Free cash flow means the cash that is left over after a company pays for its operating expenses and capital expenditures (Capex) like purchasing new machinery, equipment, land & building, etc. and satisfying all its working capital needs.

Everything about Free cash Flow Simplified!

What we will talk about in this 🧵🧵:

1⃣What is Free Cash Flow

2⃣How to calculate Free Cash Flow

3⃣Types of Free Cash Flow

4⃣Importance & Limitations of Free Cash Flow

Let's dive in ⤵️⤵️

Free cash flow means the cash that is left over after a company pays for its operating expenses and capital expenditures (Capex) like purchasing new machinery, equipment, land & building, etc. and satisfying all its working capital needs.

1⃣Give investors higher dividends

2⃣Do share buybacks

3⃣Build a war chest for acquisitions or Capex.

4⃣Reinvest in the business when opportunity arises with lesser dependence on debt.

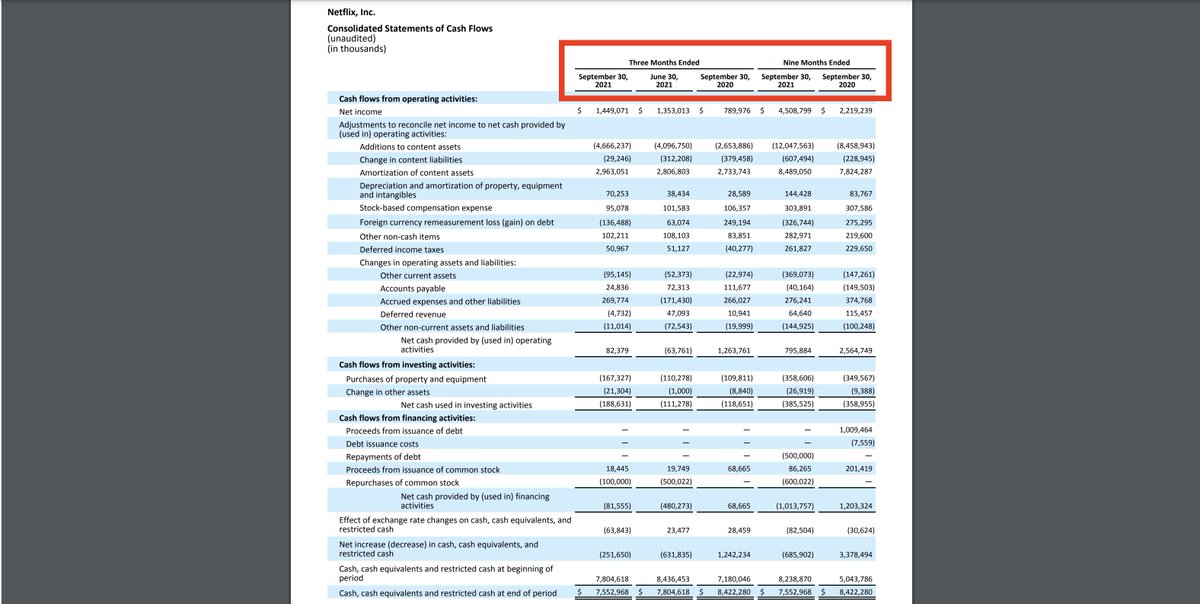

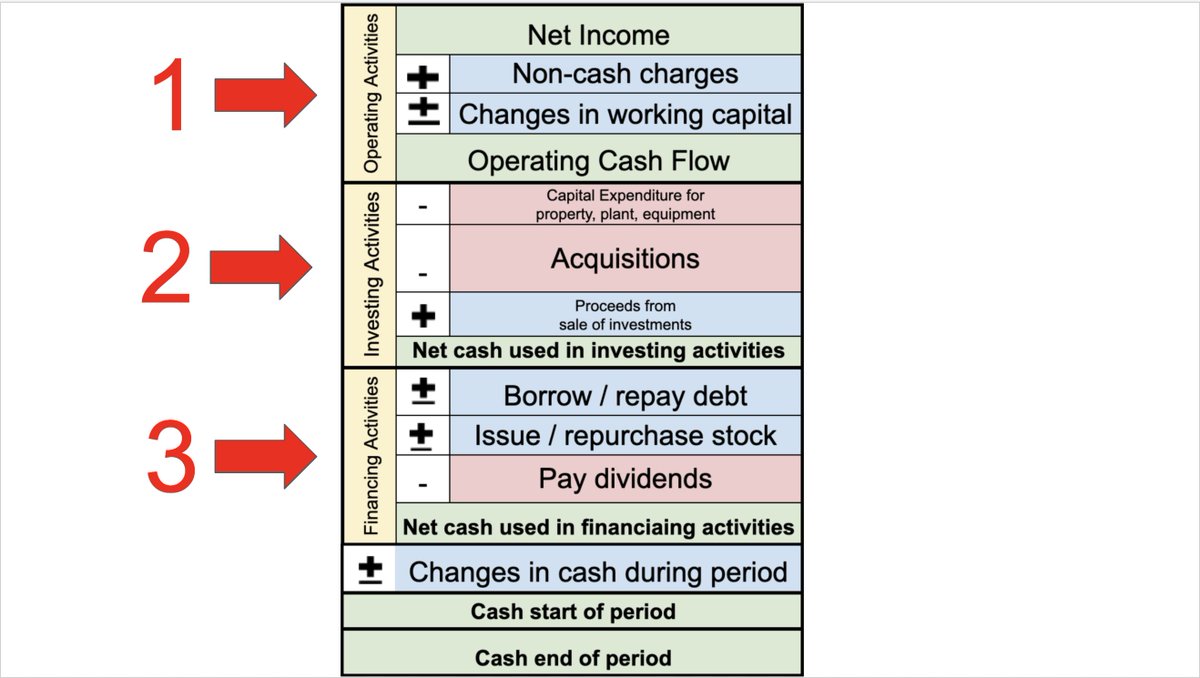

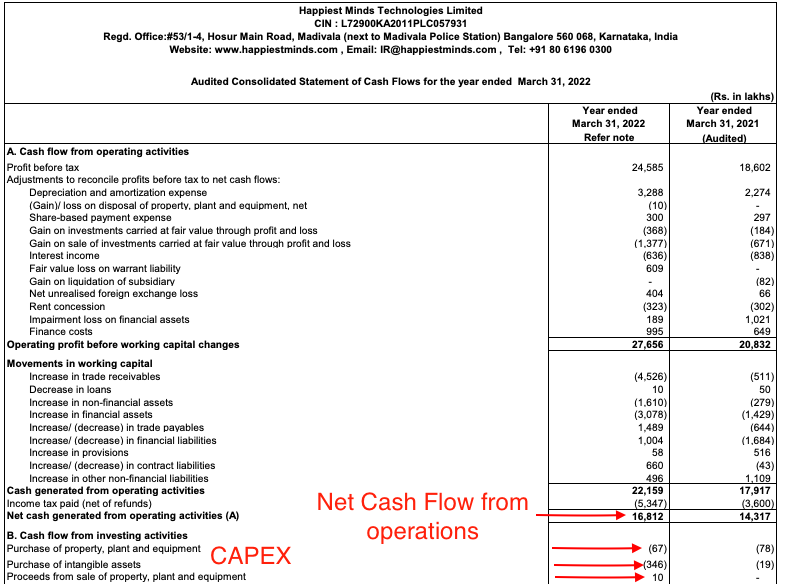

To calculate free cash flow, all you need to do is open the Cash Flow Statement and subtract "Net Capital expenditure" from "net cash from operating activities".

As we can see from the financials its cash flow from operating activities is 168 cr and its net capital expenditure is = 67Lakhs+3.46cr-(10Lakhs)

=168 Cr-4.03 crores= 163.97 crores is the FCF!

