Authors Swapnil Kommawar

7 days

30 days

All time

Recent

Popular

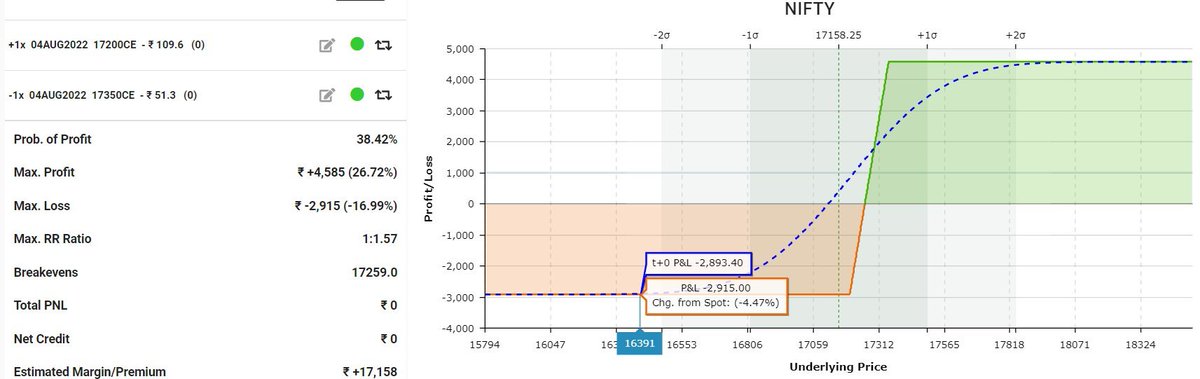

How I trade monthly short strangles for regular income

A thread 🧵🧵

Retweet 🔃🔃 for max reach

👉Short strangle means,

Selling OTM call option and Selling OTM put option

Here is a detailed thread on short strangle

👉Generally, this strategy gives good returns when market is sideways but most trader get wrong entries and wrong exist

👉Ahead of major event option price will increase because of uncertainty. We have to take advantage of that

👉As the VIX is the derivative of option price, we have to check this parameter first

When VIX is >20, it is the right opportunity to deploy short strangle

👉If we look at the weekly and monthly candles of nifty, it is easier to identify which strikes to choose

Entry conditions:

👉VIX >20

👉Choose the strikes which are 6% above and below of nifty in next month contracts

👉Combined premium should be in the range of 160-170

👉Next month contracts should be taken at the mid of current month

A thread 🧵🧵

Retweet 🔃🔃 for max reach

👉Short strangle means,

Selling OTM call option and Selling OTM put option

Here is a detailed thread on short strangle

NEUTRAL STRATEGIES

— Swapnil Kommawar (@KommawarSwapnil) August 5, 2022

If market is sideways, These strategies can be deployed

Retweet for max reach!

A Thread \U0001f9f5\U0001f9f5\U0001f9f5

👉Generally, this strategy gives good returns when market is sideways but most trader get wrong entries and wrong exist

👉Ahead of major event option price will increase because of uncertainty. We have to take advantage of that

👉As the VIX is the derivative of option price, we have to check this parameter first

When VIX is >20, it is the right opportunity to deploy short strangle

👉If we look at the weekly and monthly candles of nifty, it is easier to identify which strikes to choose

Entry conditions:

👉VIX >20

👉Choose the strikes which are 6% above and below of nifty in next month contracts

👉Combined premium should be in the range of 160-170

👉Next month contracts should be taken at the mid of current month

Generally, VWAP is used to know the strength in a buying or selling. VWAP means VOLUME WEIGHTED AVERAGE PIRCE

A thread 🧵🧵🧵🧵🧵

Retweet/like for maximum reach

👉when price starts rising it would be pulled back to VWAP line. Then buyers would again rush in to buy the stock taking price higher.

👉If we compare the CALL and PUT charts, we can identify the correct entry. On trending days VWAP acts as support/resistance.

👉If market is trending UPSIDE, VWAP acts as support in CALL option charts of ATM STRIKES and same VWAP acts as RESISTANCE in PUT option charts of ATM STRIKES

(Use VWAP on 5 minutes chart on OPTION CHARTS)

https://t.co/TLmAiypV45

👉If market is trending DOWNSIDE, VWAP acts as support in PUT option charts of ATM STRIKES and same VWAP acts as RESISTANCE in CALL option charts of ATM STRIKE

A thread 🧵🧵🧵🧵🧵

Retweet/like for maximum reach

👉when price starts rising it would be pulled back to VWAP line. Then buyers would again rush in to buy the stock taking price higher.

👉If we compare the CALL and PUT charts, we can identify the correct entry. On trending days VWAP acts as support/resistance.

👉If market is trending UPSIDE, VWAP acts as support in CALL option charts of ATM STRIKES and same VWAP acts as RESISTANCE in PUT option charts of ATM STRIKES

(Use VWAP on 5 minutes chart on OPTION CHARTS)

https://t.co/TLmAiypV45

👉If market is trending DOWNSIDE, VWAP acts as support in PUT option charts of ATM STRIKES and same VWAP acts as RESISTANCE in CALL option charts of ATM STRIKE