1/ Thinking in Bets: Making Smarter Decisions When You Don't Have All the Facts (Annie Duke)

Thread

"World-class poker players taught me to understand what a bet really is: a decision about an uncertain future."

https://t.co/Nr2zCrVve3

"In four words: the play didn't work.

"He had control over the quality of the decision but not over how it turned out."

"We’ve tuned out, cut short, and are predisposed to dismiss anything that varies from what we already 'know.' "

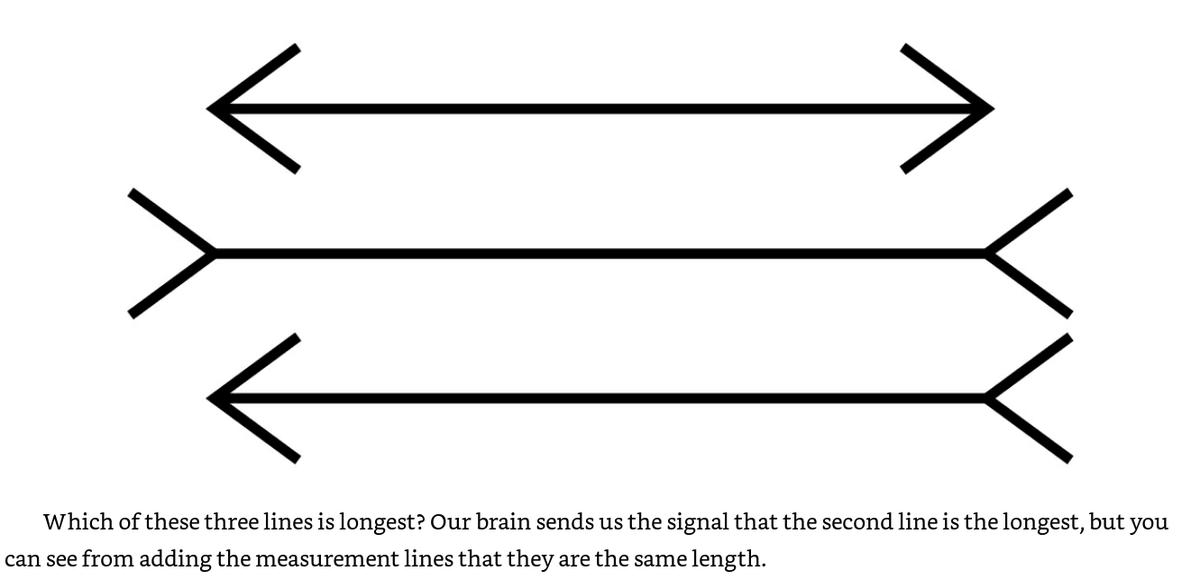

"Being aware of irrational behavior and wanting to change is not enough, just as knowing that you are looking at a visual illusion is not enough to make the illusion go away."

"Solving the problem of how to execute (avoiding common decision traps, learning from results in a rational way, keeping emotions out of the process) is even more important than innate talent in poker."

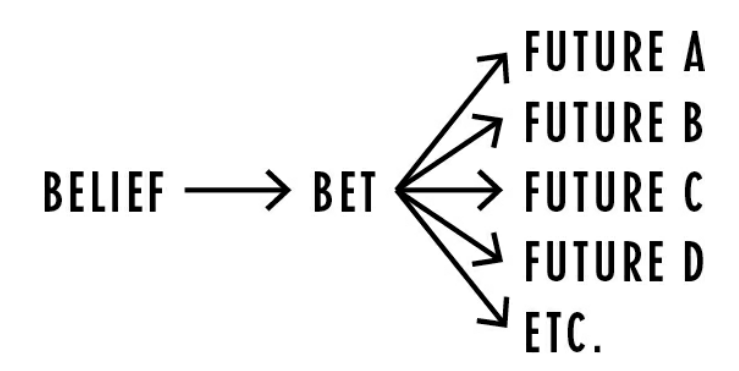

"We are betting that the future version of us that results from the decisions we make will be better off."

