Every company has 3 reports in its financial statements

1. Balance sheet

2. Income statement

3. Cash flow statement

Most people focus on the Income Statement to look at PROFIT

There is nothing wrong with this…

But profit, isn’t CASH FLOW

Profit is an accounting measure

It doesn’t tell you how much MONEY actually came into the business

Sounds confusing?

Let’s look at an example:

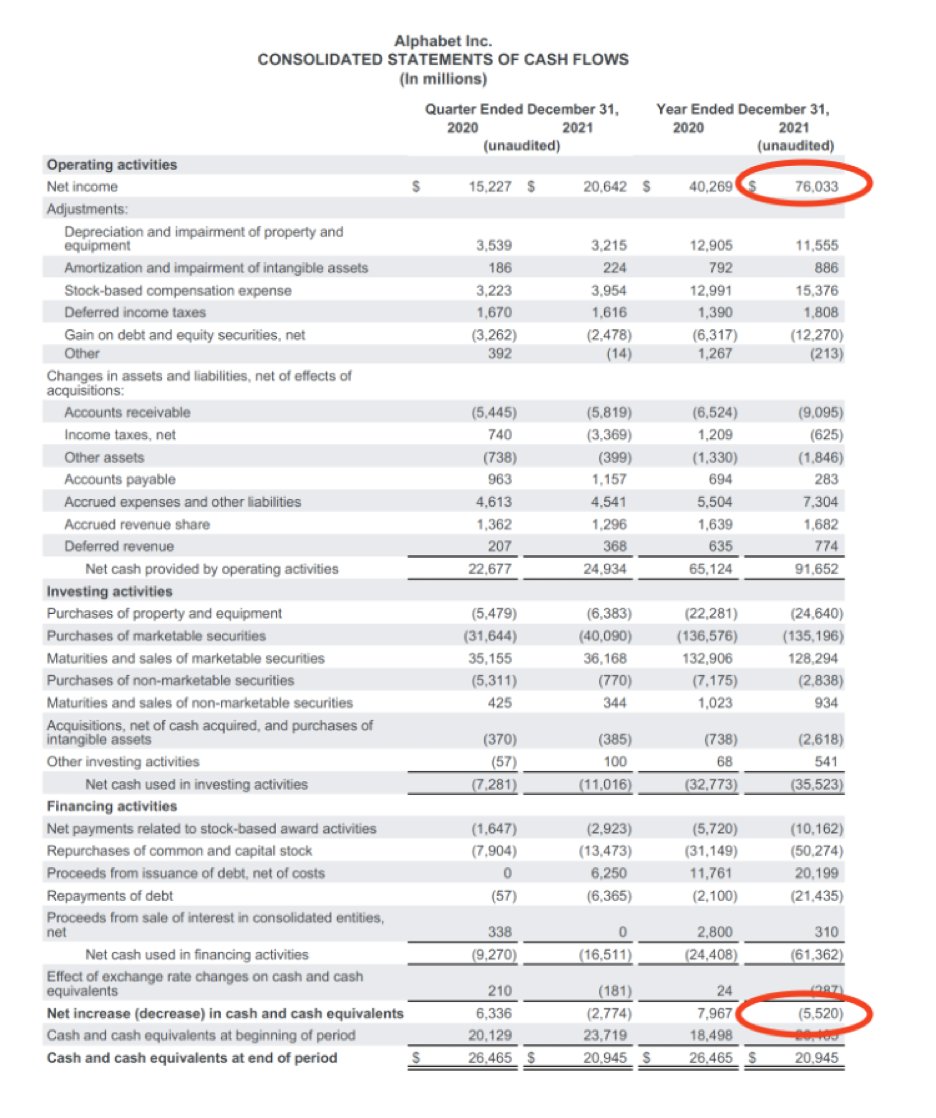

In 2021 Google’s profit was: $76 billion

You would think that if Google’s profit was $76 billion...

The cash in Google's bank account would also increase by $76 billion?

Not quite..

If you look at Google’s bank account,

From 2020 to 2021, CASH actually went DOWN ⬇️

From $26.4 billion to $20.9 billion

This is a reduction of $5.5 billion

So let’s get this straight…

Google MADE $76 billion in profit

But its cash balance went DOWN by almost $5.5 billion?

If a company makes a profit, shouldn’t its cash balance go up?!?

What's going on here?!

How can we uncover this mismatch between profit and cash?

By looking at the CASH FLOW statement

The cash flow statement tells you 3 things:

1. How PROFIT was converted into CASH

2. How that cash was used

3. How you got the cash balance in your bank account

In the case of Google,

The Cash Flow Statement starts with $76 billion in profit

And ends with a decrease of $5.5 billion in cash

In essence, the Cash Flow Statement is saying:

In 2021:

Google Made a PROFIT of $76 billion

But lost $5.5 billion of Cash

Let’s dig into why this happened:

As you can tell from the graphic, the cash flow statement has three sections:

1. Cash flow from Operating Activities

2. Cash flow from Investing Activities

3. Cash flow from Financing Activities

We’ll cover each of them:

Cash flow from Operating Activities

Tells you:

• How profit was converted into cash

• How much cash the business made

In the case of Google,

The company made $76 billion of profit in 2021

But it actually collected COLD HARD cash of $91.6 billion during the year

Cash collected at Google was HIGHER than Profit!

Cash flow from Investing Activities

Tells you:

• What assets did the company buy?

• Did the company do any M&A?

In the case of Google,

The company spent $35.5 billion buying:

• Property and equipment

• Marketable securities (bonds and stocks)

• Making acquisitions (M&A)

Cash flow from Financing Activities

Tells you:

• Did the company raise money from investors?

• Did the company get a loan?

In the case of Google

The company spent $61.3 billion on:

• Buying back stock

• Paying back debt

• Issuing stock rewards

So the final tally is:

• Cash Flow from Operating Activities: $91.6 billion

• Cash Flow from Investing Activities: ($35.5) billion

• Cash Flow from Financing Activities: ($61.3) billion

The sum makes up the decrease in cash of ($5.5) billion

(minor diff. due to f/x)

So what does this mean?

It means Google generates INSANE amounts of cash to the tune of $91 billion per year

However, the company also SPENDS all of this cash

It is spent on FINANCING and INVESTING activities until it’s in a negative position of $5.5 billion

Is this a bad thing?

No.

If Google is investing in new equipment, that’s probably a good long-term decision for the company

If Google is buying back stock, that rewards its shareholders

You’re probably asking yourself….

But if Google made $91 billion in cash, shouldn’t it keep some of itself?

Google can actually afford to go into a negative cash position because its balance sheet is actually FLUSH with CASH

At the end of 2021, Google had $20.9 billion of cash

Google also had $118.8 billion of marketable securities (stocks and bonds) that can be sold and converted to cash.

So Google’s total cash + marketable securities otherwise called “cash equivalents” balance was $139.6 billion

Hopefully, now it’s starting to make sense why the company doesn’t need to keep its cash and it can spend it all...

The company already has so much CASH on hand!

Adding another $91 billion is not necessary

The executives at Google chose to spend the cash on investments and give it back to shareholders instead of adding more cash to the company's bank account

TL;DR

• Profit is an accounting measure

• Profit doesn’t tell you how much CASH was made

• Uncover the mismatch between profit and Cash Flow

• The Cash Flow Statement explains How PROFIT was converted into CASH

If you learned something new in this thread, retweet it!

Let's learn together and follow

@AliTheCFO I tweet about:

• Finance

• Business

• Personal Growth