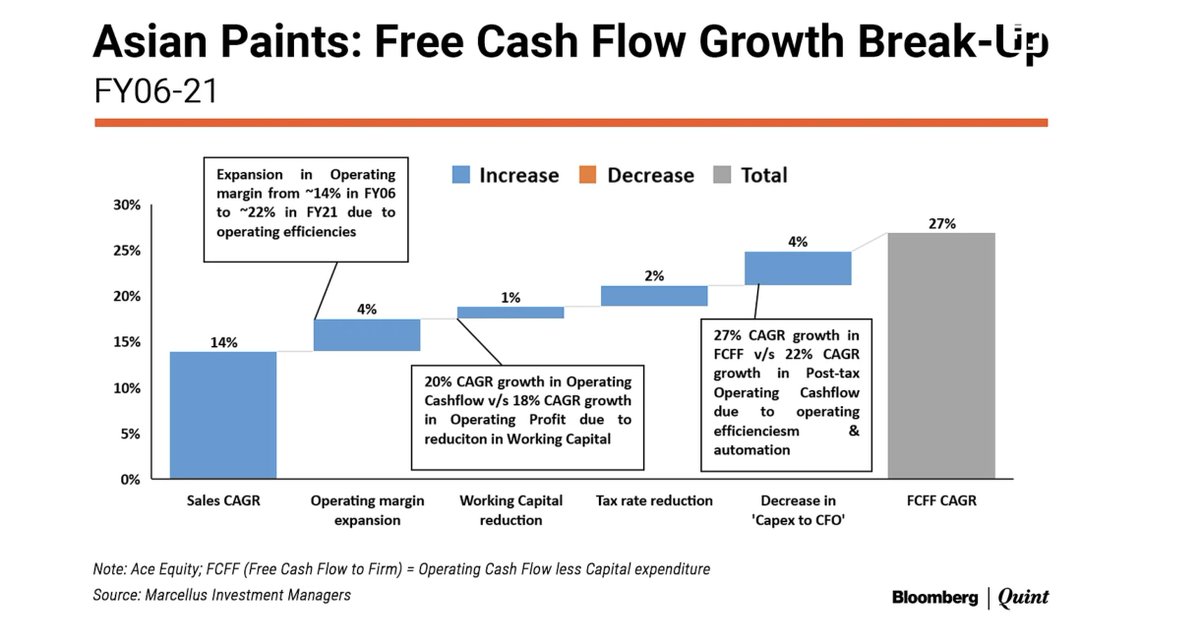

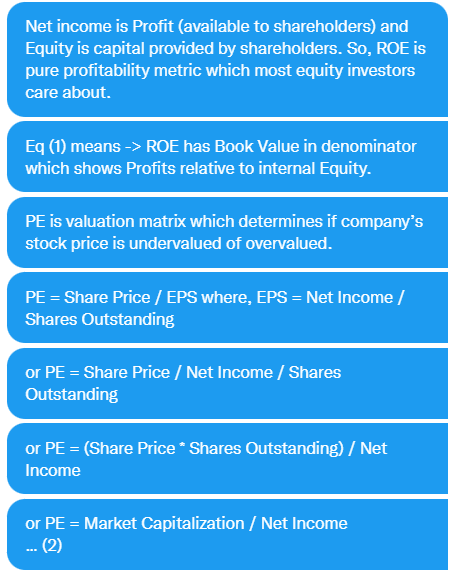

FCFF is the same FCF which we have discussed above, FCFF means the ability of the business to produce cash after deducting all its capital expenditures which is calculated as CFO - Capex.

Thus, the free cash flow that is left to the Firm

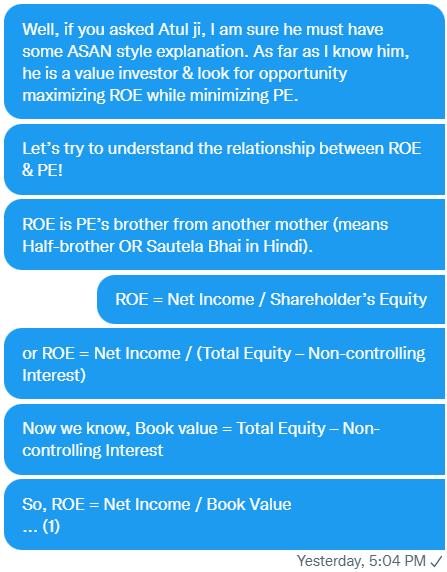

Free cash flow to equity (FCFE) is the amount of cash a business generates that is available to be distributed to the company’s equity shareholders as dividends or stock buybacks after all expenses, reinvestments, and debt repayments.