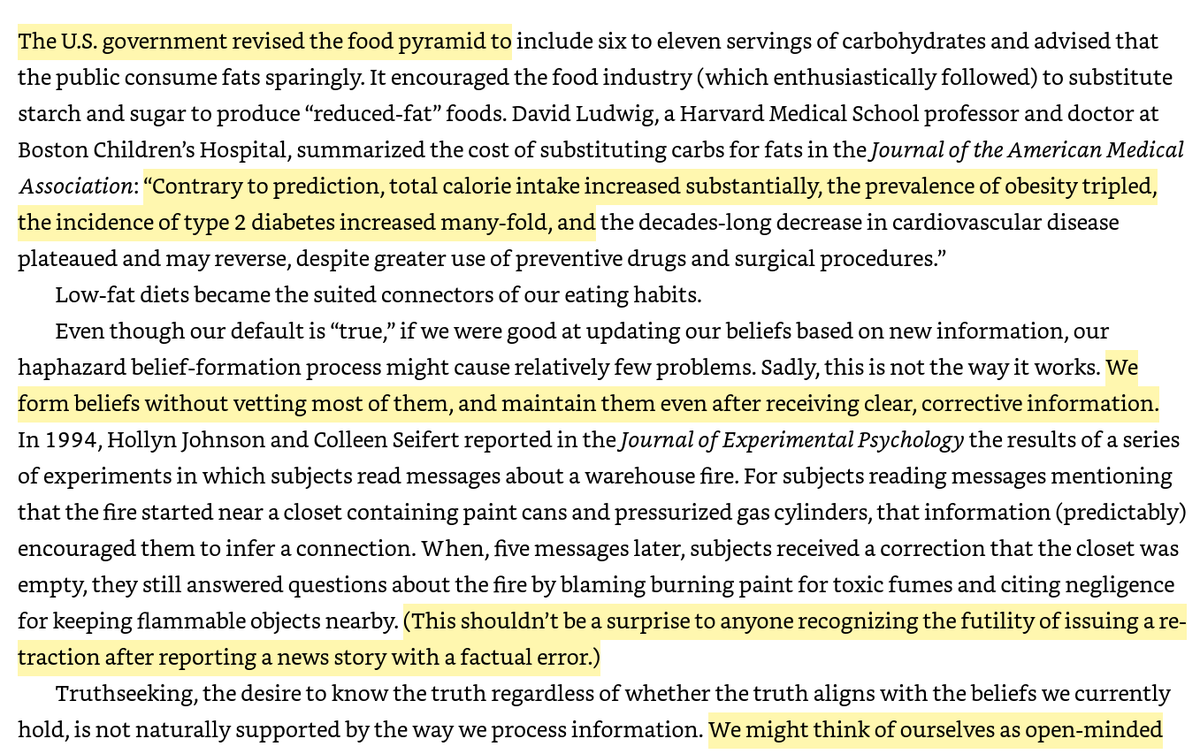

"We form beliefs in a haphazard way, believing all sorts of things based just on what we hear out in the world but haven’t researched for ourselves."

1. We hear something

2. We believe it to be true

3. Only sometimes, later, if we have the time or the inclination, we think about it and vet it, determining whether it is, in fact, true or false.

...

"A quick Google search will show many of our commonly held beliefs to be untrue."

"The same belief-formation process led hundreds of millions of people (led by advice drawn, in part, from research secretly funded by the sugar industry) to bet the quality and length of their lives on their belief about the merits of a low-fat diet."

