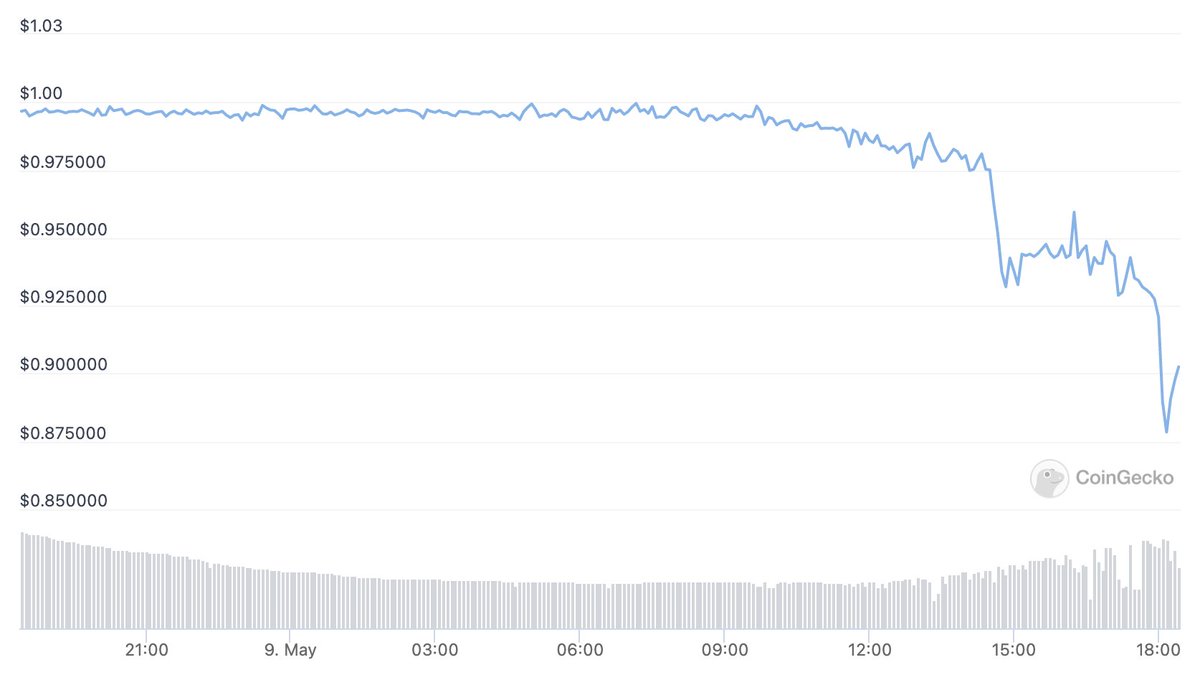

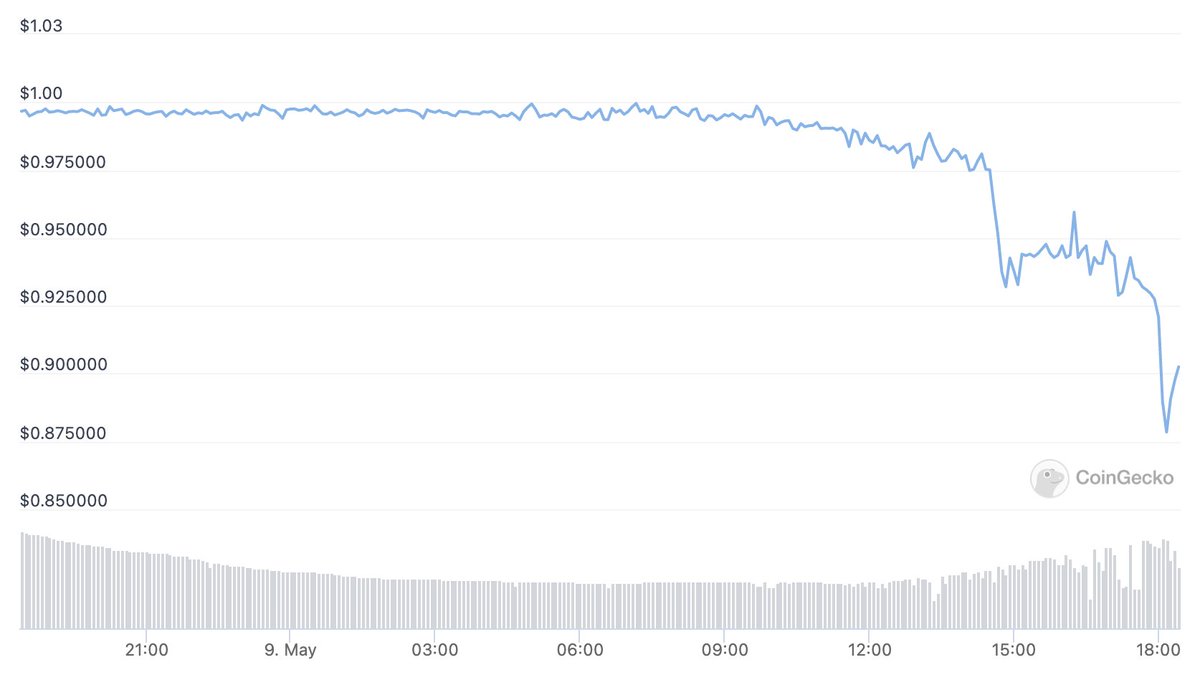

An $18 billion stablecoin is losing its dollar peg with all the magical chaos of algorithmic stables, with a dash of Bitcoin systemic risk drama.

Here's everything you need to know.

The $UST Depeg Thread:

👇

You can always redeem $LUNA for $UST dollar-for-dollar, and vice versa.

If $LUNA is at $50, you can redeem it for 50 $UST.

Similarly you can redeem 50 $UST for 1 $LUNA.

https://t.co/DAGmnXrdM4

A thread about all the opportunities in the Terra $LUNA ecosystem:

— Route 2 FI (@Route2FI) January 7, 2022

In this thread, I'll focus on the nr. 2 biggest ecosystem in terms of TVL in DeFi ($16.8b).

There are plenty of opportunities in crypto to earn yield.

Let's look at how you can make it with Terra $LUNA

/THREAD pic.twitter.com/SKmEY3cBOT

It's meant to be a stabilizing mechanism:

If $UST is trading at $0.99, arbitrageurs can buy it and redeem it for $1 of $LUNA.

So where does $UST get utility?

Simple, Anchor Protocol.

Anchor Protocol is (nominally) a money market, but the important tl;dr is it pays you 19.5% to stake $UST.

Right now, it's only ~40%, but it's been as high as 70%+ historically.

So, why hold $UST?

Easy: because they're paying you 20% per year to hold it.

1) if something is paying you 20% risk-free, why not just borrow a ton of money and make it pay you like, 100%+?

Oh uhm, that's exactly what Abracadabra / $MIM's degenbox did:

https://t.co/2MUoAvjFiI

Our $UST Strategy! The first application of the magic potentialities of Degenbox by Abracadabra Money https://t.co/xCWIh8JYwj

— Jason Wang \U0001f316 (@jwang815) November 3, 2021

Sound kinda familiar?

Something something history may not repeat itself but it can rhyme.

Well that's also easy, the LFG (Luna Foundation Guard), overseers of Terra's multi-billion dollar ecosystem fund.

We'll come back to that.

I'm not going to focus on what drives its fundamental value and focus instead narrative:

~Every $UST in circulation reduces the circulation of $LUNA~

The win scenario is every single $LUNA on earth gets burned for $UST.

The more $UST, the less $LUNA.

Holders should want to diamond-hands $LUNA:

If there's unstoppable demand for $UST and you're the last $LUNA holder on earth, you have immense redemption power.

It's right on their site:

https://t.co/afSOcN3aJs

It doesn't matter what the total implied value of $LUNA is.