It is calculated as follows:

FCFE = Cash from Operating Activities – Capital Expenditures + Net Debt Issued (Proceeds from borrowings-Repayment of borrowings)

The main difference between the two is that Free cash flow to firm represents the Cash flow that is available to both the Debt and Equity holders.

FCFE only represents the cash flow that is available to the shareholders!

Company with high free cash flow can expand, develop new products, have a safety cushion, be in control of its own destiny, can expand without debt and pay dividends etc. Positive free cash flow is indicative of overall business health.

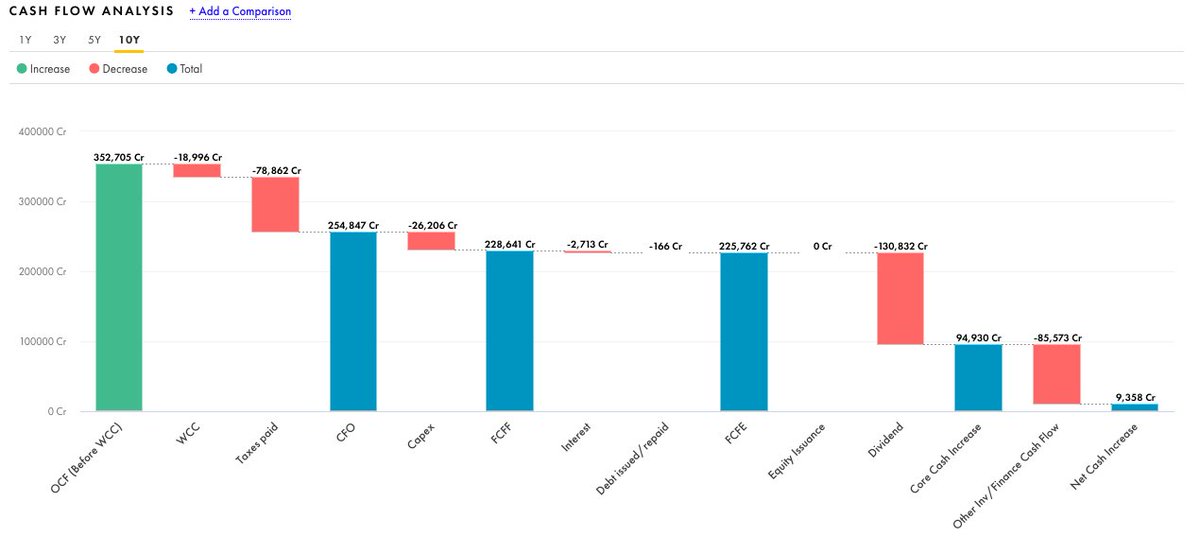

Out of 2.25 Lakh crores of Cumulative Cash flows generated by TCS, they have paid almost 1.4 Lakh crores of dividend in the last decade. As the business can grow without Capex.

@Tijori1

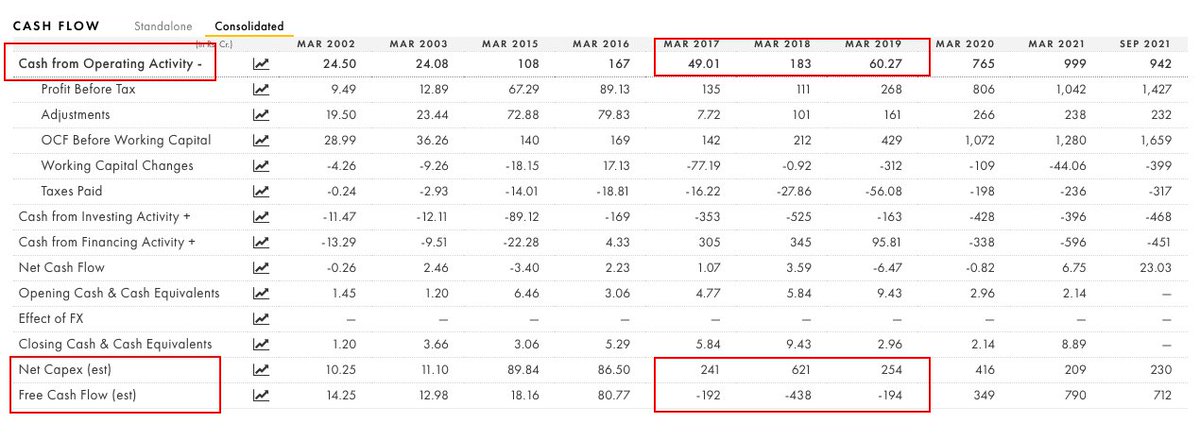

Low free cash flow is not always indicative of a failing business. Even healthy companies see a dip in free cash flow when they're actively doing Capex for pursuing growth.