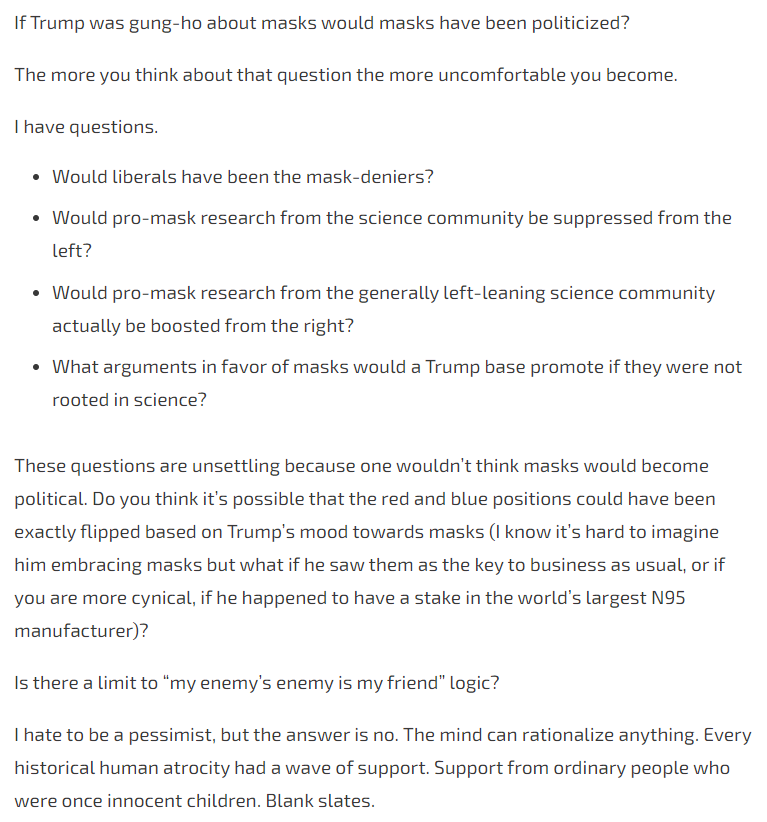

"The smarter you are, the better at rationalizing and framing data to fit your point of view."

"More numerate people made more mistakes interpreting data on the emotionally charged topic."

"Practically every fact we’ve ever known has been subject to revision or reversal. (Samuel Arbesman’s The Half-Life of Facts)"

"By institutionalizing the expression of uncertainty, scientists invite their community to test and challenge the results."

"When we figure out why something happened, we look for a plausible reason, but one that also fits our wishes."

"The way we field other people’s outcomes is part of our self-serving bias." (p. 102)

"Any other interpretation would create cognitive dissonance." (p. 102)

"We are doing well by comparison because we are doing something hard that most people don’t do." (p. 107)

"Thinking in bets triggers an exploration of alternative hypotheses." (p. 111)

"For negative outcomes, you can recognize, in addition to things you can improve, things you did well and things outside your control. You realize that not knowing is okay." (p. 113)

"The benefits compound over time." (p. 115)

"It isn’t for everyone; it must be freely chosen to be productive and sustainable." (p. 122)

"As long as there are three people in the group (two to disagree and one to referee), a truthseeking group can be stable and productive." (p. 125)

”It's important to have intellectual and ideological diversity.” (p. 129)

"We can't underestimate how hard it is to maintain diversity of thinking. After all, it feels good to hear our ideas echoed back to us." (p. 140)

"Experimental studies found that reviewers “work extra hard to find flaws with papers whose conclusions they dislike and are more permissive when they endorse conclusions.”

"Check your Twitter followers. It’s a safe bet that the bulk of them are ideologically aligned with you. If that’s the case, start following some people from the other side of the aisle." (p. 148)

"At least one study has found that a betting market where scientists wager on the likelihood of results replicating was more accurate than expert opinion alone.

"Sharing data is the best way to move toward accuracy because it extracts insight from your listeners of the highest fidelity." (p. 158)

"Likewise, when we have a positive opinion of the messenger, we tend to accept the message without much vetting. Both are bad." (p. 160)

"Even when I determined that his strategy wasn’t profitable, I had a deeper understanding of my opponent’s game, which helped me devise counter-strategies." (p. 161)

The Hedge Fund Market Wizards used lots of strategies, but most didn't consider combining for diversification.

https://t.co/Rcofe6XAot

Similarly, AQR finds that superstar investors concentrate their strategies/exposures:

https://t.co/hfFqnUUZpi

249/ * Even the best managers have blind spots and sub-optimal portfolios. (Value managers ignoring momentum = underdiversification, rules-of-thumb risk management instead of systematic vol targeting)

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) January 16, 2020

* Successful traders survive fat tails (long volatility, stops, vol targeting)

"Attorneys can evaluate trial strategy before the verdict comes in." (p. 166)

"We need to be particularly skeptical of information that agrees with us because we know that we are biased to just accept and applaud confirming evidence." (p. 169)

"Expression of disagreement is just another way to express our beliefs, which we acknowledge are probabilistic." (p. 170)

"By affirming their ideas, we will be more open-minded to what others have to say as well." (p. 172)

"Even then, tread lightly: people may say they want advice when what they really want is to be affirmed." (p. 173)

"Military employees took lump-sum payments at a 40% discount compared to the present value of the annuity payments they would have received." (p. 181)

“Every 10-10-10 process starts with a question. . . . [W]hat are the consequences of each of my options in ten minutes? In ten months? In ten years?” (p. 187)

"Recruiting past-us and future-us engages inhibits the emotional mind, keeping events in more rational perspective." (p. 190)

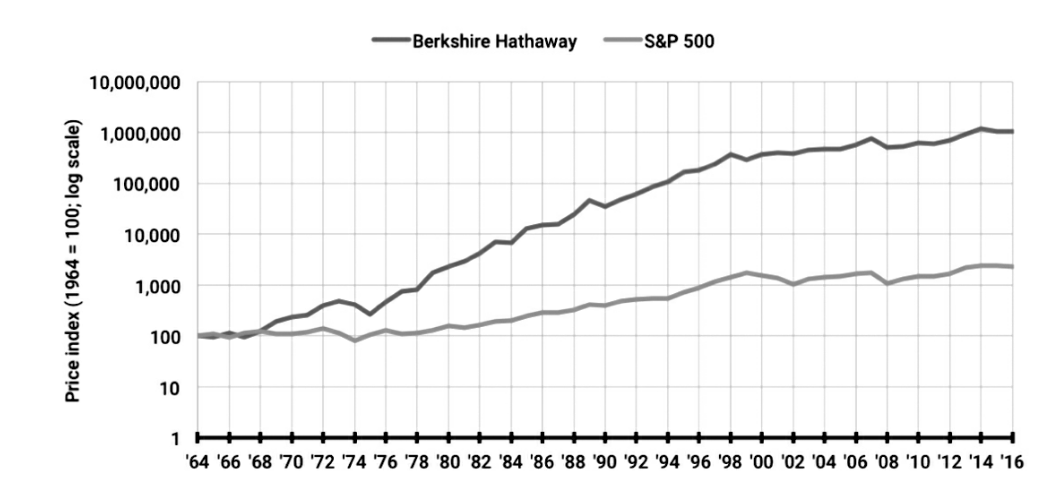

"Minute-to-minute and even day-to-day changes have little effect on an investment’s general upward trajectory."

"In relationships, even small disagreements seem big in the midst of the disagreement. In-the-moment emotions affect the quality of the decisions we make in those moments." (p. 195)