What matters is the marginal value of each $LUNA that is redeemed for $UST, or vice versa, aka $LUNA's price.

https://t.co/29oAXB98s5

is there a problem if UST mcap is larger than LUNA mcap https://t.co/24z3kPMpNv

— \ucc0c G \u8dfb \u3058 Goblin King of the scam bots (@DegenSpartan) May 9, 2022

It's a Big Motherfucking Problem if the average redemption price of $LUNA for $UST is high relative to $LUNA's current price.

- $LUNA price high

- $LUNA burned, many $UST minted

- $LUNA's price fall

- $UST redeemed for many $LUNA

👉 That is bad mmkay?

Say the price of $LUNA is $1 billion.

Then someone could mint 1 billion $UST by burning a single $LUNA.

Then let's say the price of $LUNA falls to $1 for no good reason.

That person could redeem their UST for 1 billion $LUNA.

This is--in essence--what's happening today.

$UST has the same dynamics as many other algo-stables, except in addition to the "algo" part they also have LFG.

In other words, UST is stabilized by:

1) Contracts.

2) The gigantic gravity well created by the size of Do Kwon's nuts.

Take treasury $LUNA, sell it, and fill up the Anchor Protocol Reserve (the big slush fund that pays $UST stakers 20%).

Every other L1 eco fund does shit like this, just less directly.

Don't @ me.

- $UST burned for staking

- $LUNA price goes up

- Sell more $LUNA to fund the Protocol Reserve

And, longer term:

- $UST takes off as a widely-used stable before LFG runs out of money

- $LUNA goes to the moon

- Everyone happy

Hence this tweet:

https://t.co/kQ9oEN7xd2

Don\u2019t wanna get another DM about the @anchor_protocol yield reserve. What do you want?

— Do Kwon \U0001f315 (@stablekwon) January 25, 2022

That implosion took down a big push for $UST to be used in a 10-figure cross-chain ecosystem headed by Daniele Sesta.

That's when Jump, 3AC, and others piled into the $1 billion Luna OTC deal to buy Bitcoin.

1) Get the Bitcoin gang on board (every cycle needs one crazy billionaire to go hard for the King)

2) Give redemptions a $UST -> $BTC offramp in addition to the existing $UST -> $LUNA one.

https://t.co/hCI9I60TXt

Today LFG announced they have raised $1 billion dollars to form $BTC reserve for Terra's $UST, lead by Jump Crypto and Three Arrows Capital.

— Westie \U0001f316 \U0001f7ea (@WestieCapital) February 22, 2022

Here I explain why this deal is extremely important for Terra's stability, $LUNA's value capture, and future developments of LFG \U0001f9f5

https://t.co/HJrfVj3PCj

today's attack on Terra-Luna-UST was deliberate and coordinated. Massive 285m UST dump on Curve and Binance by a single player followed by massive shorts on Luna and hundreds of twitter posts. Pure staging. The project is bothering someone. \U0001f31d on the right path!

— Caetano Manfrini \U0001f53a\U0001f316 (@CaetanoManfrini) May 8, 2022

- $UST unstaked and dumped

- $UST depegs due to downward pressure

- $UST holders redeem for $1 of $LUNA

- Dump $LUNA

What complicates things is all the Bitcoin in the treasury.

Remember the $1 billion OTC news?

That triggered a massive run-up in $LUNA, which allowed for tons of high-basis $UST minting.

Simultaneously, the LFG DCA'd into Bitcoin at an average price north of $40K.

Any redemptions of $UST -> $BTC now will essentially be booked losses for LFG, when they could have just sat on stables instead.

As of this morning, commit $1.5B to defending the $UST peg, collateralized against Bitcoin reserves:

https://t.co/Fc5Nt6VaZn

4/ As a result, the LFG Council has voted to execute the following:

— LFG | Luna Foundation Guard (@LFG_org) May 9, 2022

- Loan $750M worth of BTC to OTC trading firms to help protect the UST peg.

