SAnngeri Categories Genericlearnings

7 days

30 days

All time

Recent

Popular

A list of all the articles that we have created - From Banking to Fiber!

The content in the articles has been written in a very simple language which will help you learn everything about the sector and/or the company!

Do Retweet and help your fellow tweeples learn!

Let's go 👇

Starting with Financials -

A to Z of Banking, all basics of banking explained -

https://t.co/tMfB73CHYs

Top 5 Banks and their strategies -

https://t.co/aivfUtuw9g

Large Bank - HDFC Bank - How did HDFC Bank become HDFC Bank -

Mid Sized Bank - Kotak Mahindra Bank

How did they avoid all NPAs from 1999? What makes Uday Kotak's Concalls a goldmine of information on the Banking sector? Everything explained!

We have given details from 1999! The most comprehensive article ever!

Large NBFC - Consumer Durables Play - Bajaj Finance

From its origins to how it gives 0% EMI to how it earns money from manufacturers - everything explained!

More - Origins, Products, Loan Book, Cross-Selling, Risk management, Concalls of 8 Years,

Gold NBFC - Manappuram Finance

Origins (with fun facts)

Products, 10Y Financials, Business model and how do they make money, How does a gold loan work, Operational efficiency, peer comparison, mgmt commentary, why we don't like the stock, and much

The content in the articles has been written in a very simple language which will help you learn everything about the sector and/or the company!

Do Retweet and help your fellow tweeples learn!

Let's go 👇

Starting with Financials -

A to Z of Banking, all basics of banking explained -

https://t.co/tMfB73CHYs

Top 5 Banks and their strategies -

https://t.co/aivfUtuw9g

Large Bank - HDFC Bank - How did HDFC Bank become HDFC Bank -

Mid Sized Bank - Kotak Mahindra Bank

How did they avoid all NPAs from 1999? What makes Uday Kotak's Concalls a goldmine of information on the Banking sector? Everything explained!

We have given details from 1999! The most comprehensive article ever!

Large NBFC - Consumer Durables Play - Bajaj Finance

From its origins to how it gives 0% EMI to how it earns money from manufacturers - everything explained!

More - Origins, Products, Loan Book, Cross-Selling, Risk management, Concalls of 8 Years,

Gold NBFC - Manappuram Finance

Origins (with fun facts)

Products, 10Y Financials, Business model and how do they make money, How does a gold loan work, Operational efficiency, peer comparison, mgmt commentary, why we don't like the stock, and much

Find out the answer for the question we asked today morning.

Here is the

Here is the

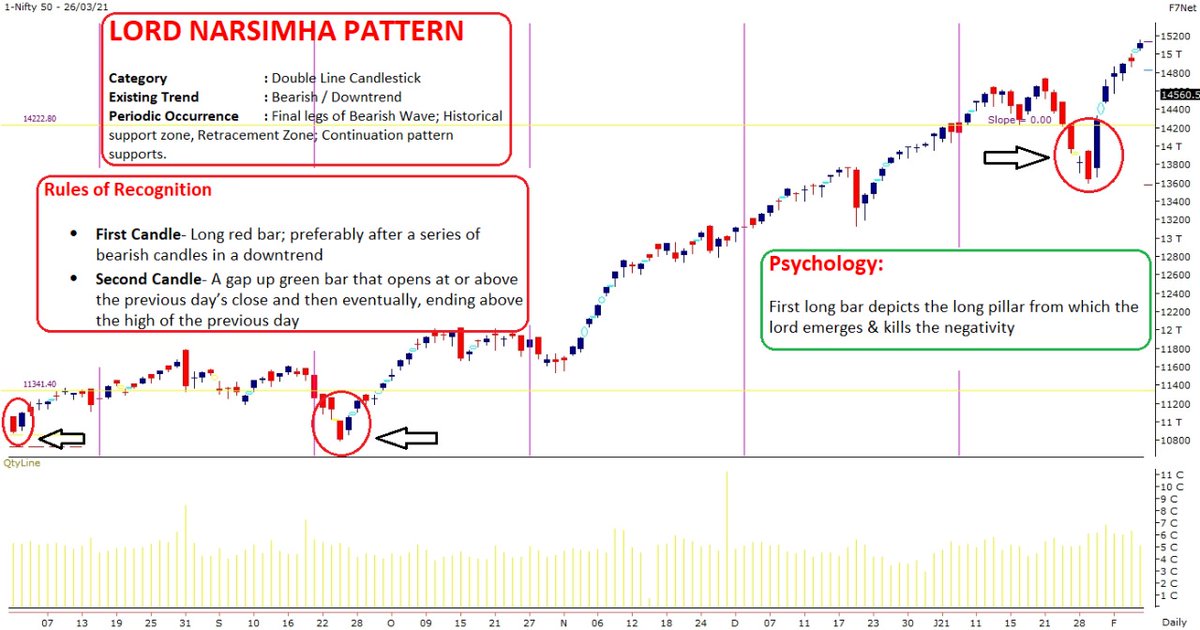

Glad that many could guess/ know the candle stick pattern and mainly know how to use it.

— The Chartians (@chartians) July 24, 2021

The one shown in the image was bullish Harami

The word Harami comes from an old Japanese word meaning pregnant.. pic.twitter.com/4qBDCyY2Pq

Perhaps you have the idea that calling me " 1 lot Nandy" is somehow derogatory and a easy poke at me. Allow me to explain why I look at this moniker as a badge of honour

I have traded 1 lot continuously twice in my life. The first in 2003 after I blew up on my INFY trade. I traded 1 lot ACC fut consistently and made 50k in a month

The 2nd time in 2013. When I suffered continuous losses for 5-6 months due to a variety of psychological issues. Then I traded 1 lot Nifty options consistently for 3 months. After that 2 lots for next 1 month and slowly increased

I have shared these two incidents on my various interveiws and regularly share this in detail with my handholding students when I talk about trading psychology.

This logic of trading 1 lot to iron out trading issues I learnt from the interview of Anthony Saliba, who traded 1 lot in options for 6 months. BTW, Saliba was the only options trader to have been profiled on the original Market Wizards ( I read his interview and used his logic)

Sir itseems people call you as "one lot Nandy".. Is it true?

— Bittu (@nanoobittu) July 16, 2021

I have traded 1 lot continuously twice in my life. The first in 2003 after I blew up on my INFY trade. I traded 1 lot ACC fut consistently and made 50k in a month

The 2nd time in 2013. When I suffered continuous losses for 5-6 months due to a variety of psychological issues. Then I traded 1 lot Nifty options consistently for 3 months. After that 2 lots for next 1 month and slowly increased

I have shared these two incidents on my various interveiws and regularly share this in detail with my handholding students when I talk about trading psychology.

This logic of trading 1 lot to iron out trading issues I learnt from the interview of Anthony Saliba, who traded 1 lot in options for 6 months. BTW, Saliba was the only options trader to have been profiled on the original Market Wizards ( I read his interview and used his logic)