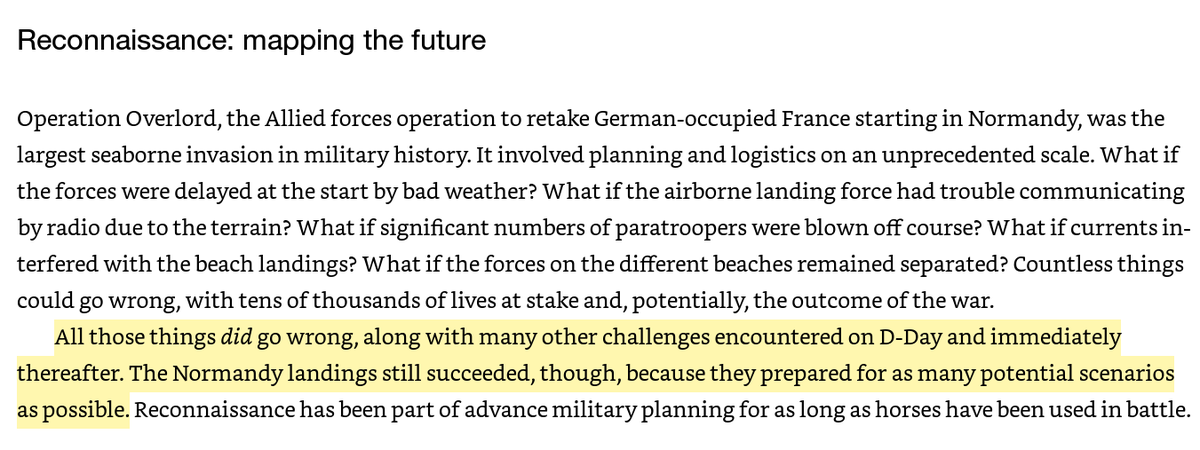

"We shouldn’t plan without advance work on the range of futures that could result and the probabilities of those futures occurring." (p. 207)

"We make a prediction every time we make a decision, so we’re better off making that explicit." (p. 210)

People who consider the probability of success given what they've saved, how much they plan to spend, and expected returns (low!) may need to change their plans.

Thread:

https://t.co/HObz7IoOVs

Most Monte Carlo simulators online don't allow custom return and \u03c3 assumptions.

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) September 9, 2020

The traditional stock+bond constraint probably has unrealistic return assumptions and doesn't allow for easy comparisons to risk parity, etc.

The one below is more flexible:https://t.co/QKrPuDrjBY pic.twitter.com/Dq35pdmtzd

"Arbesman’s The Half-Life of Facts makes a book-length case for the hazards of assuming the future is going to be like the present. The world changes too fast." (p. 218)

"A premortem is where we imagine *not* achieving our goals. Backcasting and premortems complement each other. Backcasting imagines a positive future; a premortem imagines a negative future." (p. 221)

"Gabriele Oettingen has conducted over twenty years of research, consistently finding that people who imagine obstacles in the way of their goals are more likely to achieve success." (p. 222)

"A premortem (“What are ways we could fail?”) frees people to identify problems they otherwise might not bring up for fear of being viewed as naysayers." (p. 224)

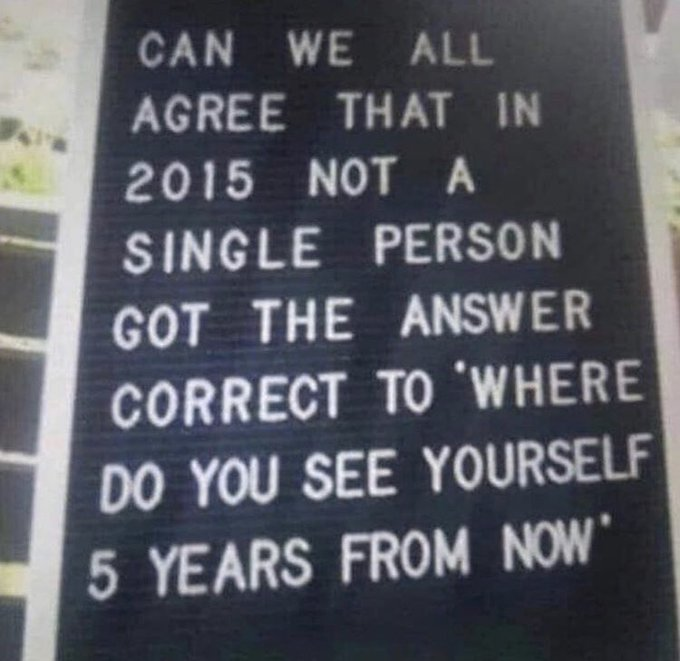

"If we don’t hold all the potential futures in mind before one of them happens, it's almost impossible to evaluate probabilities afterward." (p. 229)

"We are going to do better, and be happier, if we start by recognizing that we’ll never be sure of the future." (p. 231)

So true lol pic.twitter.com/VFx4QmpCnd

— Andrew Thrasher, CMT (@AndrewThrasher) September 11, 2020

Ten-year

https://t.co/FQQGy5Lgqs

One-year

https://t.co/Oh5k4Yx64X

Roughly speaking, the Z-score should increase with the square root of time, so for a ten-year time span:

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) September 6, 2020

SR 0.1 \u2248 62% (expected return of U.S. stocks, REITS)

SR -0.3 \u2248 18% (T-bonds)

SR 1.0 \u2248 99.9%

So the reduction in volatility that comes with diversification matters.

John Kenneth Galbraith

https://t.co/yBWtVHvTJ9

"If I gave you those facts about the 2020 pandemic in advance, what would you have done with your portfolio?

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) September 16, 2020

"The concept of something that seems obvious in the market ending up being far from it is not rare at all." @practicalquant https://t.co/zz2o8fKLUh

No one seems to get, viscerally, that the vast majority of the propositions they hold to be true will be shown to be false in 1000 years' time.

— Stewart Alsop III - Host of Crazy Wisdom Podcast (@StewartalsopIII) September 18, 2020

What's the proof?

What propositions did most people hold to be true 1000 years ago?

Answer that and you have your proof.

https://t.co/tAhcFouypp

"Many of a society’s cherished beliefs are castles built on sand."

https://t.co/OMW337rgRR

6/We literally don\u2019t know what we don\u2019t know.

— Jim OShaughnessy (@jposhaughnessy) August 16, 2018

How does this affect us? People who don\u2019t ask questions don\u2019t get answers.

NEVER be afraid to ask a question, even if everyone you know thinks the answer is obvious.

We\u2019ll never progress without the simple question, why?

The power of negative thinking > the power of positive thinking.

— Annie Duke (@AnnieDuke) September 16, 2020

Instead of visualizing a clear path, imagine the obstacles that might make you fail and then clear your own path. #HowToDecide

"In my case, that might mean topping this article with a clever title or pre-writing some 140-character barbs to rout the haters."

https://t.co/W75JgPh40w

Defensive pessimism FTW! https://t.co/xpLkcEUn3p

— Andie (@AndieDS) September 16, 2020

https://t.co/PPrQBA56FY

Don't get programed with this algorithm:

— Jim OShaughnessy (@jposhaughnessy) September 21, 2020

Whatabout! >Bothsidesism! >Ergo, the ONLY legitimate answer is the one you came to emotionally

Thoughtful piece from @EpsilonTheory https://t.co/lCwloAeeCa

Willingness to explore good & bad outcomes is asymmetric.

— Annie Duke (@AnnieDuke) September 27, 2020

If you do a process dive on a bad outcome, you might find out your decision was perfectly fine, you just got unlucky.

You have a chance to turn a loss into a win because you might find out it wasn\u2019t your \u201cfault.\u201d 1/3

In which @jposhaughnessy challenges @AnnieDuke to a bet:

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) October 22, 2020

* Resulting

* Tracking decision-making processes to fight hindsight bias

* Outcomes look obvious in hindsight

* Bad decision but "good" result is more insidious than good decision but "bad" resulthttps://t.co/AIDF3IRQuD

"I prefer true but imperfect knowledge, even if it leaves much indetermined and unpredictable, to a pretense of exact knowledge that is likely to be false." -Hayek Nothing wrong with good approximation versus a precise falsehood.

— Mark Rzepczynski (@mrzepczynski) October 23, 2020

https://t.co/eeEMw2j2Rg

96/ "People guessed, on average, that a 2,000-word text contained 13.4 seven-letter words ending in -ing and only 4.7 seven-letter words with 'n' in the sixth position. (It was easier to think of words ending in -ing: the availability heuristic in action.)" (p. 328)

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) October 26, 2020

https://t.co/PVxej6y5AF

1/ The Undoing Project (Michael Lewis)

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) October 18, 2020

"What were people\u2019s minds doing that led to the misjudgments that could be exploited for profit by those who ignored experts and relied on data?

"How does a psychologist win a Nobel Prize in economics?" (p. 20)https://t.co/klptLJuw1F pic.twitter.com/hrsgsAptpv

The "consensus" in finance (by street-corner practitioners) is empirically false (CAPM) and under-diversified (60/40).

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) October 27, 2020

In the literature, there is no consensus on basic ideas like factors/costs.

Imagine this dynamic echoed in science more generally. We know less than we think! https://t.co/yRMLkOrORO

1/ Some radical thoughts from the ever provocative Jed McKenna

— Jim OShaughnessy (@jposhaughnessy) October 26, 2020

Shot: pic.twitter.com/GUIVy1PLSx

...

* Beliefs easily become entrenched

* ‘Happiness test’ frees time for the important decisions

* Choosing ‘quittable’ things

* Doing things in parallel (choice diversification)

* Problematic committee dynamics

* Records → accountability

...

https://t.co/F8a3tztwUA

One of the first things you learn when building a trading system is that individual outcomes are essentially random and unusable for system evaluation.

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) November 14, 2020

One of the first things you learn in politics is that individual outcomes can be leveraged as weapons to accomplish your goals.

100/ "People often assume that when a decision is followed by a good outcome, the decision was good, which isn\u2019t always true. That assumption can be dangerous if it blinds us to the flaws in our thinking." (p. 186)

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) November 14, 2020

More on this:https://t.co/T7JIqnIbTV

Decisions should be judged based on the information available at the time, not on outcomes, which include random factors.

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) November 16, 2020

Not being hedged in early 2020 led to a poor outcome, but it was no better/worse a decision than not being hedged at any other time when options were cheap. https://t.co/T7JIqnIbTV

https://t.co/Zy6vCla1l5

1/ Superforecasting: The Art and Science of Prediction (Tetlock, Gardner)

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) November 10, 2020

"Foresight isn\u2019t a mysterious gift bestowed at birth. It is the product of particular ways of thinking, of gathering information, of updating beliefs." (p. 18)https://t.co/oFkSPbUC19

We\u2019re deterministic thinkers living in a probabilistic world and we process things sequentially when we\u2019re living in an aggregate world. @jposhaughnessy @AnnieDuke

— Franco Sosa (@fjsosah) November 16, 2020

98/ "We designed a plan to discipline people who make outrageously confident statements: Following any factual claim, another member of the group can challenge it. The initiator has to either withdraw his claim or accept a $50 \u201cstandard bet\u201d predetermined by the group." (p. 265)

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) November 26, 2020

Profile in probabilistic thinking + deep understanding of process > outcome.

— Annie Duke (@AnnieDuke) January 11, 2021

Via @farnamstreet + h/t @davenuss79 pic.twitter.com/8gpaCeViF0

"Chess, for all its strategic complexity, isn't a great model for decision-making in real life...in chess, outcomes correlate more tightly with decision quality. In poker, it is easier to get lucky and win, or get unlucky and lose..life is more like poker" https://t.co/dfKXNMlJjy pic.twitter.com/f0Adp1n8is

— Rob Henderson (@robkhenderson) January 6, 2021

* Fight hindsight bias with “knowledge tracking”

* Hitting the bull’s eye is overrated

* Apply the “only option” test as a way to choose between choices that don’t fundamentally matter

https://t.co/f6CpjJYZHp

Expert Political Judgment

https://t.co/BNEjjaIuR4

Superforecasting: The Art and Science of Prediction

https://t.co/Zy6vCla1l5

1/ Expert Political Judgment (Philip Tetlock)

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) March 6, 2021

"What experts think matters far less than how they think. We are better off with experts who draw from an eclectic array of traditions and accept ambiguity/contradiction as inevitable features of life." (p. 2)https://t.co/MJH8kpfndc pic.twitter.com/qcfKYBKqJw

https://t.co/5rQoiCNiqU

1/ In Defense of Troublemakers: The Power of Dissent in Life and Business (Charlan Jeanne Nemeth)

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) March 7, 2021

"Consensus narrows, while dissent opens, the mind. Both affect the quality of our decisions. There are perils in consensus and value in dissent." (p. 14)https://t.co/kKPccQNZND pic.twitter.com/AUyMMzySGF

https://t.co/wbdQglvngK

4/ "Annie Duke, former world champion of poker, teaches us that there\u2019s a huge gap between a good decision and a good outcome.

— Darren \U0001f95a \U0001f423 \U0001f54a\ufe0f (@ReformedTrader) April 24, 2021

"Reassurance is futile\u2014focusing on outcomes at the expense of process is a shortcut that will destroy your work." (p. 25)

More:https://t.co/T7JIqnIbTV