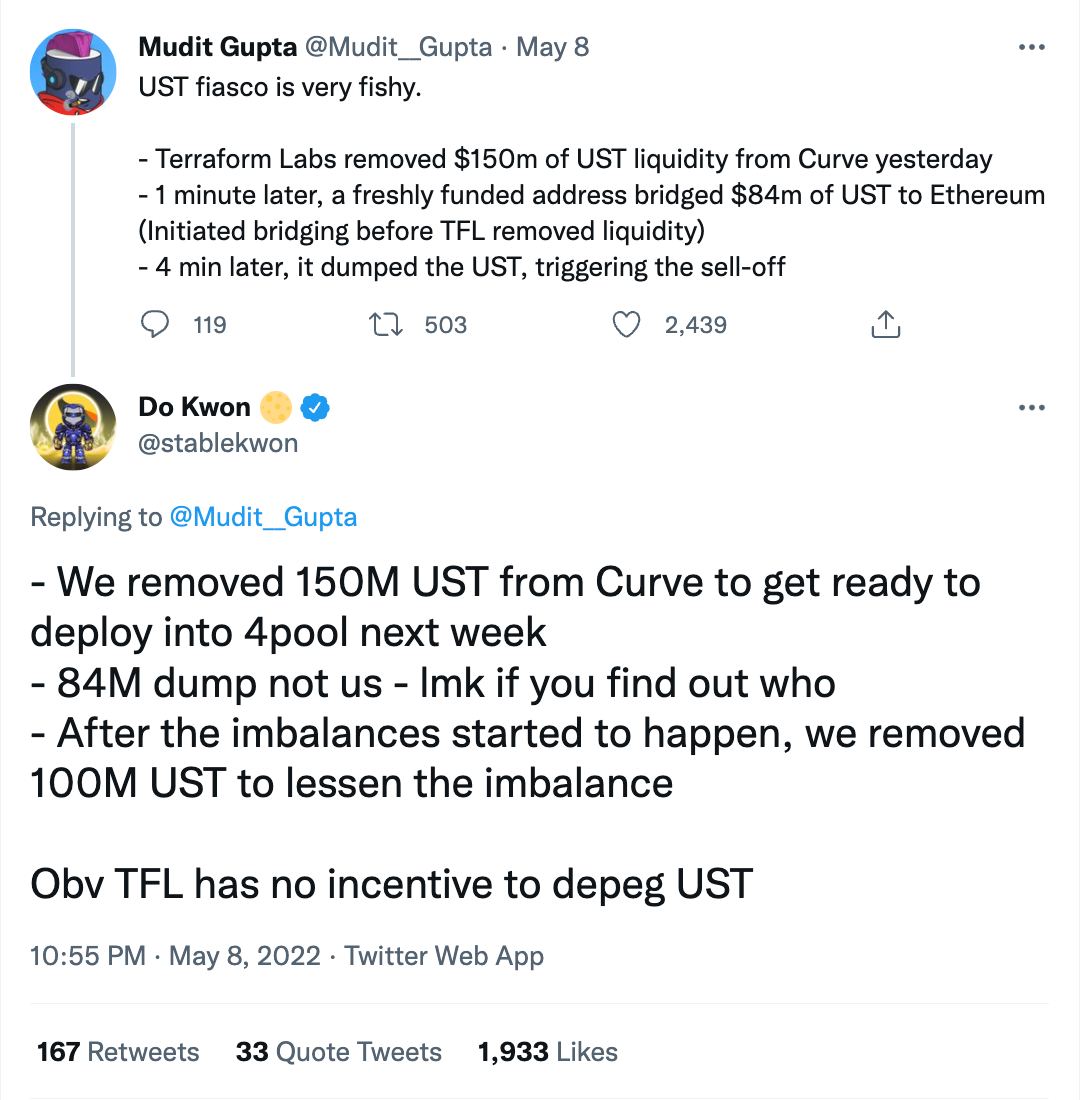

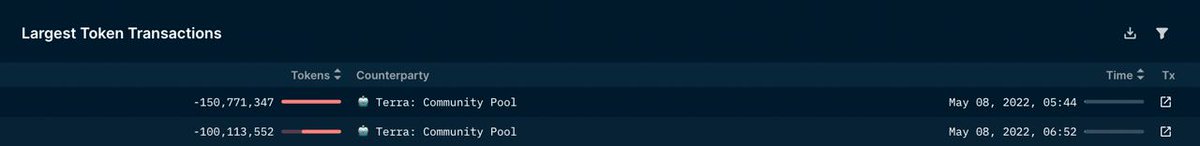

By some horrible luck, just as @stablekwon and #TFL were withdrawing 150m worth of $ust from the 3pool to prep for the 4pool, 84m of ust was bridged to eth by the attacker

150 + 100 = 500m worth of LP from the 3pool, which is a staggering ~40% of their 3pool holdings, a v significant sum.

here's a thread by @4484 on what happened next: https://t.co/WU8aDDsSu4

ok here is how the $luna $ust attack was coordinated & executed. \U0001f9f5 (quoted from a friend)

— 4484 (@4484) May 10, 2022

- attacker OTC accumulated $1bn of UST

- borrowed $3bn in $btc

- spread around some fud about peg and bank runs

- dumped the fuck out of their $3bn $btc on market to trigger wider panic

And strike he did; the rest is history.

What can we learn from this?

the fact that this saga has proved me and @dicksonlai_'s hypothesis 2 reinforces that