There are 2 types of operators:

Those who...

1. Track everything

2. Track nothing

Whether ignorance or information overload - neither is ideal.

Instead, choose fewer, but more meaningful KPIs.

Cash Conversion Cycle (CCC) is simple, but has far reaching application - that's why I like it.

The info can be applied to:

1. Finance

2. Operations

3. Customer Management

One centralized KPI keeps departments working together.

The best part?

It's centered around cash.

What is CCC?

The time (in days) it takes a dollar to go from product or service to cash in the bank.

Note: CCC is used for inventory investments, but the service equivalent is called:

Service-to-Cash Cycle.

Same principles, so we'll use CCC for simplicity.

How is it measured?

In days, and...

Above 0 = longer to sell & collect cash than to pay vendors.

Below 0 = faster to sell & collect cash than to pay vendors.

The lower, the better.

Higher numbers indicate current or future cash flow issues.

Though typically a financial metric, it has use as a company-wide measuring stick.

How is it used across departments?

FINANCE:

Strong CCC means there is cash to fuel growth.

Without it, growth must be financed.

It's risky - with larger receivables, comes larger payables.

When bills are due & there's no cash...

You know what happens.

Long A/R cycles are interest free loans to customers that bear opportunity cost.

Make cash collection a priority & finance teams can analyze new opportunities instead of restructuring debt.

OPERATIONS:

Collecting cash quickly is a function of operational efficiency.

Product/service, sales, A/R, & A/P teams must be working together with accurate and timely information.

This is easier said than done.

Low CCC = effective management.

RELATIONSHIP MANAGEMENT:

Getting great payment terms from customers & vendors requires quality relationship management.

Consistency, reliability, & being liked will dramatically improve the cash position.

Treat them well and be clear with expectations.

So, how important is CCC?

Extremely.

Harvard Business Review credits a negative CCC for Amazon's survival of Dot Com bust.

By collecting before spending, sustainable growth was possible.

Competition was financing product purchases, hoping to collect.

A viscous cycle.

How can you implement in your small business?

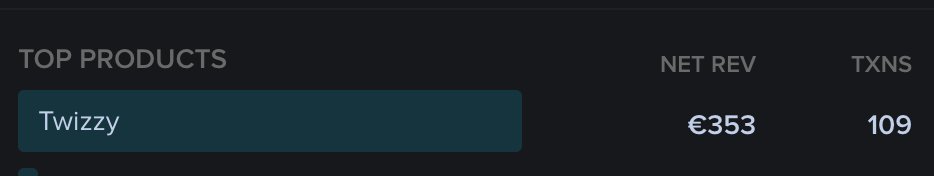

With my SEO company, Bright Line Media, I collect cash 21 days before I owe vendors.

It wasn't always this way.

I once paid a vendor 2X before getting paid and it prompted change.

Here's what I did:

I called customers and switched:

1. Payment date to the 5th

2. Must pay via Stripe

3. NO physical checks

Receivables, solved.

Next, I called my vendors:

I negotiated better payment terms by always paying on time & promising to pay via ACH (no fees).

Payment Date 26th.

21 Days from collection to payment.

New sales enter into this cycle & never incur an out of pocket cost.

Cash Conversion or Service-to-Cash Cycles change the fortunes of a business quickly.

Quick Summary:

1. Don't overproduce / hire

2. Collect cash quickly

3. Set consistent payable cadence

4. Cross department communication

Build a healthy company - on the cash you're owed!

Lastly, I recommend having an accountant or CFO do the math - accuracy is critical.

If you found this helpful, please RT the 1st tweet so others can find it.

Follow me

@barrettjoneill for more on business, growth, & SEO.