Authors Tar ⚡

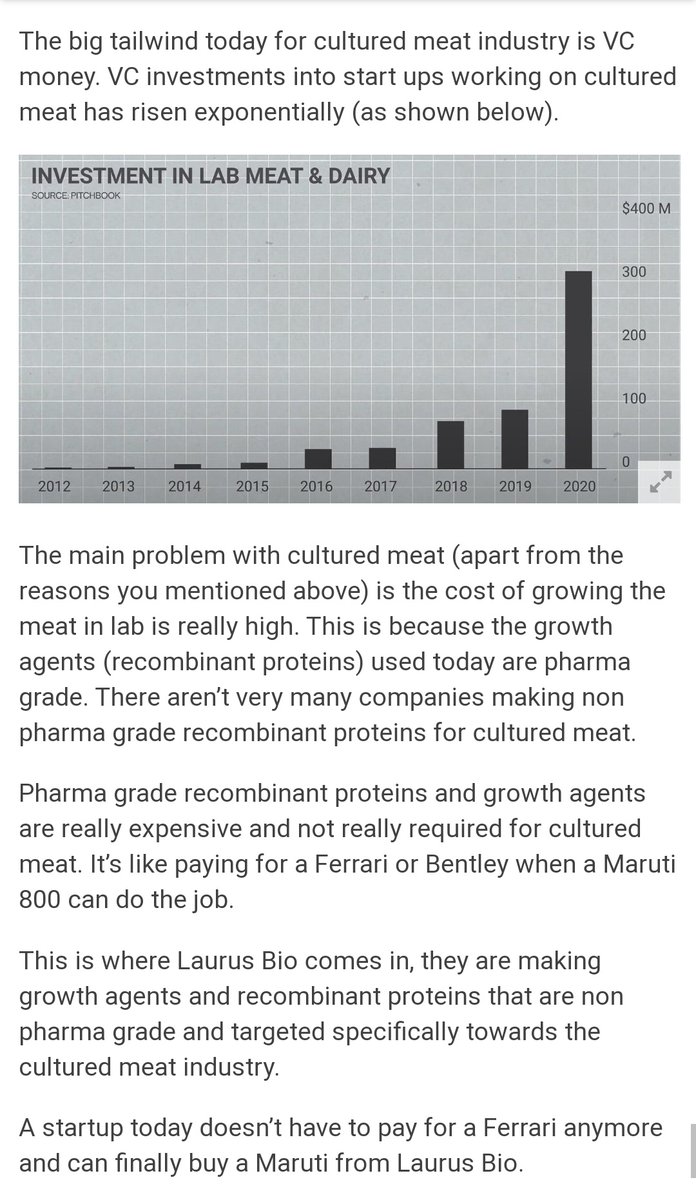

Market always moves to the cheaper alternative, slowly at first, then all of a sudden.