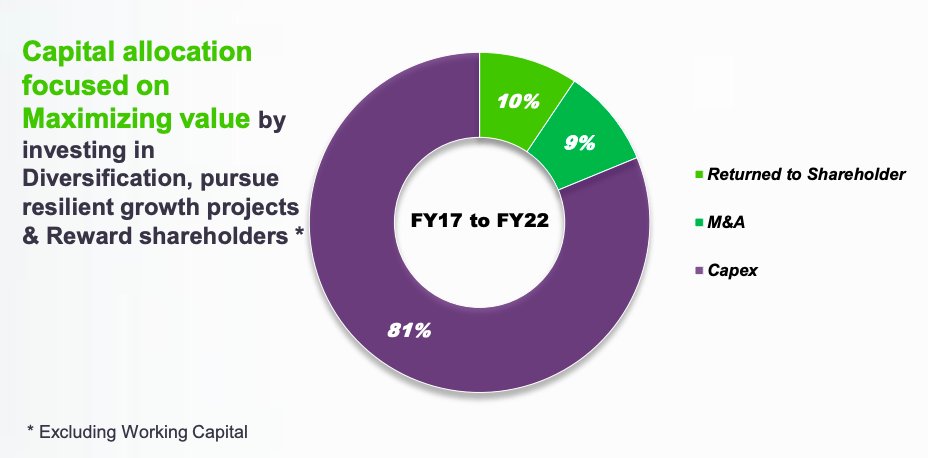

We can see the same from some examples where companies were doing high capex to leverage growth resulting in negative free cash flow for a few years ⤵️⤵️

(Credits @Tijori1 )

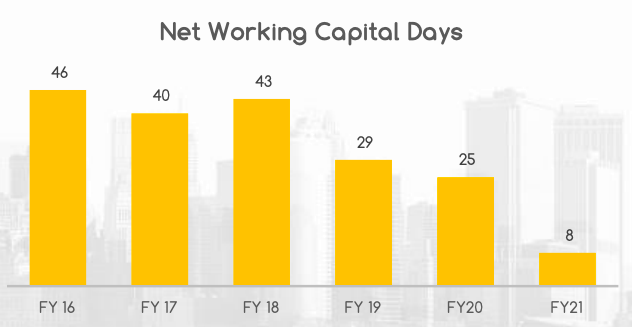

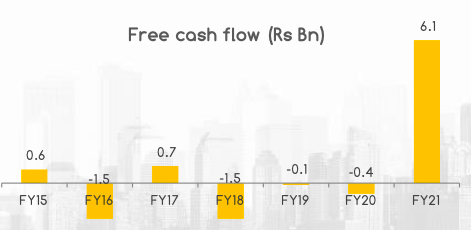

Linking the concept of change in working capital and its impact on Free Cash Flow. Those who understand can make a killing if they see working capital improving in a company.

In FY 2020 they switched to a cash and carry model from normal credit period business of 20 days which resulted in the reduction in net working capital days from 25 to 8 in FY 2021.

Just look at the working capital days:-

1. Massive deleveraging as lesser working capital loans were required to run the business.

2. Generation of solid free cash flow that can be paid out dividends or be used for Capacity expansion through internal accruals.