- Loan 750M UST to accumulate BTC as market conditions normalize.

The deeper the liquidity the harder it is for any one actor to "dig out" and move the price (even further) away from $1:

https://t.co/IQ9MO8Ck2Q

The other way to visualize this is like a ravine or canyon surrounding the market-clearing price.

— jonwu.eth (@jonwu_) May 14, 2021

The steeper the walls, the more market depth and liquidity around the spot price & the harder it is for market orders to "dig out" and move price. pic.twitter.com/d5tNhgT4Qp

That's why Jump Capital and 3AC are involved (they were part of the consortium that bought $1 billion of Luna OTC in February).

They're deep-pocketed, sophisticated traders willing to do whatever it takes to prevent a $UST death-spiral.

Friendly marketmakers go to work on deploying a piece of the $BTC treasury to market-buy $UST and keep the peg up.

Hope is there's more (falling-knife) $BTC collateral in LFG than there is bank-run pressure from people fudding $UST.

1) The treasury gets drained, but $UST stabilizes.

For now, $BTC seems to have stopped dumping on liquidations and liquidation fears.

There's a win where:

✅ $BTC gets pressured to $30K

✅ $UST peg restores

✅ LFG buys back into $BTC at lower basis

Profit!

Better yet, $BTC somehow moons and we get a @feiprotocol situation where despite a difficult situation, the underlying collateral goes up in value and the protocol ends up fully collateralized.

2) Do Kwon and the LFG cease their $UST defense, annihilating Luna holders and allowing the $UST to settle at collateral value

https://t.co/eVzWMvQNaL

In this situation, you have to sacrifice either LUNA or UST holders. As a stablecoin issuer, the moral choice should be easy. Defend UST by holding the treasury, even if it means LUNA going to zero

— Hasu\u26a1\ufe0f\U0001f916 (@hasufl) May 9, 2022

More from All

Starts the night before.

9 evening habits that make all the difference:

1. Write down tomorrow's 3:3:3 plan

• 3 hours on your most important project

• 3 shorter tasks

• 3 maintenance activities

Defining a "productive day" is crucial.

Or else you'll never be at peace (even with excellent output).

Learn more

How to be 5x more productive.

— Ben Meer (@SystemSunday) August 1, 2022

A best-selling author\u2019s 3-3-3 Method:

2. End the workday with a shutdown ritual

Create a short shutdown ritual (hat-tip to Cal Newport). Close your laptop, plug in the charger, spend 2 minutes tidying your desk. Then say, "shutdown."

Separating your life and work is key.

3. Journal 1 beautiful life moment

Delicious tacos, presentation you crushed, a moment of inner peace. Write it down.

Gratitude programs a mindset of abundance.

4. Lay out clothes

Get exercise clothes ready for tomorrow. Upon waking up, jump rope for 2 mins. It will activate your mind + body.

You May Also Like

He has been wrong (or lying) so often that it will be nearly impossible for me to track every grift, lie, deceit, manipulation he has pulled. I will use...

... other sources who have been trying to shine on light on this grifter (as I have tried to do, time and again:

Ivor Cummins BE (Chem) is a former R&D Manager at HP (sourcre: https://t.co/Wbf5scf7gn), turned Content Creator/Podcast Host/YouTube personality. (Call it what you will.)

— Steve (@braidedmanga) November 17, 2020

Example #1: "Still not seeing Sweden signal versus Denmark really"... There it was (Images attached).

19 to 80 is an over 300% difference.

Tweet: https://t.co/36FnYnsRT9

Example #2 - "Yes, I'm comparing the Noridcs / No, you cannot compare the Nordics."

I wonder why...

Tweets: https://t.co/XLfoX4rpck / https://t.co/vjE1ctLU5x

Example #3 - "I'm only looking at what makes the data fit in my favour" a.k.a moving the goalposts.

Tweets: https://t.co/vcDpTu3qyj / https://t.co/CA3N6hC2Lq

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu