The Ultimate List of Trading Mistakes I have committed.

A long thread. Read on.

Which mistakes have you committed?

a few examples

a) Change in lot size

b) Not knowing the margin

c) Not knowing how Options settle

Sounds Familiar?

One should be prepared for unknown events, like having 2 internet lines, 2 laptops, 2 brokers, etc

Remember

PNB Scam

Air Strike

A big leader dying

Anything can happen, that's why keep stop-loss in the system.

Remember Nirmala Sitaraman Candle, I was not watching the news but luckily @yogeeswarpal called me and told me abt the news. Else I would have missed the rally. The inverse can also happen.

Some say trading begins post-market and ends before the market opens.

It's all about the preparation for the next day, analysis of today's trades, even small things like preparing watchlist upfront matters.

This is what kills most traders, during their good run they are not willing to listen to anyone.

I kept 3-4 points SL in Nifty and 20 points in Bn, Market was smart enough to take all my SL. Should have placed SL based on proper exits.

10% a month = 0.5% a day. I kept daily targets, when not met, felt unhappy. Shifted to weekly and monthly targets.

Finding a systems R:R and win/loss ratio can help a lot, but i ignored it intially. When you are bad at basic maths, more likely to fail.

I found a quick fix to console myself, Whenever I had a loss I blamed the market, operators for SL hunting, taking my stop loss. A big mistake.

I too fell in the trap of pundits on tv who were forecasting nifty/Sensex on daily basis just like an astrologer forecasted my future when I was born, got married, and other times.

Getting bored and firing trades. Once I was in a hospital and was getting bored, started trading. Suddenly the doctor called, by the time doctor gave me his bill, the market also gave me a huge bill. Always trade from your proper work setup.

I would have bought a car if today i would have avoided this loss or if I can get x amt I can go to Antarctica. Dreaming with virtual profit

This video will help in understanding my situation.

https://t.co/Z6DvBcDvw1

Trading in Correlated strategies and expecting different outcomes.

A simple example is if the market is down by 2%, most of your scripts will be down, That's correlation.

Almost everyone i know has done this mistake once. When you buy a script and it goes down you add more to the average. Nahin Karne ka.

Selling winners first and holding losers is another mistake i did a lot

More from Jitendra Jain

Resolved!

Here is what i did

a) Filed a complaint on phone got a complaint number.

b) Used Twitter to amplify the reach

c) Found C level executives and emailed them, One of C level executives emailed support and asked them to look into it urgently.

d) resolved. https://t.co/arCfnRBhBf

Here is what i did

a) Filed a complaint on phone got a complaint number.

b) Used Twitter to amplify the reach

c) Found C level executives and emailed them, One of C level executives emailed support and asked them to look into it urgently.

d) resolved. https://t.co/arCfnRBhBf

Kal hi mail kiya aur. https://t.co/8kyZhkxz2n pic.twitter.com/xFfo7i23z4

— Jitendra Jain (@jitendrajain) March 15, 2022

Download: The Simple Guide to VWAP.

A Simple 8 pager guide!

Retweet to get the guide in DM

Learn

What is VWAP

How to use Vwap for trading.

VWAP Patters.

How to use VWAP on Options Chart

How to use Vwap on Straddle Chart

Retweet and i will send you link in DM

@yogeshnanda1

Here is pdf in case someone doesn't want to Retweet

The Simple Guide to Volume Weighted Average Price

Click here to download :

https://t.co/3Plrm2duyY

Share with friends if you like it.

Retweet

A Simple 8 pager guide!

Retweet to get the guide in DM

Learn

What is VWAP

How to use Vwap for trading.

VWAP Patters.

How to use VWAP on Options Chart

How to use Vwap on Straddle Chart

Retweet and i will send you link in DM

@yogeshnanda1

Here is pdf in case someone doesn't want to Retweet

The Simple Guide to Volume Weighted Average Price

Click here to download :

https://t.co/3Plrm2duyY

Share with friends if you like it.

Retweet

More from All

Ivor Cummins has been wrong (or lying) almost entirely throughout this pandemic and got paid handsomly for it.

He has been wrong (or lying) so often that it will be nearly impossible for me to track every grift, lie, deceit, manipulation he has pulled. I will use...

... other sources who have been trying to shine on light on this grifter (as I have tried to do, time and again:

Example #1: "Still not seeing Sweden signal versus Denmark really"... There it was (Images attached).

19 to 80 is an over 300% difference.

Tweet: https://t.co/36FnYnsRT9

Example #2 - "Yes, I'm comparing the Noridcs / No, you cannot compare the Nordics."

I wonder why...

Tweets: https://t.co/XLfoX4rpck / https://t.co/vjE1ctLU5x

Example #3 - "I'm only looking at what makes the data fit in my favour" a.k.a moving the goalposts.

Tweets: https://t.co/vcDpTu3qyj / https://t.co/CA3N6hC2Lq

He has been wrong (or lying) so often that it will be nearly impossible for me to track every grift, lie, deceit, manipulation he has pulled. I will use...

... other sources who have been trying to shine on light on this grifter (as I have tried to do, time and again:

Ivor Cummins BE (Chem) is a former R&D Manager at HP (sourcre: https://t.co/Wbf5scf7gn), turned Content Creator/Podcast Host/YouTube personality. (Call it what you will.)

— Steve (@braidedmanga) November 17, 2020

Example #1: "Still not seeing Sweden signal versus Denmark really"... There it was (Images attached).

19 to 80 is an over 300% difference.

Tweet: https://t.co/36FnYnsRT9

Example #2 - "Yes, I'm comparing the Noridcs / No, you cannot compare the Nordics."

I wonder why...

Tweets: https://t.co/XLfoX4rpck / https://t.co/vjE1ctLU5x

Example #3 - "I'm only looking at what makes the data fit in my favour" a.k.a moving the goalposts.

Tweets: https://t.co/vcDpTu3qyj / https://t.co/CA3N6hC2Lq

You May Also Like

I'm going to do two history threads on Ethiopia, one on its ancient history, one on its modern story (1800 to today). 🇪🇹

I'll begin with the ancient history ... and it goes way back. Because modern humans - and before that, the ancestors of humans - almost certainly originated in Ethiopia. 🇪🇹 (sub-thread):

The first likely historical reference to Ethiopia is ancient Egyptian records of trade expeditions to the "Land of Punt" in search of gold, ebony, ivory, incense, and wild animals, starting in c 2500 BC 🇪🇹

Ethiopians themselves believe that the Queen of Sheba, who visited Israel's King Solomon in the Bible (c 950 BC), came from Ethiopia (not Yemen, as others believe). Here she is meeting Solomon in a stain-glassed window in Addis Ababa's Holy Trinity Church. 🇪🇹

References to the Queen of Sheba are everywhere in Ethiopia. The national airline's frequent flier miles are even called "ShebaMiles". 🇪🇹

I'll begin with the ancient history ... and it goes way back. Because modern humans - and before that, the ancestors of humans - almost certainly originated in Ethiopia. 🇪🇹 (sub-thread):

The famous \u201cLucy\u201d, an early ancestor of modern humans (Australopithecus) that lived 3.2 million years ago, and was discovered in 1974 in Ethiopia, displayed in the national museum in Addis Ababa \U0001f1ea\U0001f1f9 pic.twitter.com/N3oWqk1SW2

— Patrick Chovanec (@prchovanec) November 9, 2018

The first likely historical reference to Ethiopia is ancient Egyptian records of trade expeditions to the "Land of Punt" in search of gold, ebony, ivory, incense, and wild animals, starting in c 2500 BC 🇪🇹

Ethiopians themselves believe that the Queen of Sheba, who visited Israel's King Solomon in the Bible (c 950 BC), came from Ethiopia (not Yemen, as others believe). Here she is meeting Solomon in a stain-glassed window in Addis Ababa's Holy Trinity Church. 🇪🇹

References to the Queen of Sheba are everywhere in Ethiopia. The national airline's frequent flier miles are even called "ShebaMiles". 🇪🇹