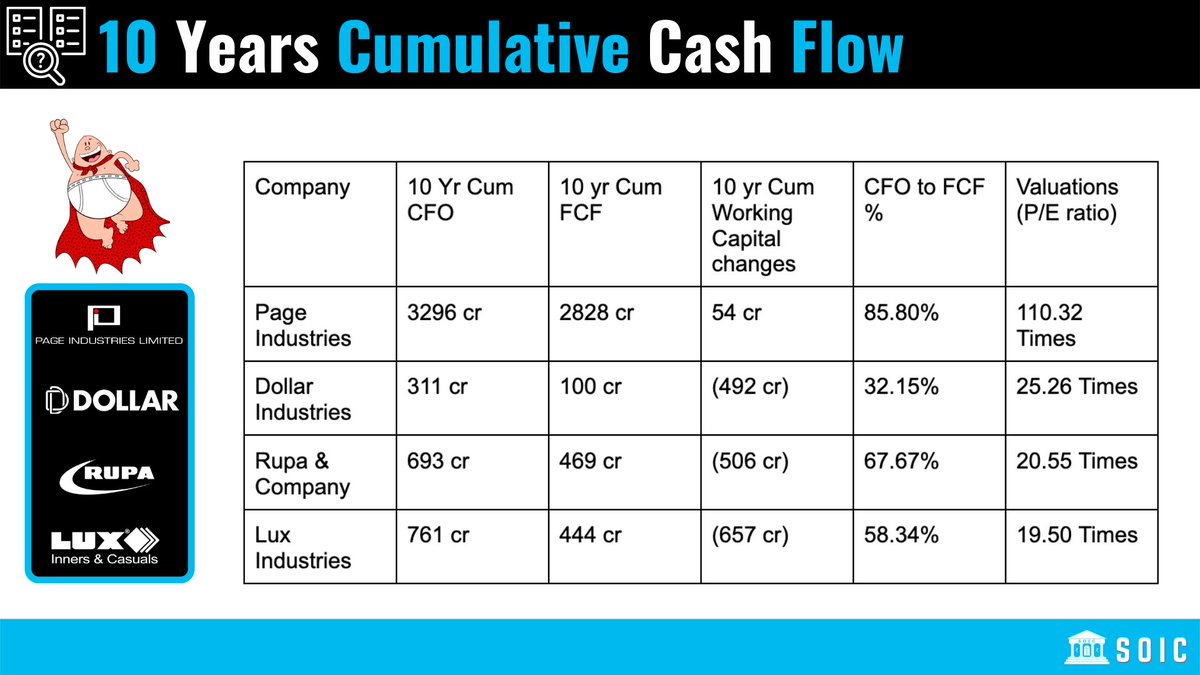

If we look at the 10 Years cumulative cash flow of the companies, it is as follows:

Look at the Working capital and this where Page wins!!

Thank you for reading!

Link to register 🔗: https://t.co/fTr7JYgszn

More from Intrinsic Compounding

More from Accounting

It's simple, if ""FY23 PAT of this API to CDMO = FY21 PAT of largest pure-play CDMO/API"" then the FY23 Mcap of this API/CDMO= FY21 Mcap of largest pure-play CDMO/API, am I correct Sajal saab??

— richman (@greatrichman3) June 14, 2021

10 threads that will teach you more about accounting than any accounting degree:

1/ Who: @10kdiver

What: Understand the balance

1/

— 10-K Diver (@10kdiver) February 5, 2022

Get a cup of coffee.

In this thread, I'll show you how to read and understand a company's Balance Sheet.

As investors, we should be able to judge businesses by looking at their financial statements.

And the Balance Sheet, of course, is 1 of 3 key financial statements: pic.twitter.com/6D0HA0vmEN

2/ Who: @SoulFairy3

What: Income statement

Many new investors are scared of financial statements. I don't blame them. Us accountants complicate the simplest things to keep ourselves employed\U0001f602

— Soul \U0001f4da (@SoulFairy3) December 6, 2021

Let me show you guys the Income Statement first. You honestly just need 3 numbers. Trus bob\U0001f483

Short \U0001f9f5

3/ Who: @BrianFeroldi

What: Income statement

Accounting is the language of business.

— Brian Feroldi (\U0001f9e0,\U0001f4c8) (@BrianFeroldi) July 28, 2021

If you buy stocks, you MUST learn how to read an income statement

Here\u2019s everything you need to know:

4/ Who: @AliTheCFO

What: Profit vs cash

Most founders don\u2019t understand the difference between PROFIT and CASH FLOW

— Ali Ladha (@AliTheCFO) November 2, 2021

Not knowing this difference, could leave your business without cash and push you into bankruptcy

Here are the key differences between PROFIT and CASH FLOW

//A THREAD//