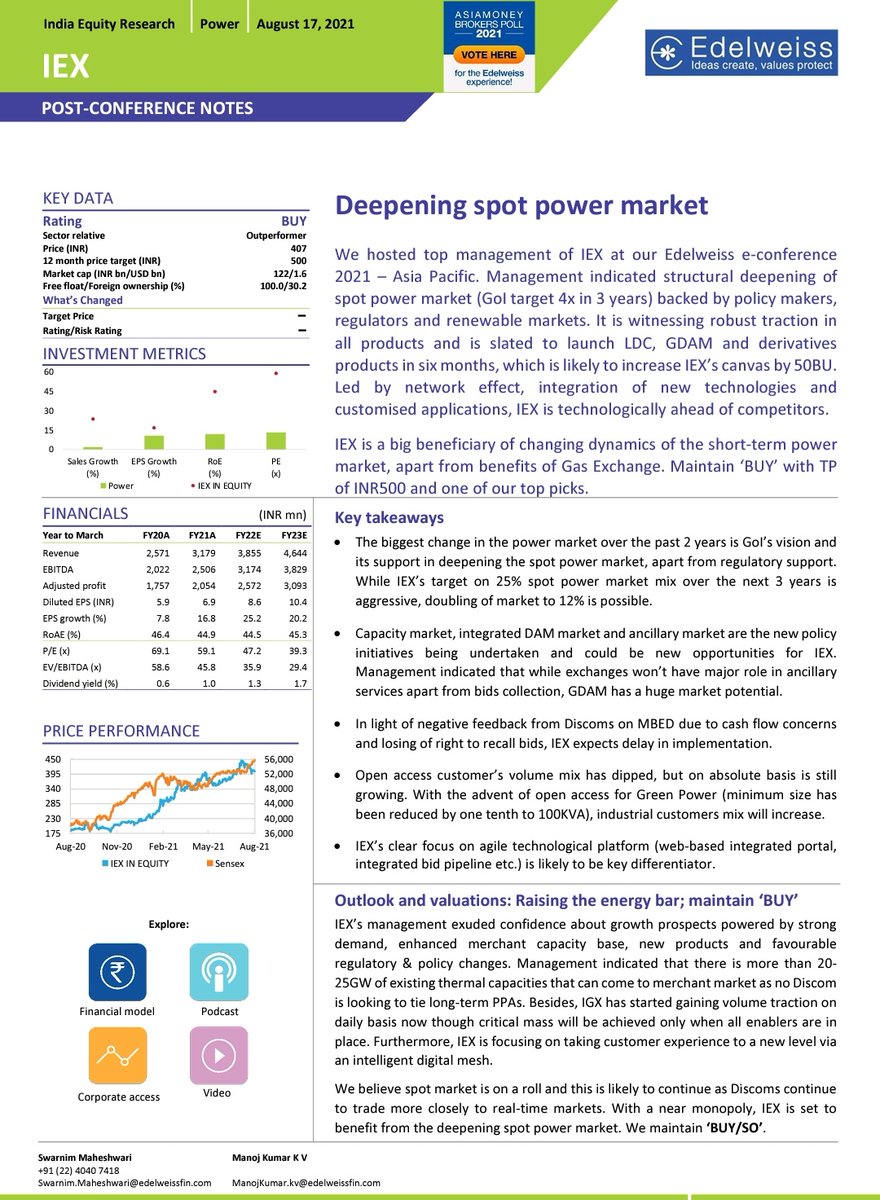

As more and more companies look towards the ESG factors, IEX would be a potential beneficiary.

— Kharanshu Parikh (@Kharanshu) August 7, 2021

Source: Suven Pharma\u2019s Annual Report

\u2066@itsTarH\u2069 pic.twitter.com/sRdMIAMaVP

Lot of regulatory crackdown in China. Top rated companies are available for huge discounts. $BABA for example now has a market cap of less than 600 Billion and is bigger than Amazon in every regard.

I have been aggressively investing more in Chinese equities than Indian ones.

