Thread About of My Trading Journey #3years

I placed my 1st intraday Trade on 12-03-2020 it was ITC trade😀 it was random trading as newbie news based, Calls based trades. I was not aware about trading system, Risk management nothing and I lost 64 K in 1st month on 1 Lac Capital.

More from All

Best 5 public APIs you can use to build your next project:

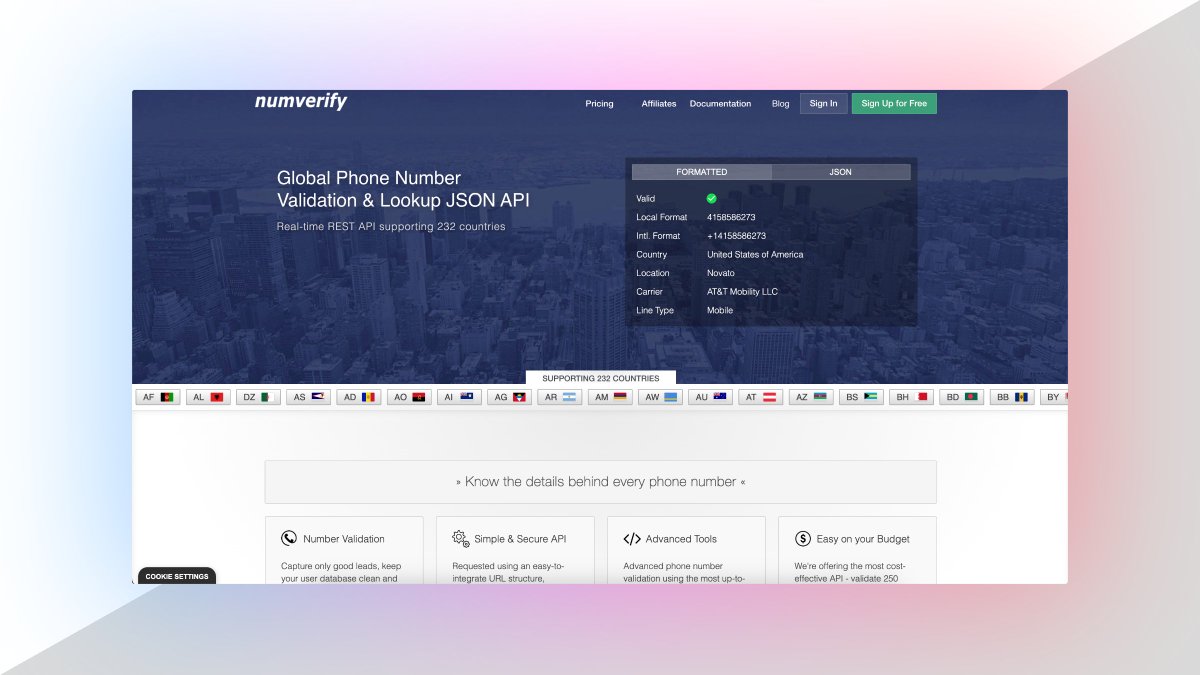

1. Number Verification API

A RESTful JSON API for national and international phone number validation.

🔗 https://t.co/fzBmCMFdIj

2. OpenAI API

ChatGPT is an outstanding tool. Build your own API applications with OpenAI API.

