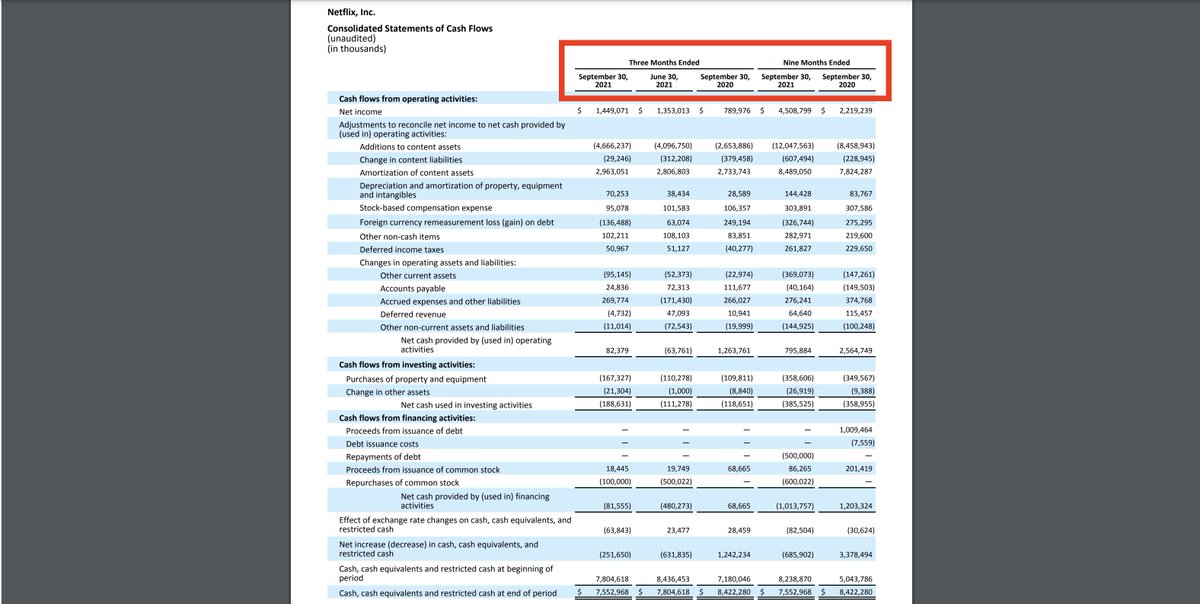

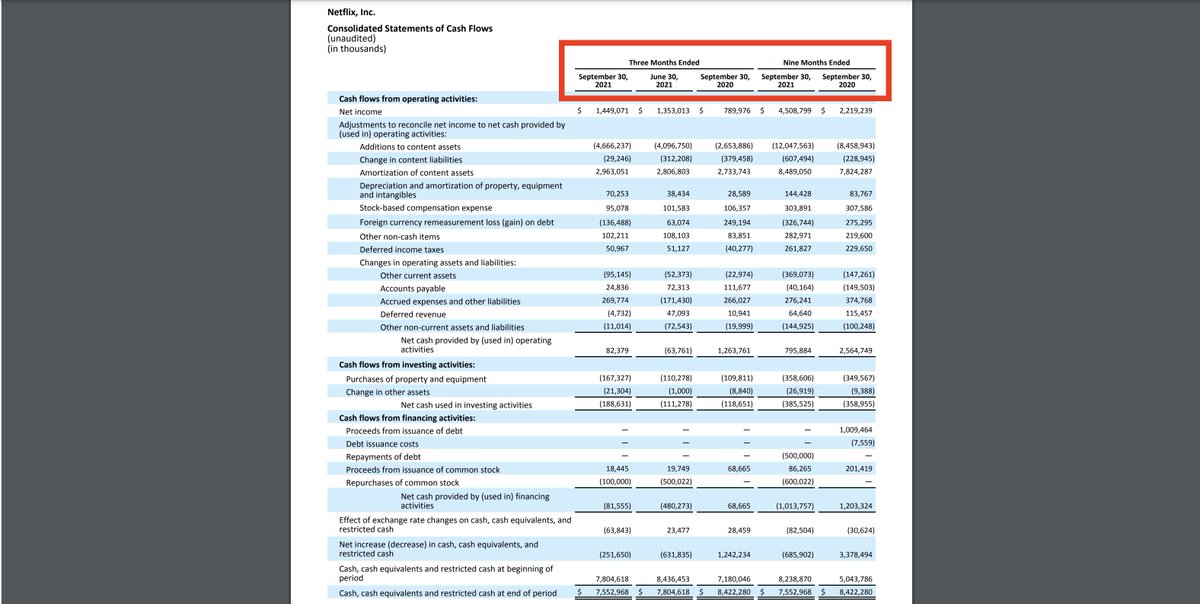

The most common time periods are:

▪️1 Quarter

▪️1 Year

▪️Year-to-date (usually 6 or 9 months)

The time period is at the top. Here's $NFLX recent cash flow statement time period.

Accounting is the language of business.

— Brian Feroldi (@BrianFeroldi) July 28, 2021

If you buy stocks, you MUST learn how to read an income statement

Here\u2019s everything you need to know:

Accounting is the language of business.

— Brian Feroldi (@BrianFeroldi) September 30, 2021

If you buy stocks, you MUST learn how to read a balance sheet.

Here\u2019s everything you need to know:

A THREAD:

— Aditya Todmal (@AdityaTodmal) November 28, 2020

7 FREE OPTION TRADING COURSES FOR BEGINNERS.

Been getting lot of dm's from people telling me they want to learn option trading and need some recommendations.

Here I'm listing the resources every beginner should go through to shorten their learning curve.

(1/10)

The absolute best 15 scanners which experts are using.

— Aditya Todmal (@AdityaTodmal) January 29, 2021

Got these scanners from the following accounts:

1. @Pathik_Trader

2. @sanjufunda

3. @sanstocktrader

4. @SouravSenguptaI

5. @Rishikesh_ADX

Share for the benefit of everyone.

12 TRADING SETUPS which experts are using.

— Aditya Todmal (@AdityaTodmal) February 7, 2021

These setups I found from the following 4 accounts:

1. @Pathik_Trader

2. @sourabhsiso19

3. @ITRADE191

4. @DillikiBiili

Share for the benefit of everyone.

Curated tweets on How to Sell Straddles

— Aditya Todmal (@AdityaTodmal) February 21, 2021

Everything covered in this thread.

1. Management

2. How to initiate

3. When to exit straddles

4. Examples

5. Videos on Straddles

Share if you find this knowledgeable for the benefit of others.

Flat Earth conference attendees explain how they have been brainwashed by YouTube and Infowarshttps://t.co/gqZwGXPOoc

— Raw Story (@RawStory) November 18, 2018

BREAKING: President Donald Trump has submitted his answers to questions from special counsel Robert Mueller

— Ryan Saavedra (@RealSaavedra) November 20, 2018