https://t.co/W1RWdKU3sy

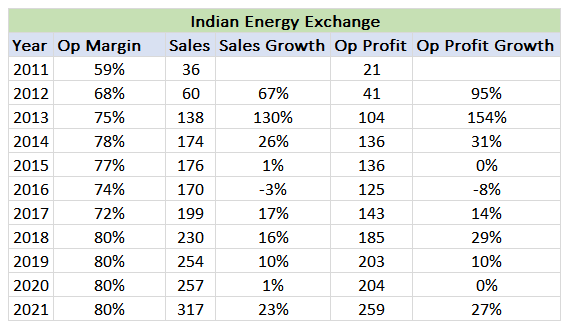

250: Electricity in India won't grow

300: It just makes 4paise per trade

350: MBED will erode it's profitablilty

500: Maybe what @itsTarH said about IEX = NSE + Zerodha was right

570: Buys IEX

#JourneyOfAPessimist

Zerodha + NSE = IEX \U0001f4a1\u26a1\ufe0f

— Tar \u26a1 (@itsTarH) June 20, 2021

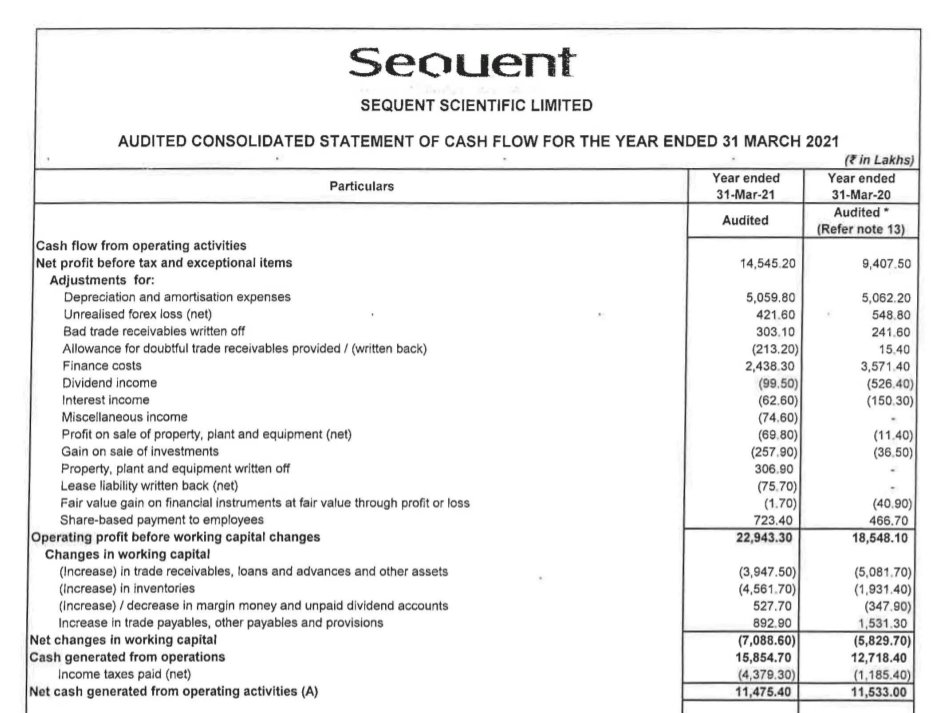

The One with the Cash Flow Explained

It's the weekend!

— Tar \u26a1 (@itsTarH) May 15, 2021

Grab a cup of coffee, in this thread I will explain

1. What a cash flow statement is?

2. What does it tell you about a business?

3. How to analyze one?

Examples included various Indian companies.

Let's dive right in. pic.twitter.com/c8tNP26Z8K

The One with Free Cash Flow Explained

Its the weekend!

— Tar \u26a1 (@itsTarH) May 22, 2021

Grab a cup of coffee, in this thread I will explain

1. What is Capex?\U0001f4b0

2. What is Free Cash Flow? \U0001f4b8

3. What does Cash Flow from Investing and Cash Flow from Financing tells us? \U0001f4a1

Examples includes some famous companies.

Lets dive right in. pic.twitter.com/HDJgUvE8f8

The One with Mutual Funds

Its the weekend!

— Tar \u26a1 (@itsTarH) May 29, 2021

Grab a cup of coffee, in this thread I will explain

1. How to select a Mutual Fund?

2. Common and costly mistakes people make while choosing a Mutual Fund

3. Some tools and tips to help you while selecting a fund

Lets dive right in. pic.twitter.com/teelsojtn9

The One on Laurus Labs

Laurus Labs : A Visual Story

— Tar \u26a1 (@itsTarH) May 30, 2021

I am a Data Science / Machine Learning developer by profession and data along with finance are my two areas of competence.

I realize how powerful combining both of them can be, so here is a visual analysis for Laurus Labs.