🔗 https://t.co/TVnTciMpML

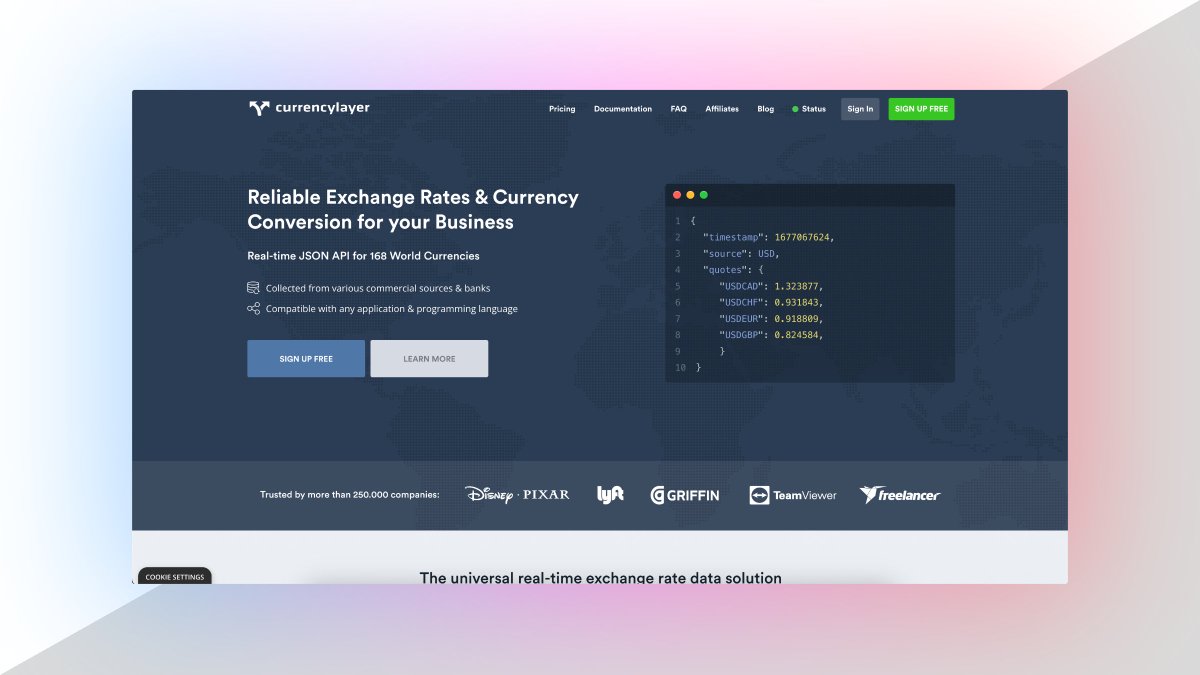

3. Currency Data API

Currency Data API provides a simple REST API with real-time and historical exchange rates for 168 world currencies

🔗 https://t.co/TRj35IUUec

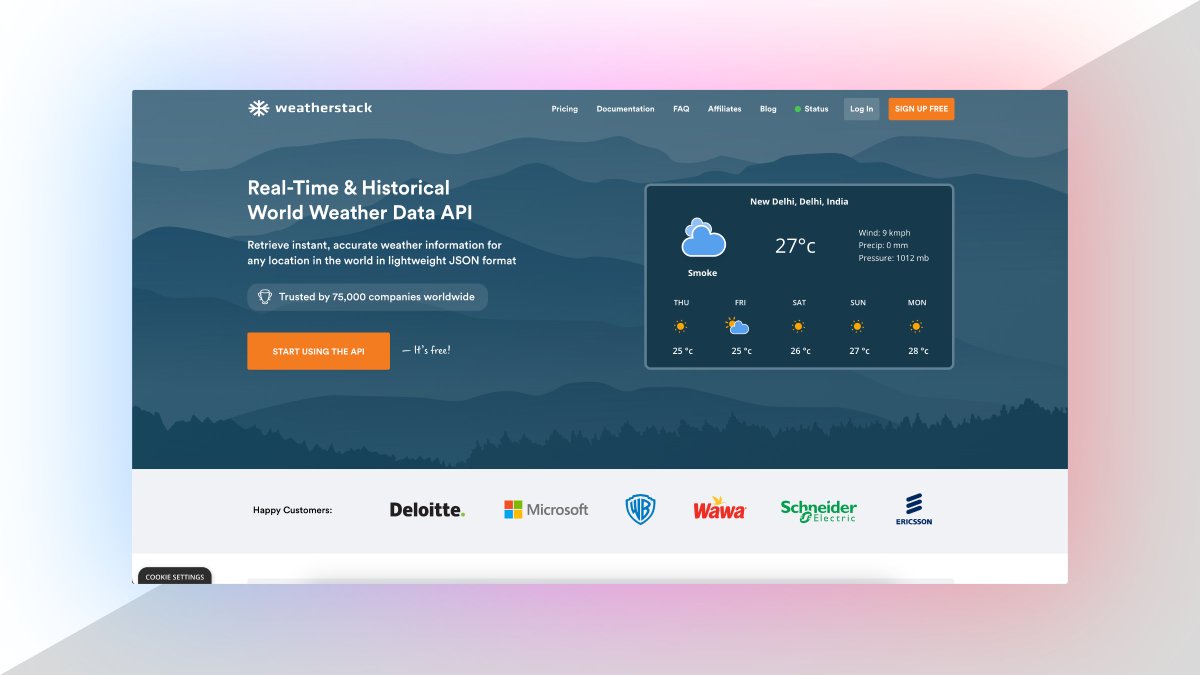

4. Weather API

Real-Time & historical world weather data API.

Retrieve instant, accurate weather information for

any location in the world in lightweight JSON format.

🔗 https://t.co/DCY8kXqVIK

You May Also Like

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0