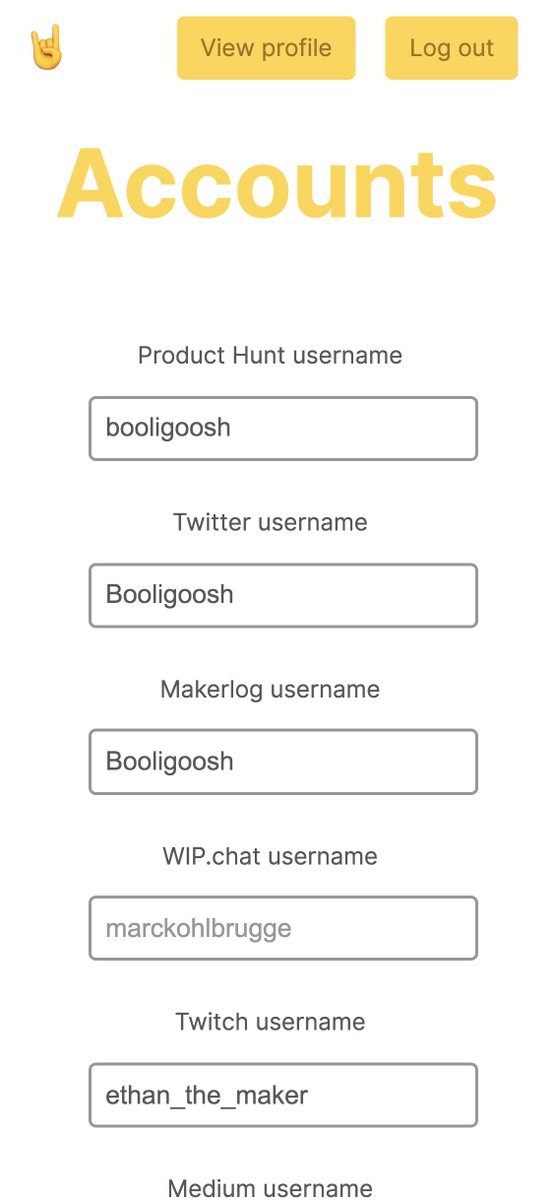

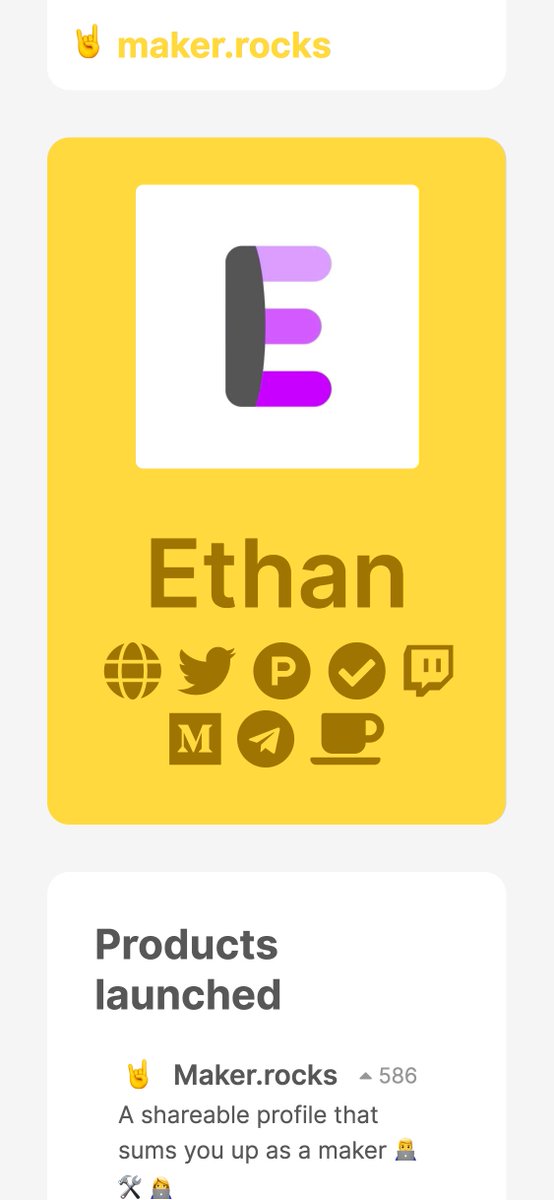

First update to https://t.co/lDdqjtKTZL since the challenge ended – Medium links!! Go add your Medium profile now 👀📝 (thanks @diannamallen for the suggestion 😁)

Just added Telegram links to https://t.co/lDdqjtKTZL too! Now you can provide a nice easy way for people to message you :)

Less than 1 hour since I started adding stuff to https://t.co/lDdqjtKTZL again, and profile pages are now responsive!!! 🥳 Check it out -> https://t.co/fVkEL4fu0L

Accounts page is now also responsive!! 📱✨

💪 I managed to make the whole site responsive in about an hour. On my roadmap I had it down as 4-5 hours!!! 🤘🤠🤘

Just added Telegram links to https://t.co/lDdqjtKTZL too! Now you can provide a nice easy way for people to message you :)

Less than 1 hour since I started adding stuff to https://t.co/lDdqjtKTZL again, and profile pages are now responsive!!! 🥳 Check it out -> https://t.co/fVkEL4fu0L

Accounts page is now also responsive!! 📱✨

💪 I managed to make the whole site responsive in about an hour. On my roadmap I had it down as 4-5 hours!!! 🤘🤠🤘

The Eye of Horus. 1/*

I believe that @ripple_crippler and @looP_rM311_7211 are the same person. I know, nobody believes that. 2/*