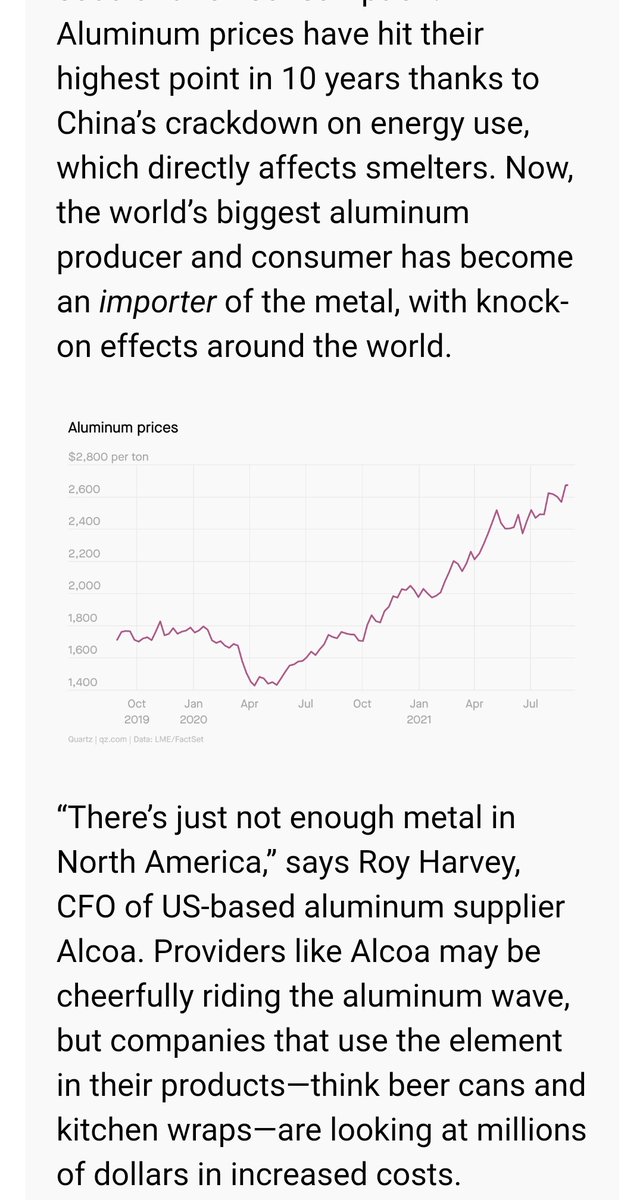

Crackdown on factories in China driven by political rulings to curb emissions

Nalco delivers the highest grossing quarter ever

2+2 = 20 https://t.co/paEk76EaGT

Common theme coming out of China is

— Tar \u26a1 (@itsTarH) August 31, 2021

1\u20e3 Govt wants to focus on general prosperity than just prosperity of a few

2\u20e3 Large focus on limiting emissions

3\u20e3 Willing to lose market share and global dominance in some categories to achieve the above

Bodes well for some sectors in India.

https://t.co/eabqmzuU2v

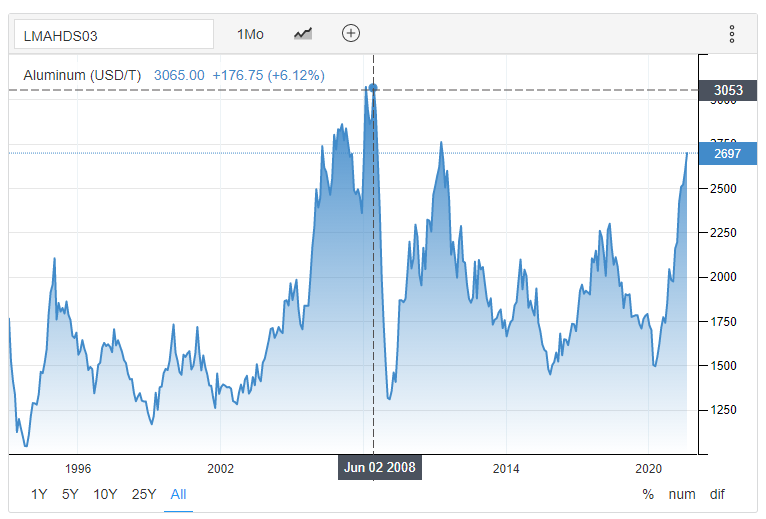

Aluminum prices have risen almost 40% this year on the LME. https://t.co/yWD0I1yECY pic.twitter.com/IhaJD53mmX

— Lisa Abramowicz (@lisaabramowicz1) August 31, 2021

VP Thread on

Nalco's earnings have very high sensitivity to aluminum price. In fact, it’s earnings double for every US$400/t increase in aluminum

Aluminum Prices just ~14% away from their ATH of 3000+ USD/T

Market is short sighted and loves to buy high and sell low

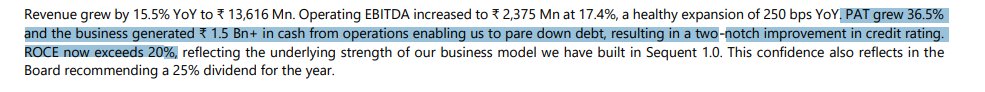

Sequent is a long gestation stock, it won't deliver it's real earnings until FY23-25

Not suitable investment for those who want 100% return/yr

@itsTarH hey Tariq, any idea why is Sequent falling?

— Vivek (@pa_stock) September 27, 2021

https://t.co/7ytUeSd7gg

Don't expect the earnings to go anywhere till FY23.

— Tar \u26a1 (@itsTarH) August 10, 2021

Real growth will only come post FY24.

I expect the stock to either correct or stay muted till then. https://t.co/lUQfzxojTO