Today I want to prove that Mr Pool smile faces mean XRP and price increase. In Ripple_Crippler, previous to Mr Pool existence, smile faces were frequent. They were very similar to the ones Mr Pool posts. The eyes also were usually a couple of "x", in fact, XRP logo. 3/*

The smile XRP-eyed face also appears related to the Moon. XRP going to the Moon. 4/*

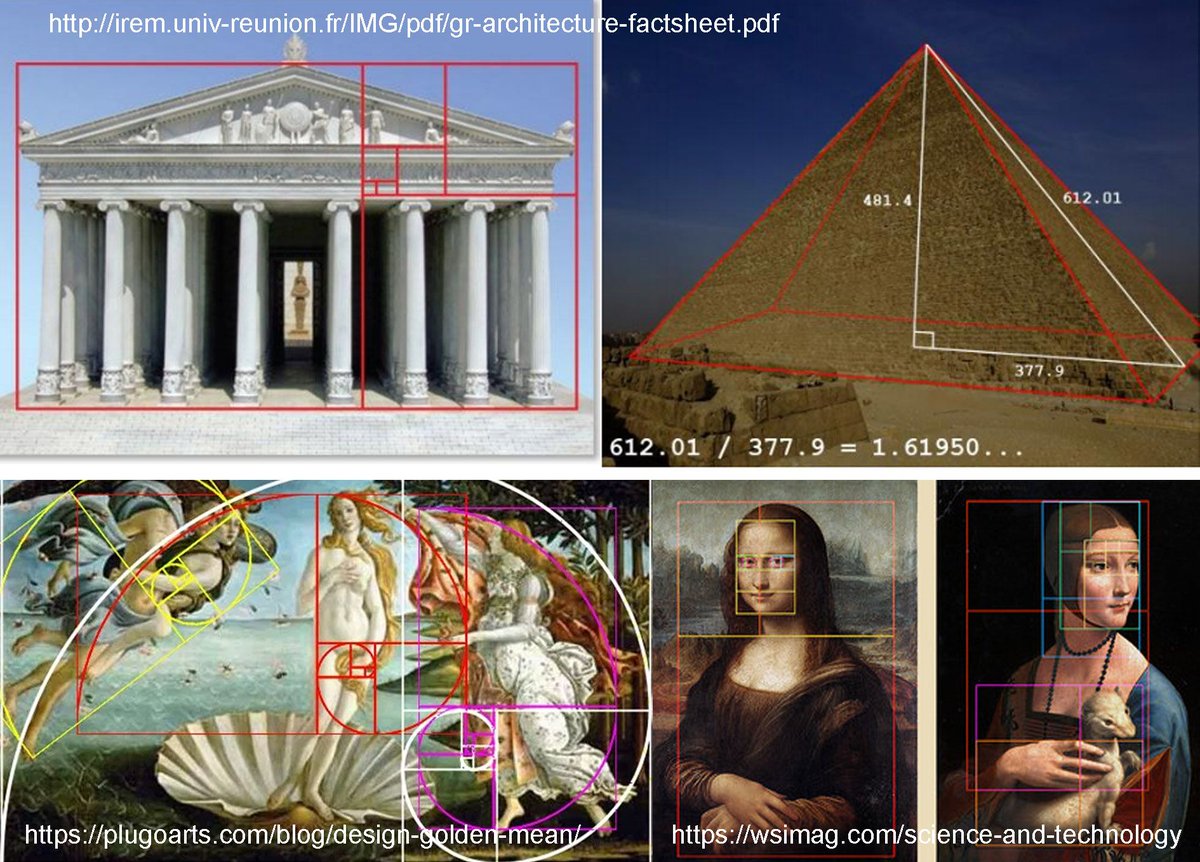

And smile XRP-eyed faces also appear related to Egypt. In particular, to the Eye of Horus. https://t.co/i4rRzuQ0gZ 5/*

I believe that @ripple_crippler and @looP_rM311_7211 are the same person. I know, nobody believes that. 2/*

Today I want to prove that Mr Pool smile faces mean XRP and price increase. In Ripple_Crippler, previous to Mr Pool existence, smile faces were frequent. They were very similar to the ones Mr Pool posts. The eyes also were usually a couple of "x", in fact, XRP logo. 3/*

The smile XRP-eyed face also appears related to the Moon. XRP going to the Moon. 4/*

And smile XRP-eyed faces also appear related to Egypt. In particular, to the Eye of Horus. https://t.co/i4rRzuQ0gZ 5/*